the SuperTrend Strategy**

The **SuperTrend** strategy is a popular trading strategy based on a technical indicator of the same name (**SuperTrend Indicator**). This indicator is used to identify market trends (uptrend or downtrend) and provide clear entry and exit signals. It is known for its simplicity and effectiveness in trending markets.

---

### **Components of the SuperTrend Indicator**

1. **Average True Range (ATR)**:

- Used to measure market volatility.

- The higher the volatility, the higher the ATR value.

2. **Multiplier**:

- A factor multiplied by the ATR value to determine the distance of the SuperTrend line from the price.

- The default value is usually between 2 and 4.

3. **SuperTrend Line**:

- A dynamic line that adjusts based on price movements.

- If the price is above the line, the trend is considered bullish.

- If the price is below the line, the trend is considered bearish.

---

### **How Does the SuperTrend Indicator Work?**

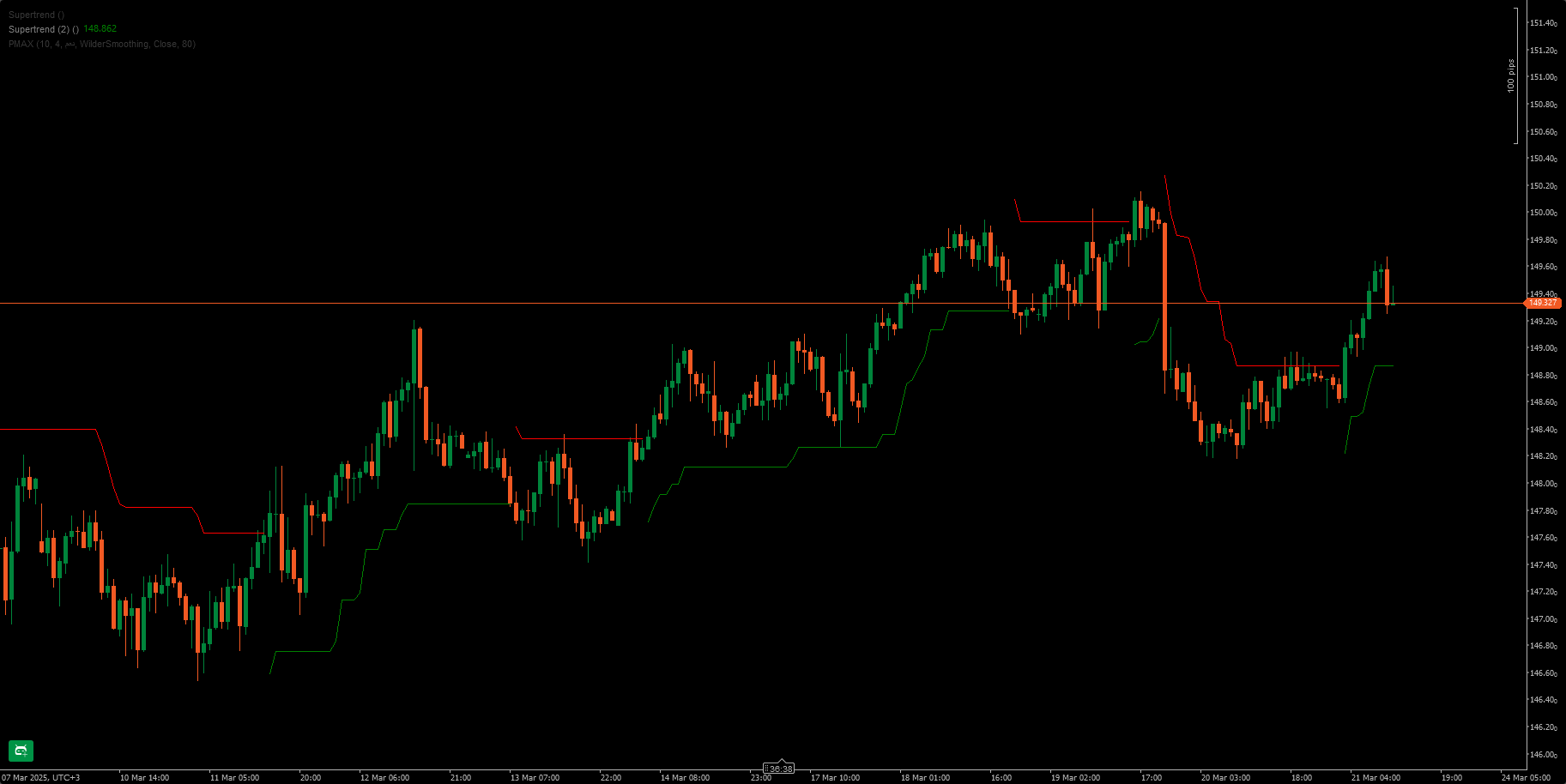

1. **Uptrend**:

- When the price is above the SuperTrend line, the trend is considered bullish.

- The line is drawn below the price, acting as dynamic support.

