AIO4 Cloud

cBot

Version 1.0, Feb 2025

Windows, Mac, Mobile, Web

This is a fully automated bot. The All In One BOT Version 4 On Cloud. This bot works based on the following:

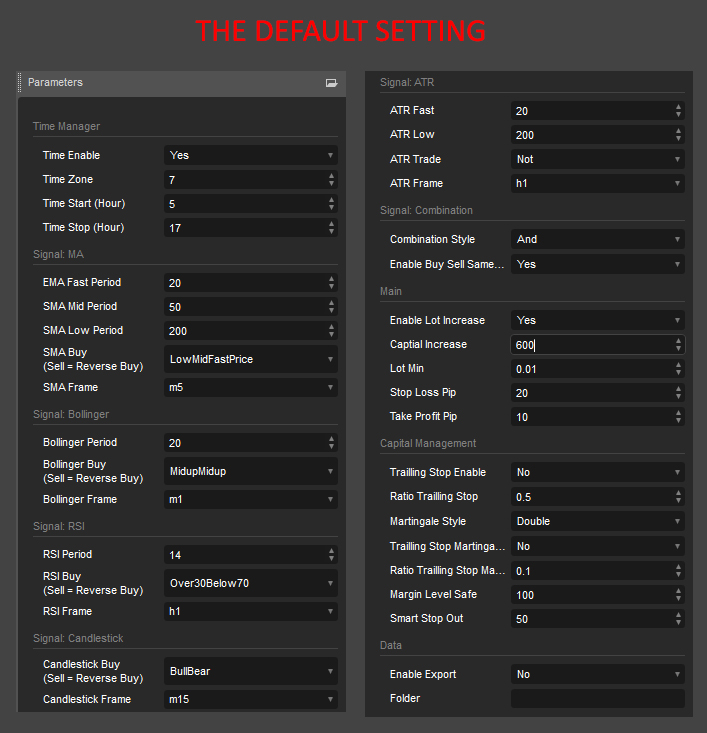

- Combines many different indicators at many different timeframes at the same time. If all these signals meet the given requirements, a buy order will be executed at the market price, and the sell signal will be taken in reverse symmetry according to the selected buy signal.

