🎯 Bot Overview

The ORB Smart Money Bot for XAUUSD is a sophisticated algorithmic trading system specifically optimized for Gold (XAUUSD) trading. It combines Opening Range Breakout (ORB) strategies with Smart Money Concepts (SMC) to identify high-probability trading opportunities during the New York trading session.

✨ Key Features & Innovations

1. XAUUSD-Optimized Trading Engine

- Specialized for Gold: All parameters are specifically tuned for XAUUSD's unique volatility and price behavior

- Conservative Risk Management: Enhanced safety measures for Gold's higher volatility

- Proper Pip Value Calculation: Accurate position sizing for precious metals trading

2. Smart Money Concepts Integration

- Fair Value Gap (FVG) Detection: Automatically identifies and visualizes institutional order imbalances

- FVG Confirmation: Optional requirement for FVG alignment before trade execution

- Smart Zone Retests: Waits for price to return to key SMC levels for better entries

3. Dynamic Market Regime Detection

- Real-time Volatility Assessment: Uses ATR to classify market conditions (High/Low/Medium Volatility)

- Trend Strength Analysis: EMA-based trend detection with configurable strength thresholds

- Adaptive Entry Methods: Automatically adjusts entry strategy based on current market regime

4. Multi-Timeframe Analysis

- ORB Timeframe: Configurable (default: 1 Hour) for opening range calculation

- Entry Timeframe: Configurable (default: 5 Minutes) for precise trade execution

- Separate Bar Series: Independent analysis prevents timeframe conflicts

🔧 Critical Technical Fixes Implemented

✅ Volume Calculation System

Problem: Previous versions had incorrect volume unit conversions leading to position sizing errors.

Solution:

csharp

// CORRECT: Proper double to long conversion with normalization

double volumeDouble = Symbol.QuantityToVolumeInUnits(FixedVolumeLots);

long volumeUnits = NormalizeVolumeUnits(volumeDouble);

Features:

- Uses cTrader's built-in

QuantityToVolumeInUnits()method - Proper casting from

doubletolongwith safety checks - Broker-specific volume step normalization

- Minimum and maximum volume enforcement

✅ XAUUSD Pip Value Calculation

Problem: Standard forex pip value calculations don't work for Gold.

Solution:

csharp

// XAUUSD-specific pip value calculation

double calculatedPipValue = 1.0; // $1 per pip for Gold (100 oz contract)

Features:

- Recognizes XAUUSD and GOLD symbols automatically

- Uses broker-provided pip value when available

- Fallback calculation for Gold's unique contract specifications

- Handles both USD and non-USD account currencies

✅ ATR-Based Dynamic Risk Management

Problem: Fixed stop losses don't adapt to changing market volatility.

Solution:

csharp

double atrValue = GetSafeAtrValue();

double dynamicSL = (atrValue / Symbol.PipSize) * AtrMultiplierSL;

Features:

- Real-time volatility measurement using Average True Range

- Configurable ATR multipliers for stop loss and take profit

- Automatic adjustment to market conditions

- Sanity checks for extreme ATR values

✅ Robust Error Handling

Problem: Insufficient error handling could cause bot crashes.

Solution: Comprehensive try-catch blocks throughout all critical methods with detailed logging and fallback mechanisms.

📊 Trading Strategy Components

Opening Range Breakout (ORB) Logic

- Session-Based Calculation: Automatically calculates ORB levels at New York session open

- Breakout Detection: Identifies valid breakouts with minimum strength requirements

- Multiple Entry Methods:

- Immediate: Enter on breakout confirmation

- Retest: Wait for price to return to ORB level

- Break Previous: Require break of previous structure

Entry Confirmation System

- Momentum Verification: Confirms breakout strength with closing price validation

