DualEdgeBot: Flexible Breakout and Mean Reversion Trading System

DualEdgeBot is a versatile trading algorithm designed to trade both breakout and mean reversion strategies with fully customizable parameters. Whether you want to trade range breakouts or capitalize on price reversals, DualEdgeBot provides you with the tools to do so while managing risk effectively.

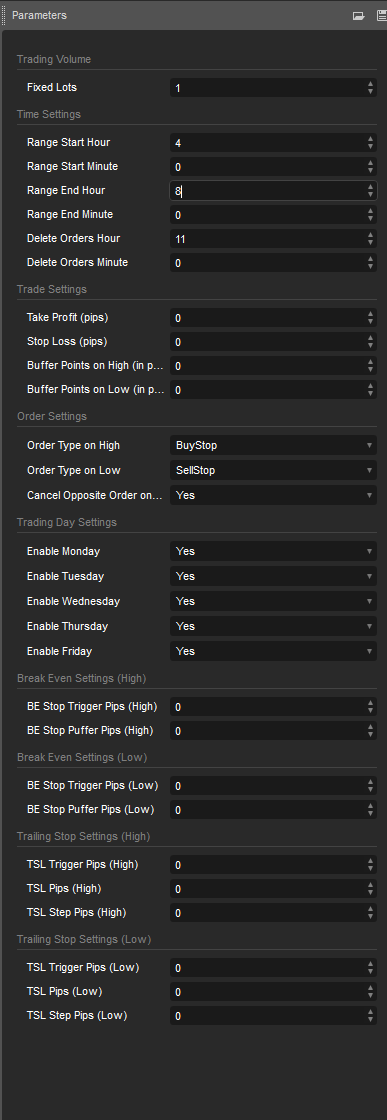

Trading Volume:

- Fixed Lots: Set the exact lot size for each trade, giving you full control over position sizing.

Time Settings:

- Range Start Hour/Minute: Define the hour and minute to start measuring the trading range.

- Range End Hour/Minute: Specify the time to end the range definition and start trading based on breakouts or reversals.

- Delete Orders Hour/Minute: Set the exact time to cancel all pending orders, preventing unwanted trades after a certain period.

Trade Settings:

- Take Profit (pips): Set the target profit in pips for each trade.

- Stop Loss (pips): Define the maximum loss in pips before a position is closed.

- Buffer Points on High (pips): Add a buffer above the high price before executing an order to avoid false breakouts.

- Buffer Points on Low (pips): Add a buffer below the low price to prevent premature trade executions.

Order Settings:

- Order Type on High: Select whether to place a Sell Limit or Buy Stop order when the high of the range is breached.

- Order Type on Low: Choose between Buy Limit or Sell Stop when the low of the range is breached.

- Cancel Opposite Order on Fill: Automatically cancel the pending opposite order (high or low) once one order is filled, to avoid double entries.

Trading Day Settings:

- Enable Monday-Friday: Toggle trading activity for each day of the week, giving you full control over when the bot is allowed to execute trades.

Break Even Settings (High):

- BE Stop Trigger Pips (High): Define how many pips the price must move in your favor before the stop loss is moved to break even for a high breakout.

- BE Stop Puffer Pips (High): Add a buffer to the break-even stop for high breakouts. A positive value helps lock in profits by moving the stop further away from the entry, while a negative value keeps it tighter, allowing for more flexibility in case of retracements.

Break Even Settings (Low):

- BE Stop Trigger Pips (Low): Same as above, but for low breakout trades.

- BE Stop Puffer Pips (Low): Adjust the buffer after the stop-loss moves to break even for a low breakout. A positive value locks in profits by moving the stop further from the entry point, while a negative value keeps it closer, allowing for more market fluctuation before exiting

Trailing Stop Settings (High):

- TSL Trigger Pips (High): Define the number of pips in profit needed before the trailing stop is activated for high breakout trades.

- TSL Pips (High): Set how closely the trailing stop follows the price after the TSL trigger is hit.

- TSL Step Pips (High): Configure the step size for the trailing stop to follow price movement at defined intervals.

