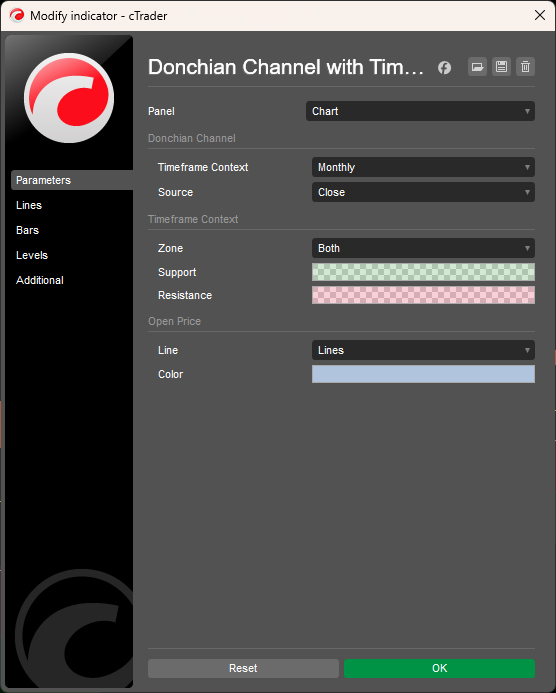

WHAT IT DOES

Donchian Channel with Timeframe Context overlays higher-timeframe structural boundaries onto your current chart — giving every breakout and pullback a reference frame that standard Donchian channels don't provide.

The standard Donchian Channel draws the highest high and lowest low over a fixed lookback period on your current timeframe. It's effective for breakout identification — but it operates in isolation. A breakout on a 15-minute chart may be nothing more than noise within a Weekly range.

This indicator adds that missing context.

It calculates the previous higher-timeframe period's range and projects it as support/resistance zones on your execution chart. You see both: the standard Donchian Channel tracking current-timeframe price extremes, and the higher-timeframe context showing where price sits relative to larger structural boundaries.

The result is a Donchian Channel that knows where it is within the bigger picture.

WHY TIMEFRAME CONTEXT MATTERS

The Donchian Channel is one of the most respected breakout systems in trading. Richard Donchian's original concept — buy the highest high, sell the lowest low — remains the foundation of trend-following strategies. But the channel alone doesn't tell you whether the breakout you're seeing is structurally significant.

The Problem

A standard Donchian breakout on your chart timeframe creates a common set of frustrations:

- Price breaks above the upper channel on H1 — but the Weekly range tells you it's hitting resistance, not starting a trend

- Price tests the lower channel on M15 — but the Daily context shows strong demand below that hasn't been tested

- You enter a breakout trade with confidence — only to watch price reverse because the move was corrective within a larger timeframe structure

These aren't indicator failures. They're context failures. The channel works exactly as designed — it just doesn't know about the structural boundaries one timeframe above.

The Solution

This indicator projects the previous higher-timeframe period's Donchian range as visual zones on your current chart. When price approaches the upper or lower standard channel line, you immediately see whether it's heading into or away from the higher-timeframe boundary.

The higher-timeframe zones divide the current period into resistance territory (above midpoint) and support territory (below midpoint) — giving you a structural bias before the breakout even occurs.

THE CORE CONCEPT

Traditional Donchian answers: "What are the highest and lowest prices over the last N bars?"

This indicator adds: "Where does that range sit relative to the previous higher-timeframe period's range?"

The system works in two layers:

- Standard Donchian Channel calculates on your current chart with an automatically adapted period. The period is derived from the ratio between your selected timeframe context and your chart timeframe — no manual setting required. A Weekly context on an H1 chart automatically uses a 120-bar lookback (5 days × 24 hours ÷ 1 hour).

- Timeframe Context Zones calculate the highest and lowest price from the previous higher-timeframe period, then project those levels as colored zones across the current period. Support zone extends from the lower boundary to midpoint. Resistance zone extends from midpoint to upper boundary.

When a standard Donchian breakout occurs within the support zone, the higher-timeframe context suggests the move has room. When it occurs within the resistance zone, context suggests caution — the breakout is pushing against larger structural supply.

PRACTICAL APPLICATION

False Breakout Filtering

The primary use case. When price breaks above the standard upper channel line but is already deep inside the HTF resistance zone, the breakout carries higher reversal risk. The zone provides the context to distinguish between genuine expansion and exhaustive probing into overhead supply.

Conversely, a breakout that occurs near the HTF midpoint has more structural room to develop before encountering the larger boundary.

Correction Exhaustion

During pullbacks within a trend, the HTF support/resistance zones give you structural reference for where correction might exhaust. A pullback that reaches the HTF support zone boundary suggests sellers may have spent their energy at a structural level — prepare for potential reversal. A pullback that stalls before reaching the zone suggests the trend remains strong.

Structural Positioning

Before any breakout signal fires, the zones tell you where price currently sits within the higher-timeframe range. Upper half of the HTF range = caution for longs. Lower half = caution for shorts. Near the midpoint = neutral zone where direction is less defined.

