ASRB – Adaptive Session Range Breakout

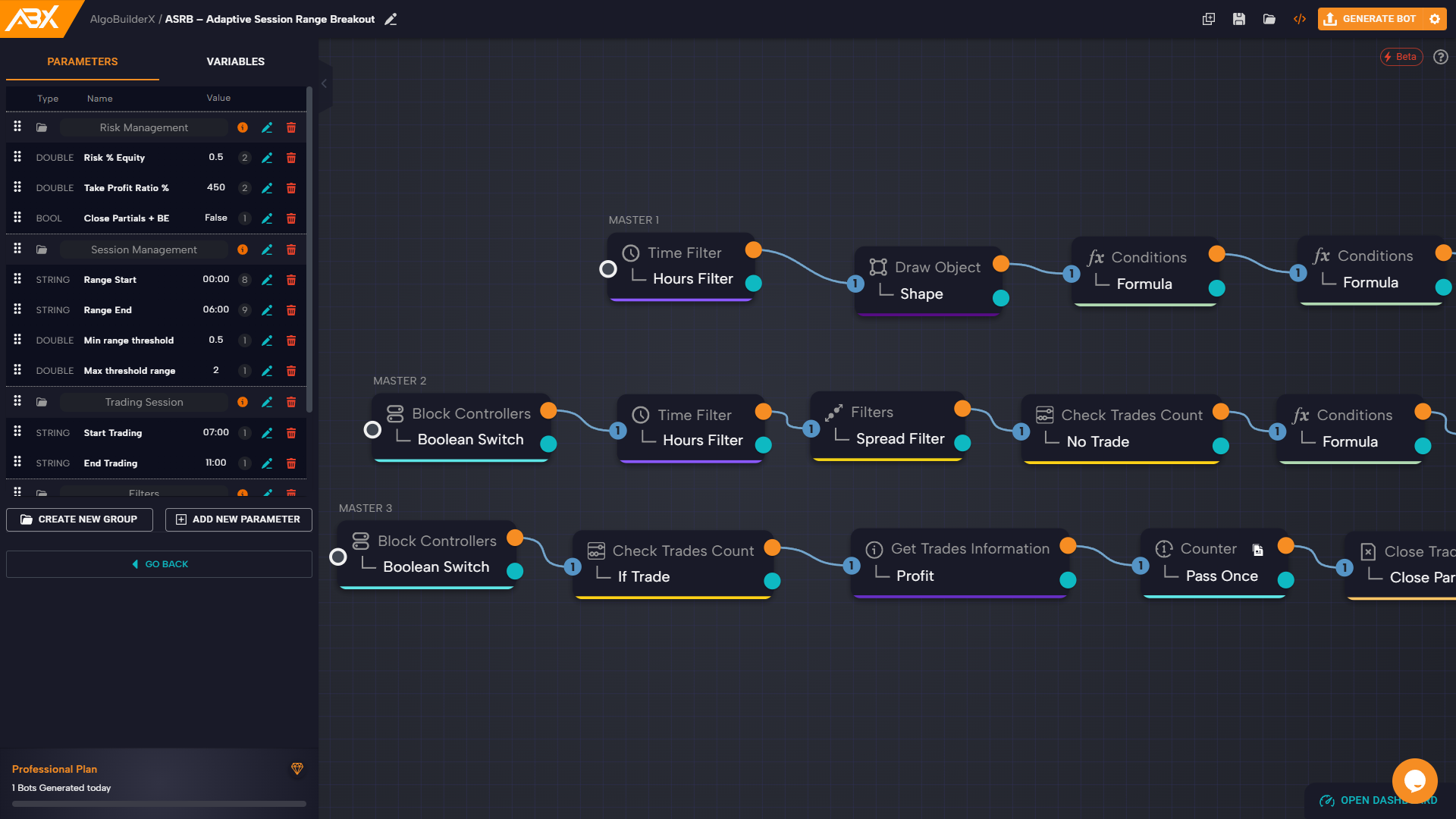

ASRB is a session-based breakout strategy designed to trade only market expansion phases following a valid accumulation period.

