WHAT IT DOES

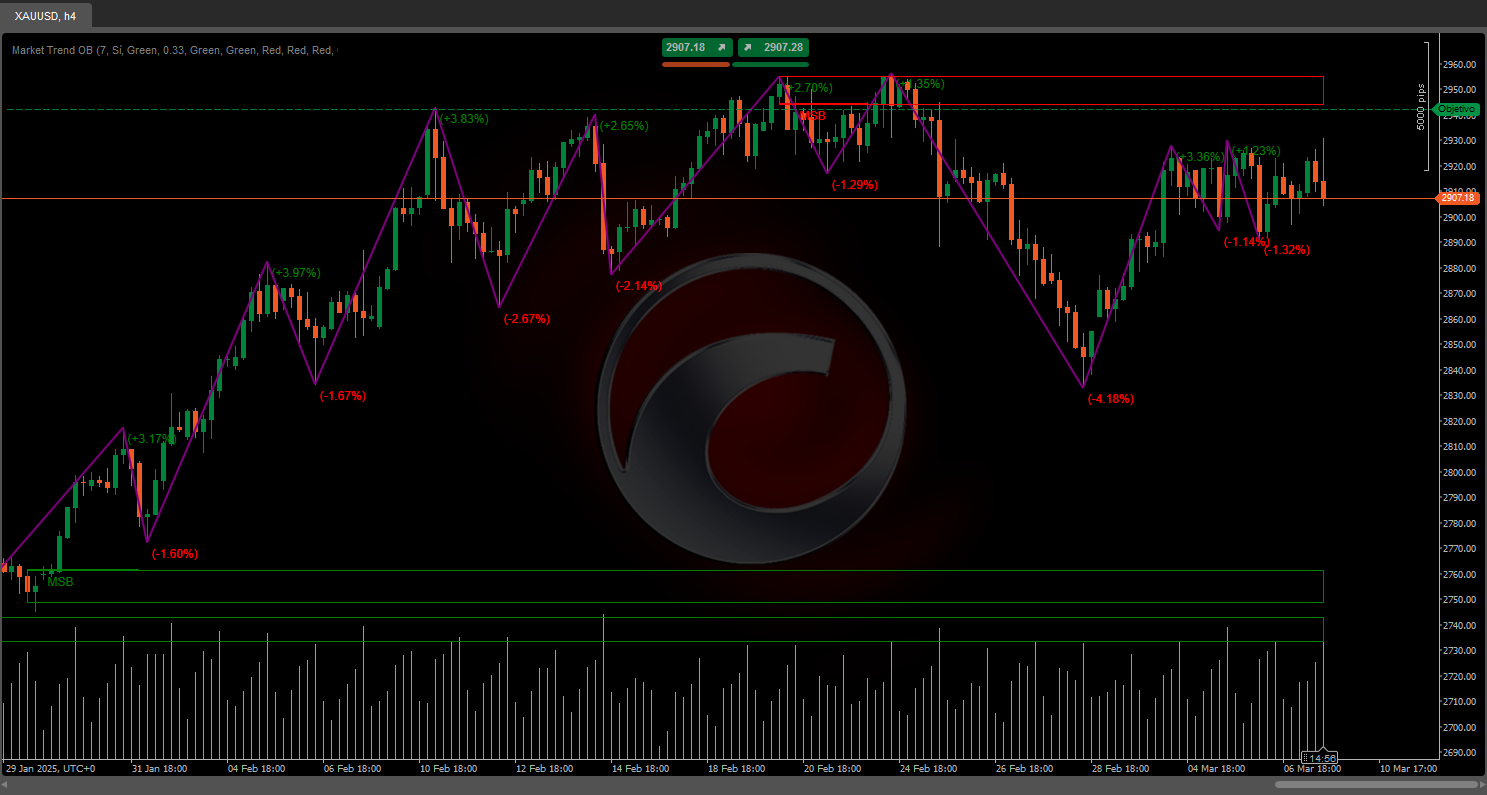

Structural Supertrend addresses a fundamental limitation of the classic Supertrend: it flips direction the moment price closes beyond its band.

In clean trends, that works well. In volatile or choppy conditions, a single aggressive candle can trigger a flip — even when the broader trend remains structurally intact. The result is whipsaws, premature exits, and re-entries at worse prices.

