Use Renko

How to Use the Grid Trading Bot

This guide explains how to use the Grid Trading Bot effectively. The bot automates grid trading by placing buy and sell orders at set price intervals, allowing traders to profit from market movements.

Step 1: Configure the Parameters

The bot allows you to customize several settings to fit your trading strategy. Below are the key parameters:

Volume Settings

- Initial Volume (lots) – The starting trade size.

- Volume Increment (lots) – The amount added to each new trade.

Grid Step Settings

- Step in Pips Down (Buy) – Distance below the last buy order for the next buy.

- Step in Pips Up (Buy) – Distance above the last buy order for the next buy.

- Step in Pips Down (Sell) – Distance below the last sell order for the next sell.

- Step in Pips Up (Sell) – Distance above the last sell order for the next sell.

Grid Activation

- Start Buy Grid After (Pips) – The price increase needed to start the buy grid.

- Start Sell Grid After (Pips) – The price drop needed to start the sell grid.

Dynamic Adjustments

- Dynamic Step Adjustment Factor – Adjusts grid step size based on the number of open trades.

Risk Management

- Maximum Drawdown (%) – The maximum loss as a percentage of the account balance.

- Use Trailing Drawdown – If enabled, the bot tracks peak equity to adjust drawdown limits.

Profit Conditions

- Max Net Profit (Buy Grid Only) – The highest profit before closing all buy positions.

- Max Net Profit (Sell Grid Only) – The highest profit before closing all sell positions.

- Max Net Profit (Both Grids) – The highest profit allowed across both grids.

Step 2: Start the Bot

- Set Your Preferences – Adjust settings based on your risk level and strategy.

- Ensure Sufficient Funds – Make sure your trading account has enough margin.

- Run the Bot – Click "Start" to activate trading. The bot will automatically open and manage positions.