Trades are executed exclusively on filtered, high-quality ranges and only when trend and volatility conditions justify participation.

Market Logic

- Market phases: Accumulation → Expansion → Rebalancing

- ASRB operates only during the expansion phase

- Breakouts are taken only from validated session ranges, not from raw session highs/lows

Session Range Construction

- Reference session: Asian Session

- Time window: 00:00 – 06:00 UTC

- Range calculation timeframe: M15

Calculated values:

- Session High

- Session Low

- Session Range = High − Low

It only works on pairs that have 4 digits after the decimal point, such as EURUSD.

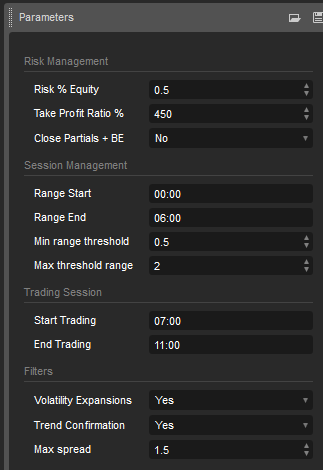

Filter 1 – Range Quality Filter

Purpose: eliminate low-quality noise and late moves.

- Volatility reference: ATR(14) on H1

- Valid range condition:

0.5 × ATR(H1) ≤ Session Range ≤ 2 × ATR(H1)

