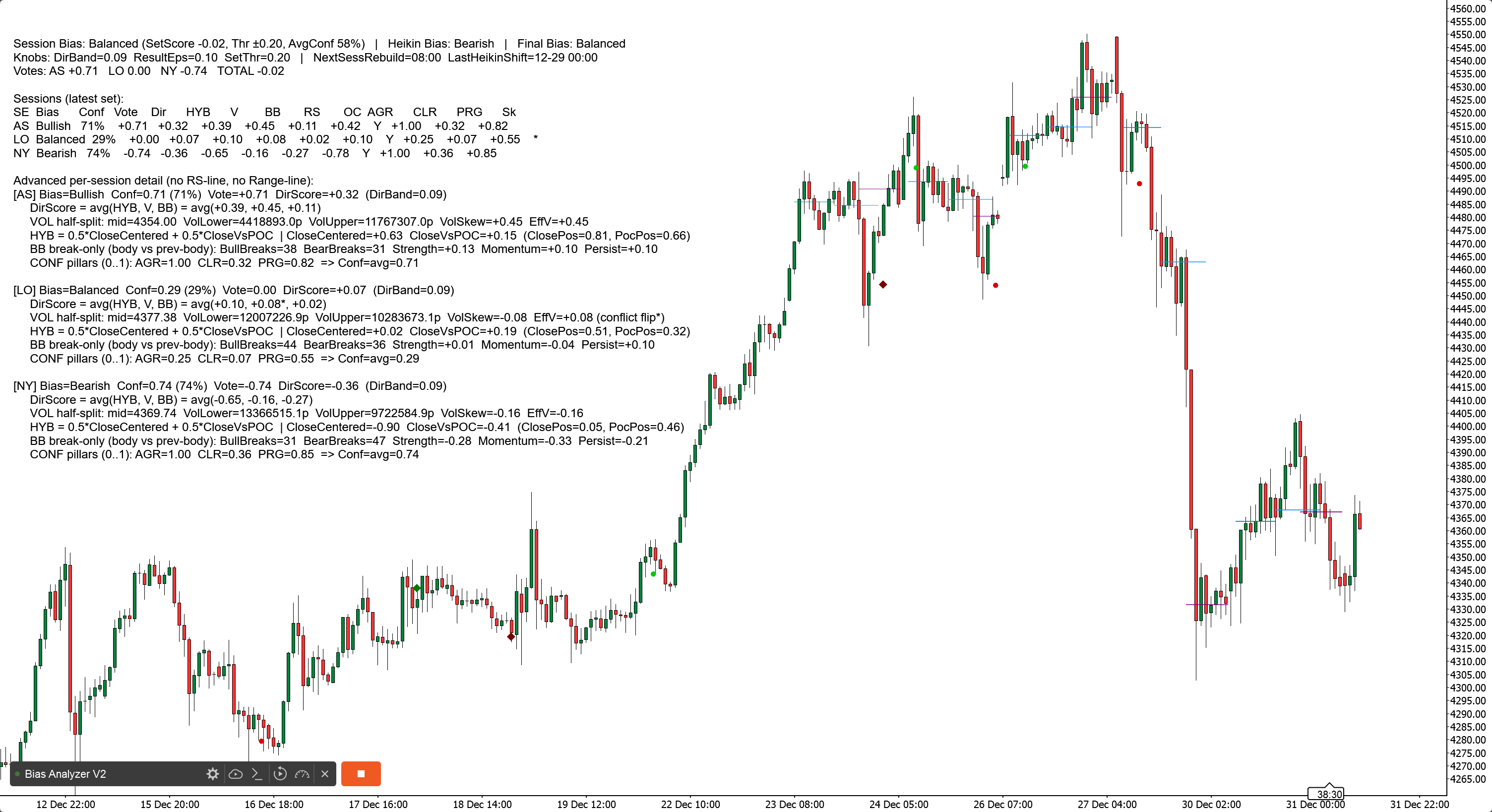

Cheat Sheet . 3 years of Data summarized below high probability Direction.

