GALAXY Multi CROSS TRIAL DAY 15

"ATTENTION," IN THE PAID VERSIONS, A FREE TRIAL VERSION OF 15 DAYS IS ALSO AVAILABLE"

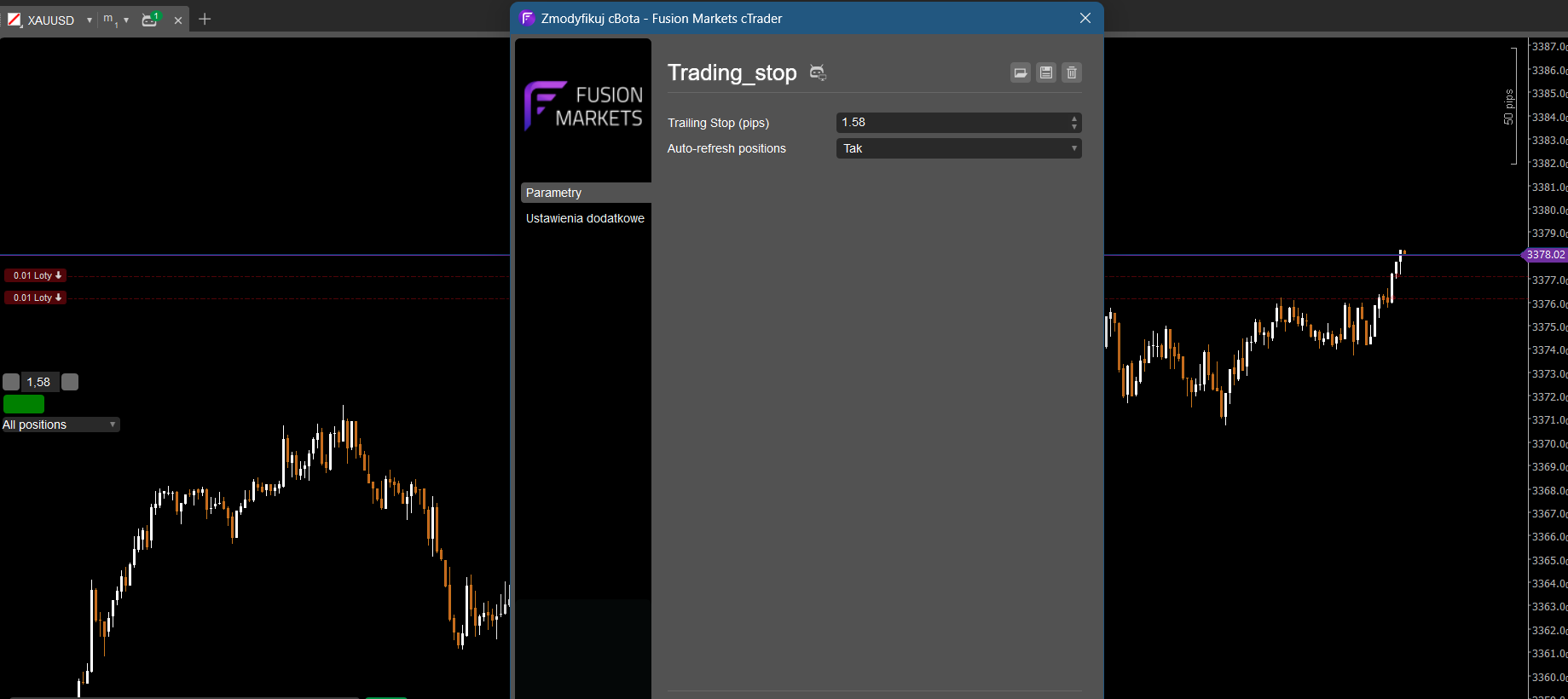

Please note that cBot may take some time to execute trades as it waits for the right market conditions and the parameters defined in its logic to be met.

🚀 Critical Analysis of "Galaxy C Bot PRO" 🚀

The idea of a multi-asset trading robot with built-in risk management is theoretically appealing. However, it is crucial to separate the marketing language from the realistic expectations and inherent risks of such automated trading products.

