![Logotipo de "[Stellar Strategies] Market Structure Breakout"](https://market-prod-23f4d22-e289.s3.amazonaws.com/99d762b3-fbbe-489d-9c19-e72c41ffe387_cT_cs_4141285_EURUSD_2025-04-21_20-25-12.png)

![Imagen cargada de "[Stellar Strategies] Market Structure Breakout"](https://market-prod-23f4d22-e289.s3.amazonaws.com/413eafdc-e574-48ed-b399-aa8077b33067_cT_cs_4141285_EURUSD_2025-04-21_20-16-49.png)

![Imagen cargada de "[Stellar Strategies] Market Structure Breakout"](https://market-prod-23f4d22-e289.s3.amazonaws.com/1c205d1d-7eda-47fa-b757-0886c1395785_cT_cs_4141285_GBPUSD_2025-04-21_20-23-16.png)

![Imagen cargada de "[Stellar Strategies] Market Structure Breakout"](https://market-prod-23f4d22-e289.s3.amazonaws.com/d61fc030-2176-4928-b7ed-c4c1e3c09294_cT_cs_4141285_EURUSD_2025-04-21_20-17-35.png)

![Imagen cargada de "[Stellar Strategies] Market Structure Breakout"](https://market-prod-23f4d22-e289.s3.amazonaws.com/7c3de011-aa2f-4bd4-a256-37fec1330726_cTrader_Zpw4JmwDQC.png)

Market Structure Breakout Indicator

Overview

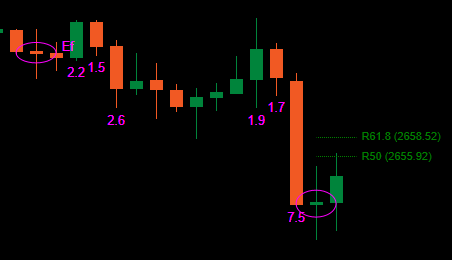

This indicator is designed to identify potential trading opportunities by detecting breakouts from recent price ranges on your cTrader chart. It visually highlights when the price closes significantly above a recent high (potential bullish continuation/reversal) or below a recent low (potential bearish continuation/reversal), drawing inspiration from market structure break concepts.

How it Works

- Range Identification: For each bar, the indicator looks back over a specified number of previous bars (defined by

Lookback Period). It identifies the absolute highest high price and lowest low price reached within that period. - Breakout Detection: It checks if the current bar's closing price is higher than the highest high found in the lookback period (a bullish breakout) or lower than the lowest low (a bearish breakout).

- Trend Filtering (Optional): If

Enable Trend Filteris set totrue, the indicator also checks the price relative to a Moving Average (Trend MA Period&Trend MA Type). - A bullish breakout signal is only considered valid if the closing price is also above the Moving Average.

- A bearish breakout signal is only considered valid if the closing price is also below the Moving Average. This helps filter out breakouts that go against the prevailing trend defined by the MA.

Visual Elements

- Arrows:

- A Bullish Arrow (default LimeGreen) appears below the low of a bar that closes above the recent highest high (and satisfies the trend filter, if enabled).

- A Bearish Arrow (default Red) appears above the high of a bar that closes below the recent lowest low (and satisfies the trend filter, if enabled).

- The distance of the arrow from the bar is automatically adjusted based on market volatility using ATR (

Arrow ATR Offset Multiplier).

- Horizontal Lines:

- When a bullish breakout occurs, a Broken Resistance Line (default Red) is drawn at the level of the highest high that was broken.

- When a bearish breakout occurs, a Broken Support Line (default LimeGreen) is drawn at the level of the lowest low that was broken.

- These lines start from the bar where the high/low pivot occurred and extend forward past the breakout bar by a number of bars defined by

Line Extension Bars. This helps visualize the broken level. - Line style and thickness can be customized.

- Labels (Optional):

- If

Label Typeis not set toNone, a text label appears near the end of the extended horizontal line. - This can display the actual

Pricelevel, customText(like "MSB"), orBoth. - Label color is customizable.

- If

- History Limit: Only the most recent

Max Historical Breakoutsnumber of bullish and bearish signals (arrow + line + label) are displayed to keep the chart clean. Setting this to 0 shows all.

How to Use & What to Look For

- Entry Signals: Breakout arrows can signal potential entry points in the direction of the breakout. A bullish arrow suggests a possible long entry, while a bearish arrow suggests a possible short entry.

- Confirmation: Use breakouts in conjunction with other forms of analysis (e.g., volume analysis, chart patterns, fundamental analysis) to confirm signals. Don't rely solely on this indicator.

- Support/Resistance: The horizontal lines drawn by the indicator represent price levels where price previously stopped. After a breakout, these levels can reverse their roles:

- A broken resistance level (red line) might act as potential future support.

