ADX and ADI

지표

196 다운로드

버전 1.0, Aug 2025

Windows, Mac

5.0

리뷰: 2

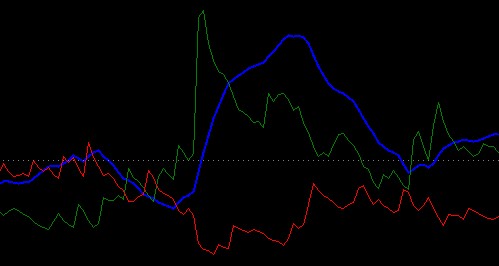

Key Features:

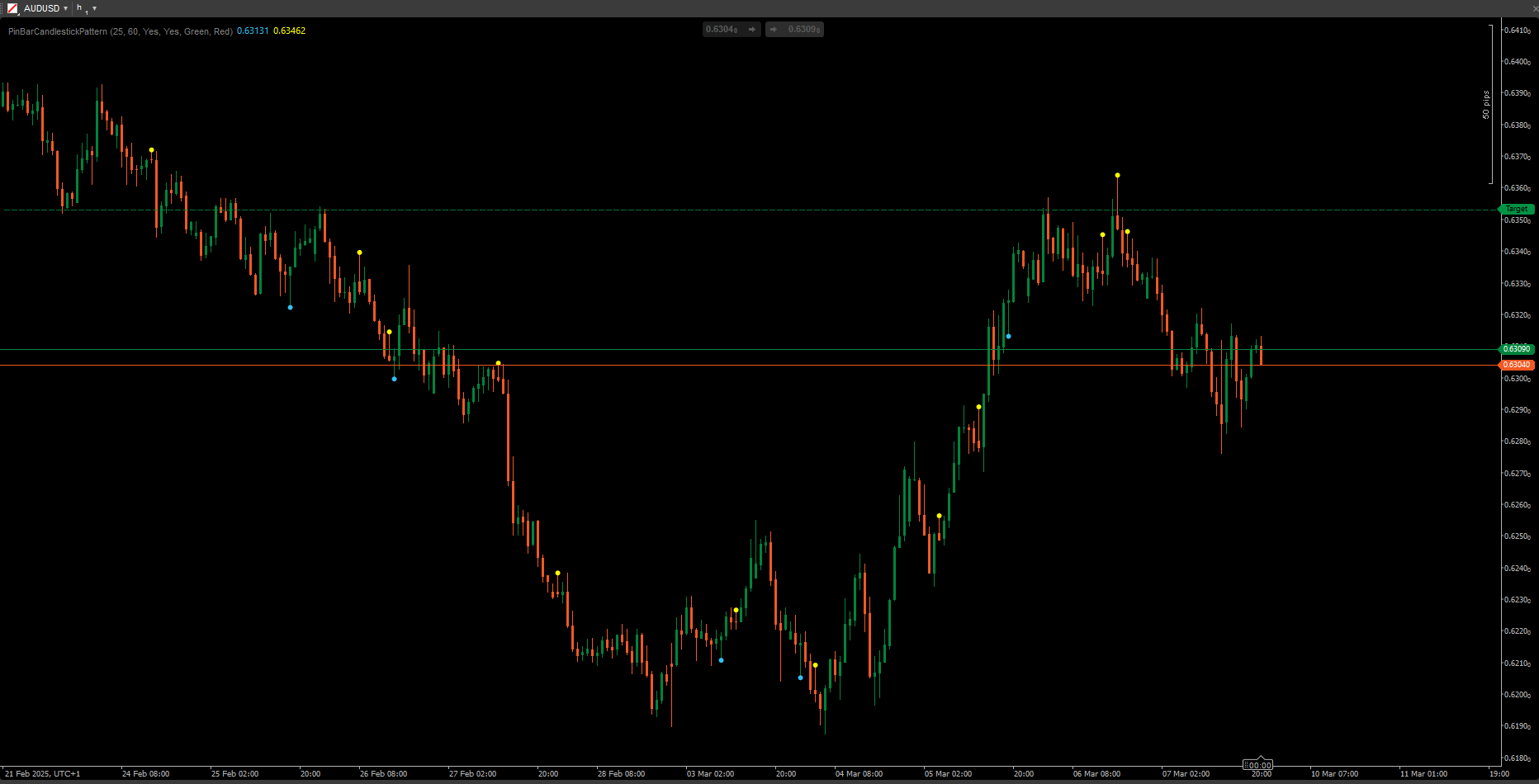

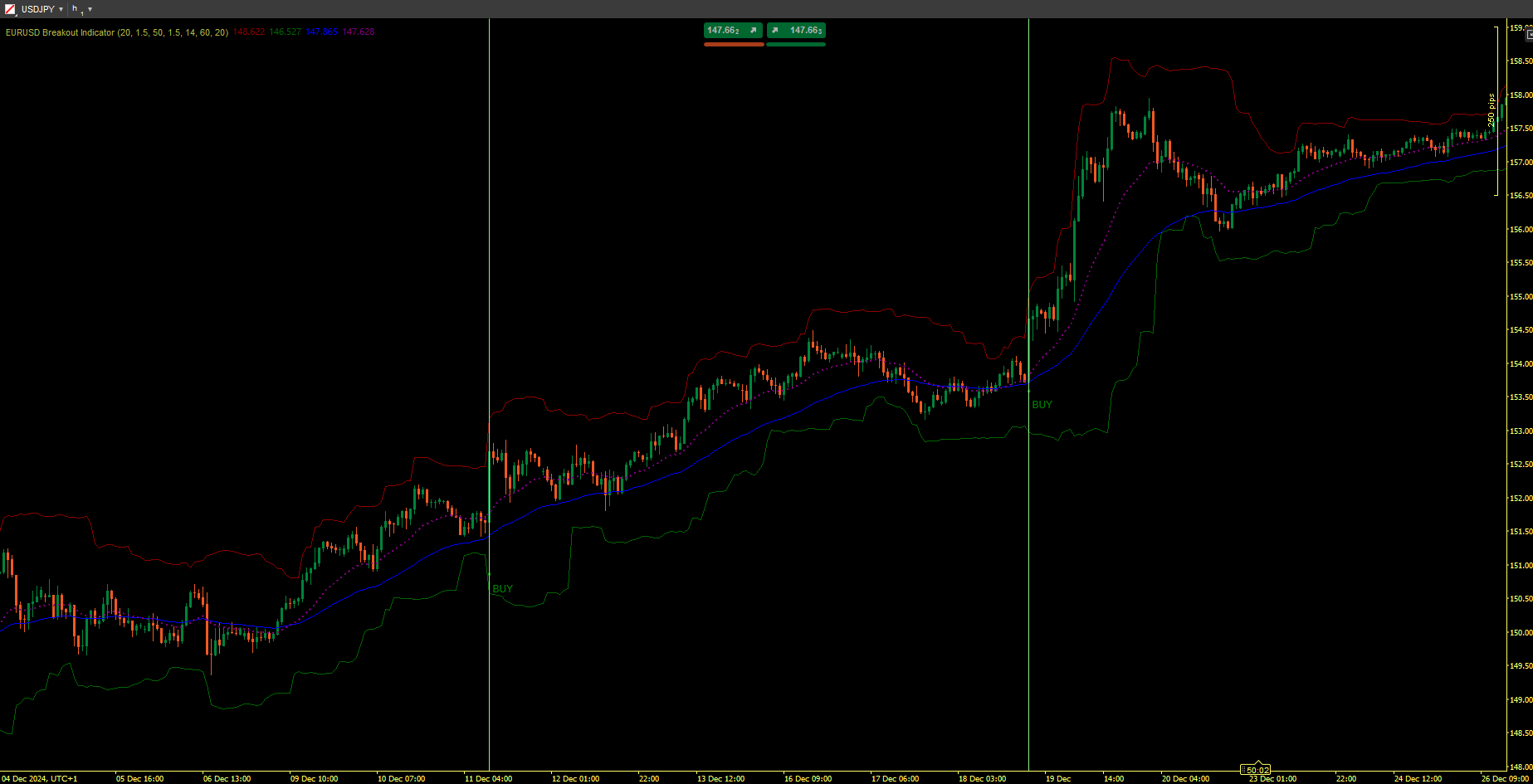

- ADX and ADI Line (Blue): Shows the smoothed strength of the current trend, regardless of direction.

- +DI Line (Green): Indicates the strength of upward movements.

- -DI Line (Red): Indicates the strength of downward movements.

- Threshold Line (Gray): A horizontal reference level (default 25) to help identify whether the trend strength is significant.