🔍 Critical Points of Attention & Realities

1. Basic and Easily Replicable Strategy

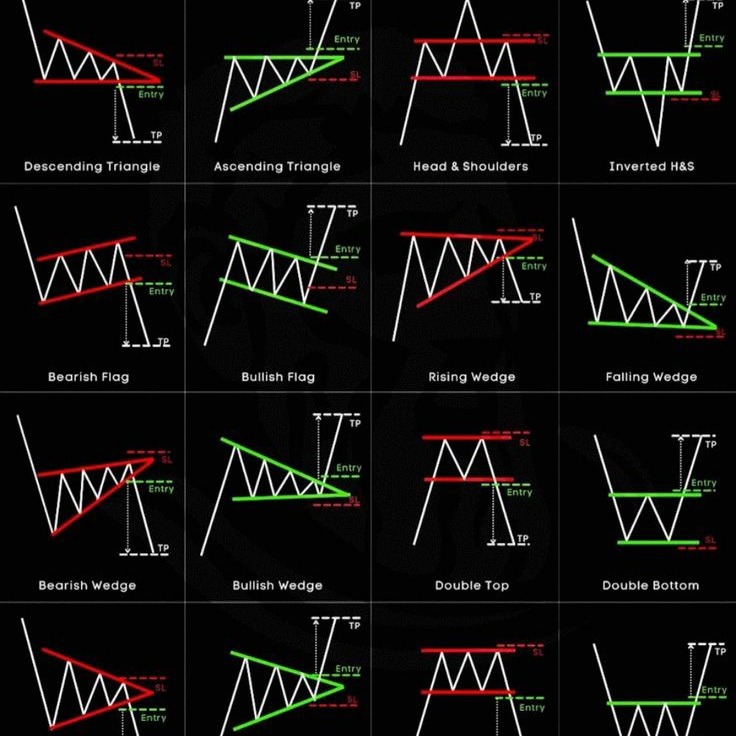

- The core strategy of EMA crossovers with ATR-based stops/targets is extremely common and well-documented. It does not represent a unique or competitive "edge" in modern markets.

- Many commercial C BOT and free code available use very similar, if not identical, logic.

2. Unverified Performance Claims

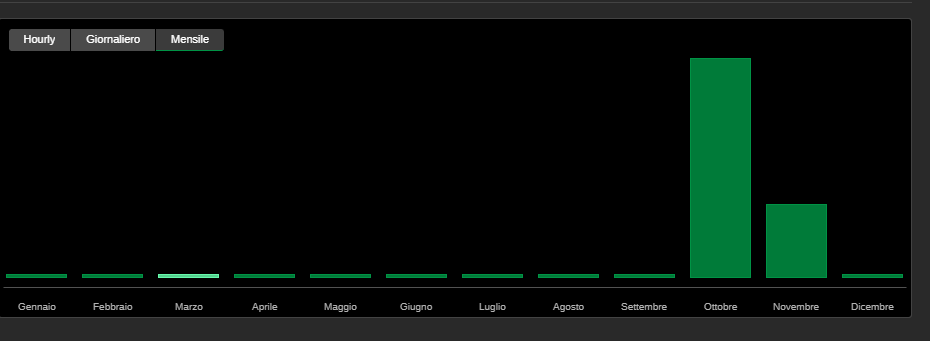

- The description provides no verifiable backtest results (e.g., detailed equity curves, profit factor, Sharpe ratio) from a credible platform like Strategy Tester.

- There is no proof of live trading performance through a verified Myfxbook or FXBlue account. Any performance claim without this is merely marketing.

3. The Inherent Flaw of "One-Size-Fits-All" Multi-Asset

- A single trend-following strategy is highly unlikely to perform optimally across different asset classes (e.g., EURUSD, BTCUSD).

- What works for a major Forex pair will almost certainly need different parameter tuning for a volatile asset like Bitcoin. Using the same

MA PeriodandATR Multiplierfor all is a significant oversimplification.

4. Misleading "Advanced" Risk Management

- While percentage-based money management is a positive feature, the "Equity Protection" and "Max Drawdown %" features often work by shutting down the robot after the drawdown has already occurred. They do not prevent the drawdown; they only lock in the losses.

- A

Max Drawdownof 15% is a very significant loss for most traders.

5. Minimum Balance Mismatch

- A $500 minimum balance is dangerously low for the proposed multi-asset trading, especially if using the suggested 1-3% risk. A few consecutive losses could rapidly deplete the account due to the compounding effect of the risk.

✅ Plausible & Positive Features

- Risk % Management: Using a fixed percentage of the account per trade is a correct and professional approach to position sizing.

- Spread Filter: This is a useful feature to avoid entering trades during periods of illiquidity (e.g., news events, market open/close) when spreads widen.

- Max Positions Control: Limiting the number of trades per symbol helps prevent over-exposure to a single asset.

- Error Handling: Robust connection and error management is essential for any reliable automated system.

⚠️ Important Warnings & The Fine Print

The disclaimer, while legally necessary, is the most truthful part of the description:

"CFD trading involves significant risks. 70-90% of retail investor accounts lose money. Only use capital you can afford to lose."

This is not a disclaimer to be glossed over. It is a statistical reality, and the use of automated systems can amplify both gains and losses, often the latter for inexperienced users.

📋 Realistic Setup & Recommendation

If you were to proceed with testing such a robot, here is a realistic approach:

- Demand Proof: Before purchasing, ask the vendor for a verified live track record and detailed backtest reports. If they cannot provide it, assume it is unproven.

- Extended Demo Testing: Run the robot on a demo account for *at least 2-3 months*. Test it across different market conditions (trending, ranging, volatile).

- Realistic Parameter Setting:

- Risk %: Start with 0.5% - 1%, not 1.5-3%. This is crucial for survival.

- Minimum Balance: Do not use a live account with less than $2,000 - $5,000 if trading multiple assets. This provides a necessary buffer for drawdowns.

