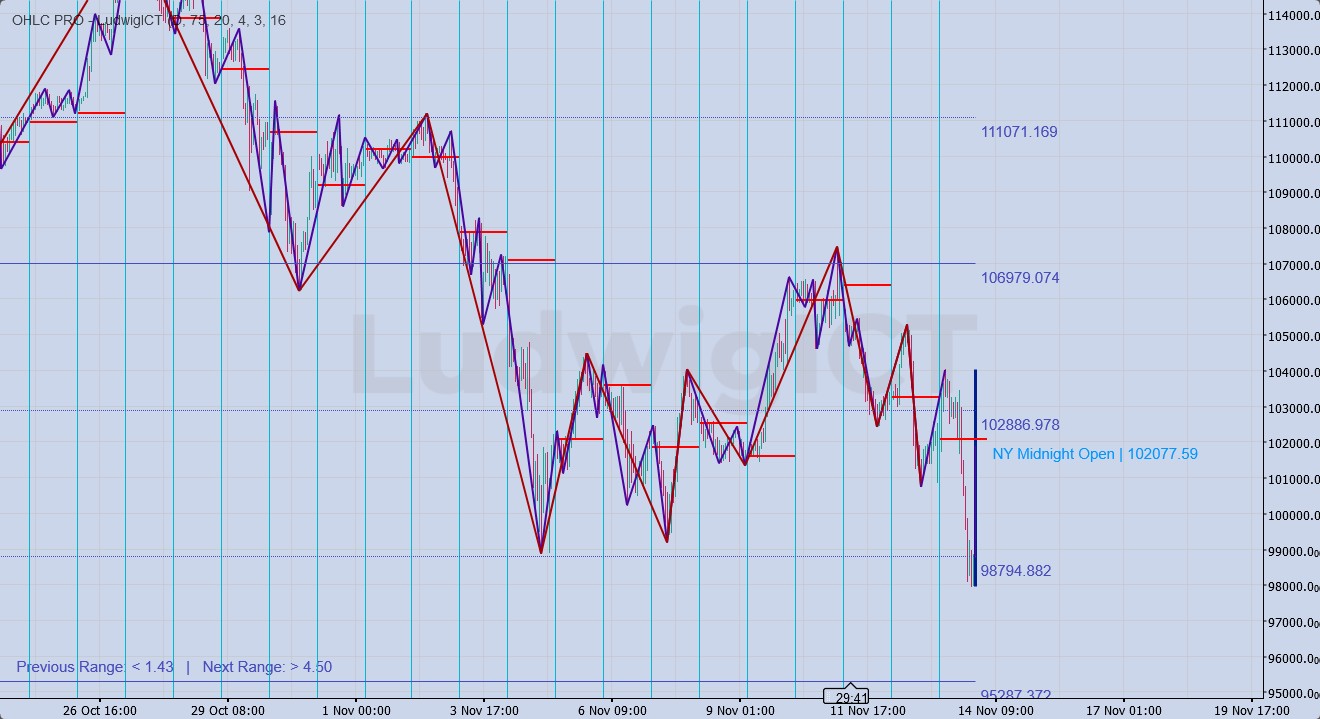

This OHLC PRO by LudwigICT indicator is a multi-feature chart overlay tool designed to give a professional, information-rich visualization on your cTrader chart.

Here’s a breakdown of what it does:

🔹 Core Function: OHLC Overlay

- Draws custom OHLC (Open, High, Low, Close) bars on your chart.

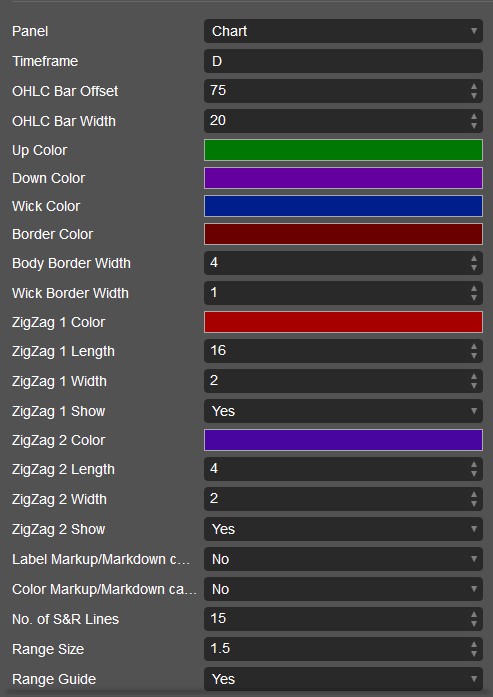

- You can set:

- Which timeframe OHLC to use (Daily, Weekly, Monthly, or intraday like H1, M15, etc.).

