.png)

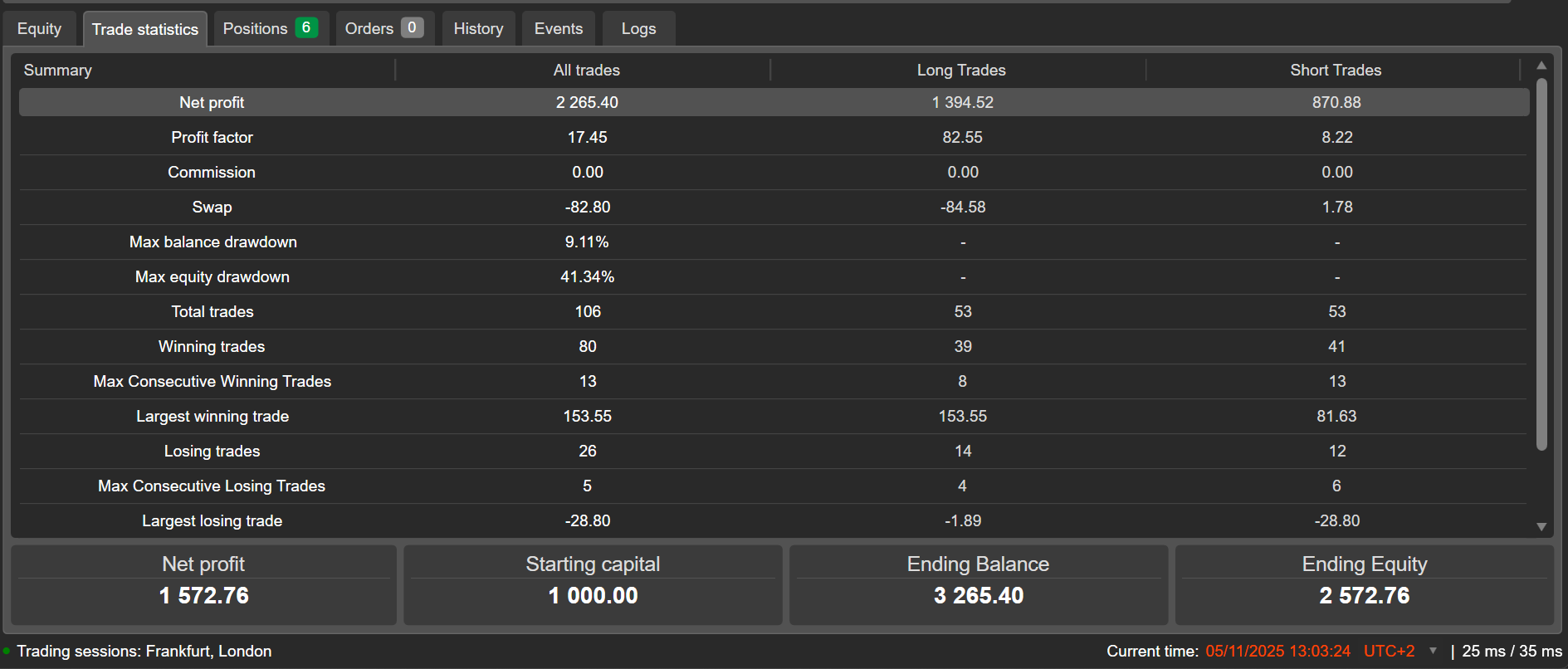

This cBot is a multi-indicator scoring engine.

On each bar close it reads a lot of different signals (ADX, EMA, Bollinger, MACD, Ichimoku, RSI, Stochastic, and many custom tools like DynamicTrendFlux, InstitutionalFlowRadar, Liquidity Cluster Order, Pressure Scanner, Deep Mood, Hub Pro, VWAP Pro ATR, Volume Delta CVD, ZigZag Pro…), converts each one to:

- +1 = bullish

- -1 = bearish

- 0 = neutral

then multiplies by individual weights and sums up everything into a global score.

A trade is opened only if:

- the score passes the long/short thresholds (Min Score Long / Short)

- a minimum number of indicators agree (Min Indicators Aligned)

- position and risk limits (max positions, volume, etc.) are respected

The bot then manages exits with SL/TP based on fixed pips or ATR, and optional BreakEven and Trailing Stop.

