CandlePatternBot

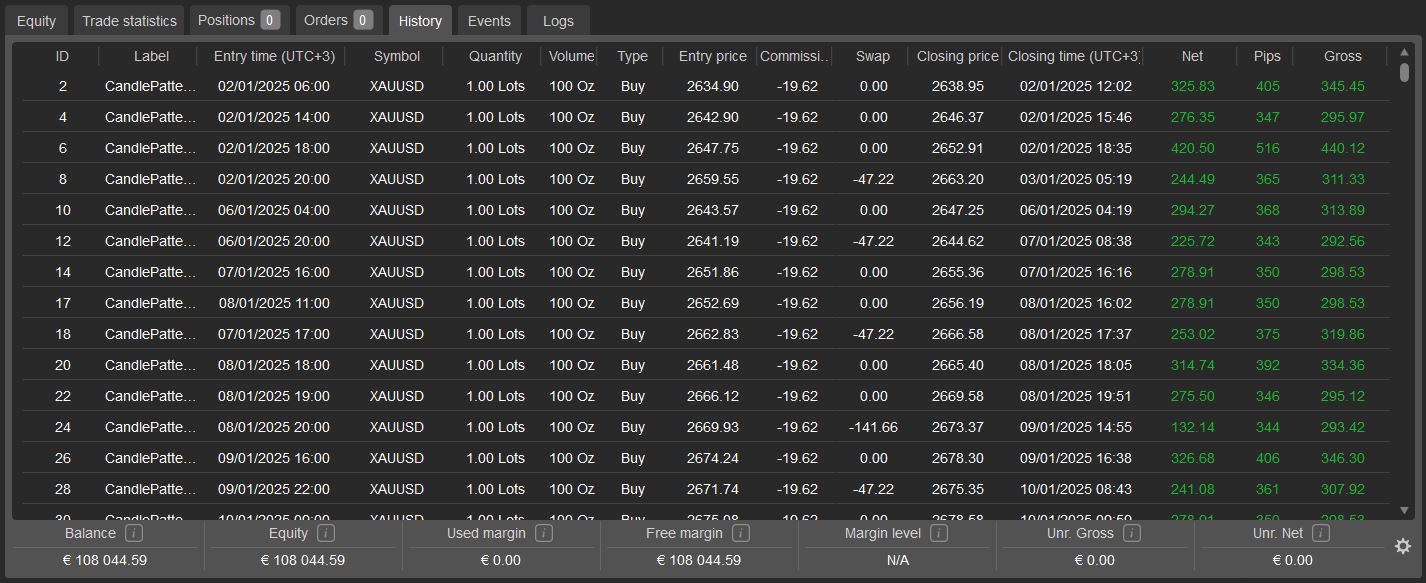

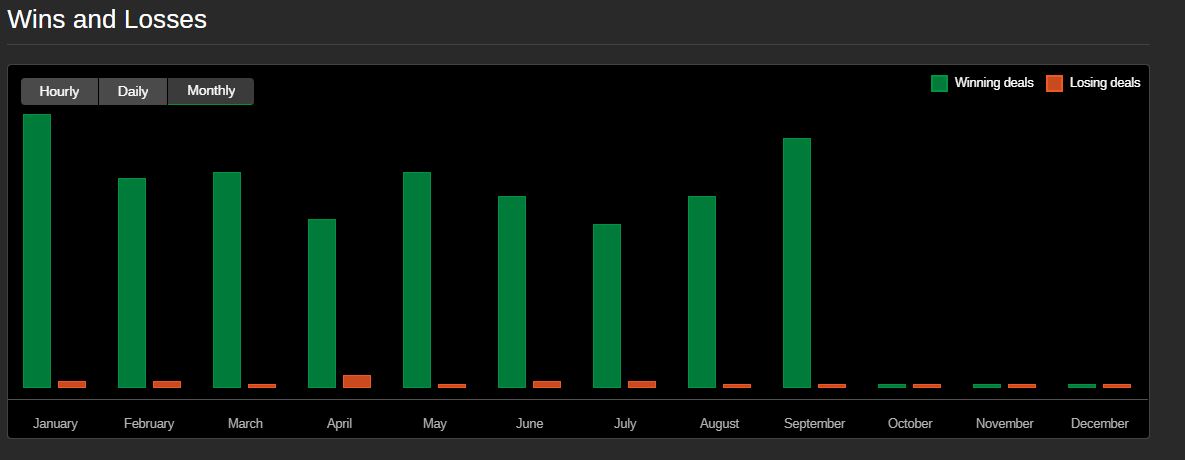

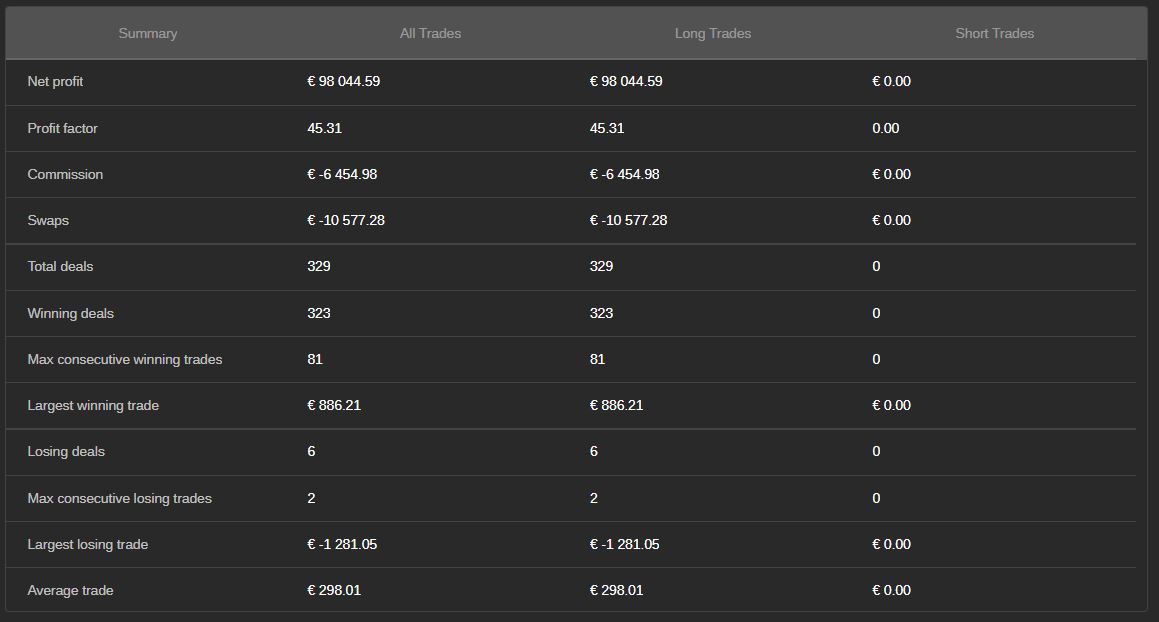

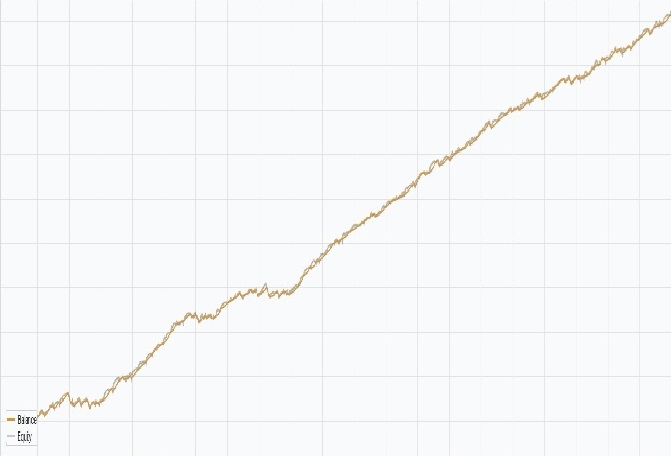

In 9 months, I earned what you see on the screenshot — the CandlePatternBot harnesses classic candlestick formations with strict entry/exit rules and a direction bias. It opens on bar close, filters noise with body-size thresholds, and can exit by SL/TP or on the next pattern so it adapts fast when the market tone flips.

Disclaimer: figures shown are from my run and for illustration only; past performance doesn’t guarantee future results. Always validate on your own data and size risk appropriately.

CandlePatternBot — User Guide

What it does

- Scans the last 2–3 bars for enabled candlestick patterns.

- Enters at bar close (market orders).

- Optional Trend Bias to trade all, bullish-only, or bearish-only signals.

- Exits by SL/TP and/or on the next detected pattern (configurable).