- Bar offset (distance from current candles).

- Bar width, wick, borders, and custom colors.

- Effectively, you get “reference candles” from higher timeframes placed on your current chart.

🔹 Triple-M Setup (Bullish/Bearish Signals)

- Detects a pattern of consecutive higher lows (bullish) or lower highs (bearish).

- When detected:

- Can place triangle icons (up or down) on the candles.

- Can also recolor bars to show momentum shift.

- This acts like a momentum structure shift signal.

🔹 Dual ZigZag Tools

- Two independent ZigZag overlays:

- ZigZag #1 (longer length, e.g. swing structure).

- ZigZag #2 (shorter length, e.g. micro swings).

- Highlights market swings for structure, trend, and breakout analysis.

🔹 Gann Support & Resistance

- Uses a Gann number table + ATR logic to calculate S/R levels.

- Plots multiple support/resistance lines above and below price.

- Lines can be styled (solid, dotted, extended left, etc.).

- Labels levels with price values.

- Also gives Range Guides:

- “Previous Range” vs. “Next Range” relative to ATR.

- Helps forecast expansion or contraction zones.

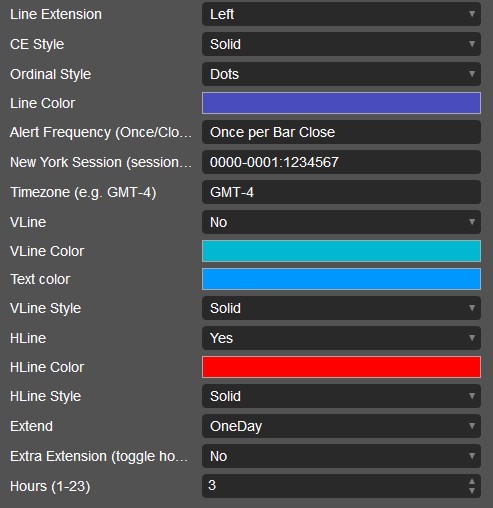

🔹 New York Midnight Levels

- Automatically detects New York Session midnight open price.

- Draws:

- Horizontal line at NY midnight open price.

- Vertical line at session start.

- Labels showing “NY Midnight Open | price”.

- You can extend these lines for 1 or 2 days, or add extra hours.

- Useful for ICT-style trading (New York session bias, equilibrium points, etc.).

🔹 Customization & Alerts

- Every feature has parameters in dropdowns:

- Colors, styles, line extensions, number of lines, etc.

- Alerts are supported (though mainly via chart visuals—alert frequency param is there).

- Clean removal on indicator close (so your chart doesn’t stay cluttered).

✅ In short:

This indicator is a multi-purpose price action tool. It combines:

- Higher timeframe OHLC candles

- Momentum pattern signals (Triple-M)

- Two ZigZag structures

- Gann S/R levels + range guides

- New York session midnight open markers

It’s made for structure, session, and level-based trading, especially useful for ICT-style or price action traders.

I explain how you could practically use it when trading XAU/USD

🔹 Practical Trading Use (Gold with OHLC PRO)

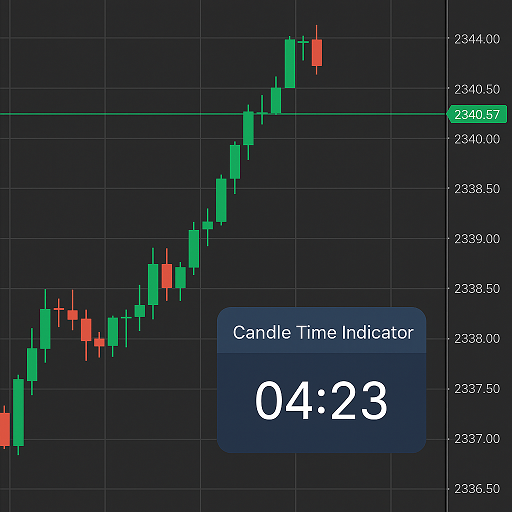

1. Higher Timeframe OHLC Overlay

- Example: Plot Daily OHLC while trading on M5/M15.