Day trading

- Asia: B120 (Session Bias + Heikin 2H agree) | alt: Session Bias only

- London: Heikin 1H

- New York: Heikin 2H

- West(London and NY): Heikin 2H

- Timing: West + Heikin 2H flip → best 30m follow-through

Swing (2–3 days)

- Direction (3 days / 72h): Global Session Bias (Asia+London+New York combined)

- Entry filter: Global Session Bias + Heikin 4H agree (if no agreement → skip)

- Avoid default: 2 days / 48h

HeikinSessionBiasOnlyBot is a bias dashboard and market-structure “compass” for discretionary traders. It does not place trades. Instead, it gives you a clean, always-updated view of trend/bias using two independent engines:

- Heikin Bias (higher-timeframe directional bias)

- Session Bias (Asia/London/New York range + volume-profile bias)

What it does (in plain English)

1) Heikin Bias (trend bias engine)

This engine works on your chosen Bias TF (minutes) (default 360 min / 6H):

- It builds Heikin Ashi candles on that timeframe.

- It detects pivot zones when HA “color” changes (green ↔ red).

- Bias flips when the close breaks the latest pivot zone:

- Close breaks above resistance zone → Bullish

- Close breaks below support zone → Bearish

- If no pivot-breach flip happens, it can still flip using an Inside Engine v2:

- It watches for inside-bar coils (a squeeze) anchored by wick range.

- After MinInsideBarsForReversal inside bars, it becomes “armed.”

- A close above the anchor wick range flips bullish; below flips bearish.

Result: you get a clean higher-timeframe directional bias that updates automatically.

2) Session Bias (Asia / London / New York bias engine)

This engine runs on a hard-coded 5-minute analysis timeframe and rebuilds itself at each session end.

For each session (Asia, London, NY), it:

- Builds that session’s high/low range

- Builds a simple volume profile (bins) and finds POC (Point of Control)

- Uses a half-range volume split:

- Takes the session range midpoint: mid = (Low + High) / 2

- Compares volume traded in the lower half vs upper half

- Produces a per-session direction score from three pillars:

- HYB (close placement vs range + vs POC)

- V (effective volume skew from half-split)

- BB (body-break momentum: break-only logic vs previous candle body)

Then it calculates:

- DirScore = average(HYB, V, BB)

- A session Bias from DirScore using DirBand

- A session Confidence from:

- AGR (agreement across HYB/V/BB)

- CLR (how strong/clear the inputs are)

- PRG (how “progressive” the move was through the session)

Finally, it combines the three sessions into a SetScore and labels the overall Session Bias.

3) Final “Combined Bias” (your top-line answer)

You choose how to combine the two engines:

- BothAgree (default): only shows Bullish/Bearish if both engines agree; otherwise Balanced (or Pending if incomplete).

- HeikinOnly: only the higher-timeframe Heikin bias.

- SessionOnly: only the session engine result.

This is a practical filter: if you want fewer trades but cleaner alignment, use BothAgree.

1) Dashboard Header (top line)

You will see something like:

Session Bias: Bullish (SetScore +0.85, Thr ±0.20, AvgConf 72%) | Heikin Bias: Bullish | Final Bias: Bullish

What each term means

- Session Bias: the combined direction from Asia/London/NY

- SetScore: the combined “vote total” from the three sessions

- Each session contributes a Vote = direction sign × confidence

- Bullish adds, bearish subtracts

- Thr (SetThr): the minimum SetScore needed to call the Session Bias bullish/bearish

- If SetScore is inside ±Thr → Session Bias becomes Balanced

- AvgConf: average confidence across the three sessions (0–100%)

- Heikin Bias: the higher-timeframe bias (Bullish/Bearish/Pending)

- Final Bias: the final output after your combine mode (BothAgree / HeikinOnly / SessionOnly)