Trailing Stop Settings (Low):

- TSL Trigger Pips (Low): Same as above, but for low breakout or mean reversion trades.

- TSL Pips (Low): Define the trailing stop distance for low trades.

- TSL Step Pips (Low): Set the interval step size for trailing stop adjustments in low trades.

How It Works ?

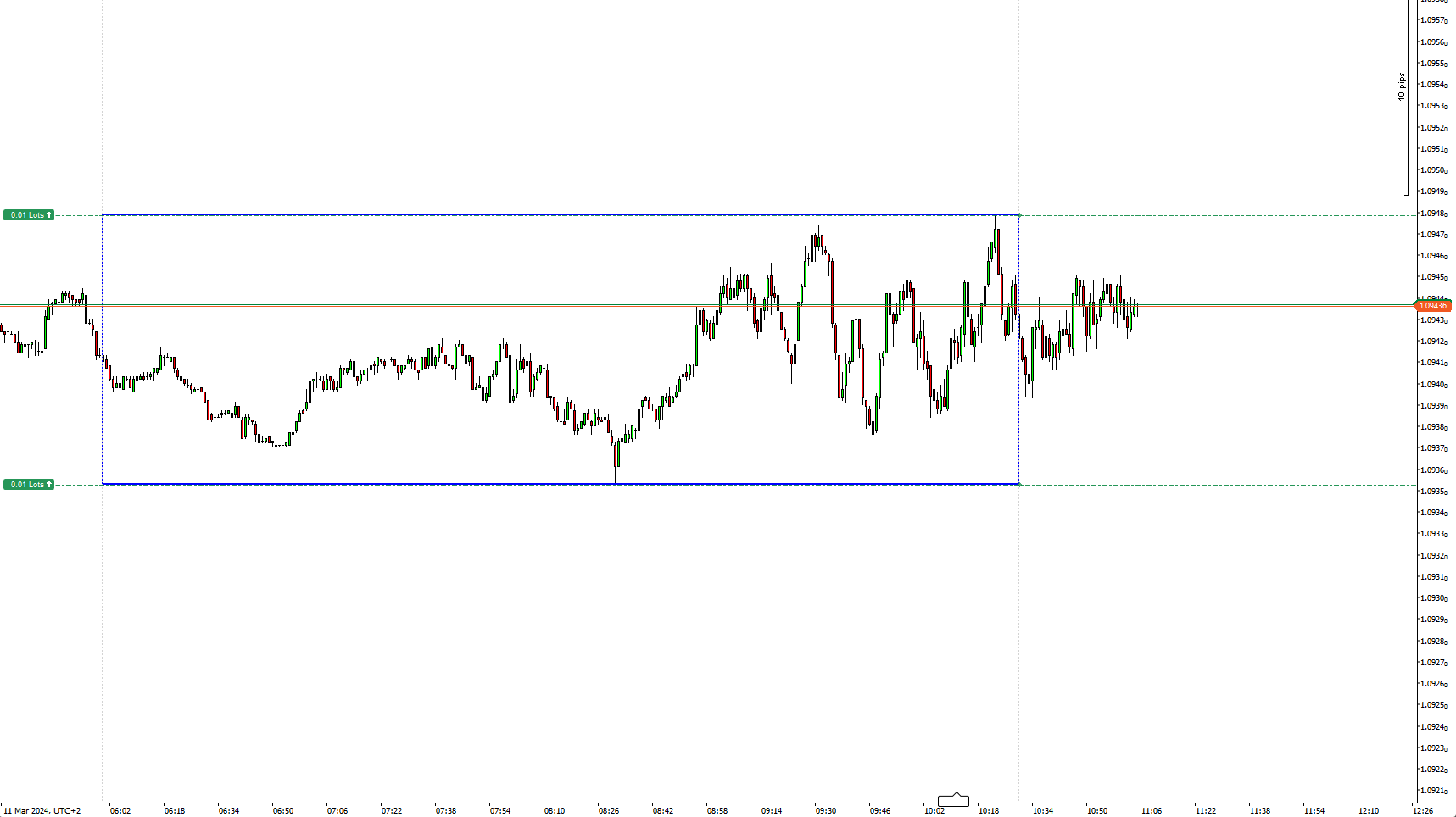

- Time-Based Range Definition:

- The bot operates within a specified time range set by the user.

