Overview

The ORB cBot implements a sophisticated multi-session Opening Range Breakout strategy specifically designed for XAU/USD (Gold). This algorithmic trading system combines time-tested market concepts - including session-based range identification, consolidation breakouts, and turtle soup reversals - with advanced risk management features. The bot automatically identifies key market structures during major trading sessions and executes trades with precise entry/exit logic while protecting capital through dynamic position sizing and trailing stops.

Key Features

1. Multi-Session Base Range Identification

- Automated Session Detection:

- Tokyo Session (00:00-09:00 UTC)

- London Session (09:00-16:00 UTC)

- New York Session (16:00-21:00 UTC)

- Smart Base Candle Capture:

- Identifies the most recent 4-hour candle within active sessions

- Automatically adjusts for market holidays/weekends

- Visualizes base range with gold lines on chart

2. Advanced Pattern Recognition

- CRT Formation Detection:

- Finds consolidation-range-trigger (CRT) patterns at base boundaries

- Identifies turtle soup reversal setups:

- Bearish: False breakout above previous high followed by close below low

- Bullish: False breakdown below previous low followed by close above high

- Buffer Zone Flexibility:

- Configurable buffer distance from base levels (default: 50 pips)

- Adjustable to market volatility conditions

3. Precision Trade Execution

- Entry Logic:

- Enters on close of reversal confirmation candle

- Executes at market prices (Ask for shorts, Bid for longs)

- Stop Placement:

- Stop loss 3 pips beyond signal bar extreme

- Protects against immediate whipsaws

- Take Profit Strategy:

- Targets opposite end of base range

- Captures full range expansion potential

4. Sophisticated Risk Management

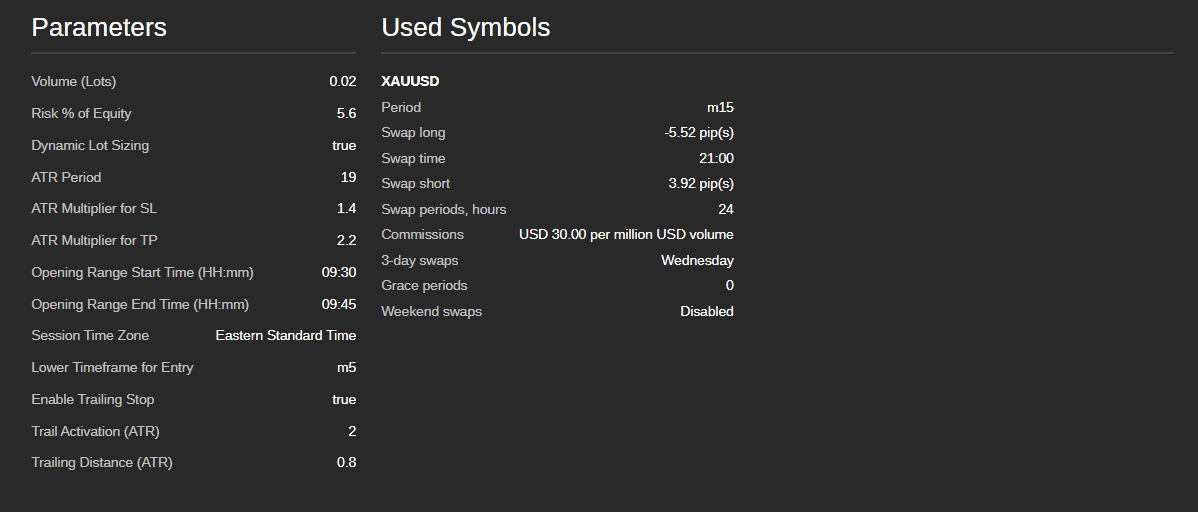

- Flexible Position Sizing:

csharp

double riskAmount = Account.Balance * (RiskPercent / 100.0);

double riskPerUnit = stopLossDistance * Symbol.PipValue;

double units = riskAmount / riskPerUnit; - Option 1: Fixed lot size (default: 0.02 lots)

- Option 2: Risk-based sizing (% of account balance)

- Daily Trade Limits:

- Configurable max daily trades (default: 1)

- Prevents over-trading during volatile conditions

5. Professional Trailing Stop System

- Activation Condition:

- Triggers when trade reaches specified profit (default: 30 pips)

- Trailing Logic:

csharp

double newStopLoss = position.TradeType == TradeType.Buy

? currentPrice - TrailDistancePips * Symbol.PipSize

: currentPrice + TrailDistancePips * Symbol.PipSize; - Maintains fixed distance from current price (default: 20 pips)