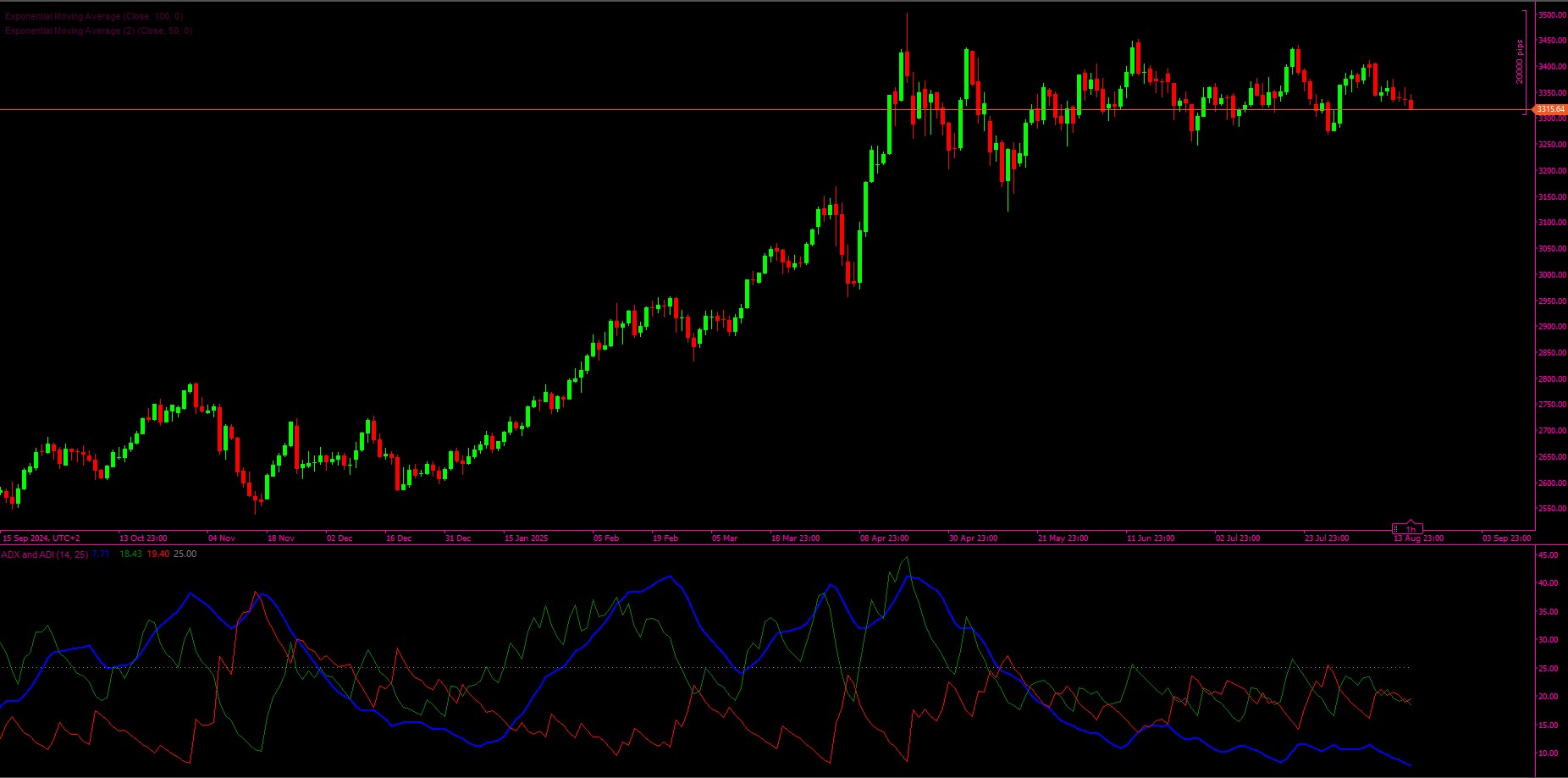

How It Works:

- The indicator calculates True Range (TR), Positive Directional Movement (+DM), and Negative Directional Movement (-DM).

- It applies Wilder’s smoothing technique to compute the smoothed values of TR, +DM, and -DM.

- From these, the Directional Indicators (+DI and -DI) are derived, showing which side (bullish or bearish) has stronger momentum.

- The DX (Directional Index) is calculated from the relative difference between +DI and -DI.

- Finally, the ADX (Average Directional Index) is computed as a smoothed version of DX, providing a measure of overall trend strength.

Interpretation:

- When ADX is above the threshold (e.g., 25), the market is considered to be trending strongly.

- When +DI > -DI, bulls are in control (uptrend).

- When -DI > +DI, bears are in control (downtrend).

- When ADX is below the threshold, the market is considered to be ranging (weak or no trend).

