Bias Analyzer — a clean, rules-based “market context” dashboard

Most trading mistakes aren’t bad entries — they’re good entries in the wrong context.

Bias Analyzer is built to solve that: it gives you a consistent directional read using two independent engines and shows the result right on your chart.

Important: Bias Analyzer is an analytical, visual tool. It does not open, modify, or close trades.

What Bias Analyzer shows

✅ A compact top-left dashboard with:

- Heikin bias (Bullish / Bearish / Pending)

- Session bias (Bullish / Bearish / Neutral / Pending)

- Final alignment bias (Bullish / Bearish / Neutral / Pending)

- Confidence % for the session engine

- Per-session stats: ADV% vs STD%, Δ pips, surge count, dominance

✅ Session POC lines (latest session or multi-session history)

- ADV POC = thicker solid line (primary)

- STD/Base POC = dotted line (optional comparison)

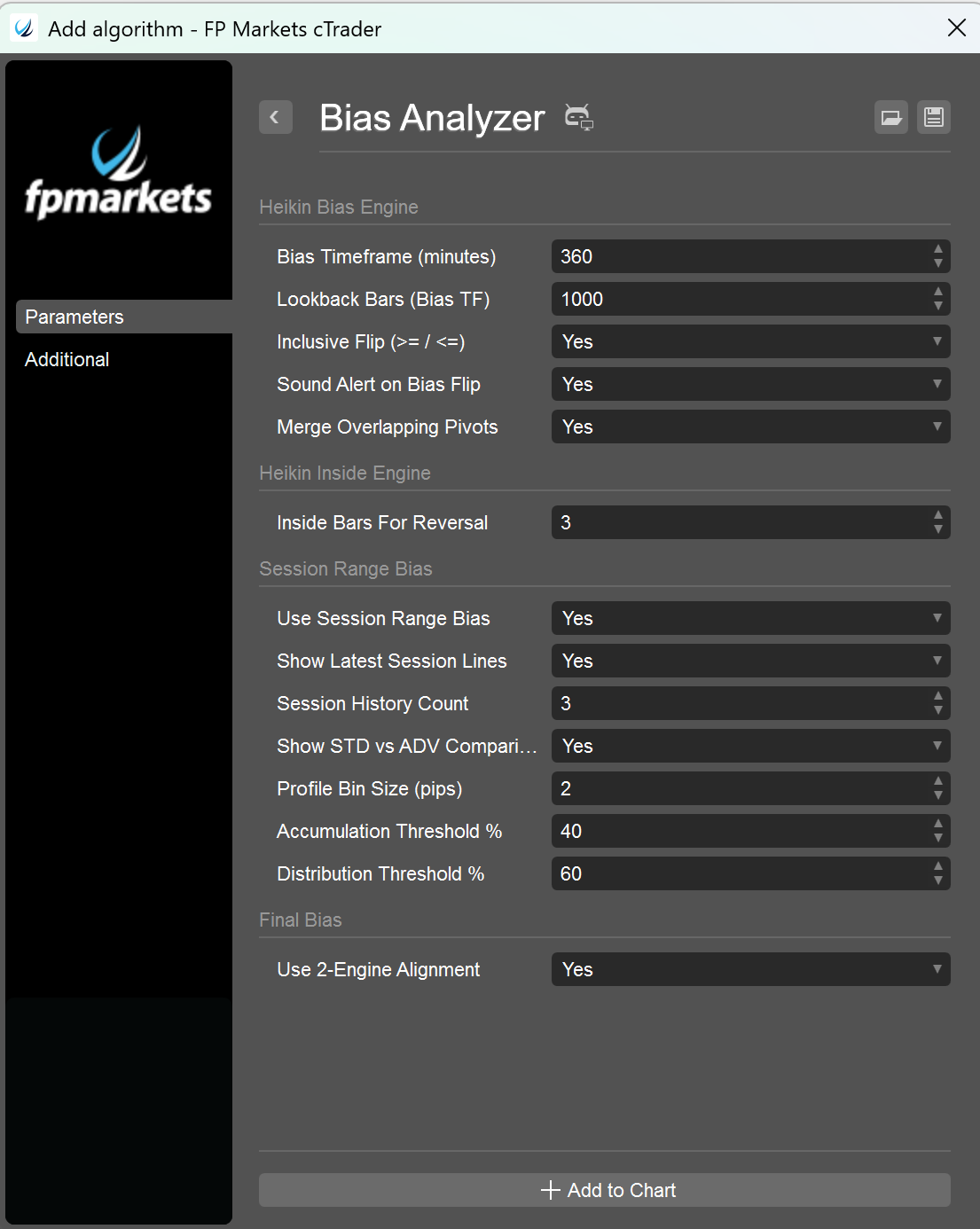

Engine 1 — Heikin Ashi Pivot Bias (structure)

This engine reads Heikin Ashi “color flips” on your chosen Bias Timeframe and builds pivot zones:

- Optional merging of overlapping pivots

- Bias flips when price breaks the latest opposing zone (inclusive or strict)

- Includes an inside-bar coil module (body-only) for early continuation/reversal context

Use it as your higher-timeframe “pressure” filter.

Engine 2 — Session Range Bias (Asia / London / New York)

Bias Analyzer evaluates the most recent completed Asia, London, and New York sessions and applies a strict 2-out-of-3 vote:

- Each session computes Low/High and a POC

- Sessions are classified by where the POC sits within the session range:

- Near the bottom → Accumulation (Bull vote)

- Near the top → Distribution (Bear vote)

- Middle → Balanced (no vote)

ADV POC (the difference-maker)

Instead of treating candle bodies as “truth”, ADV focuses on where price was rejected with volume:

- Detects M15 surge candles (tick volume ≥ prior candle)

- Uses wick-only intervals and distributes volume by wick length

- Adds intent weighting using:

- wick imbalance on the surge candle

- next candle color

- first breach of surge high/low later in the same session

- Builds a session profile and selects the best-score ADV POC

STD/Base POC remains available for comparison (so you can see what ADV is changing).

Final Bias (Alignment)

When 2-engine alignment is enabled:

- If Heikin + Sessions agree → Final = Bullish/Bearish

- If they conflict → Final = Neutral

- If data is insufficient → Final = Pending

This is designed to keep you out of “mixed-message” conditions.

Works best on

- Any symbol with consistent tick volume (Forex majors/minors, indices, metals recommended)

- Any chart timeframe (internally uses M5 for session ranges and M15 for ADV surges)

Risk disclaimer

Trading involves risk. Bias Analyzer provides analytical information only and does not guarantee outcomes. Always test on a demo account and use your own risk management.

![Logo de "[Fx4U] EURAUD - Price Action"](https://market-prod-23f4d22-e289.s3.amazonaws.com/885e7e65-64d4-4b38-860a-55bd35629aa5_Wallpaper.jpg)