- Controls trading frequency with One Trade Per Bar and Max Concurrent Positions.

Settings

Core

- Pattern Start

Confirmed— builds patterns on already closed bars (i-1, i-2, i-3). Cleaner, less noise.Immediate— includes the just-closed bar (i, i-1, i-2). Earlier signals, more noise.

- MA Period (AvgBody) — window length for the average candle body; used in size filters.

- Min Body Ratio vs Avg — minimum body size as a fraction of AvgBody (0 = disabled).

Example:0.5→ each required body must be ≥ 50% of the average. - Trend Bias

All— trade all signals,BullOnly— only bullish (longs),BearOnly— only bearish (shorts).

- One Trade Per Bar — prevent more than one entry per bar.

- Max Concurrent Positions — cap simultaneous positions per symbol (0 = no cap).

Exit (when to close)

- Exit Rule

TP_SL_Only— close only by stop/target.NextOpposite— close positions against the next pattern’s direction.NextAny— close all positions on any new pattern.TP_SL_or_NextOpposite— SL/TP or opposite pattern (whichever comes first).TP_SL_or_NextAny— SL/TP or any new pattern.

Risk

- Volume (Units) — trade size in units (on FX, ~100,000 units ≈ 1.00 lot).

- Stop Loss (pips), Take Profit (pips) — levels in instrument pips.

0= don’t set.

Pattern toggles

Enable/disable each formation individually (see logic below). Keep only those that prove effective for your symbol/timeframe.

Candlestick Patterns

Bullish (long)

- Three White Soldiers — three consecutive bullish candles; each closes above the previous; bodies meet the

Min Body Ratio × AvgBodythreshold. - Piercing Line — after a bearish candle, the next opens below its low and closes above the midpoint of the first body, yet below its open.

- Morning Doji — big bearish, then a small-body/doji, then a solid bullish closing above the first candle’s midpoint; gap down then up behavior.

- Bullish Engulfing — bearish candle followed by a bullish candle whose body fully engulfs the prior body; bullish body is sufficiently large (≥ ~2 × AvgBody × MinRatio in code).

- Morning Star — big bearish, small “star” below, then bullish closing above the first candle’s midpoint.

- Hammer — small body, long lower shadow (> 2× body), short upper shadow; in a downward context (prior close > current high).

- Bullish Harami — large bearish candle, then a small bullish inside the first body (both open/close inside); body2 ≤ 50% of body1.

- Bullish Meeting Lines — bearish then bullish; gap down on open; closes nearly equal (difference ≤ 0.1 × AvgBody) plus bullish confirmation on the current bar.

Bearish (short)

- Three Black Crows — three consecutive bearish candles; each closes below the previous; bodies satisfy the

Min Body Ratio × AvgBodyfilter. - Dark Cloud Cover — after a strong bullish candle, the next opens above its high and closes below its midpoint but above its open.

- Evening Doji — big bullish, then small-body/doji above, then a solid bearish that closes below the first candle’s midpoint; gaps present.

- Bearish Engulfing — bullish candle followed by bearish whose body fully engulfs the prior body; bearish body large enough (≥ ~2 × AvgBody × MinRatio).

- Evening Star — big bullish, small “star” above, then bearish closing below the first candle’s midpoint.

- Hanging Man — small body, very long lower shadow (> 3× body), short upper shadow; in an upward context (prior close < current high).

- Bearish Harami — large bullish, then small bearish inside the first body; body2 ≤ 50% of body1.

- Bearish Meeting Lines — bullish then bearish; gap up on open; closes nearly equal (≤ 0.1 × AvgBody) with bearish confirmation on the current bar.

Notes on implementation

- “Small body” for stars/doji is

|Open - Close| < ~0.1 × AvgBody. - Context checks enforce downtrend/uptrend surroundings for Hammer/Hanging Man.

- Many models also require minimum body size via

Min Body Ratio × AvgBody.

Practical tips

- Reduce noise:

Pattern Start = Confirmed,Min Body Ratio ≥ 0.5. - Directional focus:

Trend Bias = BullOnlyorBearOnly. - Control trade frequency: enable a core subset (Engulfing, Stars, Soldiers/Crows, Hammer/Hanging Man).

- Adaptive exits:

TP_SL_or_NextOppositebalances profit-taking with quick tone changes;NextAnyis more aggressive.

.png)