In short: it’s a flexible framework to combine trend, mean-reversion, institutional flow and volume into one single strategy. ⚙️📊

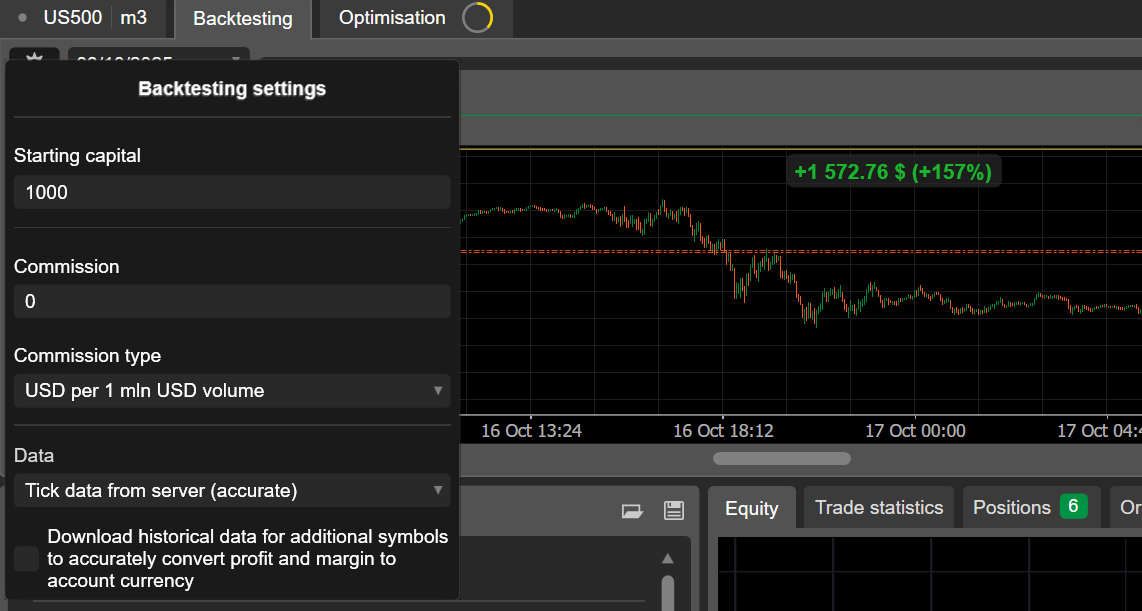

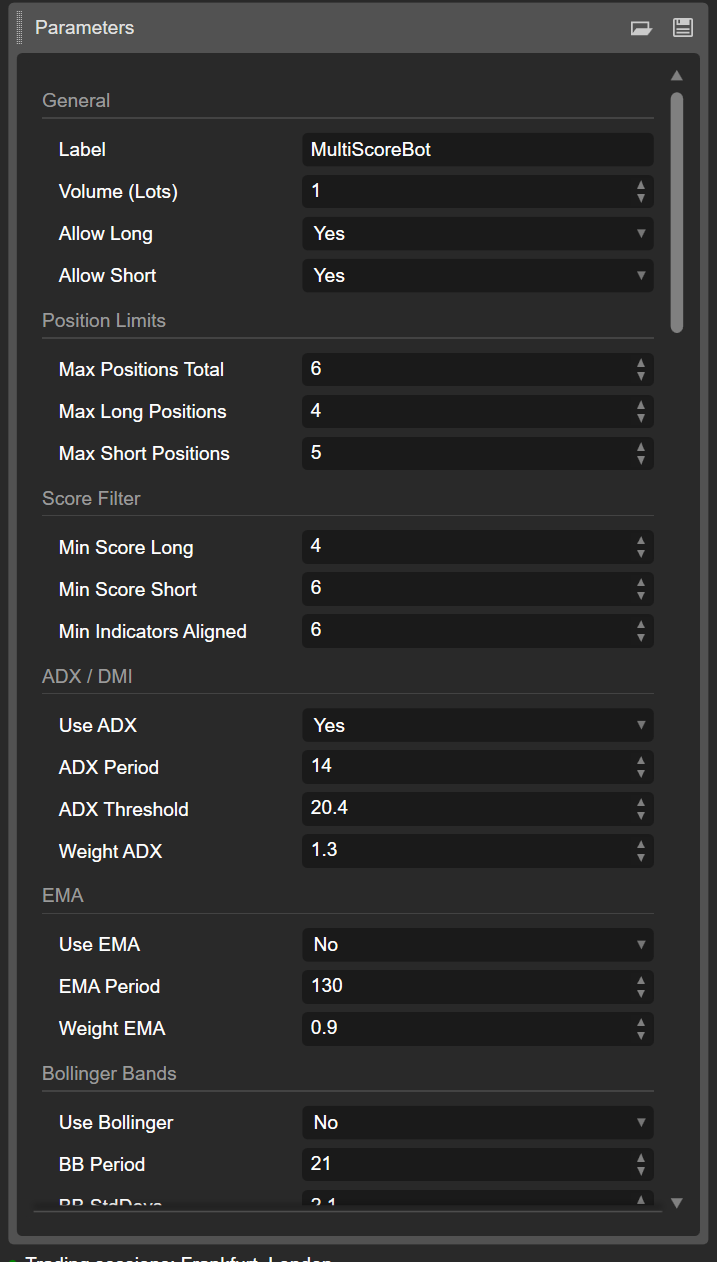

📌 1. General & Position Limits

General

- Label – Used to tag all positions opened by this cBot (helps filter them from others).

- Volume (Lots) – Trade size in lots.

- Allow Long – Enable/disable BUY trades.

- Allow Short – Enable/disable SELL trades.

Position Limits

- Max Positions Total – Maximum total open positions (long + short) for this symbol/Label.

- Max Long Positions – Maximum number of simultaneous long trades.

- Max Short Positions – Maximum number of simultaneous short trades.

🧮 2. Global Score Filter

- Min Score Long – Minimal score required to allow a long entry (

score >= MinScoreLong). - Min Score Short – Minimal negative score for shorts (

score <= -MinScoreShort). - Min Indicators Aligned – Minimal number of indicators that must agree bullish or bearish.

Raising these values makes the bot more selective ✅ (fewer but more filtered trades).

📈 3. Classic Indicators

ADX / DMI

- Use ADX – Toggle ADX/DMI contribution.

- ADX Period – ADX calculation period.

- ADX Threshold – Minimal ADX to treat the trend as “strong”; below that, ADX is neutral.

- Weight ADX – Impact of ADX trend bias on the global score.

EMA

- Use EMA – Enable EMA filter.

- EMA Period – EMA length (e.g. 200 for higher-TF trend).

- Weight EMA – Weight of EMA signal (price vs EMA and EMA slope).

Bollinger Bands

- Use Bollinger – Enable Bollinger Bands.

- BB Period / BB StdDevs – Period and number of standard deviations.

- Weight Bollinger – Weight of mean-reversion band signal (near lower band → bull, near upper band → bear).