- During this time, it analyzes price movements to determine the highest and lowest prices, effectively establishing a trading range.

- Order Placement:

- Strategic Order Types:

- The bot places pending orders based on the defined range:

- Sell Limit Orders: Placed above the highest price in the range to capitalize on potential downward movements.

- Buy Stop Orders: Placed above the highest price in the range to capture upward breakouts.

- Buy Limit Orders: Placed below the lowest price in the range for potential upward reversals.

- Sell Stop Orders: Placed below the lowest price in the range to capture downward breakouts.

- The bot includes customizable buffer points (in pips) to adjust the order placement levels for increased effectiveness.

- Risk Management Features:

- Stop Loss and Take Profit: Users can set their desired stop-loss and take-profit levels (in pips) to manage risk effectively and secure profits.

- Break Even and Trailing Stops: The bot can automatically adjust stop-loss levels to the entry price (break-even) after reaching a specified profit, as well as trail the stop-loss to lock in profits as the price moves favorably.

- Trading Day Settings:

- Users can choose which days of the week the bot will trade, allowing for flexibility based on market conditions or personal preferences.

- Order Management:

- The bot monitors open orders and has the ability to cancel opposite pending orders if one order gets filled, ensuring that only relevant positions are active.

- It also has a feature to delete all pending orders after a specified time to avoid unnecessary exposure.

- Visual Feedback:

- The bot draws a rectangle on the chart to visually indicate the defined trading range, helping users to understand the trading context.

- Vertical lines are drawn to mark the start and end of the trading time for clarity.

- User-Friendly Customization:

- All key parameters, including lot sizes, buffer points, and time settings, are easily adjustable, allowing users to tailor the bot's behavior to fit their trading strategy.

With DualEdgeBot, traders can take advantage of market volatility in both directions, using breakout strategies for trend continuation or mean reversion for range-bound markets. The bot's advanced risk management options ensure that profits are protected and losses are minimized.