5.0

리뷰: 2

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

고객 리뷰

December 1, 2025

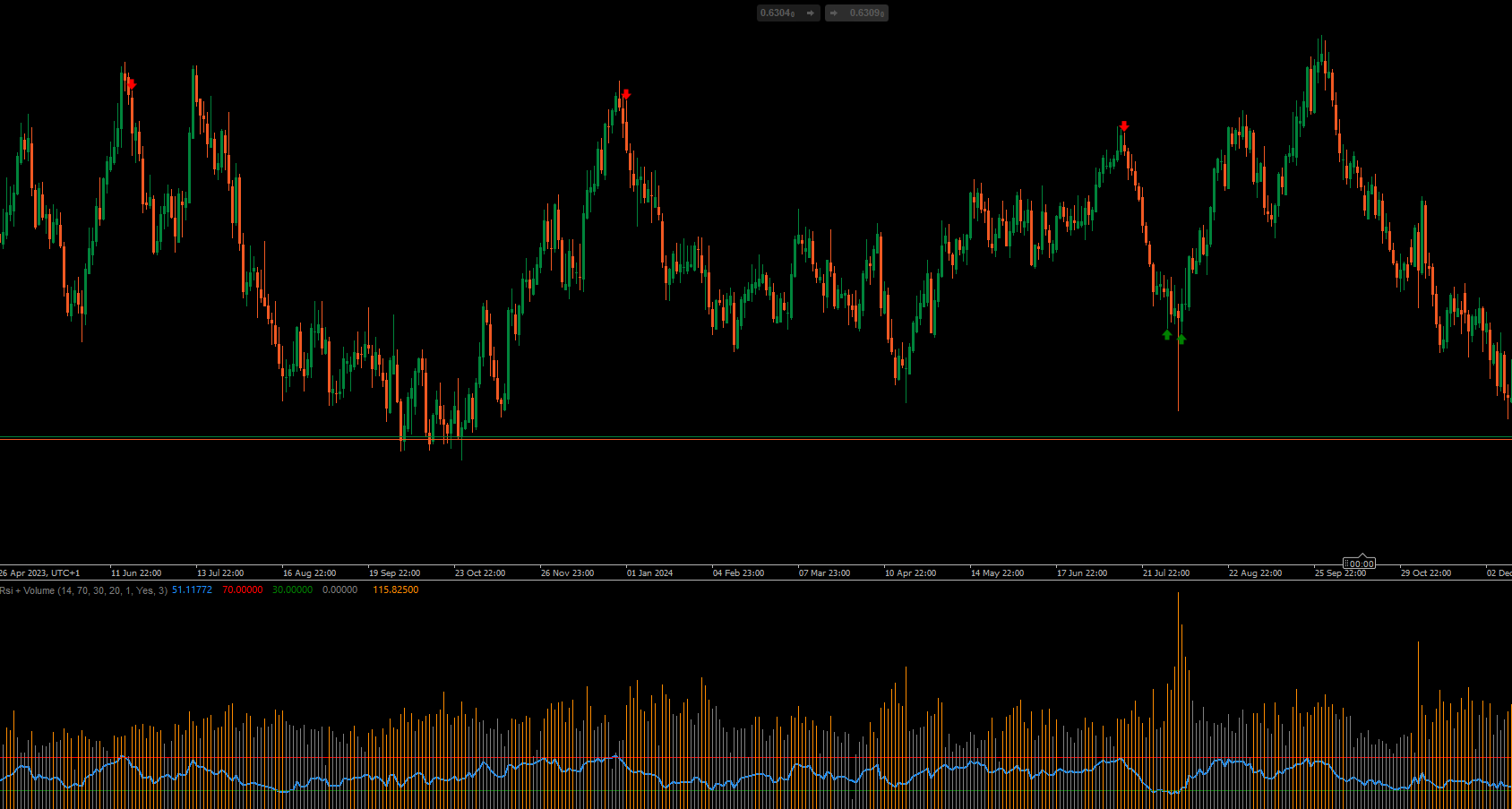

ADX and ADI delivers clean trend strength and direction signals. ADX shows when the market is actually trending, while +DI and -DI reveal who’s in control. Stable, lightweight and reliable across all timeframes. Best on H1+ for smoother signals. Alerts and zone-highlighting would be great additions.

September 12, 2025

이 작성자의 상품 더 보기

지표

Signal

Hammer Pattern Indicator

좋아하실 만한 다른 항목

가입일 21/02/2025

461.42M

거래량

178.3K

핍 수익

9

판매

5.42K

무료 설치

!["Smart Money Concepts (SMC) [Iridio Capital]" 로고](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

!["Session Volume Profile (SVP) [Iridio Capital]" 로고](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

!["High-Low Divergence [Iridio Capital]" 로고](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)