!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/62a77232-02a9-423b-a5e4-bd2c2bc8db97_cT_cs_4141285_US500_2025-03-21_17-12-57.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/af1bb651-4b73-4da6-8a9a-300a2beb7ad2_cTrader_mCpNSZFcyT.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/49b3a15f-b208-47e4-b284-e12a7120f769_cTrader_xsjM2bcQX0.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/8f191030-6618-4245-9c8c-610d9b444d53_cTrader_RQNzTCxfTW.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/915be168-0e8e-4f85-aba3-4f97e43a2368_cTrader_LSKzR9ZDmU.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/190b428d-aecc-444f-9edf-5245ab053180_cTrader_YwQQjPuTCc.png)

!["[Stellar Strategies] SP500 Gap Closure cBot 1.0" yüklenen resmi](https://market-prod-23f4d22-e289.s3.amazonaws.com/6ddef973-6790-4ce0-9fa6-91a648b7aff9_ztGBHjuGtS.png)

[Stellar Strategies] SP500 Gap Closure cBot Description

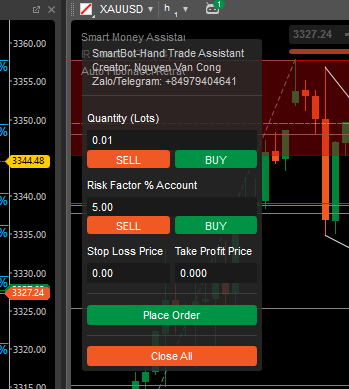

The SP500 Gap Closure cBot is an algorithmic trading robot designed to trade the S&P 500 index (or any other instrument) based on the concept of gap closure. The bot identifies key daily price levels and executes trades when the price moves beyond these levels, aiming to capitalize on the market's tendency to "fill gaps" or revert to previous price ranges. It is built using cAlgo, a platform for developing and deploying automated trading strategies in the forex and CFD markets.

Key Features

- Gap Closure Strategy:

- The bot identifies daily support and resistance levels based on historical price data.

- It executes trades when the price moves below the identified support level (for long trades) or above the resistance level (for short trades), anticipating a reversal or gap closure.

- Customizable Trading Window:

- The bot operates within a user-defined trading window, specified by the

Trading Start TimeandTrading End Timeparameters. - This ensures that trades are only executed during specific hours of the day, aligning with the user's preferred trading schedule.

- The bot operates within a user-defined trading window, specified by the

- Position Sizing and Risk Management:

- Users can define the position size (

Position Size) for each trade. - A dynamic stop loss is calculated based on the daily price range (

Stop Loss Multiplier), ensuring that risk is proportional to market volatility.

- Users can define the position size (

- Daily Order Limits:

- The bot restricts the number of long and short trades per day using the

Max Long Orders per DayandMax Short Orders per Dayparameters. - This helps prevent over-trading and ensures disciplined execution.

- The bot restricts the number of long and short trades per day using the

- Exit at Close:

- The bot can be configured to automatically close all open positions at the end of the trading day (

Exit at Close), reducing overnight risk.

- The bot can be configured to automatically close all open positions at the end of the trading day (

- Dynamic Daily Levels:

- The bot updates its support and resistance levels daily using the

UpdateDailyLevelsmethod. - Support is calculated as the minimum low price over the last 3 days, while resistance is calculated as the maximum high price over the last 13 days.

- The bot updates its support and resistance levels daily using the

How It Works

- Initialization:

- At the start of each trading day, the bot calculates the daily support (

mylowX), resistance (myhighX), and price range (area) based on historical daily data.

- At the start of each trading day, the bot calculates the daily support (

- Trade Execution:

- During the trading window, the bot monitors the price action.

- If the price moves below the support level (

mylowX), the bot executes a long trade, anticipating a reversal or gap closure. - If the price moves above the resistance level (

myhighX), the bot executes a short trade, expecting a pullback.

- Stop Loss and Exit:

- Each trade is protected by a stop loss, calculated as a multiple of the daily price range (

Stop Loss Multiplier). - If the

Exit at Closeparameter is enabled, the bot closes all open positions at the end of the trading day.

- Each trade is protected by a stop loss, calculated as a multiple of the daily price range (

- Daily Reset:

- At midnight (00:00 server time), the bot resets its order counters and updates the daily levels for the new trading day.