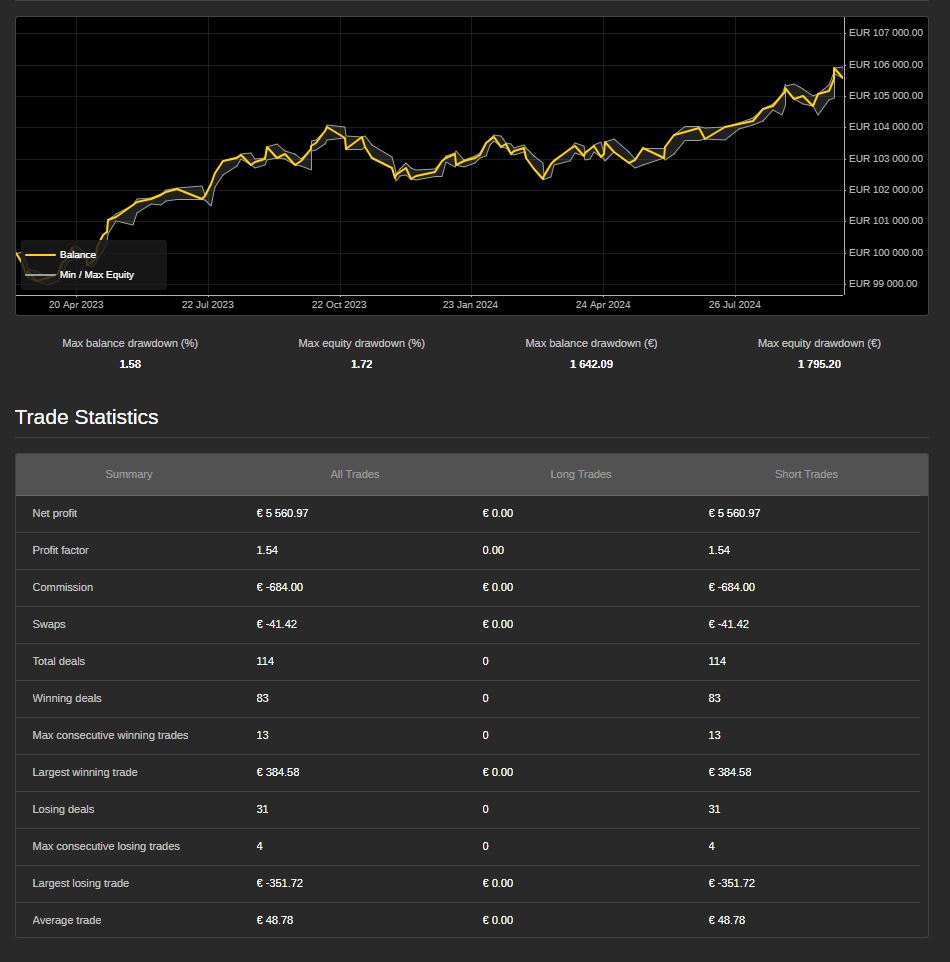

- Optimising / Backtesting / Forward Testing

- For the most accurate backtesting and optimization results, I recommend using smaller timeframes and Tick data from the server. ( 1M/5M/15M/1H are ok)

- After you find the best parameters for your system, let it run at least 100 trades on a demo account with live price movements. This will help ensure that you haven't overfitted the system during the backtesting phase.

About myself:

I've been trading for over 7 years and always wanted to create an algorithm that could perform long term. After lots of work, I finally coded one that works well for me. However, this isn't some magic bullet, there's no "holy grail" in trading. Unlike most of the systems people promote here, this one won't make you rich overnight.. It's designed to work for traders who follow strict rules, stay disciplined, and don't get greedy. If you're looking for something quick and easy, this isn't for you.

