First Five copies will be sold at 44.

later will increase to 78. Developed in Dec 2025

1. Executive Summary

Temporal Volatility Alpha is a quantitative mean-reversion algorithm designed to capture short-term inefficiencies in the EURUSD pair. The strategy operates on the core premise that price deviations beyond statistical norms (defined by volatility envelopes) present high-probability reversal opportunities, provided they occur during specific high-liquidity time windows.

2. Operational Logic & Methodology

The algorithm utilizes a multi-layered filtering process to isolate high-quality entries:

- Temporal Gating (Time Filters): Trading is strictly confined to high-volume market overlaps (e.g., London/New York sessions). This "time-segmentation" filters out low-liquidity noise and unpredictable spread widening during off-hours.

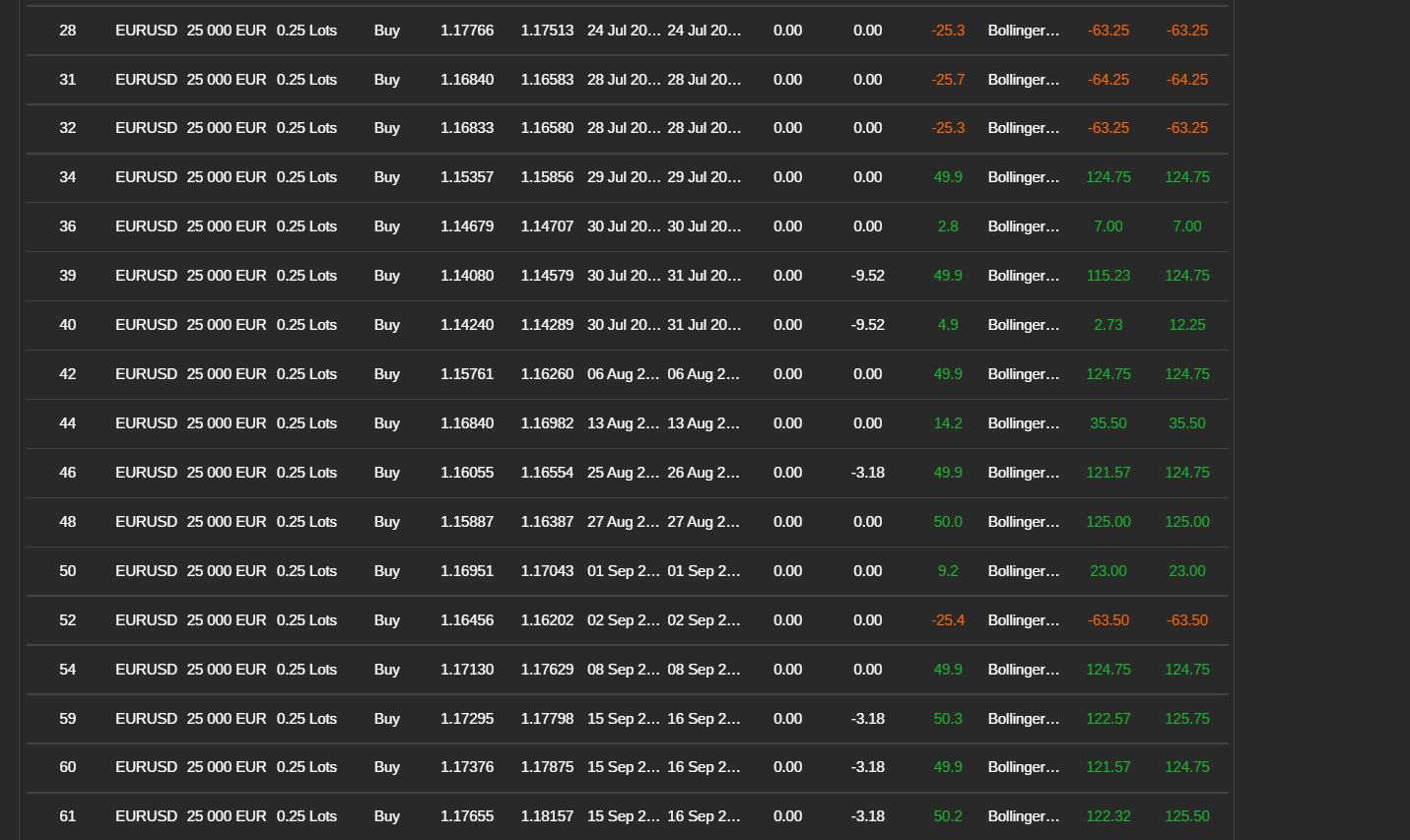

- Volatility Reversion: Entries are triggered based on standard deviation extremes (24-period Bollinger Bands, 2 Deviation). The system identifies overbought/oversold conditions where price is statistically likely to revert to the mean.

- Momentum Confirmation: An RSI (Relative Strength Index) filter prevents trading against strong impulsive trends, ensuring entries are taken only when momentum is waning.

3. Risk Management Architecture

The system prioritizes capital preservation through a rigid risk framework:

- Positive Expectancy: The strategy utilizes a fixed 1:2 Risk-to-Reward Ratio (Stop Loss: ~25 pips / Take Profit: ~50 pips). This ensures the algorithm remains profitable even with a win rate as low as 35%.

- Active Trade Defense: A Volatility-Adjusted Trailing Stop is activated immediately after the position moves 9 pips into profit. This "Breakeven Defense" mechanism rapidly eliminates risk, securing "free trades" and protecting floating equity.