2) Dashboard “Knobs” line (settings snapshot)

Example:

Knobs: DirBand=0.09 ResultEps=0.10 SetThr=0.20 | NextSessRebuild=17:00 LastHeikinShift=12-30 06:00

Meaning

- DirBand: how strong DirScore must be to label a session bullish or bearish

- Small DirBand = more signals, more “sensitive”

- Larger DirBand = fewer signals, more conservative

- ResultEps: the “dead zone” used when deciding if outcomes are clear

- Helps avoid treating tiny differences as meaningful

- SetThr: the threshold used at the combined session level (SetScore)

- NextSessRebuild: when the next session rebuild will occur (UTC)

- LastHeikinShift: last time Heikin bias changed

3) “Votes” line (quick total)

Example:

Votes: AS +0.40 LO +0.20 NY -0.10 TOTAL +0.50

Meaning

- AS / LO / NY vote = sign(direction) × confidence

- TOTAL is simply the sum

- This is basically your “session scoreboard.”

4) Detailed Mode Table (per-session breakdown)

In Detailed mode, you get a compact table like:

SE | Bias | Conf | Vote | Dir | HYB | V | BB | RS | OC | AGR | CLR | PRG | Sk

Column-by-column explanation (simple)

- SE: session label (AS, LO, NY)

- Bias: Bullish / Bearish / Balanced (for that session)

- Conf: confidence percent for that session

- Vote: direction vote (bias sign × confidence)

- Dir: DirScore = average(HYB, V, BB)

- HYB: hybrid close placement score

- Combines “close inside range” + “close vs POC”

- V: effective volume skew

- Based on upper-half vs lower-half session volume

- Can flip if it conflicts with the “outcome” (see Sk below)

- BB: body-break score

- Measures break-only momentum versus prior candle body boundary

- RS: ResultScore (blend of net move + HYB)

- Used for “outcome clarity” checks

- OC: outcome clear? (Y/N)

- If RS is big enough (beyond ResultEps), it’s considered “clear”

- AGR: agreement pillar (0..1)

- Do HYB/V/BB point in the same direction?

- CLR: clarity pillar (0..1)

- Are HYB/V/BB strong or weak?

- PRG: progress pillar (0..1)

- Did the session move steadily (less chop / better follow-through)?

- Sk: skew conflict marker

*means volume skew conflicted with result direction and was flipped internally to avoid misleading bias

2) Session POC History Lines (on-chart)

The robot draws horizontal lines showing POC (Point of Control) for recent sessions:

- Separate lines for AS, LO, NY

- It draws multiple “history sets” (default 6), fading older ones

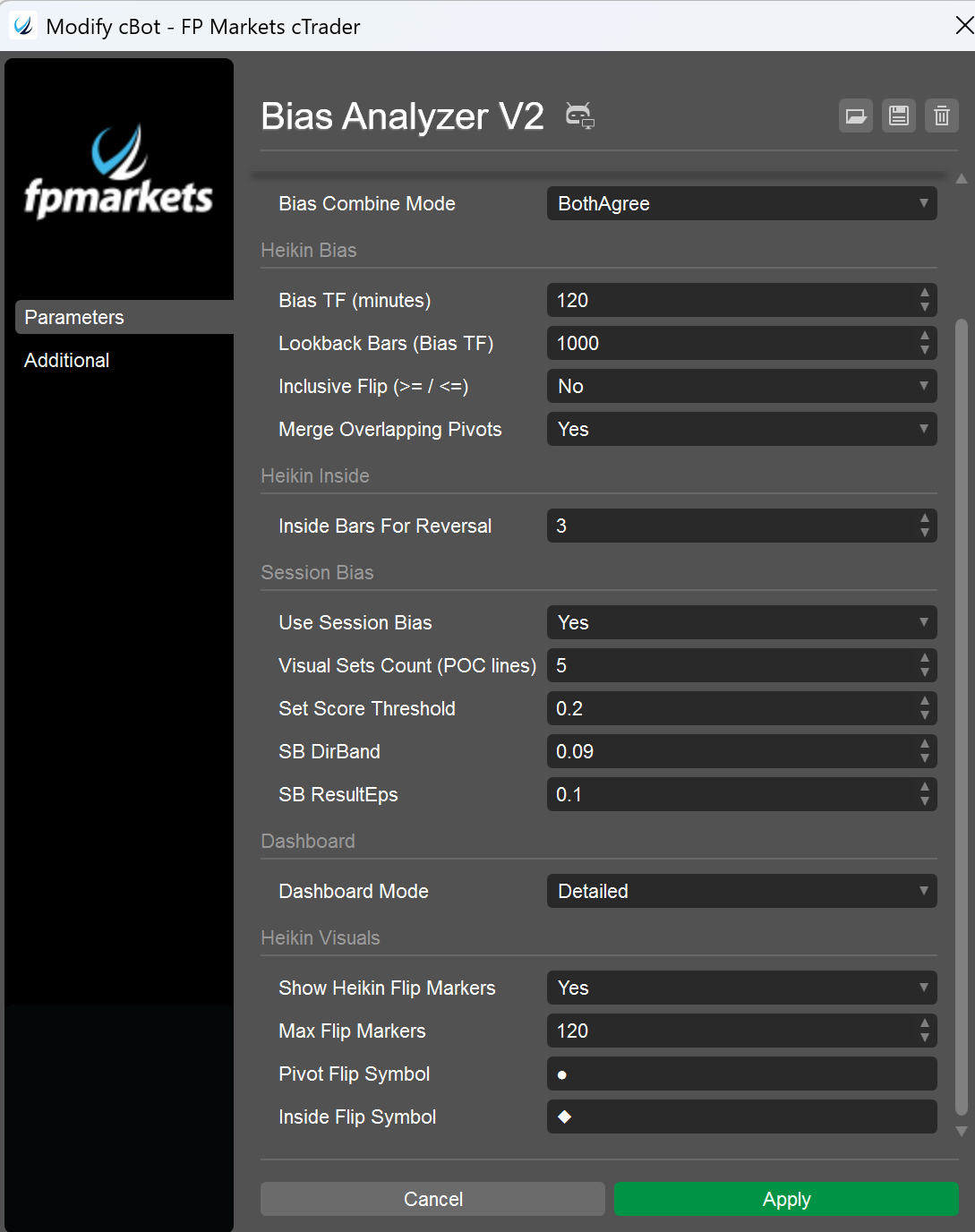

3) Heikin Flip Markers (on-chart)

When Heikin bias flips, the bot prints markers:

- Pivot breach flip uses your Pivot Flip Symbol (default ●)

- Inside Engine flip uses your Inside Flip Symbol (default ◆)

- Colors differ by direction and flip type (so you can tell “why” it changed)