- Candle Pattern Analysis: Rejection candle detection for better entries

- Multi-timeframe Alignment: Ensures consistency across timeframes

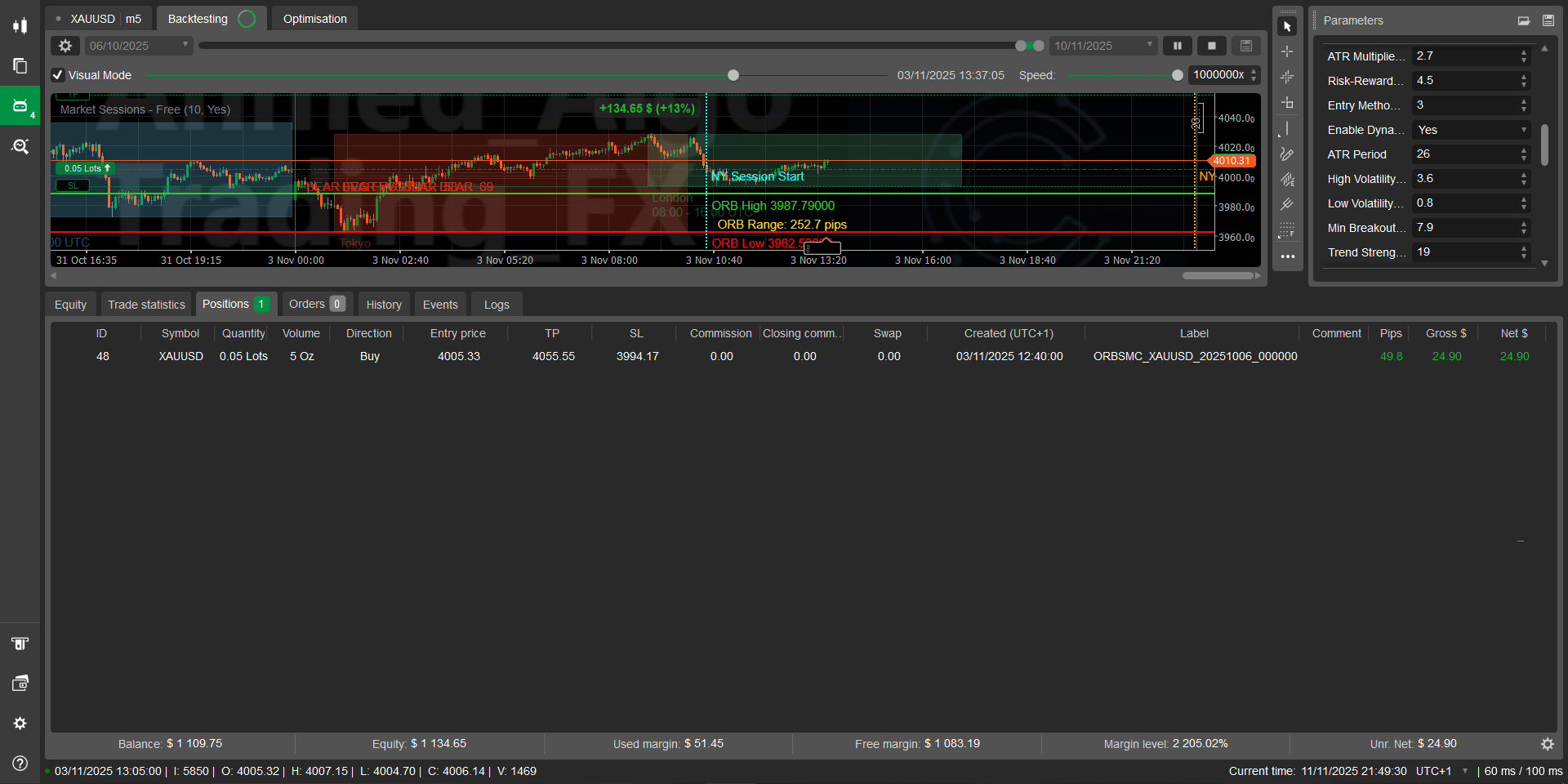

Position Management

- Trailing Stops: Automatically moves stop loss to protect profits

- Break-Even Stops: Locks in profits once trade reaches specified level

- Real-time Monitoring: Continuous position management on every tick

⚙️ Parameter Configuration Guide

Session Parameters

csharp

New York Session Start (ET): 9.5 // 9:30 AM Eastern Time

New York Session End (ET): 16.0 // 4:00 PM Eastern Time

Trade Only Weekdays: true // Avoid weekend trading

Avoid High Impact News: true // News risk management

Risk Management

csharp

// Option 1: Fixed Volume (Simpler)

