.png)

Algo-Deers Regime Aware Ultimate Bot — The cBot with a Regime Brain

(Annual Test Updated: 31 Dec 2025 | Tick Backtest)

The bot can begin with up to 25x leverage and step down toward 5x as equity grows to reduce risk (configurable).

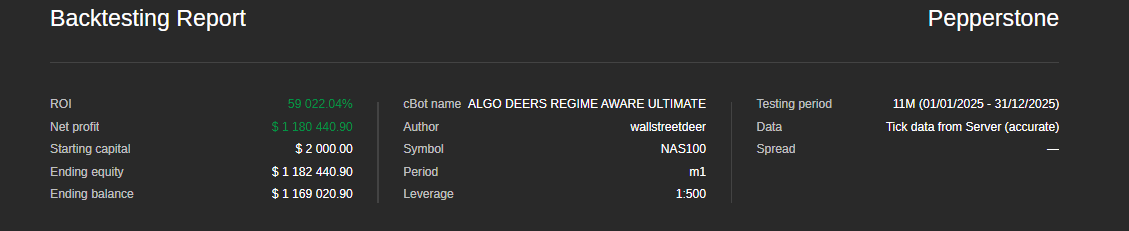

Verified 2025 Backtest

- Symbol / Broker: NAS100 (Pepper stone)

- Timeframe: M1

- Data: Tick data from server

- Window: 01/01/2025 – 31/12/2025

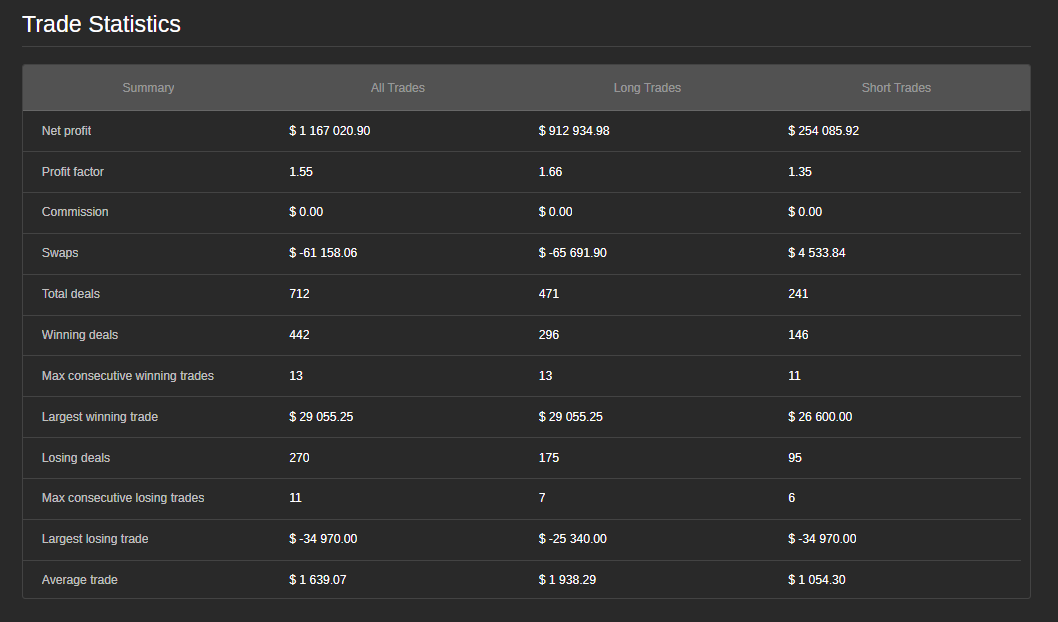

Performance snapshot (same window)

- Starting Capital → End Balance: $2,000 → $1,169,020.90

- End Equity: $1,182,440.90

- Net Profit (equity): $1,180,440.90

- ROI (equity): 59,022.04%

- Profit Factor: 1,55

- Trades: 712 (Wins 442, Losses 270) → Win rate 62,08%

- Max Drawdown: 38,18% (balance) / 43,31% (equity)