This indicator is built around a different premise.

Direction changes only when price confirms a genuine structural shift — not just a momentary close beyond a threshold. The result is fewer false reversals and better alignment with how trends actually develop.

The Supertrend becomes structural. The signals become meaningful.

WHY STRUCTURAL SUPERTREND?

The Problem

The original Supertrend treats every close beyond its band as a reversal. This is intentional — it makes the indicator reactive by design. But reactivity comes at a cost.

During consolidation phases, price frequently closes beyond one band then immediately reverses. Each of these generates a flip signal, each flip represents a potential trade decision, and each represents an exit from a position that didn't need to be exited.

Traders who've used Supertrend long enough know this frustration well.

The Solution

Structural Supertrend extends the original model to distinguish between volatility-driven closes and genuine directional changes. It filters out noise by requiring structural confirmation before changing trend direction.

Fewer flips. Better trend alignment. Less reactive to individual candles.

Why Keep Both?

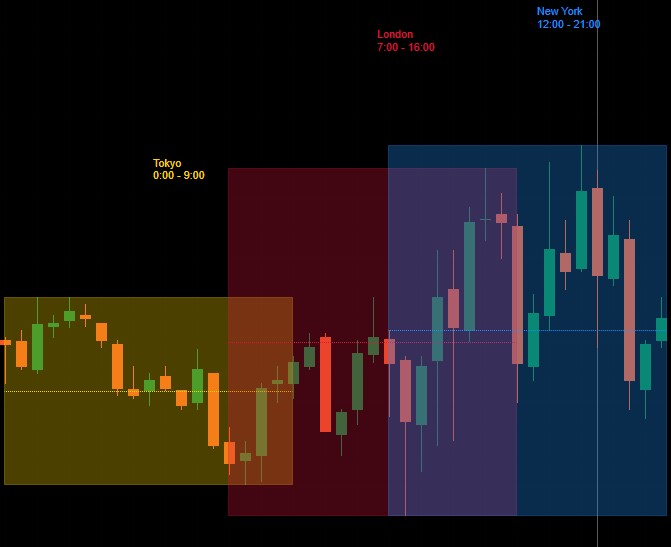

The original Supertrend still appears on the chart — but only where it differs from Structural. This design is intentional.

- Structural tracks the major trend direction

- Original reveals impulse and corrective behavior within that trend

When both agree: strong directional conviction. When they diverge: the move is likely corrective, not a true reversal. This dual-layer view gives context that neither line provides alone.

INTEGRATED SWING DETECTION

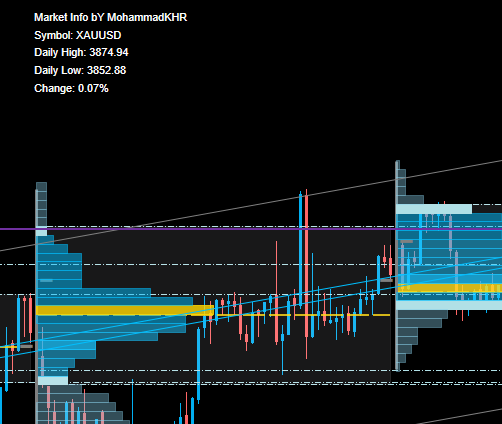

Structural Supertrend includes a full swing detection and S/R framework — not as a secondary feature, but as a direct extension of structural analysis.

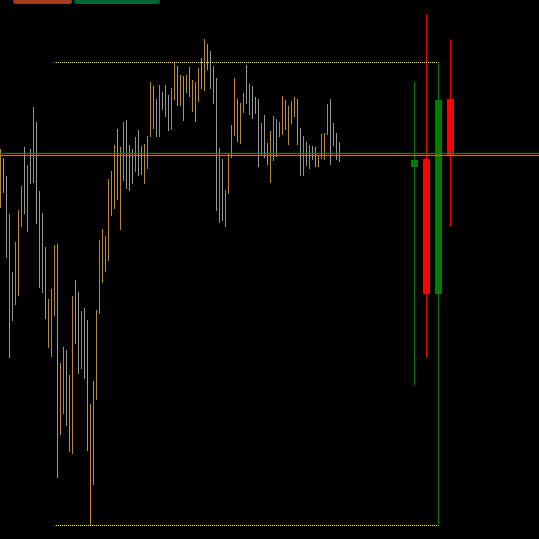

Swings are identified through a structure-first qualification process: each candidate is evaluated against displacement, volume confirmation, and ATR-relative distance before being accepted. This keeps the swing map focused on meaningful turning points rather than every local extremum.