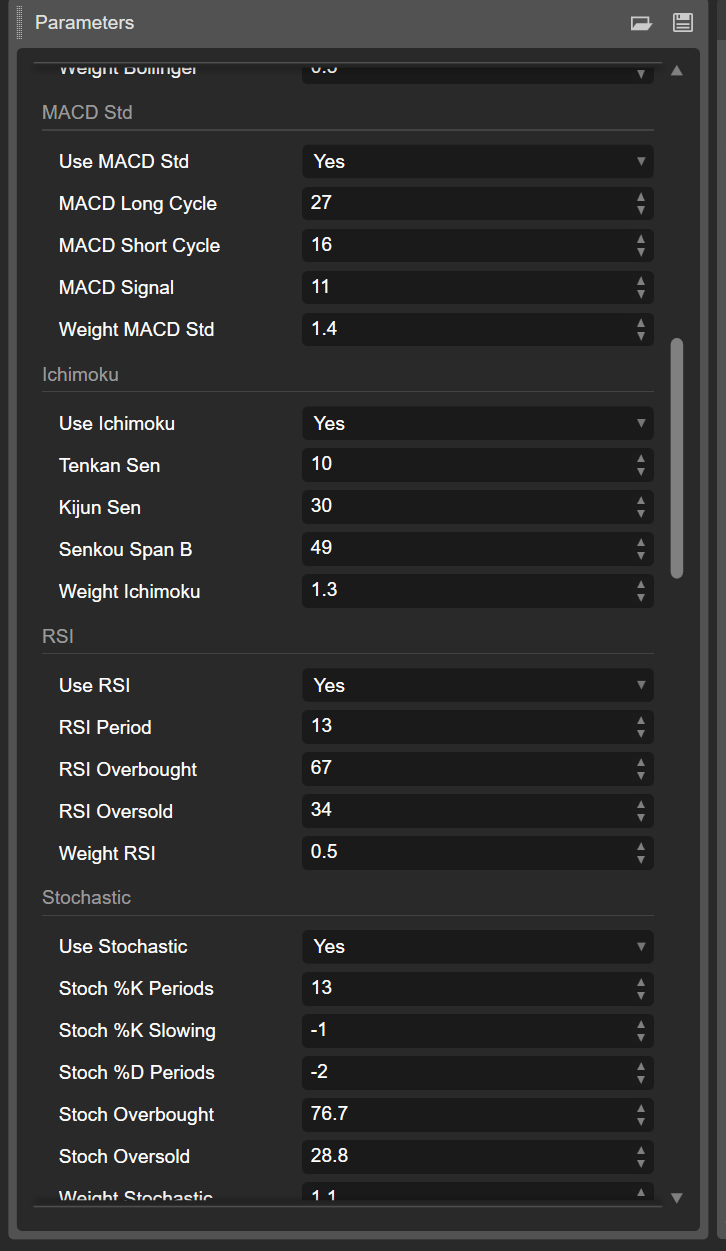

MACD Std

- Use MACD Std – Enable standard MACD CrossOver.

- MACD Long Cycle / Short Cycle / Signal – Classic MACD parameters.

- Weight MACD Std – Weight of MACD crossover (MACD>Signal = bullish, MACD<Signal = bearish).

Ichimoku

- Use Ichimoku – Use Ichimoku cloud as trend filter.

- Tenkan Sen / Kijun Sen / Senkou Span B – Ichimoku settings.

- Weight Ichimoku – Weight of cloud location (above = bull, below = bear, inside = neutral).

RSI

- Use RSI / RSI Period – Enable RSI and set lookback.

- RSI Overbought / RSI Oversold – OB/OS thresholds.

- Weight RSI – Weight of contrarian RSI signal: oversold → bull, overbought → bear.

Stochastic

- Use Stochastic – Enable Stochastic Oscillator.

- Stoch %K Periods / Slowing / %D Periods – Stochastic parameters.

- Stoch Overbought / Stoch Oversold – OB/OS levels.

- Weight Stochastic – Weight of overbought/oversold pattern (K>D or K<D logic).