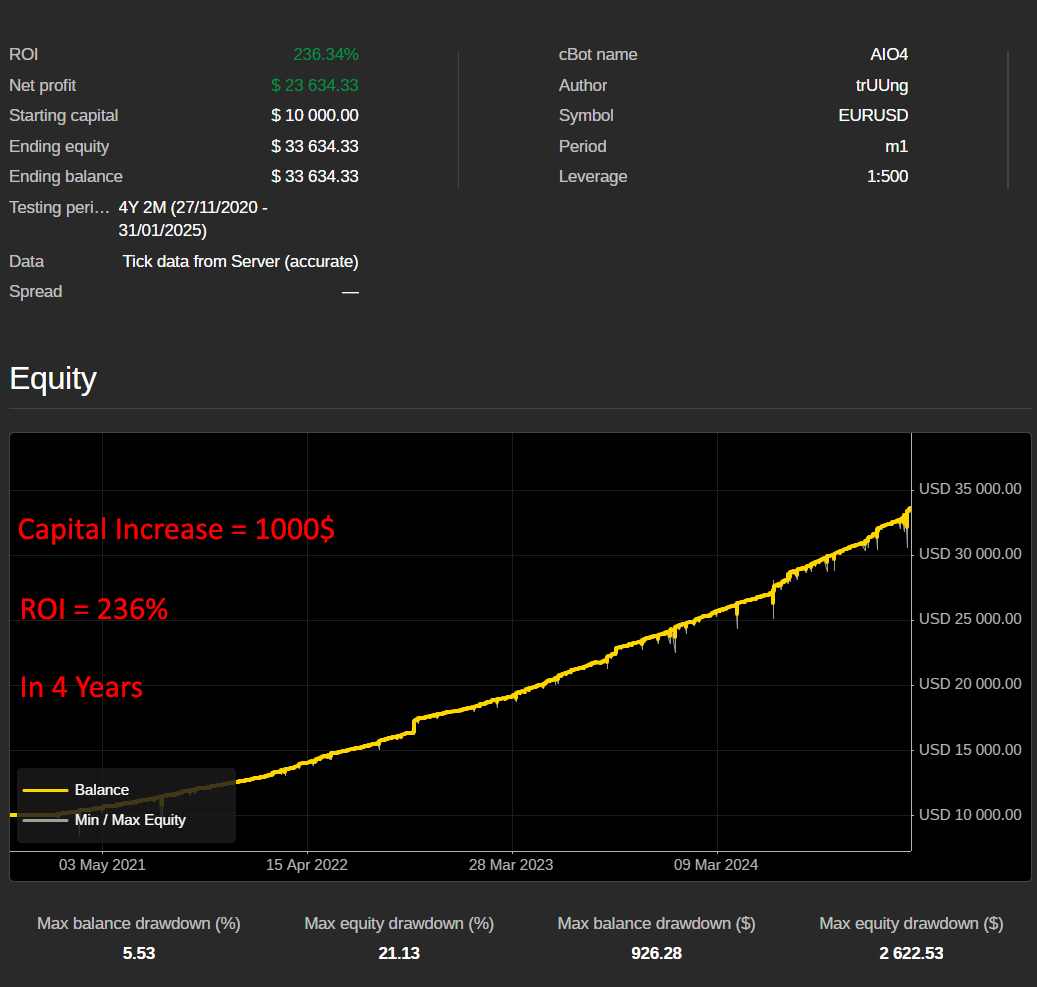

- Thoroughly backtested for 4 years up to the present time (31/1/2025) to get the best default settings for EURUSD.

- Simultaneously combines many indicators and many different types of capital management: Trailing Stop, Martingale Double, Fibo, PlusOne.

- Below is an attached image of the backtest results for EURUSD in 4 years with extremely safe settings, risk level of about 21%.

- If you want to increase your profit, set Capital Increase at $400 or $600. It is recommended not to leave it below $400 for a lot size of 0.01.

- Margin Level Safe should not be below 100%. If it is safer, it should be at 500%. That is, when the margin level is below this level, the bot will not open any more orders.

- Smart Stop Out to simulate reality when used in backtest and Optimal.

- SMA Buy = LowMidFastPrice in the m5 timeframe, meaning that Price < SMAFast < SMAMid < SMALow then execute a buy order, otherwise Price > SMAFast > SMAMid > SMALow then execute a sell order. All orders are executed at market price.

- Bollinger Buy = MidupMidup in m1 timeframe, which means when the previous price and the current price are between the Main line and the Up line, then execute a buy order, otherwise when the price is between the Main and Down line, then execute a sell order.

- RSI Buy = Over30Below70 in h1 timeframe, which means when RSI is between 30 and 70, then execute a buy and sell order.

- Candlestick Buy = BullBear in m15 timeframe, which means when the previous candle is Bull and the current candle is Bear, then execute a buy order, otherwise when the previous candle is Bear and the current candle is Bull, then execute a sell order.

- ATR Trade = FastLow in h1 timeframe, which means that the ATRFast line > ATRLow will execute a buy and sell signal at the same time to combine the signals set above.

- Combination Style = And, which means combining the signals above if they occur at the same time buy, if it happens at the same time, sell.

- Enable Export is used to export the results in Optimal to a csv file located in the path in the Folder section.

* The default setting runs on the EURUSD symbol in the m1 timeframe, this setting is the best found after 1 month of running all cases of EURUSD in the m1 timeframe on a live account, leverage 1:500, transaction fee 35 per 1 million in both directions, ROI = 236% with Capital Increase = $1000, Capital Increase is minimum to start bot, suggestion is 1000$.

** If you want ROI = 2072%, set Capital Increase = $400. ROI = 676% with Capital Increase = $600.

* If you need more details about the AIO 4 Cloud (All In One Version 4 On Cloud) please contact me via telegram +84 866 747 348

Trading profile

0.0

รีวิว: 0

รีวิวจากลูกค้า

ยังไม่มีรีวิวสำหรับผลิตภัณฑ์นี้ หากเคยลองแล้ว ขอเชิญมาเป็นคนแรกที่บอกคนอื่น!