- Buy Signal: When the price crosses above the SuperTrend line.

2. **Downtrend**:

- When the price is below the SuperTrend line, the trend is considered bearish.

- The line is drawn above the price, acting as dynamic resistance.

- Sell Signal: When the price crosses below the SuperTrend line.

---

### **Indicator Settings**

- **ATR Period**: Typically set to 10 (can be adjusted based on the timeframe).

- **Multiplier**: Typically set to 3 (can be adjusted to increase or decrease sensitivity).

---

### **Advantages of the SuperTrend Strategy**

1. **Ease of Use**: The indicator is simple and provides clear signals.

2. **Effective in Trending Markets**: Works well in markets with strong trends.

3. **Clear Entry and Exit Points**: Provides precise signals for entering and exiting trades.

4. **Customizable**: The ATR period and multiplier can be adjusted to suit your trading style.

---

### **Disadvantages of the SuperTrend Strategy**

1. **Ineffective in Range-Bound Markets**:

- In sideways or range-bound markets, the indicator may produce false signals.

2. **Lagging Signals**:

- Like most trend-following indicators, it may lag during rapid price movements.

---

### **How to Use the SuperTrend in Trading**

1. **Add the Indicator to Your Chart**:

- Add the SuperTrend indicator to your chart.

- Adjust the ATR period and multiplier according to your preferences.

2. **Buy Signals**:

- When the price crosses above the SuperTrend line and the line turns green, it’s a buy signal.

- Place a stop-loss below the SuperTrend line.

3. **Sell Signals**:

- When the price crosses below the SuperTrend line and the line turns red, it’s a sell signal.

- Place a stop-loss above the SuperTrend line.

4. **Trade Management**:

- Use the SuperTrend line as a guide for exiting trades.

- Close the trade when the indicator changes direction.

---

### **Tips to Improve Performance**

1. **Combine with Other Tools**:

- Combine SuperTrend with other indicators like **Moving Averages** or **RSI** to confirm signals.

2. **Adjust Based on Timeframe**:

- Use different settings for daily and shorter timeframes.

3. **Risk Management**:

- Always use stop-loss and take-profit levels to minimize losses.

---

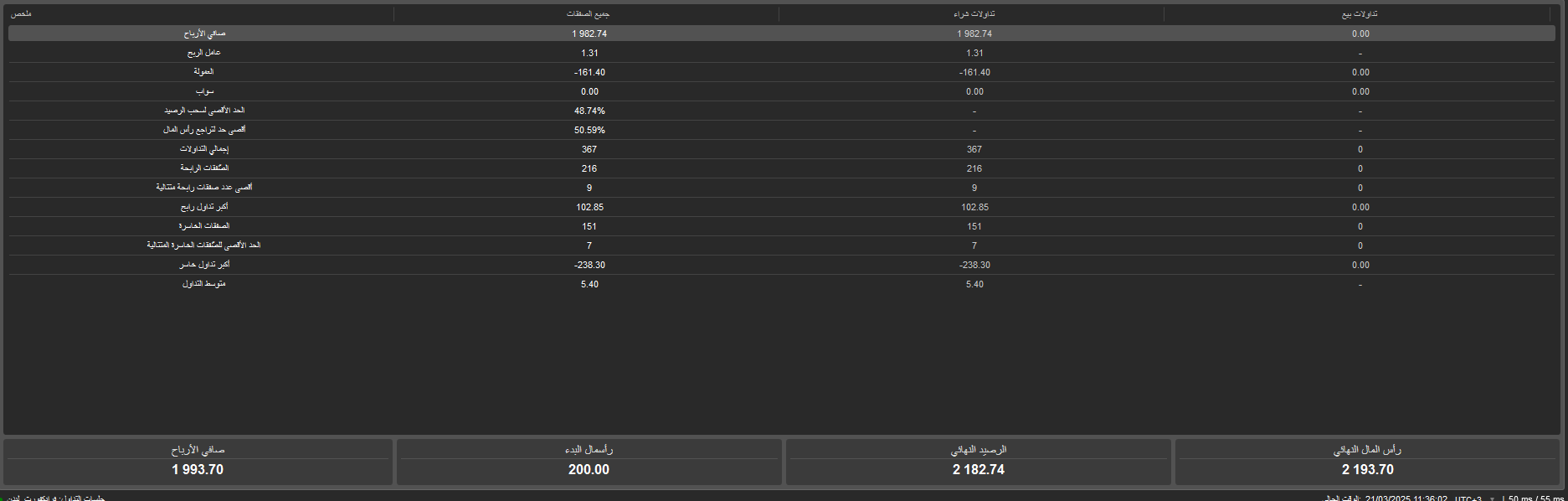

### **Conclusion**

The SuperTrend strategy is a powerful and effective tool for identifying trends and generating clear trading signals. However, it should be used cautiously and combined with other tools to improve accuracy. This strategy is ideal for traders who prefer trading in strong trending markets.

.png)