Dot Momentum %BB Dynamic Visualizer for cTrader

Quantify Volatility. Visualize Momentum. Master Your Entries.

Unleash the power of volatility with the Bollinger Bands %B Dynamic Visualizer, a unique custom indicator for cTrader designed to give you unparalleled insight into price action relative to its volatility envelope. Moving beyond traditional Bollinger Bands, this indicator transforms complex volatility metrics into an intuitive, color-coded stream of circles, helping you identify crucial market turning points and trend strength.

What is Bollinger Bands %B and How Does It Differ?

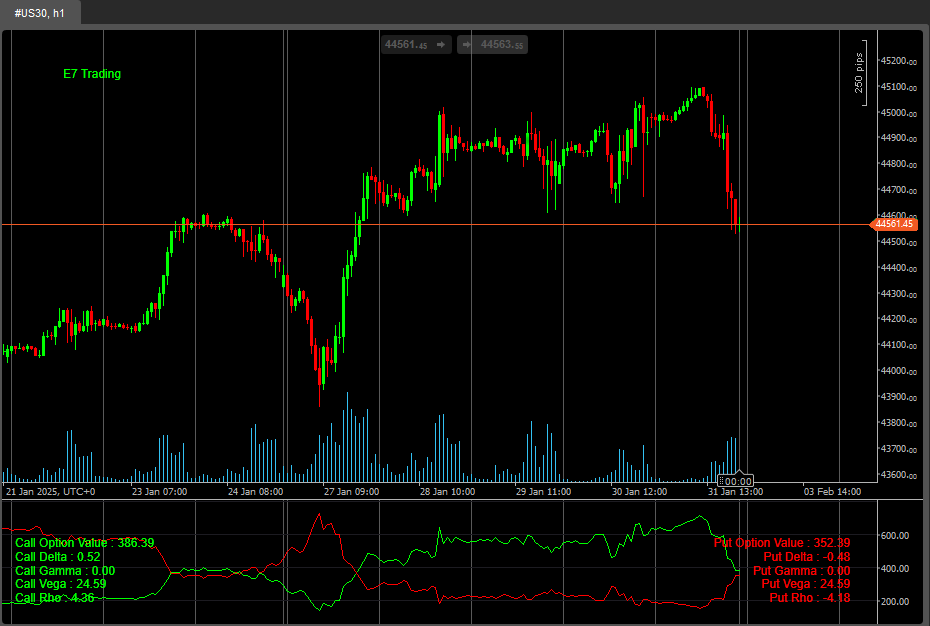

While standard Bollinger Bands overlay directly onto your price chart, showing dynamic support/resistance and visually representing market volatility through their expansion and contraction, the Bollinger Bands %B is an oscillator. It's displayed in a separate panel below your main chart, providing a quantifiable measure of where the current price stands within the Bollinger Bands' envelope.

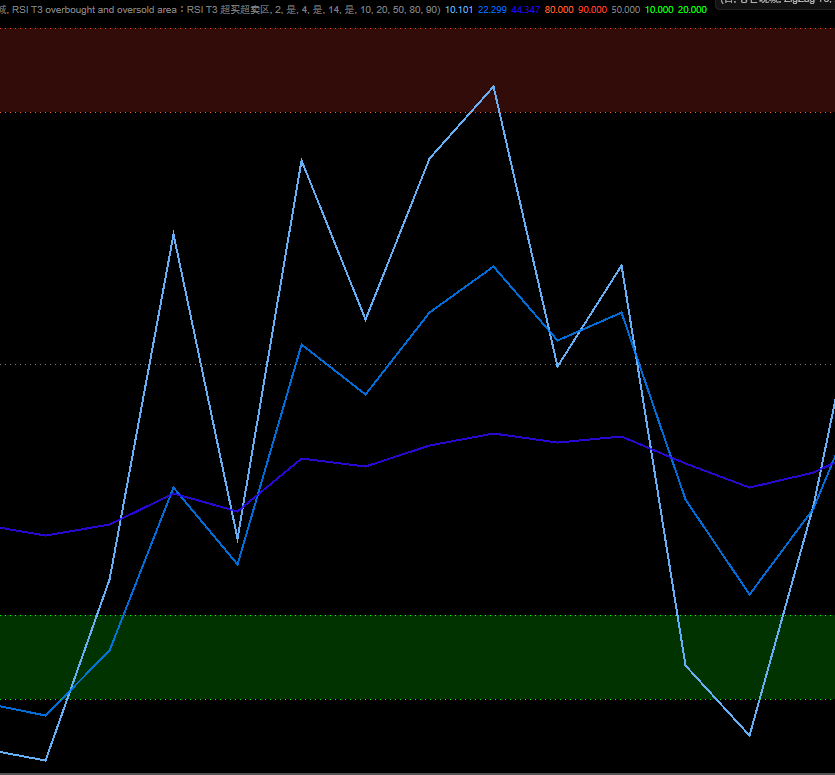

It doesn't show you price directly; instead, it reveals the price's relative position on a scale from 0 to 1:

- 0.0: Price is at the Lower Bollinger Band.

- 0.5: Price is at the Middle Bollinger Band (the Moving Average).

- 1.0: Price is at the Upper Bollinger Band.

Benefits & Volatility Context:

This indicator goes beyond mere observation. It quantifies the price's position relative to its inherent volatility, allowing you to:

- Gauge Trend Strength: A persistent %B above 0.5 suggests strong upward momentum, while below 0.5 indicates downward pressure.

- Identify Potential Reversals: Extreme readings (close to 0.0 or 1.0) can signal that price is overextended within its current volatility range.

- Understand Contextual Volatility: The volatility itself (represented by the width of the underlying Bollinger Bands) is always contextual to the timeframe you are viewing. A %B reading on a 1-hour chart reflects volatility differently than on a 1-day chart. Our indicator seamlessly adapts to your chosen timeframe, providing relevant insights.

Technical Features:

- Precise Calculation: %B is calculated as: (Current Price−Lower Band)/(Upper Band−Lower Band)

- Dynamic Color Coding (Circles):

- Lime Green Circles: Indicate that the %B value is rising from the previous bar, signaling upward momentum.

- Red Circles: Indicate that the %B value is falling from the previous bar, signaling downward momentum.

- Silver Circles: Displayed when the %B value remains unchanged or for the very first valid point.

- Subtle Path Line: A thin, light gray line subtly traces the overall path of the %B value, providing visual continuity underneath the dynamic circles.

- Discreet Level Markers: Dark gray, solid lines at 0.0, 0.5, and 1.0 (easily visible without overpowering the main visualization) provide clear reference points for volatility extremes and the mean.

- Customizable: Adjust Bollinger Bands period, standard deviations, and MA type directly from the settings.

Simplified Explanation: Over-Volatility Signals (Like an RSI for Volatility!)

Think of this indicator like an RSI, but for volatility overextension instead of simple overbought/oversold price levels.

- When the circles touch or go below 0.0, it means the price is pushing hard against the bottom of its current volatility envelope. This is like a "volatility oversold" signal, suggesting the market might be overstretched to the downside within its current context.

- When the circles touch or go above 1.0, it means the price is pushing hard against the top of its current volatility envelope. This is like a "volatility overbought" signal, suggesting the market might be overstretched to the upside within its current context.

These extreme readings don't necessarily mean "buy" or "sell" immediately, but they are powerful alerts that the market is at an extreme point within its typical range of movement for that specific timeframe. This often precedes a potential mean reversion or a change in the market's volatility behavior.

.png)