RSI

ATR

Martingale

Signal

EURUSD

Bollinger

เพิ่มเติมจากผู้เขียนคนนี้

นอกจากนี้คุณยังอาจชอบ

cBot

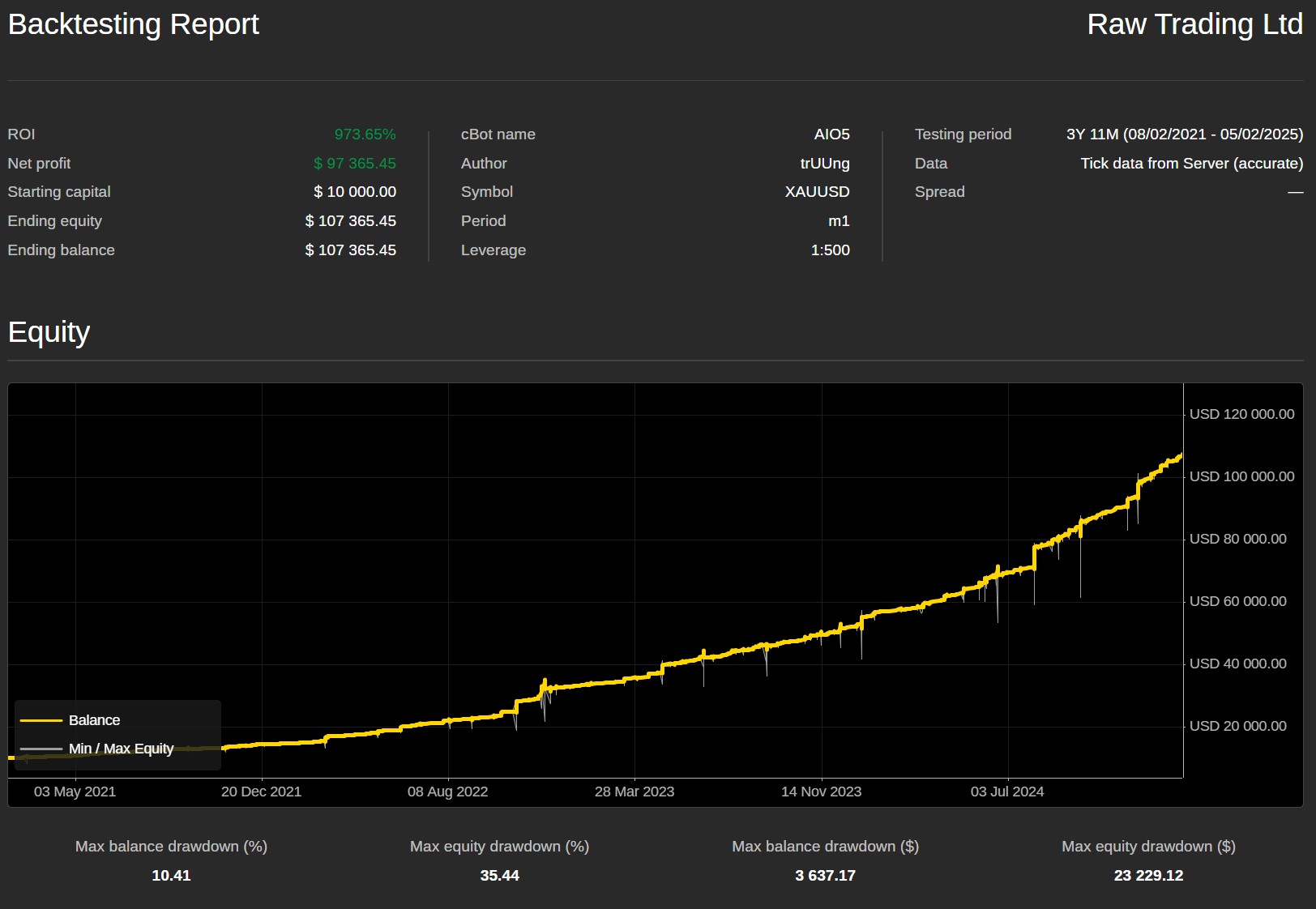

XAUUSD

GOLD BREAKER Bot

42.53M

ปริมาณการเทรด

133.11K

Pips ที่ได้กำไร

1

การขาย

102

ติดตั้งฟรี

.png)

.png)