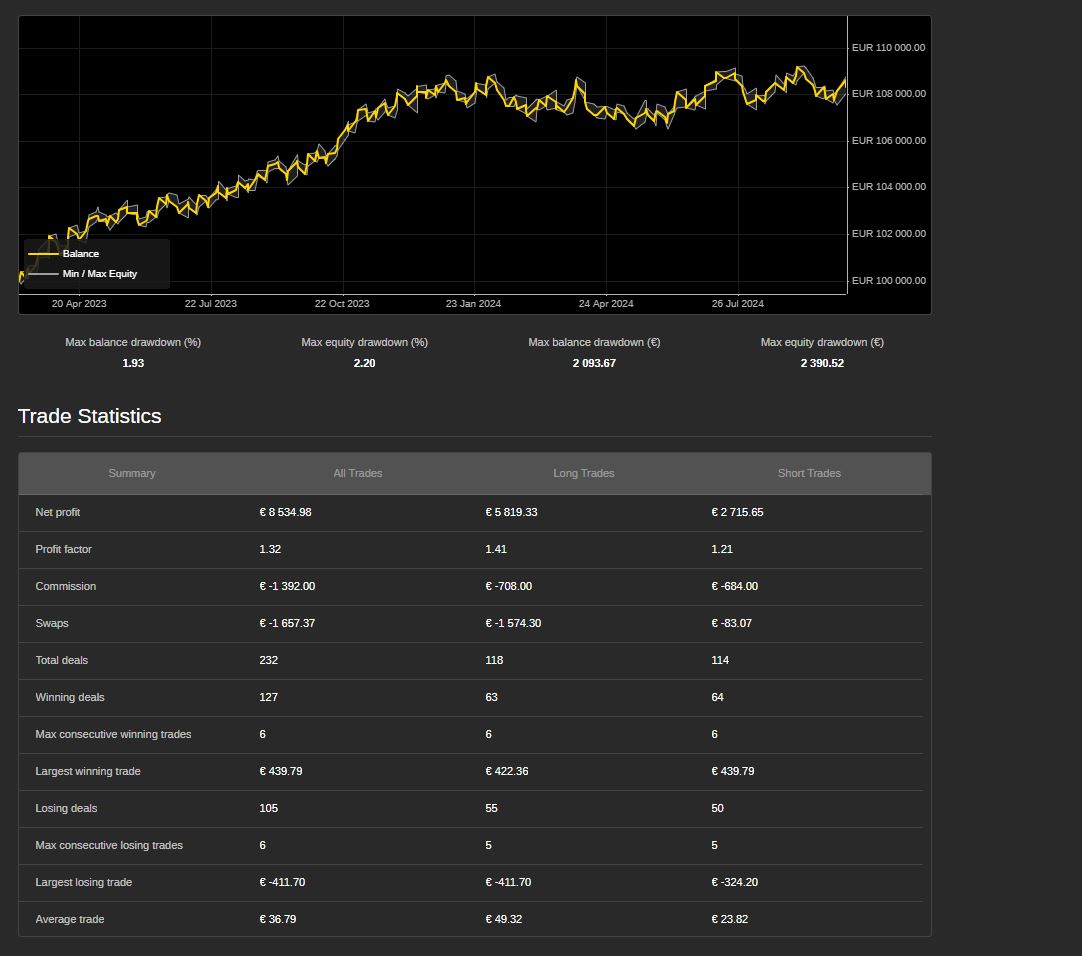

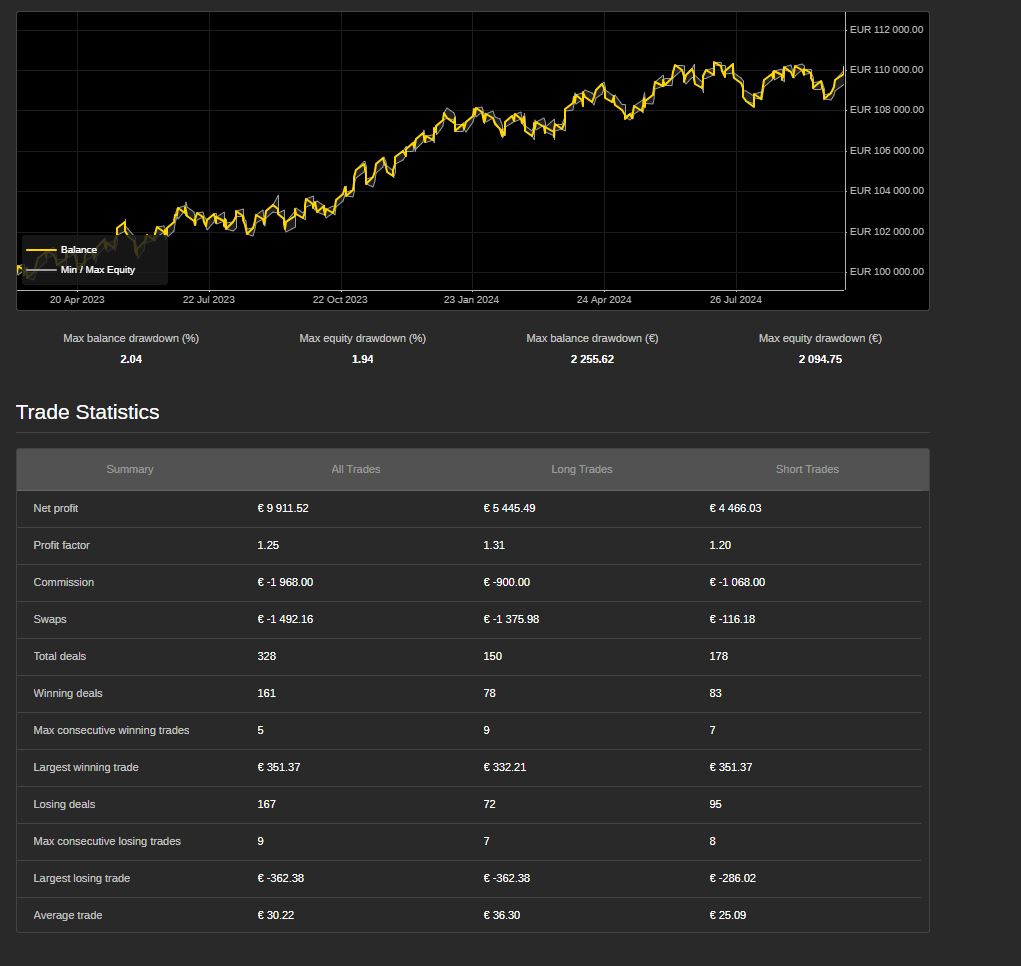

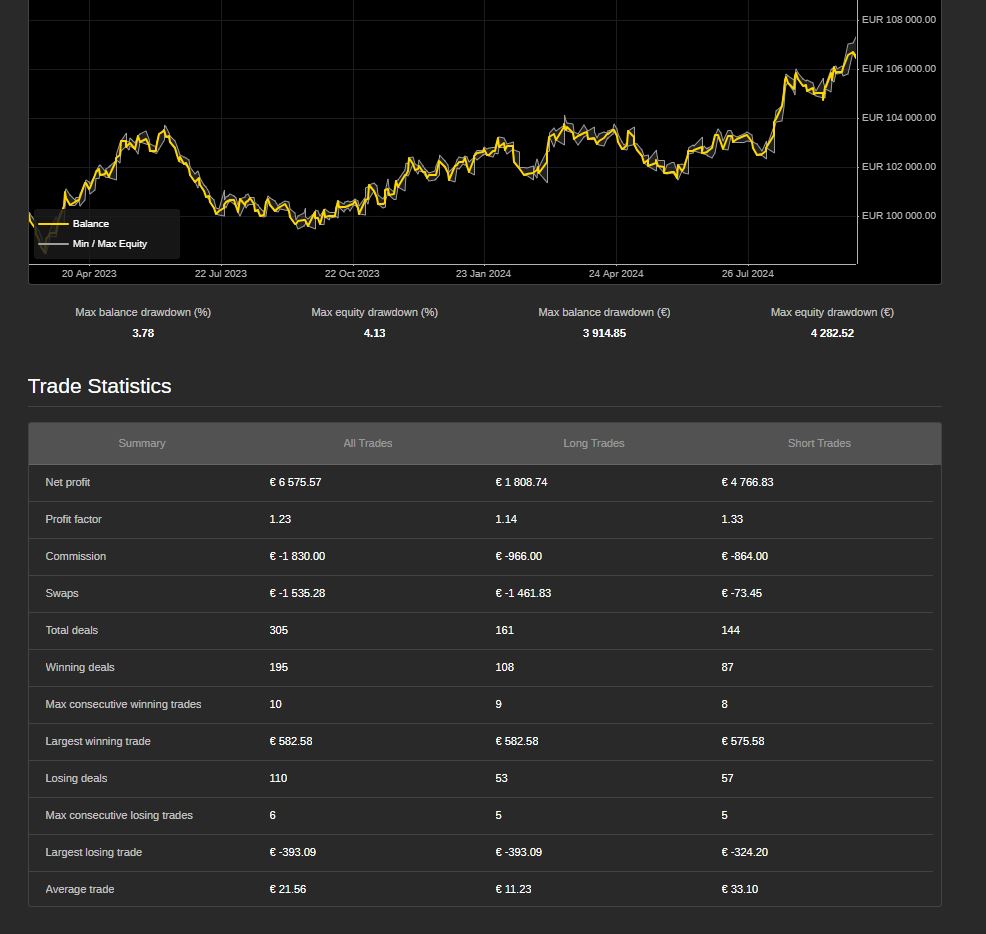

I'm not sharing my exact settings because you need to do your own backtesting and forward testing to find what works for you. The screenshots show examples of how it could look like once you’ve tailored it to your own trading style.

Version for Swing Traders : https://ctrader.com/products/1455?u=Tradinglifefx