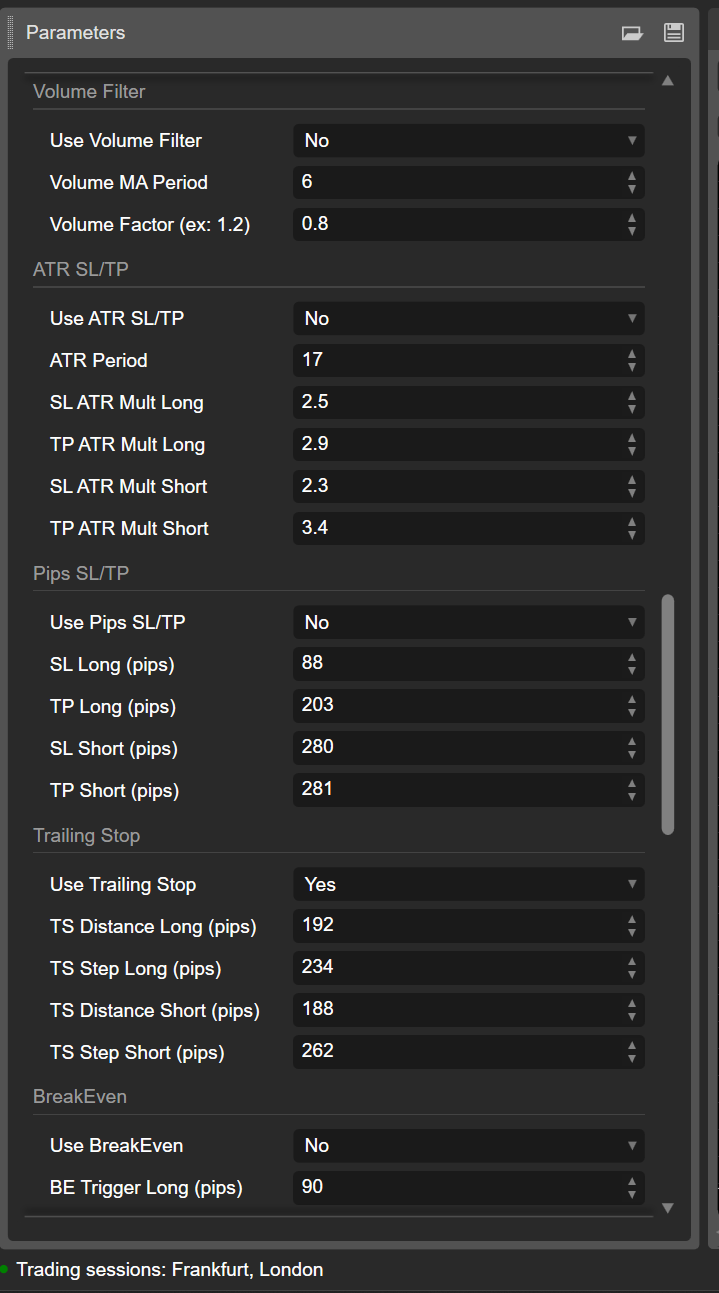

🔊 4. Volume & Market Activity

Volume Filter

- Use Volume Filter – If true, entries are blocked when volume is too low.

- Volume MA Period – Length of volume moving average.

- Volume Factor – Current volume must be at least

MA * factor(e.g. 1.2 = 120% of avg).

🎯 5. SL/TP, ATR, Pips, Trailing, BreakEven

ATR-based SL/TP

- Use ATR SL/TP – Use ATR-driven SL/TP when fixed pips are disabled.

- ATR Period – ATR lookback.

- SL/TP ATR Mult Long/Short – ATR multipliers (converted to pips) for SL & TP (long and short separately).

Pip-based SL/TP

- Use Pips SL/TP – If true, use only fixed pip distances and ignore ATR SL/TP.

- SL Long/Short (pips) – Fixed SL distance in pips.

- TP Long/Short (pips) – Fixed TP distance in pips.

Trailing Stop

- Use Trailing Stop – Enable dynamic SL trailing as price moves in favor.

- TS Distance Long/Short (pips) – Trailing distance from current price.

- TS Step Long/Short (pips) – Minimal improvement in pips required to move SL again.

BreakEven

- Use BreakEven – Automatically move SL to break-even after a certain profit.

- BE Trigger Long/Short (pips) – Profit threshold in pips to trigger BE logic.

- BE Offset Long/Short (pips) – Offset from entry when SL is moved (to lock some profit).

🧪 6. Custom / Pro Indicators

DynamicTrendFlux (MACD DTF)

- Use MACD DTF – Enable DTF Bias in score.

- Weight MACD DTF – Weight of DTF Bias: >0 bullish, <0 bearish.

InstitutionalFlowRadar (RetailSmart)

- Use RetailSmart – Use institutional flow bias.

- Weight RetailSmart – Weight of its bullish/bearish Bias in total score.

Liquidity Cluster Order (OrderBlock)

- Use OrderBlock – Enable liquidity cluster/order block pressure.

- Weight OrderBlock – Weight of its bullish/bearish pressure Bias.

Pressure Scanner (Squeeze)

- Use Squeeze – Enable squeeze/expansion detection.

- Weight Squeeze – Weight of bullish/bearish pressure signals.

Deep Mood Distribution

- Use Liquidity Sentiment – Show deep mood/sentiment profile on chart; visual only, not scored.

Hub Pro

- Use Hub Chandelier / Weight Hub Chandelier – Use Hub Pro’s Chandelier signal and set its weight.

- Use Hub AVWAP / Weight Hub AVWAP – Use AVWAP (price above/below) with given weight.

- Use Hub CVD / Weight Hub CVD – Use CVD trend (rising/falling) and its weight.

VWAP Pro ATR

- Use VWAP Plus Pro – Enable VWAP Pro ATR as a mean-reversion component.

- |z| Min (VWAP) – Minimal absolute z-score distance from VWAP to avoid “flat/neutral” zone.

- Weight VWAP Plus Pro – Weight of VWAP mean-reversion: far below = bull, far above = bear.

Volume Delta CVD

- Use Volume Delta – Use Volume Delta as a directional flow filter.

- Delta Method – Chosen method to compute delta (e.g. close vs previous close).

- Reset Mode – How often CVD is reset (daily, etc.).

- Delta EMA Period – EMA length on delta (0 = disabled).

- Min |Delta EMA| – Minimal absolute EMA needed for a valid delta signal.

- Weight Volume Delta – Weight of Volume Delta bullish/bearish signal.

ZigZag Pro

- Use ZigZag Pro – Use last confirmed pivots as trend indication.

- Weight ZigZag Pro – Weight of its signal: last pivot low = bullish, last pivot high = bearish (with fallback on last 2 pivots).

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

.png)

.png)

.jpg)