- Symbols: Do not start by trading all symbols at once. Test it on 1-2 major Forex pairs first (default: EURUSD,GBPUSD,USDCHF)

🎯 The Bottom Line

The "Galaxy C Bot PRO" is marketed with sophisticated language but is based on a common, generic strategy. There is a very high probability that it will not deliver the promised results in live market conditions.

Recommendation:

- For Experienced Traders: It could be used as a base code for further development and customization if you understand its inherent flaws and can code improvements.

- For Beginner Traders: Avoid. You are likely paying for a product that will lose money. The money you would spend on this robot would be better invested in education or as risk capital for your own manual trading journey.

Automated trading is a powerful tool, but it is not a "set and forget" path to riches. Success requires a deep understanding of the strategy, rigorous testing, and constant monitoring. This product's description suggests it is the former, while the reality is almost certainly the latter.

GALAXY Multi CROSS TRIAL DAY 15

🚀 Galaxy C Bot PRO - Multi-Asset Trading Robot 🌌

Descrizione Completa

Galaxy C Bot PRO è un sofisticato robot di trading multi-asset progettato per operare simultaneamente su multiple coppie valutarie e strumenti finanziari. Basato su una strategia di trend-following avanzata, combina l'efficacia dei moving average con la dinamicità dell'ATR per adattarsi automaticamente alle condizioni di mercato.

🎯 CARATTERISTICHE PRINCIPALI

🤖 STRATEGIA INTELLIGENTE

- Trend Detection: Rilevamento crossover EMA per identificare trend nascenti

- Volatility Adjustment: ATR dinamico per Stop Loss e Take Profit intelligenti

- Multi-Timeframe: Compatibile con tutti i timeframe (consigliato H1 e H4)

🛡️ GESTIONE RISCHI AVANZATA

- Money Management: Calcolo posizione basato su rischio percentuale del capitale

- Equity Protection: Protezione automatica da drawdown eccessivi

- Spread Filter: Blocco trade in condizioni di spread sfavorevoli

- Max Positions: Controllo simultaneo su posizioni aperte per simbolo

⚡ PERFORMANCE OTTIMIZZATE

- Multi-Symbol: Trading simultaneo su EURUSD, GBPUSD, USDCHF ,BTCUSD e altri

- Low Latency: Esecuzione ultra-rapida grazie all'architettura On Tick

- Error Handling: Gestione robusta degli errori e riconnessione automatica

📊 PARAMETRI CONFIGURABILI

🎮 IMPOSTAZIONI PRINCIPALI

Symbols List: Lista personalizzabile di simboli (default: EURUSD,GBPUSD,USDCHF)TimeFrame: Timeframe di trading (consigliato: Minute15 o Hour1)Risk %: Rischio per trade (1-3% raccomandato)

📈 STRATEGIA E INDICATORI

MA Period: Periodo Moving Average (default: 50)ATR Period: Periodo Average True Range (default: 14)ATR Multiplier SL: Moltiplicatore SL basato su ATR (default: 1.5)ATR Multiplier TP: Moltiplicatore TP basato su ATR (default: 3.0)

🛡️ PROTEZIONE E FILTRI

Max Spread: Spread massimo consentito (default: 3.0 pips)Max Drawdown %: Drawdown massimo prima di stop automatico (default: 15%)Time Filter: Filtro orario per trading sessioneMax Trades Per Symbol: Limite posizioni contemporanee per simbolo

🎓 COME FUNZIONA

- ANALISI: Monitora continuamente i crossover tra prezzo e EMA

- CONFERMA: Verifica condizioni di volatilità tramite ATR

- ENTRY: Apre posizioni su breakout confermati

- PROTEZIONE: Applica SL/TP dinamici basati su volatilità

- GESTIONE: Monitora drawdown e chiude se necessario

📋 REQUISITI DI SISTEMA

- Leverage: 1:100 o superiore

- Saldo minimo: $500 (per risk management ottimale)

✅ CONDIZIONI DI MERCATO

- Mercato: Forex, Indici, Commodities

- Volatilità: Media-Alta

- Sessioni: Tutte

🔧 INSTALLAZIONE E SETUP

- Scarica il file .algo dalla c Trader Store

- Apri c Trader e vai alla sezione Robots

- Importa il file scaricato

- Configura i parametri secondo il tuo stile di trading

- Avvia su demo per testing, poi su live

📚 STRATEGIE CONSIGLIATE

🎯 CONSERVATIVA

- Risk: 0.5-1%

- Time Frame: H4

- Simboli: Major pairs only

⚡ AGGRESSIVA

- Risk: 1.5-2%

- Time Frame: H1

- Simboli: Major + Minor pairs

⚠️ AVVERTENZE IMPORTANTI

INVESTIMENTI A RISCHIO

- Il trading CFD comporta rischi significativi

- Il 70-90% degli investitori retail perde denaro

- Usa solo capitale che puoi permetterti di perdere.