Use Risk Management: false

Fixed Volume (lots): 0.01

Fixed Stop Loss (pips): 60.0

Fixed Take Profit (pips): 90.0

// Option 2: Risk-Based (Advanced)

Use Risk Management: true

Risk Percentage (%): 0.5

Use ATR-based TP/SL: true

ATR Multiplier for SL: 2.0

Risk-Reward Ratio: 1.5

Volatility Settings

csharp

ATR Period: 14

High Volatility Threshold: 2.5 // ATR multiples

Low Volatility Threshold: 0.8

Min Breakout Strength (pips): 5.0 // Minimum breakout requirement

Smart Money Concepts

csharp

Enable Smart Money Concepts: true

Detect Fair Value Gaps: true

FVG Minimum Size (pips): 15.0

FVG Max Age (hours): 48.0

Require FVG Confirmation: false // Optional FVG requirement

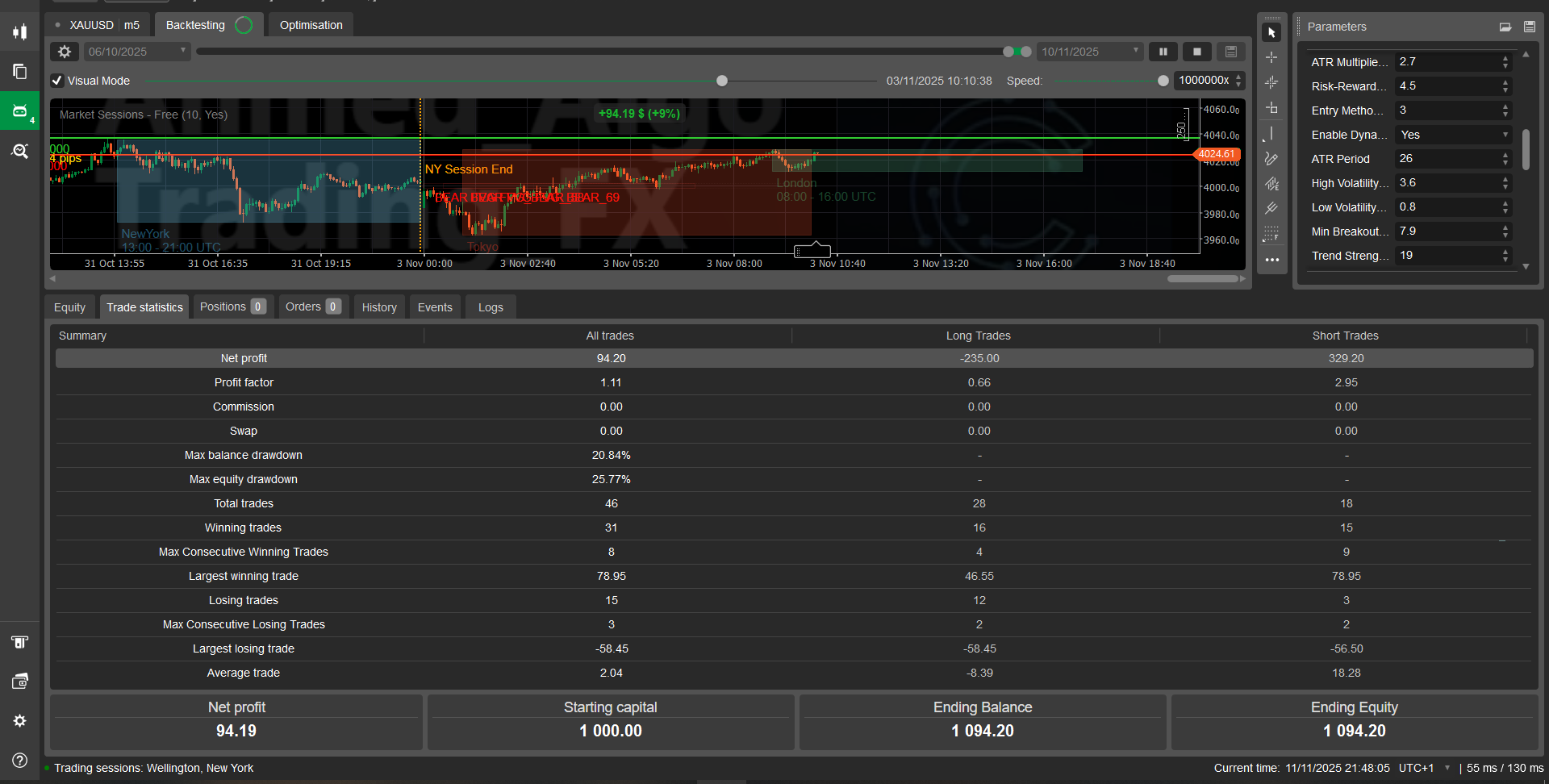

🛡️ Risk Management Features

Multi-Layer Protection System

- Daily Trade Limits: Configurable maximum trades per day