- Only moves in profitable direction

- Efficient Implementation:

- Processes in OnTick() for real-time adjustments

- Only modifies stops when improvement possible

6. Comprehensive Visualization

- Base Range Markers:

- Solid gold lines at base high/low

- Session/time labels for reference

- Pattern Identification:

- Orange diamond: First consolidation bar

- Red star: Reversal signal bar

- Automatic Cleanup:

- Removes previous day's drawings

- Maintains clean chart workspace

7. Robust Error Handling

- Market Condition Checks:

- Skips weekends/holidays

- Handles missing bars/data gaps

- Position Safeguards:

- Unique position labels with timestamps

- Prevents duplicate entries

- Comprehensive Logging:

- Detailed trade execution records

- Error reporting for failed orders

8. Flexible Configuration

csharp

// Core Parameters

[Parameter("CRT Buffer (pips)", DefaultValue = 50)]

[Parameter("Fixed Lot Size", DefaultValue = 0.02)]

[Parameter("Risk % per Trade", DefaultValue = 1.0)]

// Trailing Stop Parameters

[Parameter("Enable Trailing Stop", DefaultValue = true)]

[Parameter("Trail Activation (pips)", DefaultValue = 30)]

[Parameter("Trail Distance (pips)", DefaultValue = 20)]

// Operational Parameters

[Parameter("Max Daily Trades", DefaultValue = 1)]

[Parameter("Enable Visualization", DefaultValue = true)]

- 12 adjustable parameters

- Real-time tuning without restart

- Sensible default values for XAU/USD

Strategy Logic Workflow

- Daily Reset:

- Clears previous day's state

- Resets trade counters

- Removes old chart objects

- Base Range Identification:

- Scans recent 4-hour bars

- Selects most relevant session candle

- Sets base high/low boundaries

- Monitoring Phase:

- Watches for CRT formations during purge window (09:00-10:30 UTC)

- Identifies turtle soup reversal patterns

- Trade Execution:

- Calculates optimal position size

- Enters with protective stops

- Sets profit target at opposite base level

- Trade Management:

- Activates trailing stop at 30 pip profit

- Continuously trails at 20 pip distance

- Closes at target or trailed stop

Unique Value Propositions

- Session-Adaptive Logic:

- Automatically adjusts to Tokyo/London/NY market dynamics

- Captures institutional order flow at session opens

- Professional Risk Control:

- Dual position sizing modes

- Trailing stops that lock in profits

- Daily trade limits prevent overtrading

- Visual Trading System:

- Clear pattern recognition on chart

- Real-time visual feedback

- Historical pattern marking

- Robust Market Handling:

- Survives weekends/holidays

- Handles data gaps gracefully

- Adapts to changing volatility

- Precision Timing:

- UTC-based time calculations

- Precise session boundary detection

- Configurable purge window

Ideal Market Conditions

- Volatility Environments:

- Works best during regular market hours

- Ideal when volatility > 15 pips/15min

- Session Transitions:

- Particularly effective during:

- London open (09:00 UTC)

- NY-London overlap (12:00-16:00 UTC)

- Avoid:

- Major economic news spikes

- Illiquid market periods

- Holiday-thinned trading

Optimization Recommendations

- Buffer Sizing:

- Increase during high volatility (>60 pips)

- Decrease during low volatility (<30 pips)

- Trailing Parameters:

- Widen distance in trending markets

- Shorten activation in range-bound markets

- Time Adjustments:

- Shift purge window 30 minutes earlier for Asian markets

- Extend session end times on high-volume days

This ORB cBot provides institutional-grade trading logic in an accessible automated package, combining sophisticated pattern recognition with professional risk management - all specifically calibrated for the unique characteristics of the XAU/USD market.