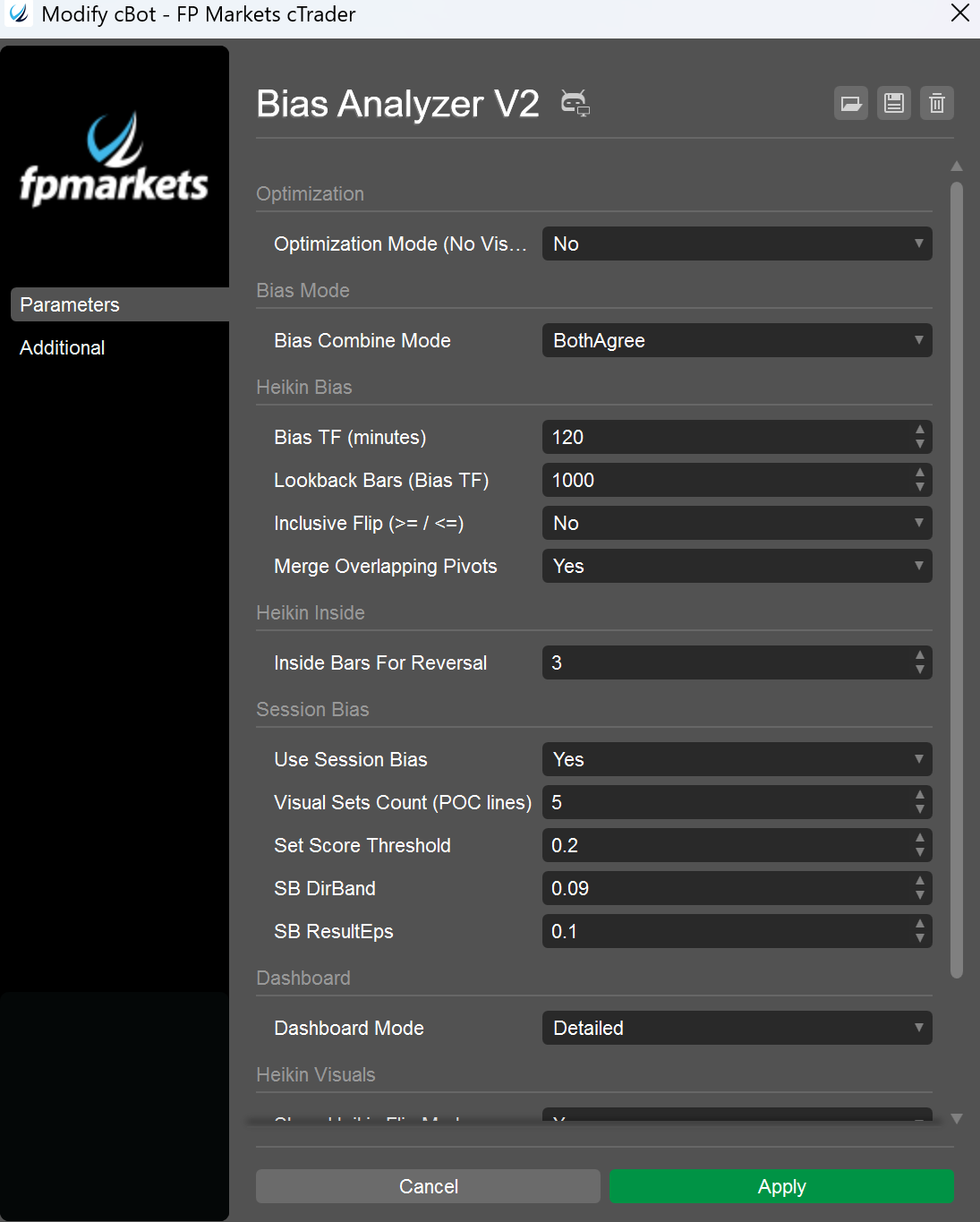

Parameters that matter most (what to highlight in your pitch)

- Bias TF (minutes): sets the “anchor timeframe” for Heikin bias (e.g., 240, 360, 720)

- MinInsideBarsForReversal: controls how tight a coil must be before the inside engine can flip

- Use Session Bias: enable/disable session engine

- Visual Sets Count: how many POC history lines to keep

- DirBand / ResultEps / SetScoreThreshold: controls how strict the session engine is

- Bias Combine Mode: defines how conservative the final bias is

- Dashboard Mode: BaseOnly vs Detailed

- Optimization Mode: disables visuals/log noise for performance testing

![Logo de "[Stellar Strategies] SP500 Gap Closure cBot 1.0"](https://market-prod-23f4d22-e289.s3.amazonaws.com/62a77232-02a9-423b-a5e4-bd2c2bc8db97_cT_cs_4141285_US500_2025-03-21_17-12-57.png)

(1).png)

.png)

.png)