Parameters

- Position Size: The volume or size of each trade.

- Max Long Orders per Day: Maximum number of long trades allowed per day.

- Max Short Orders per Day: Maximum number of short trades allowed per day.

- Stop Loss Multiplier: Multiplier applied to the daily price range to calculate the stop loss distance.

- Exit at Close: If enabled, closes all positions at the end of the trading day.

- Trading Start Time: The start time for trading (in

HHmmssformat). - Trading End Time: The end time for trading (in

HHmmssformat).

Use Cases

- Day Trading: The bot is ideal for day traders looking to capitalize on intraday price reversals and gap closures.

- Volatility-Based Trading: The strategy works well in volatile markets where price gaps and reversals are more frequent.

- Risk-Averse Trading: The built-in stop loss and daily order limits help manage risk effectively.

Advantages

- Automated Execution: Eliminates emotional trading and ensures consistent execution of the strategy.

- Customizable: Users can adjust parameters to suit their risk tolerance and trading preferences.

- Risk Management: Dynamic stop loss and daily order limits help protect against excessive losses.

Limitations

- Market Dependency: The strategy relies on the market's tendency to fill gaps, which may not always occur.

- Time Zone Sensitivity: The bot's performance may vary depending on the server time zone and the instrument's trading hours.

- Historical Data Reliance: The bot uses historical data to calculate levels, which may not always predict future price movements accurately.

Conclusion

The SP500 Gap Closure cBot is a robust and flexible trading robot designed to exploit price gaps and reversals in the S&P 500 index. With its customizable parameters, risk management features, and automated execution, it is a valuable tool for traders seeking to automate their gap trading strategies. However, as with any automated system, thorough backtesting and optimization are recommended before deploying it in live trading.

..............................................................................................................................................................................................................

Disclaimer

This cBot is a tool for automated trading and should be used with caution. Past performance is not indicative of future results. Traders are advised to backtest the cBot on historical data and run it in a demo environment before using it in live trading.

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

!["[Stellar Strategies] Market Structure Breakout" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/99d762b3-fbbe-489d-9c19-e72c41ffe387_cT_cs_4141285_EURUSD_2025-04-21_20-25-12.png)

!["[Stellar Strategies] MARSI Signal Plotter" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/a423f7d2-eb34-49ee-bb17-13e5586550fb_MARSI 2.0.png)

!["[Stellar Strategies] BOS Trend 1.0" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/808c7722-ba53-4633-b8a4-16f31eeb1fc2_[Stellar Strategies] BOS Trend.jpg)

!["[Stellar Strategies] Market Session Ultimate" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/c6ab1a32-7da1-4d09-813c-75d33b8800b2_Market Session Ultimate 2.png)

!["[Stellar Strategies] Linear Regression Candles 1.1" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/19ef277f-e0b6-48ef-8941-88bfbba145f3_cT_cs_4141285_EURUSD_2025-03-30_19-53-31.png)

!["[Stellar Strategies] Inside Bar with Signals" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/c12d088e-7b52-4961-a0d2-7e38a2499bd3_cT_cs_4141285_EURUSD_2025-07-15_13-15-32.png)

!["[Stellar Strategies] Wave Trend Pro" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/8c93438a-6b0a-4026-93b2-0694329a3bc1_cT_cs_4141285_EURUSD_2025-04-25_17-52-31.png)

!["[Stellar Strategies] Smart ADX" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/9503ee65-5386-408e-b63c-9faacd672e08_Stellar ADX.png)

!["[StellarStrategies] Scheduled Trade Executor" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/f13e96a0-274f-490e-8aa5-5a154d8bcf60_stellar12.jpg)

!["[Stellar Strategies] VBO" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/7dc1f1b1-2236-4d85-abb3-1c50a32aac9a_vbo.png)

!["[Stellar Strategies] QQE" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/ed4b3af5-54e4-404e-80eb-a23fa7ef0282_cTrader_7oDDAbSmSP.png)

!["[Stellar Strategies] Candlestick Patterns Dashboard" logosu](https://market-prod-23f4d22-e289.s3.amazonaws.com/ecbe4451-9dae-4dee-8bee-271c1e4e4ab1_CPD.png)

.png)

.png)