- You’ll see yesterday’s candle “inside” your intraday chart.

- Usage:

- Price approaching previous day’s high/low = liquidity hunt area.

- Daily open/close = bias filter (above = bullish, below = bearish).

- Helps you trade within the daily range.

👉 On gold, NY session often raids the previous day’s high/low before reversing.

2. Triple-M Signals

- The Triple-M pattern (series of rising lows or falling highs) = short-term momentum.

- Usage:

- Bullish Triple-M near support (HTF low or NY midnight open) → possible long scalp.

- Bearish Triple-M near resistance (HTF high or Gann level) → possible short scalp.

- Can color bars for fast visual recognition in fast gold moves.

👉 Works well for sniper entries on M1–M5 when aligned with HTF bias.

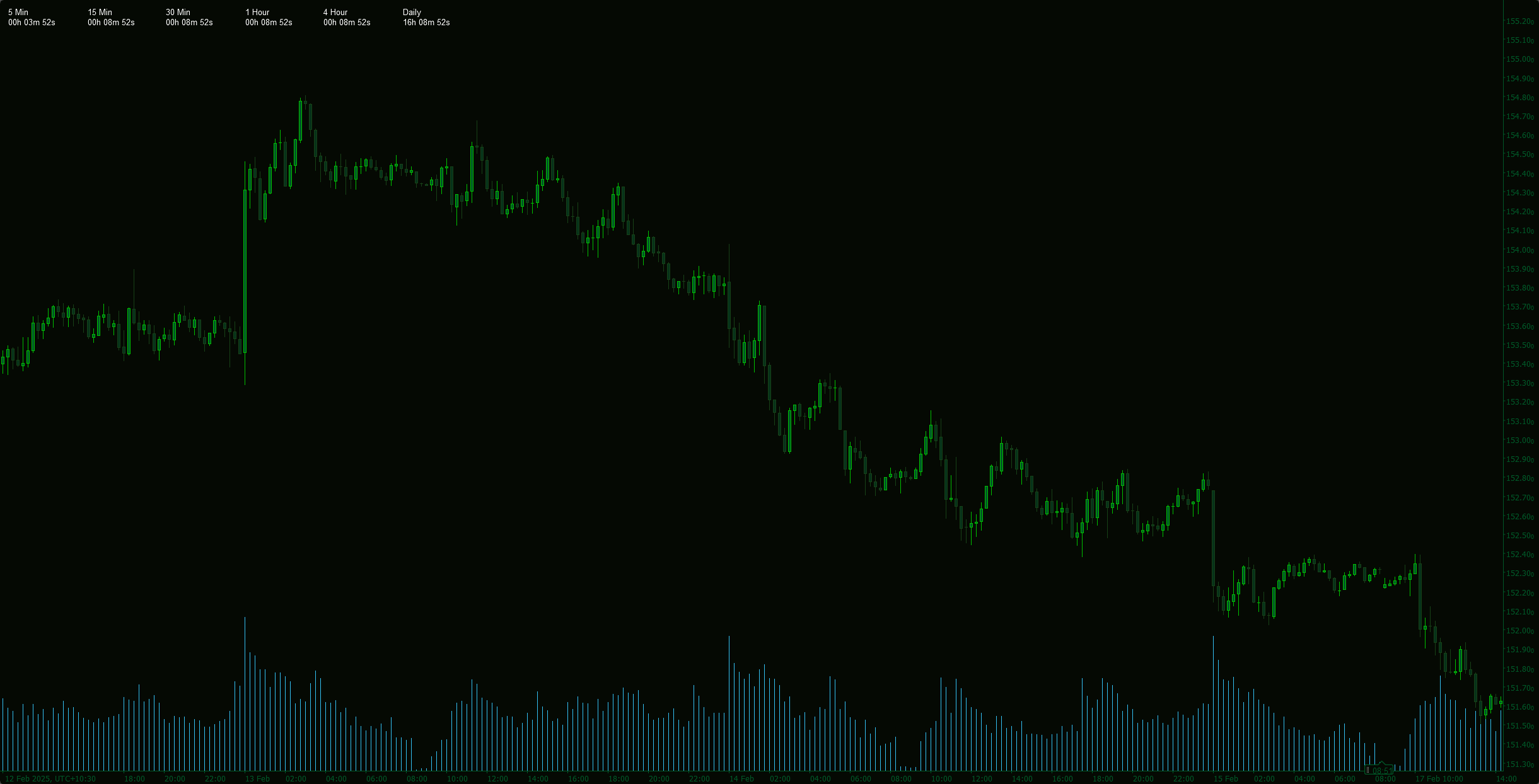

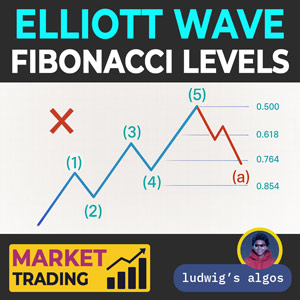

3. Dual ZigZag

- ZigZag #1 (longer length) = swing structure.