Three Detection Modes

- Minor — increased sensitivity, captures inner swings within trends

- Balanced — filtered granularity, best for most use cases

- Major — strongest structural pivots only, confirmed by broader criteria

Swing Strength Classification

Each confirmed swing is scored by depth, volume, and structural position relative to the prior swing of its type. Strength is classified dynamically using percentile ranking across recent swing history — not fixed thresholds. Visual markers reflect the classification: triangles for strong, diamonds for moderate, circles for weak.

S/R Zones with Polarity Tracking

Confirmed swings become active S/R levels that track their own interaction history. When price revisits a level, the indicator logs whether contact was a wick rejection or a body break. When a level is swept and closes beyond it, polarity flips — former resistance becomes support, and vice versa. If swept again, the zone is invalidated.

Age labels show how long each level has been active and how many times it has been tested.

READING THE CHART

- Green Structure Line: Bullish structural trend (dynamic support)

- Red Structure Line: Bearish structural trend (dynamic resistance)

- Dotted Line: Original Supertrend — visible only where it differs from Structural

- S/R Lines: Active levels with polarity state and age

Trend Alignment Check:

- Structure + Original agree → High conviction directional move

- Structure + Original diverge → Likely corrective or transitional phase

WHO IT'S FOR

This indicator is for traders who want to read trend direction and market structure from a single, coherent framework.

If you've used classic Supertrend and found it too reactive — flipping frequently during sideways conditions — Structural Supertrend was built to address exactly that.

It's well suited for trend and swing traders who want a cleaner directional read without constant false reversals, structure-based traders who track swing sequences to validate trend health, and discretionary traders who use S/R levels as context for entries, exits, and position management.

The built-in UI controls make it practical for real-time use: switch detection modes, adjust S/R references, and toggle label detail directly on the chart — no need to open the settings panel.

This is not a signal generator. It's a structural analysis framework for traders who want to understand where the market is, not just what it's doing right now.

WHAT MAKES IT DIFFERENT

Most Supertrend implementations treat every close beyond a band as actionable. This one treats it as a candidate — and requires structural evidence before committing to a direction change.

Most swing detectors identify local highs and lows without evaluation criteria. This one qualifies each swing by displacement, volume, and structural position — and scores strength dynamically against recent swing history.

Most S/R tools draw a line and leave it. This one tracks interaction history, flags polarity changes, and continues evolving as the market revisits each level.

The result: a trend and structure tool that stays relevant longer, reacts less to noise, and builds a richer picture of market condition over time.

---

UNDERSTANDING STRUCTURAL ANALYSIS

Market structure is not about finding the "right" swing or the "correct" trend direction. It's about maintaining an objective picture of how price sequences are developing — and whether that sequence remains coherent or is beginning to degrade.

A trend is defined not by a single move but by a series of relationships: higher highs and higher lows in uptrends, lower highs and lower lows in downtrends. Each new swing either confirms or challenges the existing sequence. When confirmation continues, the structure is intact. When it breaks, the structure is transitioning.

What makes structural analysis useful is not that it predicts where price will go, but that it describes where price currently is within its own sequence. This distinction matters. Prediction requires assumptions about the future. Structural observation requires only an accurate read of what has already happened.

Indicators built on structural logic are designed to support that observation — to make the sequence visible and trackable without introducing subjective interpretation. The goal is clarity about current market condition, not certainty about future price direction.

---

Trading involves risk. This indicator is a technical analysis tool — always apply proper risk management.

.png)

![Logo "[Stellar Strategies] Moving Averages Combined 1.0"](https://market-prod-23f4d22-e289.s3.amazonaws.com/b4cd360c-5f3c-4902-b2e1-6b86da1199bb_Gemini_Generated_Image_nl1erpnl1erpnl1e.jpg)