- Maximum Drawdown: Automatic trading halt if drawdown exceeds limit

- Spread Monitoring: Avoids trading during wide spreads

- Margin Validation: Prevents over-leveraging

- Session Filters: Only trades during optimal hours

Drawdown Protection

csharp

Max Daily Trades: 2 // Prevents overtrading

Max Spread (pips): 5.0 // Avoids poor execution

Max Drawdown (%): 5.0 // Automatic shutdown at 5% drawdown

Position Safety Checks

- Pre-trade margin validation

- Volume normalization to broker limits

- Minimum/Maximum position size enforcement

- Account currency compatibility checks

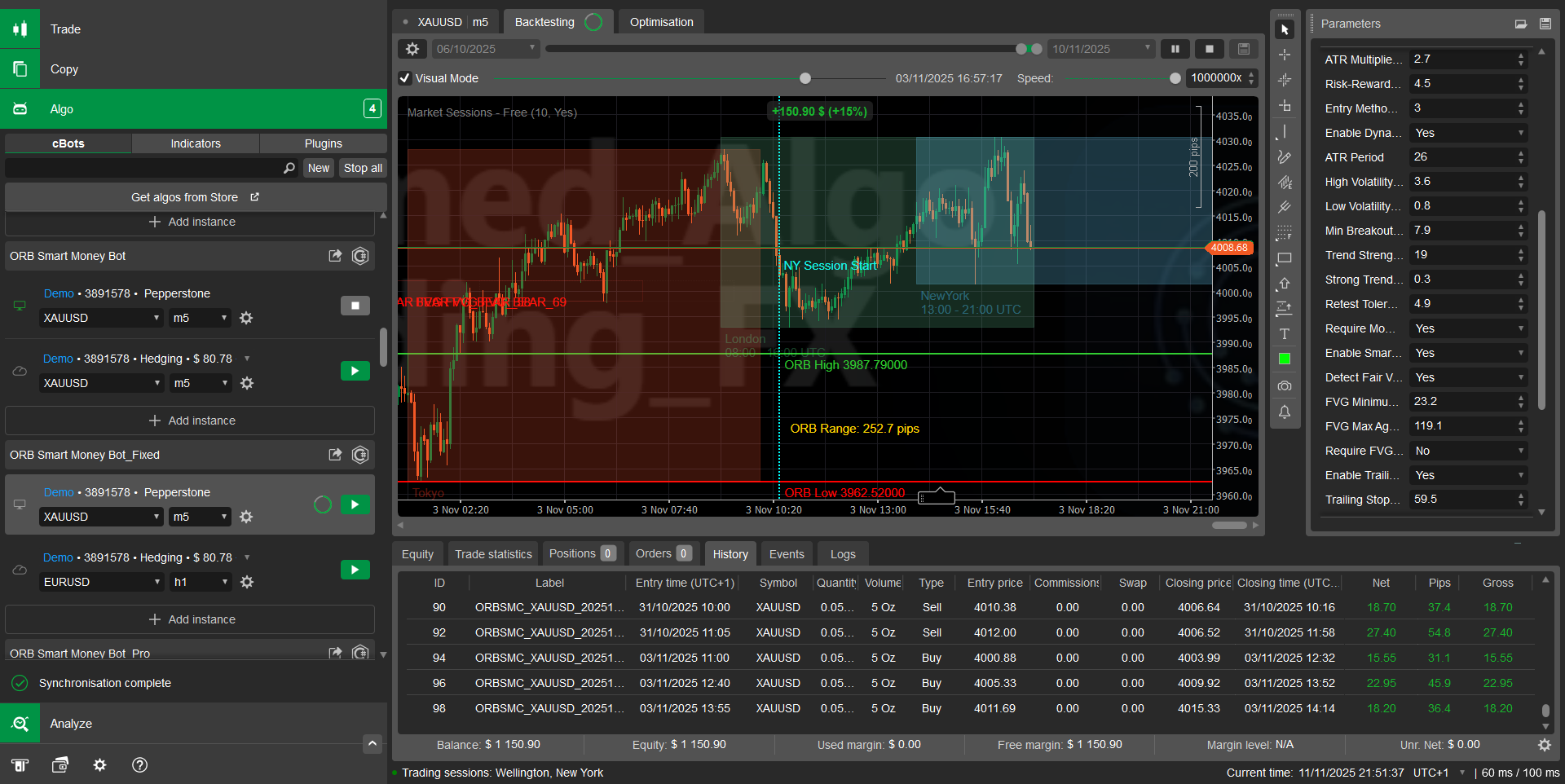

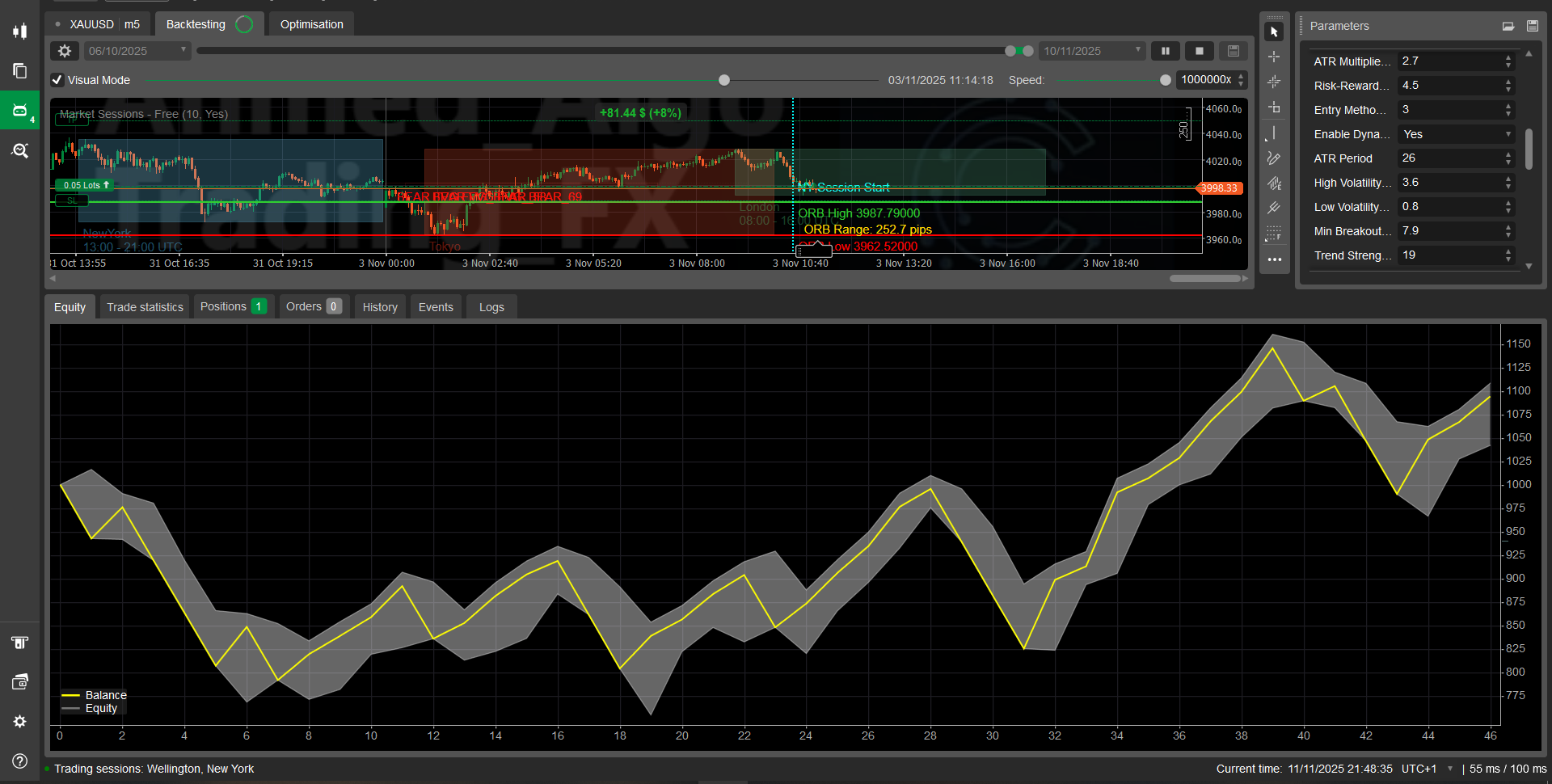

📈 Performance Monitoring

Real-time Analytics

- Daily Performance Tracking: Win/Loss ratio, P&L, drawdown

- Trade Journaling: Detailed log of every trade with reasons