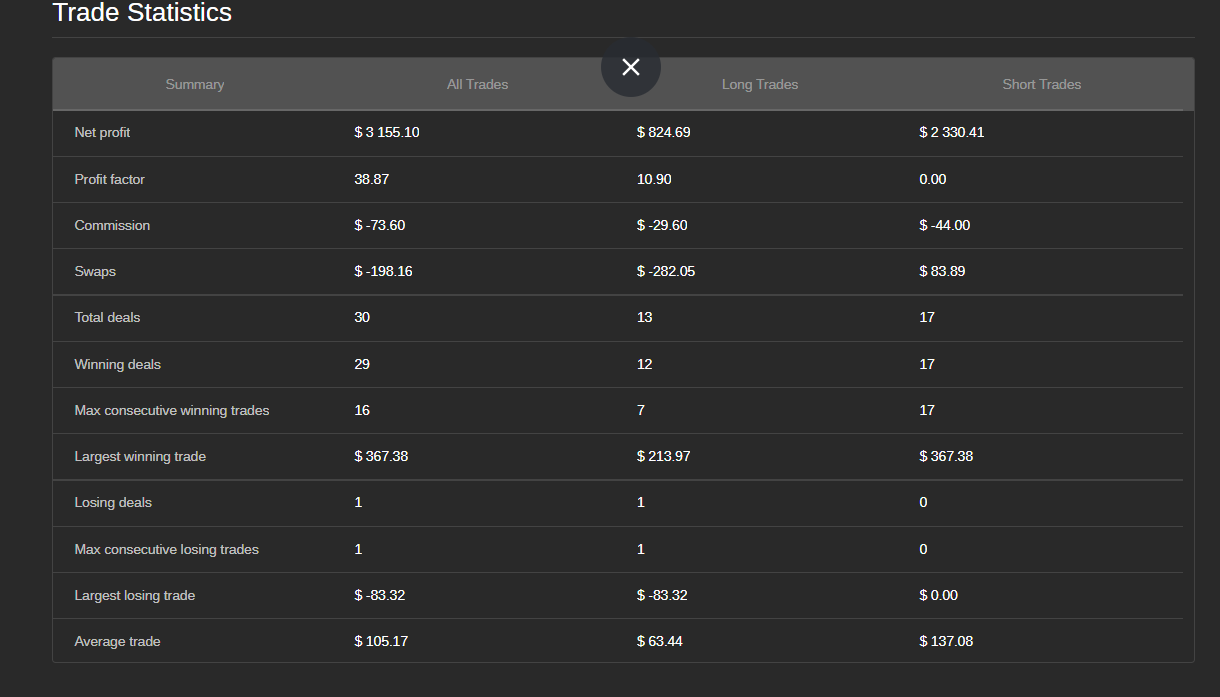

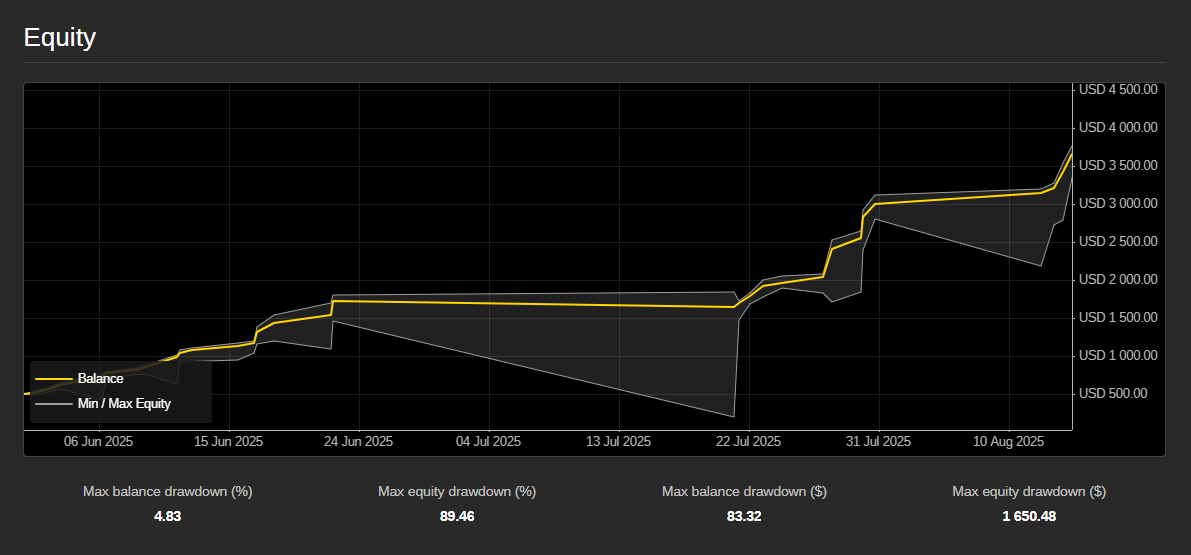

Note: As with all automated trading systems, thorough backtesting and demo trading are recommended before live deployment. Past performance does not guarantee future results, and trading leveraged products carries significant risk.

Warning:

Past successful performance does not guarantee future results; all trading products are used at your own risk.