Open Price Reference

The optional open price line marks where the current higher-timeframe period opened. This provides an additional reference for intra-period bias — price above the open suggests bullish control, below suggests bearish control.

KEY FEATURES

Dual-Layer Donchian System

- Standard Donchian Channel with auto-calculated period based on timeframe ratio

- Higher-timeframe context zones projected as support/resistance on current chart

- Both layers update in real-time as new price data arrives

Automatic Period Calculation

- Period derives from the ratio between context timeframe and chart timeframe

- No manual period setting — the context timeframe defines the lookback automatically

- Supports non-time-based charts (Tick, Renko, Range) with configurable default

Timeframe Context Options

- 13 timeframe selections: Monthly through Minute 15

- Apply Weekly context on H1 chart, Daily context on M5 chart, or any valid combination

- Zones update each time a new higher-timeframe period begins

Visual Zone Display

- Support zone (lower boundary to midpoint) — configurable color with transparency

- Resistance zone (midpoint to upper boundary) — configurable color with transparency

- Display modes: Both zones, Support only, Resistance only, or None

- Zones project forward to the end of the current HTF period

Open Price Line

- Marks the opening price of the current higher-timeframe period

- Six line style options: Solid, Dots, DotsRare, DotsVeryRare, Lines, LinesDots

- Configurable color — or disable entirely

Price Source Flexibility

- Close-based calculation: uses closing prices for channel boundaries

- HighLow-based calculation: uses high/low wicks for wider channel boundaries

- Single setting applies to both standard and context calculations

READING THE CHART

- Green Zone: Support territory — previous HTF period's lower range projected forward

- Red Zone: Resistance territory — previous HTF period's upper range projected forward

- Zone Boundary (top): Previous HTF period's highest price

- Zone Boundary (bottom): Previous HTF period's lowest price

- Zone Midpoint: Where support and resistance zones meet — equilibrium of previous period

- Standard Channel Lines: Current timeframe Donchian upper/lower/middle

- Open Line: Where the current HTF period opened

Breakout Assessment:

- Standard breakout INTO the HTF support zone → trend-aligned, structural room

- Standard breakout INTO the HTF resistance zone → counter-structural, reversal risk higher

- Standard breakout BEYOND the HTF zone → new territory, previous structure no longer contains price

WHO IT'S FOR

This indicator is designed for traders who use Donchian channels for breakout trading and want higher-timeframe structural context to filter their signals.

If you've experienced the frustration of entering Donchian breakouts that immediately reverse — because they were pushing against a larger structural boundary you couldn't see — this tool provides that visibility.

It's well suited for trend-following traders who want objective criteria for distinguishing between genuine breakouts and exhaustive probes into overhead supply or demand. Multi-timeframe analysts will benefit from seeing higher-timeframe range context directly on execution charts without switching timeframes.

Swing traders can use the HTF zones as structural reference for pullback entries — identifying where corrections are likely to exhaust based on previous period boundaries. Discretionary traders gain an additional structural layer for context without adding indicator complexity.

This is not a signal system. It's a contextual overlay that helps you evaluate Donchian breakouts within the framework of higher-timeframe market structure.

WHAT MAKES IT DIFFERENT

Standard Donchian Channel indicators operate on a single timeframe with a fixed period. They tell you when price exceeds recent extremes — but nothing about whether that extreme matters structurally.

This indicator introduces higher-timeframe awareness directly into the Donchian framework. The context zones answer questions that standard channels can't: Is this breakout pushing into structural supply? Is this pullback reaching structural demand? Where am I within the larger range?

The automatic period calculation eliminates a common source of parameter anxiety. Instead of choosing between 20, 50, or 100-bar lookbacks, the period derives naturally from the timeframe relationship. Weekly context on an hourly chart produces the correct lookback automatically — no optimization required.

The result is a Donchian Channel that operates with structural awareness rather than in isolation.

---

UNDERSTANDING MULTI-TIMEFRAME CONTEXT IN BREAKOUT TRADING

Breakout trading is straightforward in concept: price exceeds a range boundary, suggesting directional commitment. The challenge isn't identifying breakouts — it's distinguishing between breakouts that lead to trends and breakouts that immediately fail.

Most false breakouts share a common characteristic: they occur at a level that is structurally significant on a higher timeframe. A 15-minute breakout into Weekly resistance isn't a breakout at all from the Weekly perspective — it's a test of a known boundary.

This is why multi-timeframe context is fundamental to breakout evaluation. The breakout itself happens on your execution timeframe. But its significance is determined by where it occurs within the higher-timeframe structure.

Indicators that provide this context don't predict which breakouts will succeed. They help you understand the structural environment in which each breakout occurs — so you can evaluate risk more accurately and avoid taking positions that fight the larger structure.

The higher timeframe doesn't override the lower timeframe. It contextualizes it.

---

Trading involves risk. This indicator is a technical analysis tool — always apply proper risk management.

![Logo "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)