- Market Regime Logging: Records market condition changes

- Error Monitoring: Comprehensive error tracking and reporting

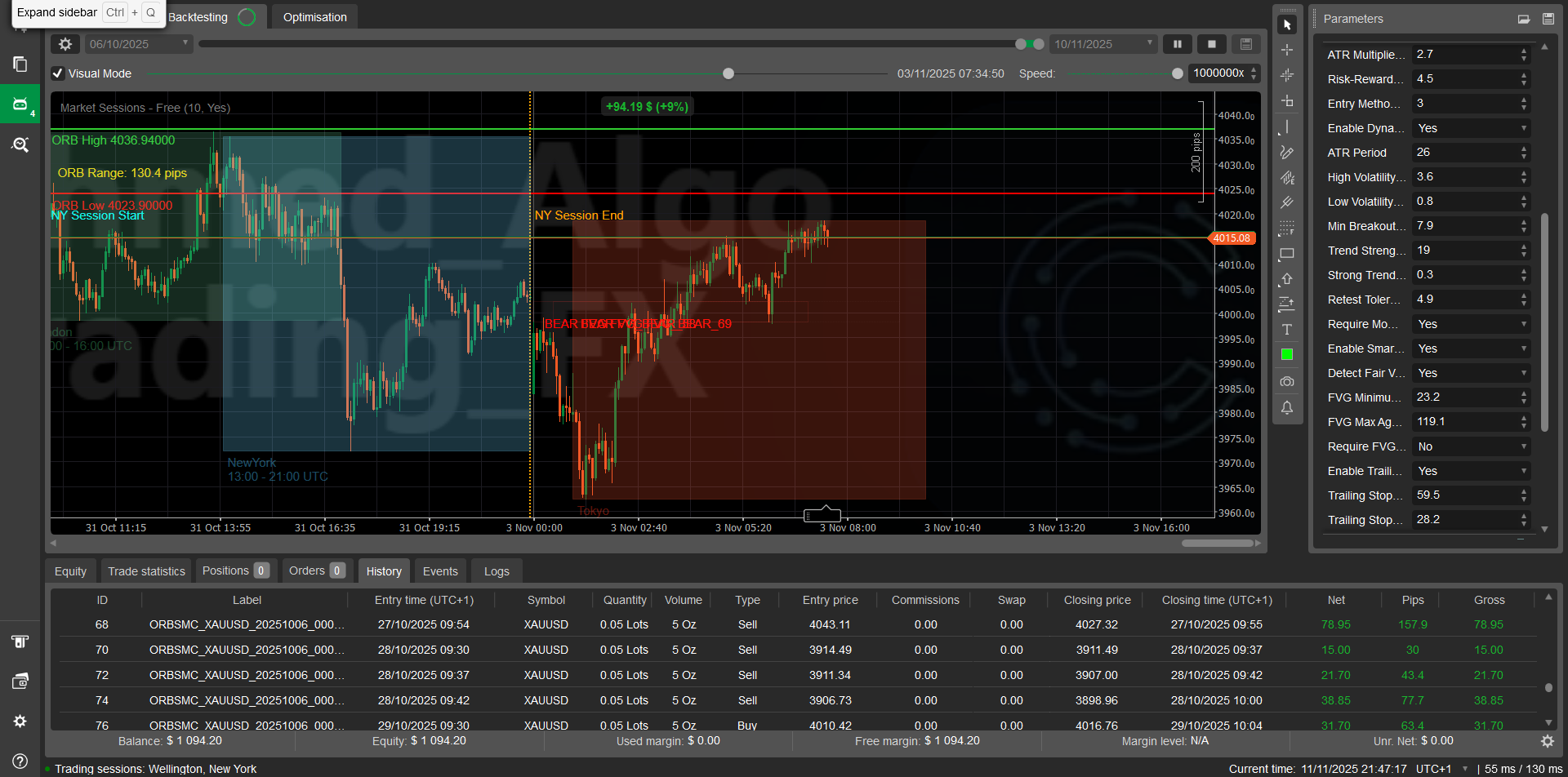

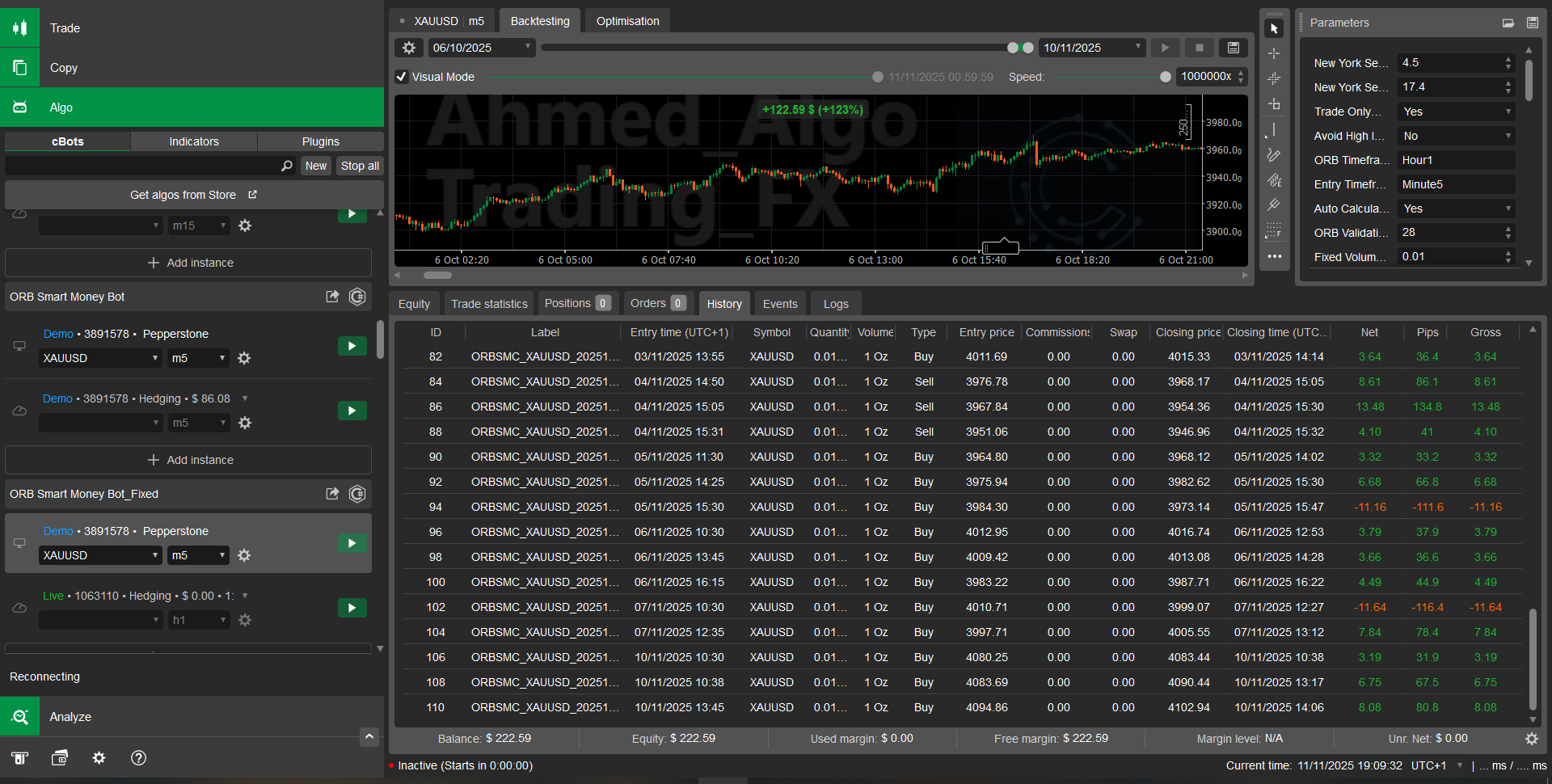

Visualization Features

- ORB Level Drawing: Clear visual representation of key levels

- FVG Zone Marking: Colored zones for Fair Value Gaps

- Session Markers: Visual indicators for session boundaries

- Real-time Updates: Dynamic updates as market conditions change

🔍 Market Condition Detection

Volatility Classification

- HIGH_VOL_TRENDING: High volatility with strong trend → Aggressive entries

- HIGH_VOL_RANGING: High volatility without trend → Cautious entries

- LOW_VOL_TRENDING: Low volatility with trend → Confident entries

- LOW_VOL_RANGING: Low volatility without trend → Patient entries