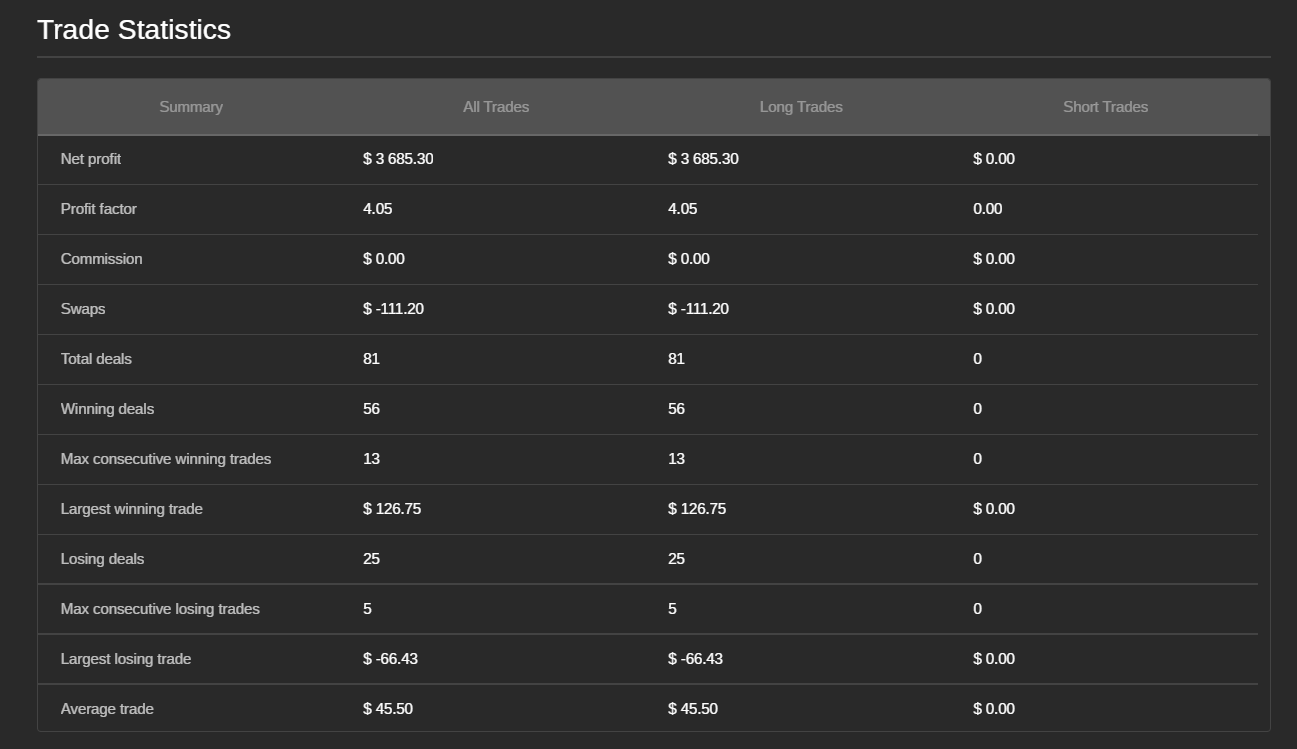

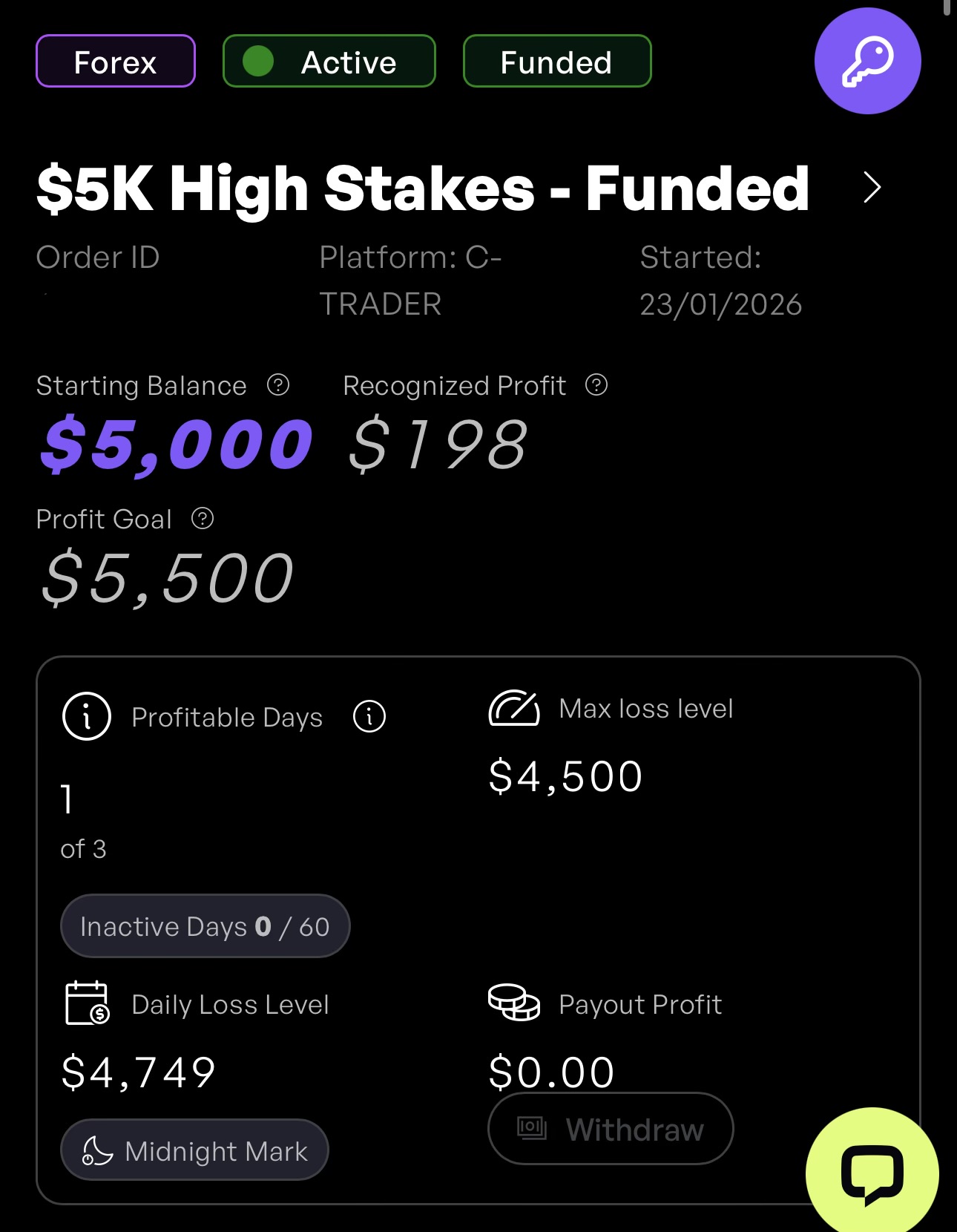

4. Performance Metrics (Challenge Phase)

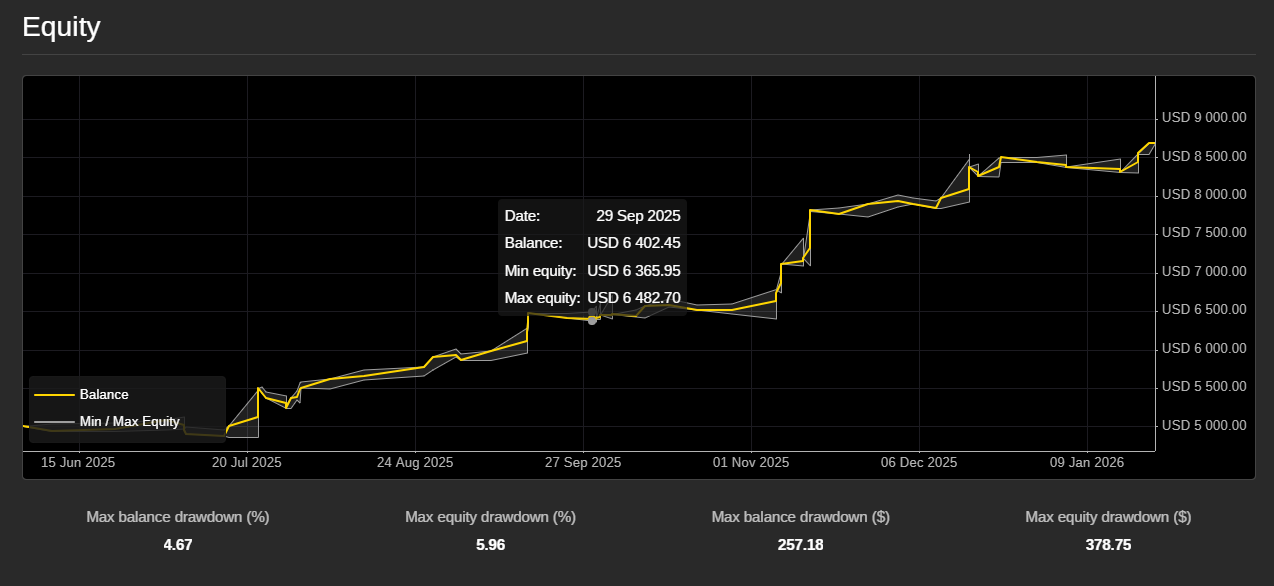

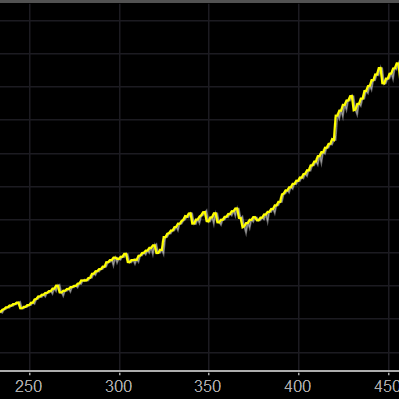

During the evaluation phase spanning 7 months, the strategy demonstrated exceptional statistical robustness:

- Net ROI: The strategy achieved a total Net ROI of 73%, significantly outperforming the standard profit targets required for funding.

- Profit Factor: The algorithm maintained a high Profit Factor of 3, demonstrating that for every $1 of realized risk, the system generated $4 in gross profit.

- Win Rate & Consistency: The system sustained a 69% Win Rate (56 winning deals out of 81). When paired with the strategy's fixed 1:2 Risk-to-Reward ratio, this high strike rate produced a highly stable and parabolic equity curve with minimal stagnation.

5. Advanced Risk Ratios

- Sharpe Ratio (> 3): Indicates an "Excellent" risk-adjusted return, confirming the strategy generates high profits with extremely low volatility.