- A broken support level (green line) might act as potential future resistance. Watch how price interacts with these extended lines on subsequent bars.

- Trend Context: Enabling the

Trend Filtercan help you focus on breakouts that align with the broader market direction, potentially reducing trades against strong trends. - Parameter Tuning: Experiment with the

Lookback Period. Shorter periods will be more sensitive and generate more signals (potentially noisier). Longer periods will identify breaks from more significant ranges but generate fewer signals. Adjust based on the timeframe and market characteristics. Tune theTrend MA Periodto define the trend you want to follow. - Timeframes: The indicator works on any timeframe. Remember that a

Lookback Periodof 20 means 20 bars of that specific timeframe.

Alerts

- If

Enable Sound Alertsistrue, the indicator will play the specifiedAlert Sound Filewhen a new breakout signal appears on the latest real-time bar (it won't alert during backtesting or history loading).

Key Parameters

Lookback Period: Number of past bars to find the highest high/lowest low.Enable Trend Filter: Turns the Moving Average filter on/off.Trend MA Period/Type: Settings for the trend-filtering Moving Average.Max Historical Breakouts: Limits how many past signals are shown.Arrow ATR Offset Multiplier: Controls arrow distance from the bar based on volatility.Line Extension Bars: How far the horizontal line extends past the breakout.Label Type/Custom Label Text: Controls the display of labels on the lines.Enable Sound Alerts/Alert Sound File: Configures audio alerts.- Color/Style Parameters: Customize the visual appearance.

Disclaimer: Trading involves risk. This indicator provides technical signals based on its calculations, but it does not guarantee profit or predict the future. Always use risk management and conduct your own analysis before making any trading decisions.

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

![Logotipo de "[Stellar Strategies] BOS Trend 1.0"](https://market-prod-23f4d22-e289.s3.amazonaws.com/808c7722-ba53-4633-b8a4-16f31eeb1fc2_[Stellar Strategies] BOS Trend.jpg)

![Logotipo de "[Stellar Strategies] MARSI Signal Plotter"](https://market-prod-23f4d22-e289.s3.amazonaws.com/a423f7d2-eb34-49ee-bb17-13e5586550fb_MARSI 2.0.png)

![Logotipo de "[Stellar Strategies] Linear Regression Candles 1.1"](https://market-prod-23f4d22-e289.s3.amazonaws.com/19ef277f-e0b6-48ef-8941-88bfbba145f3_cT_cs_4141285_EURUSD_2025-03-30_19-53-31.png)

![Logotipo de "[Stellar Strategies] Market Session Ultimate"](https://market-prod-23f4d22-e289.s3.amazonaws.com/c6ab1a32-7da1-4d09-813c-75d33b8800b2_Market Session Ultimate 2.png)

![Logotipo de "[Stellar Strategies] Wave Trend Pro"](https://market-prod-23f4d22-e289.s3.amazonaws.com/8c93438a-6b0a-4026-93b2-0694329a3bc1_cT_cs_4141285_EURUSD_2025-04-25_17-52-31.png)

![Logotipo de "[Stellar Strategies] Inside Bar with Signals"](https://market-prod-23f4d22-e289.s3.amazonaws.com/c12d088e-7b52-4961-a0d2-7e38a2499bd3_cT_cs_4141285_EURUSD_2025-07-15_13-15-32.png)

![Logotipo de "[StellarStrategies] Scheduled Trade Executor"](https://market-prod-23f4d22-e289.s3.amazonaws.com/f13e96a0-274f-490e-8aa5-5a154d8bcf60_stellar12.jpg)

![Logotipo de "[Stellar Strategies] Smart ADX"](https://market-prod-23f4d22-e289.s3.amazonaws.com/9503ee65-5386-408e-b63c-9faacd672e08_Stellar ADX.png)

![Logotipo de "[Stellar Strategies] QQE"](https://market-prod-23f4d22-e289.s3.amazonaws.com/ed4b3af5-54e4-404e-80eb-a23fa7ef0282_cTrader_7oDDAbSmSP.png)

![Logotipo de "[Stellar Strategies] VBO"](https://market-prod-23f4d22-e289.s3.amazonaws.com/7dc1f1b1-2236-4d85-abb3-1c50a32aac9a_vbo.png)

![Logotipo de "[Stellar Strategies] Visual Trend Momentum"](https://market-prod-23f4d22-e289.s3.amazonaws.com/3835d044-1c21-4909-9d3c-2635f984b93d_visualtrendmomentum.jpg)

![Logotipo de "[Stellar Strategies] Candlestick Patterns Dashboard"](https://market-prod-23f4d22-e289.s3.amazonaws.com/ecbe4451-9dae-4dee-8bee-271c1e4e4ab1_CPD.png)