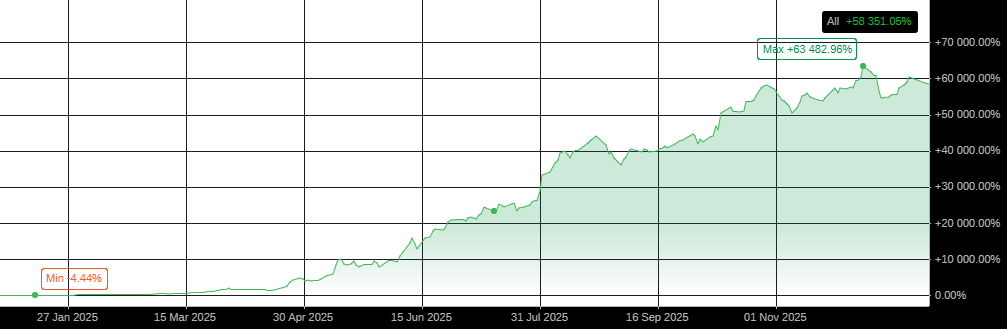

Monthly returns 2025 (Balance ROI, derived from month-end cumulative ROI series in the report)

JAN +181,42%

FEB +102,68%

MAR +247,22%

APR +130,01%

MAY +74,83%

JUN +163,01%

JUL +25,84%

AUG +44,09%

SEP +17,82%

OCT +28,09%

NOV -0,42%

DEC +2,41%

(Reference series: the report’s cumulative balance ROI ends at 58,351.045%.)

What it does

Regime awareness: Adjusts entry and exit behavior across shifting conditions (trend, range, choppy, volatility squeeze).

Dynamic SL/TP: Targets and protection scale with volatility and session context.

Discipline-first execution: Rules-based entries/exits—no emotional interference.

Operator controls: Exposure windows, sizing logic, and circuit-breakers aligned to your risk posture.

Set your guardrails once—then let it adapt.

A market is a living ocean: some days it gives you wind, other days it tests your hull. This bot is designed to change sails—without changing the captain.

Who it’s for

Intraday NAS100 traders who want bold upside with structured risk, can tolerate drawdown cycles, and prefer a transparent, process-driven system over “black-box promises.”

The bot can be tuned for other symbols, but a NASDAQ-optimized parameter set is delivered with the bot.

What you get

- The cBot + NASDAQ-optimized parameters

- 1:1 onboarding call to align sessions, sizing, drawdown limits, and safety switches (parameters adjustable to your risk profile)

What the Regime Brain does (in practical terms)

- Switches playbooks as conditions shift—momentum when clean, mean-reversion when appropriate, defense when tape turns unstable.

- Scales to volatility so targets and stops breathe with the market, instead of choking winners or panicking in noise.

- Understands asymmetry: downside often moves differently than upside; execution adapts accordingly.

- Knows when not to trade: can flatten and pause after instability, then re-arm after a cool-off (based on your rules).

Why we do not offer trials

Short trials are statistically deceptive in algorithmic trading. A few days/weeks is a random slice of the cycle; it can create false certainty—either fear or euphoria. We instead anchor the offer on verified, full-year performance data and risk metrics.

FAQ

Q: Do I need to keep tuning it as the market changes?

A: No. You define the boundaries; the bot adapts inside them.

Q: Is this machine learning?

A: It’s event-driven adaptation (rules + market structure + volatility response), not a black-box ML model.

Q: Can it stop trading during chaos?

A: Yes—via volatility/drawdown guardrails and cool-off logic (as configured).

Q: Is this grid or martingale?

A: Neither. No averaging-down dependency. Risk can step down after setbacks.

Quick start

- Attach to your symbol/timeframe.

- Choose your risk posture + exposure limits.

- Define drawdown/volatility guardrails.

- Let the Regime Brain handle execution.

Legal & Risk Disclaimer

This software is a trading tool, not financial advice. Trading involves risk. Past performance does not guarantee future results. Execution quality, spreads, slippage, swaps, and data integrity can materially impact outcomes. You are fully responsible for configuration and use. Always test on demo before going live, and never trade with funds you cannot afford to lose.

.png)

.png)

.png)