- ZigZag #2 (shorter length) = micro structure.

- Usage:

- Identify market structure breaks (BOS/CHOCH).

- Trade only in the direction of the bigger ZigZag (#1).

- Use smaller ZigZag (#2) for entry confirmation.

👉 Example: Daily bias bullish → wait for ZigZag #2 shift bullish near HTF support.

4. Gann Support & Resistance

- Generates a grid of mathematical S/R levels.

- Usage:

- If price is consolidating, levels mark likely expansion breakout points.

- Combine with ATR range guide:

- "Previous Range" small → expect volatility expansion.

- "Next Range" high → strong breakout level ahead.

👉 On gold, Gann levels often align with round numbers (e.g. 2400, 2420, 2435).

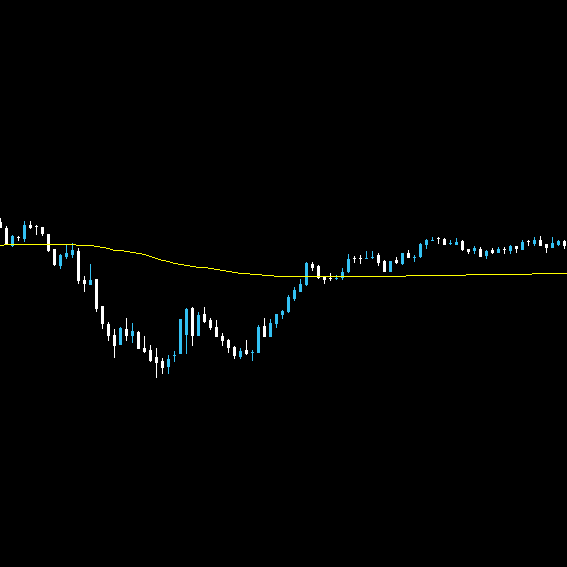

5. New York Midnight Open

- This is one of the most powerful ICT tools for gold.

- Usage:

- Price relative to NY midnight open = directional bias.

- If price stays above midnight open → bullish NY session.

- If below → bearish bias.

- Horizontal line acts as equilibrium (50%) reference.

- Watch for liquidity sweeps around this level in London/NY killzones.

👉 Example:

NY midnight open = 2405.

- If London runs price down to 2398 and NY reclaims 2405 → strong long setup.

🔑 Putting It Together (Example Setup)

- Start NY session:

- Plot Daily OHLC.

- Note NY midnight open.

- Watch Gann levels nearby.

- Wait for liquidity grab (raid of Daily High/Low or Gann SR).

- Check Triple-M / ZigZag #2 for micro bullish/bearish confirmation.

- Enter with stop behind liquidity sweep.

- Target opposite side of range or next Gann/HTF level.

✅ In short:

- Daily OHLC + NY Midnight = bias filter.

- ZigZag + Triple-M = entry timing.

- Gann + Range Guide = profit targets & expansion signals.

This indicator basically gives you all the ICT-style tools in one package for XAU/USD.

If you have any questions or run into any issues, feel free to contact me. I'm happy to help You!

Disclaimer:

By using my algorithms, you acknowledge that trading involves inherent risks and that past performance does not guarantee future results. It is essential that you have a solid risk management strategy in place and, above all, that you remain disciplined in adhering to stop-loss levels. Failure to manage risk properly can lead to significant losses. I am not responsible for any financial outcomes resulting from the use of these algorithms. Trade responsibly and always follow proper risk management practices.

Bless up! 🙌

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

.jpg)

.jpg)

.jpg)

!["[Stellar Strategies] Moving Averages Combined 1.0" โลโก้](https://market-prod-23f4d22-e289.s3.amazonaws.com/b4cd360c-5f3c-4902-b2e1-6b86da1199bb_Gemini_Generated_Image_nl1erpnl1erpnl1e.jpg)