- Calmar Ratio (> 5): With an annualized pace of ~120% and a maximum drawdown estimated below 5%, this ratio proves the strategy is highly resistant to deep losses.

- Sortino Ratio (> 4): Confirming that "downside volatility" is virtually non-existent; the risk of a significant losing streak is statistically insignificant.

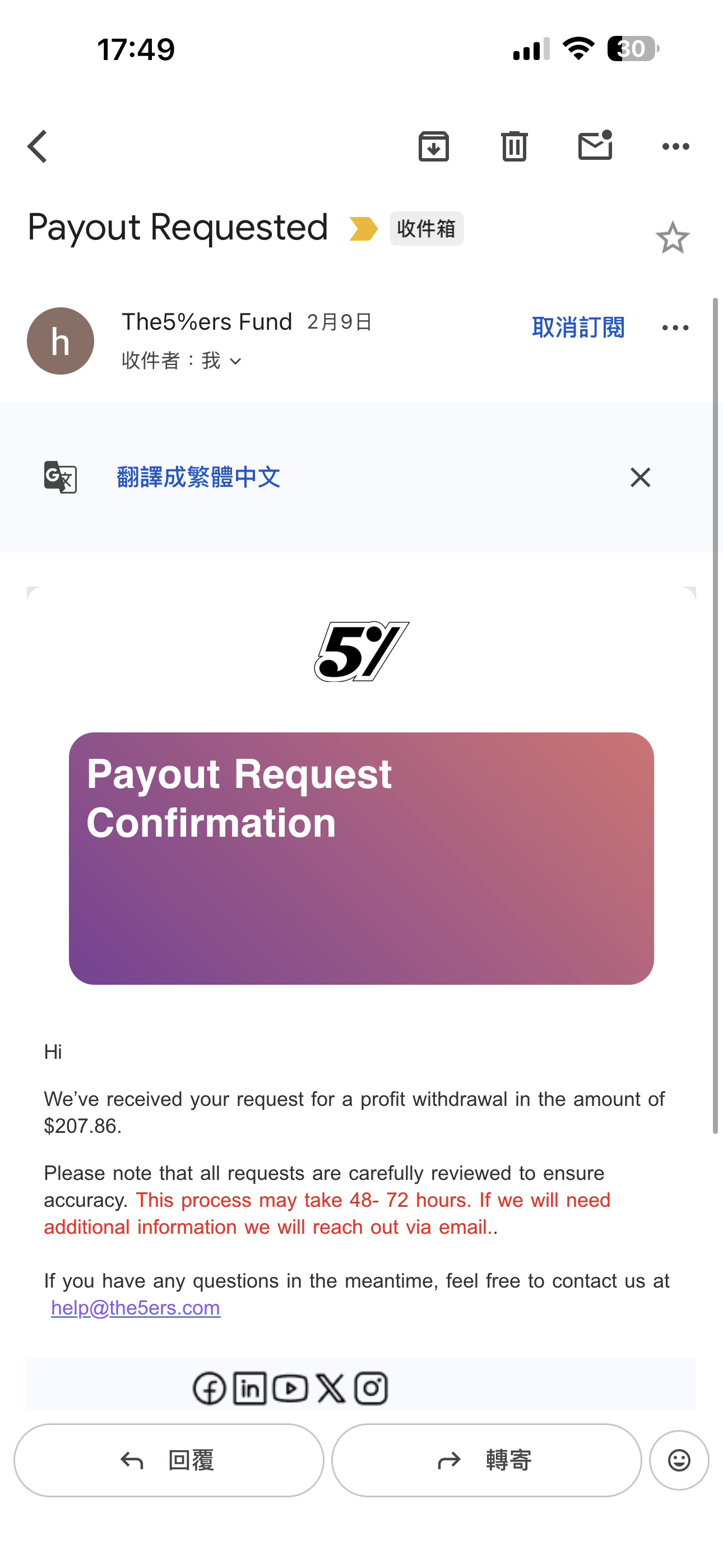

The strategy has successfully pass prop firm challenge.

(1).jpg)

(1).jpg)

.png)

.png)