- MED_VOL_*: Medium volatility scenarios → Balanced approach

Dynamic Entry Adaptation

The bot automatically selects optimal entry methods based on detected market regime:

- Immediate Entry: Best for strong trending markets

- Retest Entry: Optimal for ranging or volatile conditions

- Break Previous: Conservative approach for uncertain markets

🚀 Usage Recommendations

For Beginners

- Start with Fixed Volume mode (0.01 lots)

- Use ATR-based TP/SL for adaptive risk management

- Enable Trailing Stops and Break-Even features

- Keep Debug Logging enabled initially for learning

For Advanced Users

- Use Risk-Based position sizing for optimal capital utilization

- Experiment with FVG Confirmation requirements

- Adjust Dynamic Entry sensitivity based on market observations

- Fine-tune Volatility Thresholds for your risk tolerance

Optimal Settings for XAUUSD

- Session Hours: 9:30 AM - 4:00 PM ET (New York overlap)

- Stop Loss: 50-80 pips (Gold's typical daily range)

- Take Profit: 75-120 pips (1.5-2.0 risk-reward ratio)

- Position Size: 0.01-0.05 lots for standard accounts

⚠️ Important Notes

Broker Compatibility

- Tested with major cTrader brokers

- Requires proper XAUUSD symbol configuration

- Verify pip value calculations with your broker

- Check volume step sizes and minimums

Market Considerations

- Optimized for New York session liquidity

- Best performance during high-volatility periods

- Reduced activity during Asian session

- Automatic holiday detection and avoidance

Risk Disclaimer

- Always test in demo mode first

- Start with minimum position sizes

- Monitor performance closely initially

- Understand all parameters before live trading

📋 Change Log & Improvements

Version 2.0 Major Fixes

- ✅ Fixed volume calculation errors - Proper double to long conversion

- ✅ Correct XAUUSD pip value handling - Gold-specific calculations

- ✅ Enhanced error recovery - Comprehensive exception handling

- ✅ Improved margin validation - Realistic margin requirement estimates

- ✅ Robust ATR calculations - Sanity checks and fallback values

- ✅ Professional logging - Detailed, organized output for monitoring

This bot represents a significant advancement in retail algorithmic trading for precious metals, combining institutional concepts with robust risk management for consistent, professional-grade trading performance.

Warning:

Past successful performance does not guarantee future results; all trading products are used at your own risk.