DualSwingEdge is a swing version of the original DualEdgeBot, tailored for swing traders. It provides a versatile range of options to trade breakouts or mean reversion strategies while maintaining strict risk management. With a focus on capturing larger market movements over longer periods, it’s ideal for traders who prefer less frequent but more strategic trades. The bot allows you to configure every important aspect of your trading strategy with user-friendly parameters, giving you full control over the trading process without relying on risky strategies like martingale.

Whether you’re looking to capitalize on price breakouts or mean reversions, DualEdgeSwing offers flexibility and precision.

Key Features:

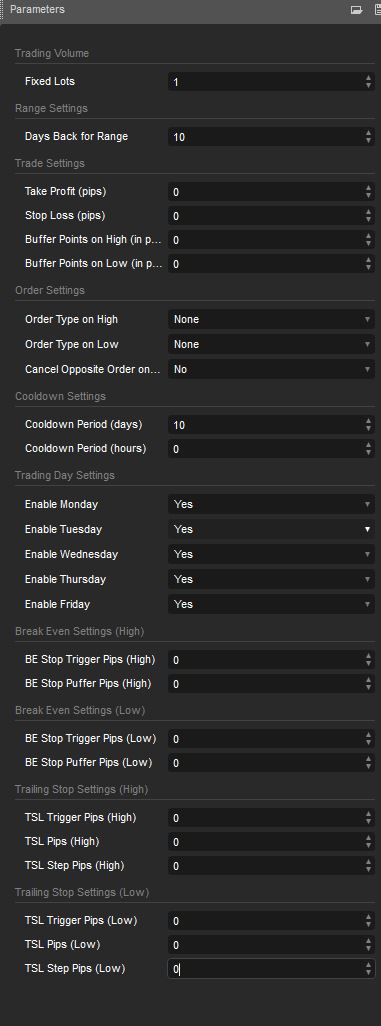

Trading Volume:

- Fixed Lots: Define the lot size for each trade, controlling your risk with precision.

Range Settings:

- Days Back for Range: Set the number of days the bot looks back to calculate the trading range.

Trade Settings:

- Take Profit (pips): Specify how many pips to gain before the trade is closed for profit.

- Stop Loss (pips): Set your risk level by defining the maximum loss in pips.

- Buffer Points on High (pips): Add a buffer above the high to avoid premature entries on a breakout.

- Buffer Points on Low (pips): Add a buffer below the low to prevent early executions in mean reversion trades.

Order Settings:

- Order Type on High: Select between Sell Limit or Buy Stop orders on the high breakout.

- Order Type on Low: Choose Buy Limit or Sell Stop on the low breakout.

- Cancel Opposite Order on Fill: Automatically cancel the opposite pending order once one side gets triggered to avoid conflicting trades.

Cooldown Settings:

- Cooldown Period (days): Set how many days the bot waits after an order is placed before new trades can occur.

- Cooldown Period (hours): Fine-tune the cooldown with hours for more control over the time between trades.

Cooldown Period (days & hours): The Cooldown Period is a important feature in DualEdgeSwing, designed to help manage trading frequency. It ensures that after a trade is executed or a range is defined, the bot pauses for a specified amount of time before placing new orders. This feature prevents overtrading and provides the market with time to stabilize, reducing the risk of entering new trades prematurely.

Trading Day Settings:

- Enable Monday-Friday: Select which days of the week the bot is allowed to trade, giving you control over when it operates.

Break Even Settings (High):

- BE Stop Trigger Pips (High): Define how many pips the price must move before the stop loss moves to break even on high breakout trades.

- BE Stop Puffer Pips (High): Add a buffer to the break-even stop for high breakouts. A positive value helps lock in profits by moving the stop further away from the entry, while a negative value keeps it tighter, allowing for more flexibility in case of retracements.

Break Even Settings (Low):

- BE Stop Trigger Pips (Low): The same break-even strategy but applied to low breakout trades.

- BE Stop Puffer Pips (Low):Adjust the buffer after the stop-loss moves to break even for a low breakout. A positive value locks in profits by moving the stop further from the entry point, while a negative value keeps it closer, allowing for more market fluctuation before exiting.

Trailing Stop Settings (High):

- TSL Trigger Pips (High): Activate the trailing stop after the price moves a certain number of pips in your favor on high trades.

- TSL Pips (High): Set how closely the trailing stop follows the price on high breakouts.

- TSL Step Pips (High): Define the step size for the trailing stop to follow price movements at regular intervals.

Trailing Stop Settings (Low):

- TSL Trigger Pips (Low): Activate the trailing stop after price movements in your favor on low breakout trades.

- TSL Pips (Low): Set how far the trailing stop will follow the price on low trades.

- TSL Step Pips (Low): Set intervals for the trailing stop to adjust itself on low breakout trades.

How It Works:

Time-Based Range Calculation:

DualEdgeSwing operates by measuring price movements over a configurable number of days to establish the high and low range. Based on this range, it places strategic pending orders either for a breakout or a mean reversion.

- Strategic Orders:

- Sell Limit Orders: Placed above the high to capitalize on price reversals.

- Buy Stop Orders: Set above the high to catch upward breakouts.

- Buy Limit Orders: Placed below the low price to capture reversals upward.

- Sell Stop Orders: Placed below the low to catch downward breakouts.

- Risk Management:

- Users can set their stop loss and take profit levels. Break-even stop-loss adjustments are available once a trade moves in your favor, and trailing stops allow you to lock in profits as the price moves.

- Visual Feedback:

The bot draws horizontal lines on the chart to represent the high and low range and updates them based on the latest price movements.

Version For daytraders - https://ctrader.com/products/139?u=Tradinglifefx