Step 3: Monitor the Bot

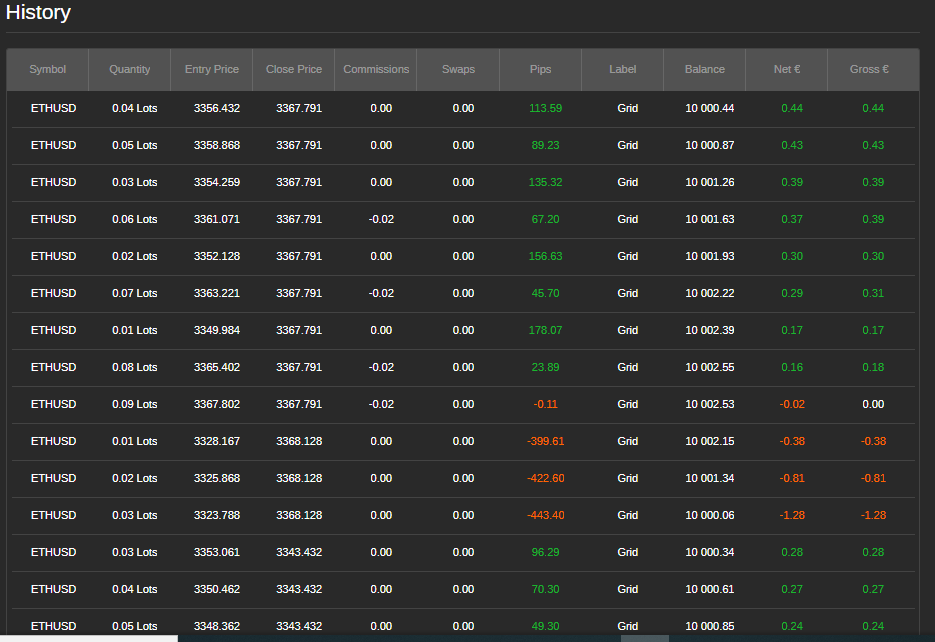

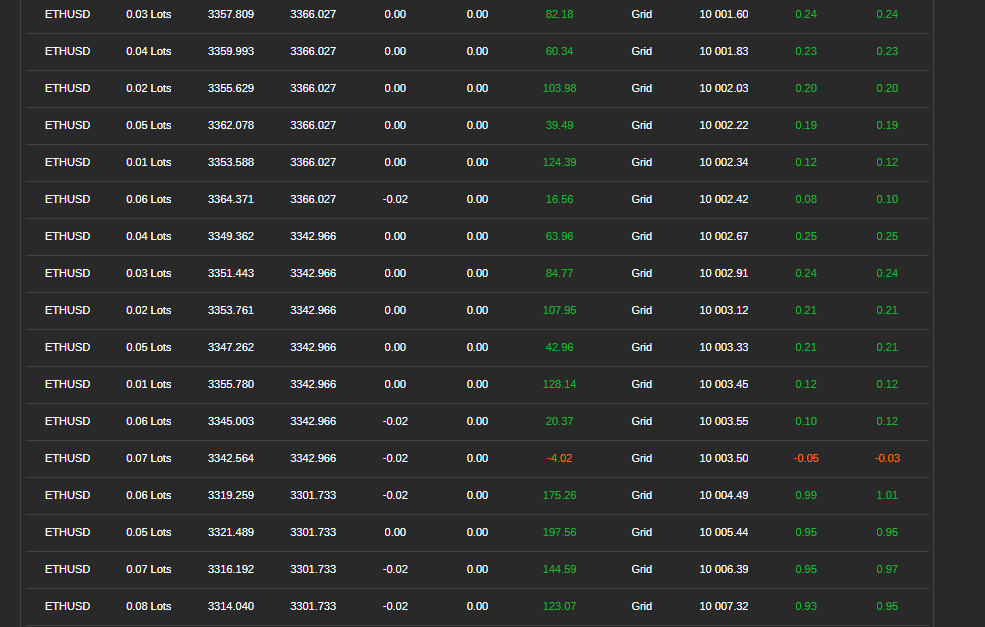

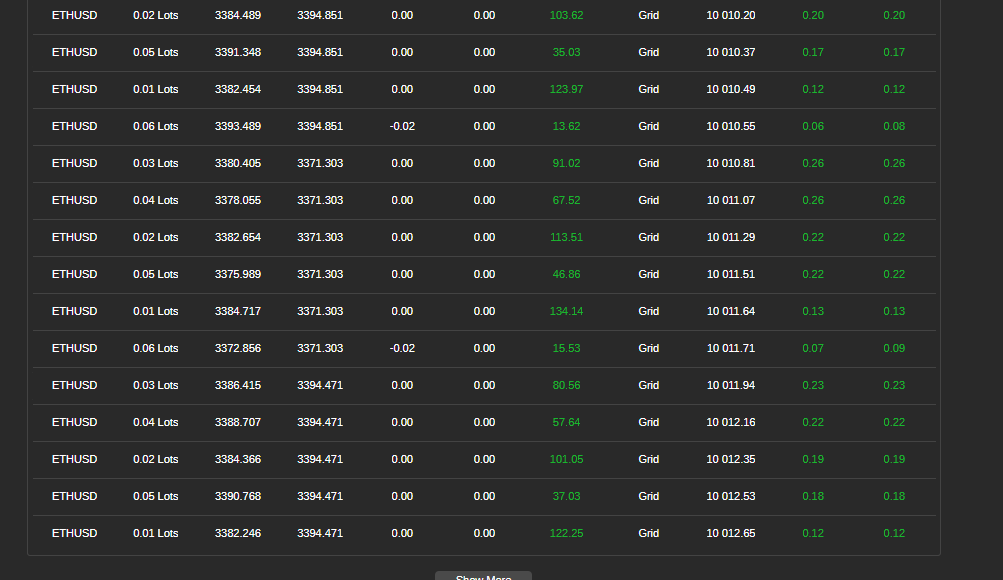

- Check Open Trades – The bot follows the grid strategy to enter and exit positions.

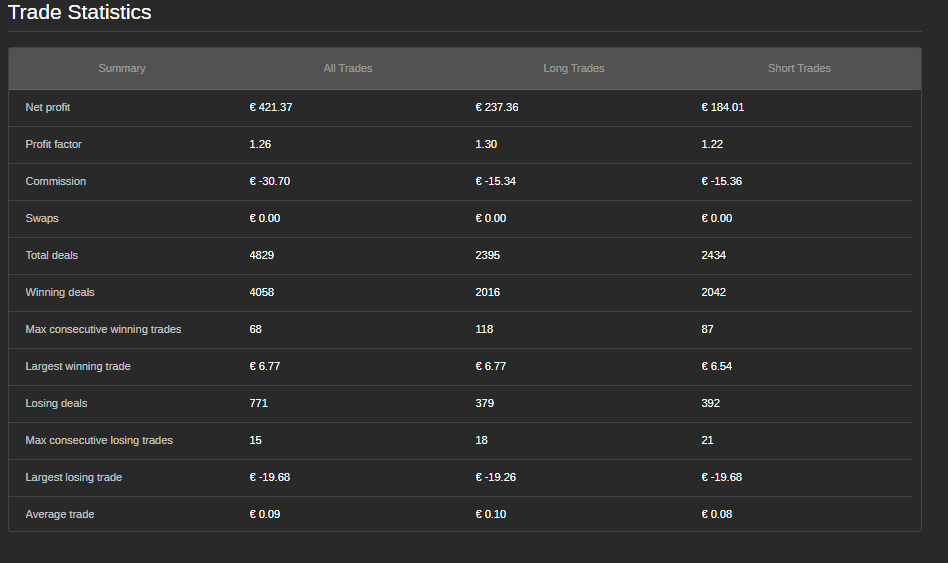

- Track Performance – Review profit, drawdown, and trade history. The bot will close trades if profit or risk limits are reached.

Step 4: Stop or Restart the Bot

- Stopping the Bot – Click "Stop" to halt trading and close all positions.

- Restarting the Bot – If the bot stops due to reaching its limits, you can restart it manually.

Tips for Best Results

- Start Small – Use a small trade size and step distance for testing.

- Adjust Settings – Optimize grid steps, volume increments, and risk levels based on market conditions.

- Watch Drawdown – Ensure losses stay within your risk tolerance.

Contact Information

For support or inquiries:

- WhatsApp: +27 73 714 0490

- Email: siyabongamsg764109@gmail.com

Trading Disclaimer

Trading involves risk and may not be suitable for all investors. There is no guarantee of profits, and past performance does not indicate future results. You are responsible for all trading decisions. Use this bot with caution, conduct backtesting, and trade on a demo account before going live. Seek professional financial advice if needed.

By following these steps, you can use the Grid Trading Bot to automate your trading strategy. Always trade responsibly.

Avoiding trading during major news events is crucial because these periods are often marked by heightened volatility and unpredictable price movements. News trading can lead to erratic market behavior that deviates from typical trends, increasing the risk of losses. Similarly, trading in a ranging market—where prices move sideways without clear direction—can result in false breakouts and limited profit opportunities, making it difficult to implement a coherent strategy. Additionally, low volume days typically feature reduced liquidity, which can cause wider spreads and slippage, further complicating trade execution. By steering clear of news trading, ranging markets, and low volume periods, traders can focus on more stable market conditions that offer clearer trends and better execution, ultimately enhancing their overall trading performance.

(2).png)

.png)