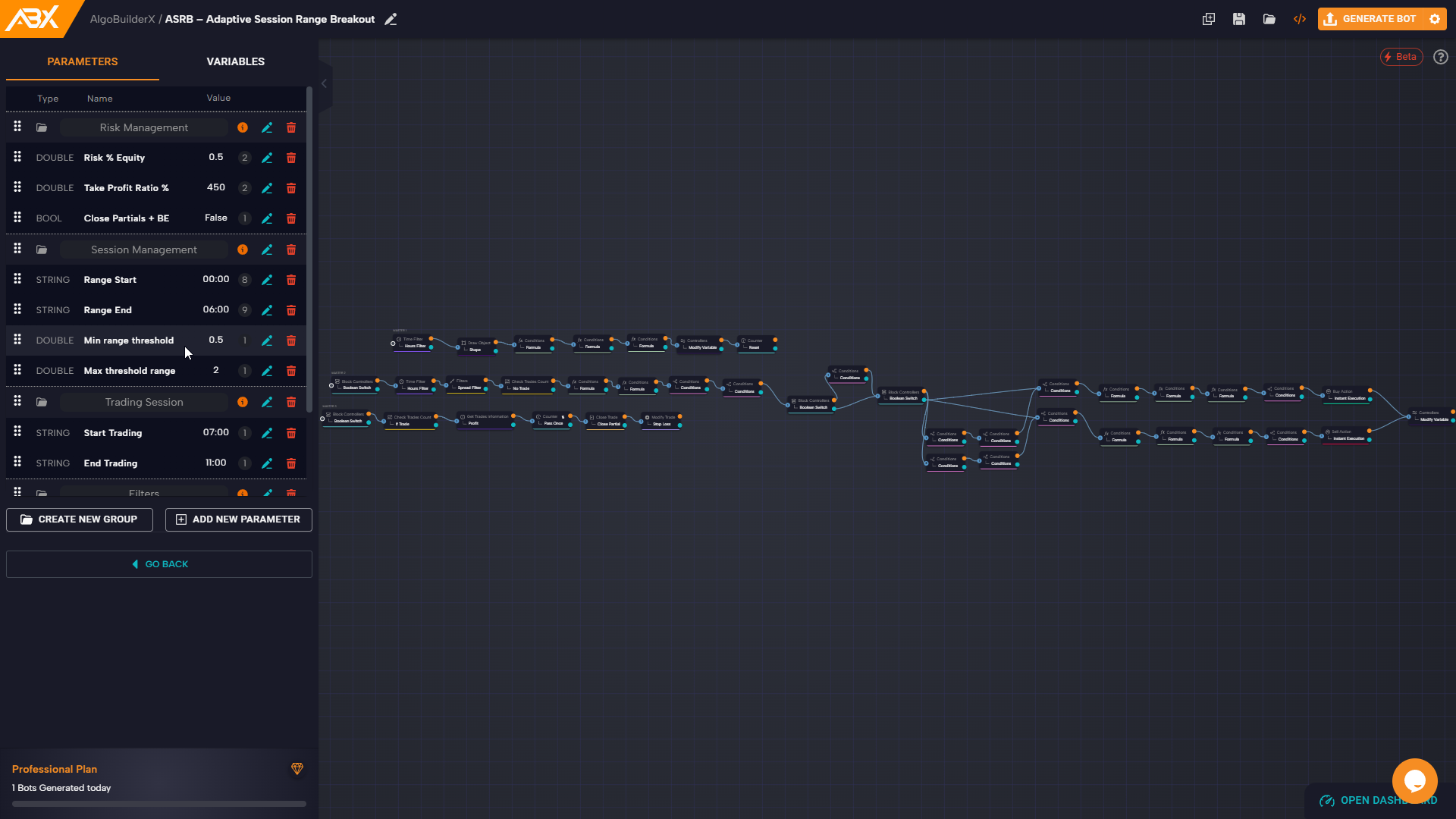

You can modify these thresholds using the parameters found in the “Session Management” group.

- Below lower bound → insufficient accumulation (noise)

- Above upper bound → move likely already exhausted

No trades are allowed outside this range.

Filter 2 – Trend Confirmation (Multi-Timeframe)

Purpose: enforce directional coherence with higher-timeframe structure.

- Timeframe: H1

- Indicators:

- EMA 50

- EMA 200

Directional rules:

- Long only if:

- EMA50 > EMA200

- Price > EMA50

- Short only if:

- EMA50 < EMA200

- Price < EMA50

The strategy trades one direction only, no hedging.

Filter 3 – Volatility Expansion Confirmation

Purpose: avoid false breakouts and low-participation moves.

- Indicator: ATR(14) on M15

- Condition:

Current ATR(M15) > Average ATR(M15) over last 20 bars

If volatility is not expanding, breakout signals are ignored.

Trade Activation Window

- Trades allowed only between:

07:00 – 11:00 UTC

This window covers the London session and early London–NY overlap, where breakouts show higher follow-through.

Entry Logic

Long Setup

- M15 candle closes above Session High

- Breakout candle requirements:

- Body ≥ 60% of candle range

- Close above the level (no wick-only break)

Short Setup

- Specular conditions:

- M15 close below Session Low

- Same candle structure and filters

The strategy executes only the initial breakout.

No continuation or re-entry trades are allowed.

Risk Management

Stop Loss

- Structural SL:

SL = 0.5 × Session Range

Take Profit

Risk-based:

- TP1 = 1R (partial close, 50%)

- TP2 = 2R (full exit)

Break-Even Logic

- When price reaches +1R (50% partial close)

- Stop Loss is moved to entry price

Use the “Close Partials + BE” parameter to enable or disable this setting.

Protection Filters

No trade execution if:

- Spread > 1.5

- One trade has already been executed for the day

The strategy enforces strict trade frequency control and avoids overtrading.

Key Characteristics

- Single-entry breakout logic

- Multi-timeframe context filtering

- Volatility-confirmed execution

- No grid, no martingale, no averaging

- Inactivity during low-quality market conditions is intentional

Developed with AlgoBuilderX.

⚠️ Important Note

This cBot works only on demo accounts.

If you want to use it on a live account, you must:

- Subscribe to algobuilderx(dot)com

- Download the original project from the AlgoBuilderX Discord

- Generate your own cBot from the project

This example is provided to demonstrate AlgoBuilderX functionality and as a starting point for building custom strategies.

Always test and optimize any strategy before using it on a real trading account.

🚀 Get Started

Create your cBot now in an easy and intuitive way!

👉 algobuilderx(dot)com