WHAT IT DOES

Liquidity-Based Support & Resistance identifies where price actually reversed — not just where lines can be drawn.

It detects swing points across your chart, maps them to psychological round number levels, and quantifies the buying/selling activity at each zone. You see which levels show meaningful liquidity activity, and which are just empty lines.

The result is support and resistance with context — bias, volume absorption, efficiency, and actionable interpretation built in.

WHY IT MATTERS

Traditional support and resistance methods share a common weakness: they show you where price was, but tell you nothing about what happened there.

A price level touched twice and a level tested fifteen times with heavy volume look identical on a standard SR indicator. But they behave very differently when price returns.

The Problem

Drawing lines at swing points is easy. Understanding whether those levels will hold, break, or trap traders requires deeper analysis that most SR tools don't provide:

- How many reversals actually occurred at the level?

- Did buyers or sellers dominate?

- Was the rejection efficient or did it require massive volume absorption?

- Is the level accumulating energy for a breakout, or distributing before failure?

The Solution

This indicator measures the liquidity signature at each level — how many reversals occurred, how deep they ran, how much volume was involved, and whether buyers or sellers operated more efficiently.

Instead of guessing which levels matter, you see exactly what the market has been doing at each zone.

HOW IT WORKS

Adaptive Swing Detection

The indicator uses a regression-based smoothing method to filter market noise and identify genuine swing points — moments where price committed to a direction change, not random wicks.

Three detection modes available:

- Major — Only confirmed, high-conviction reversals

- Standard — All primary swing structure

- Minor — Includes internal swings for granular analysis

Round Number Zone Mapping

Swing points are automatically mapped to psychological price levels. The zone spacing adapts to your instrument's volatility based on average swing depth — no manual configuration needed.

Set the multiplier to zero and the indicator calculates optimal spacing automatically.

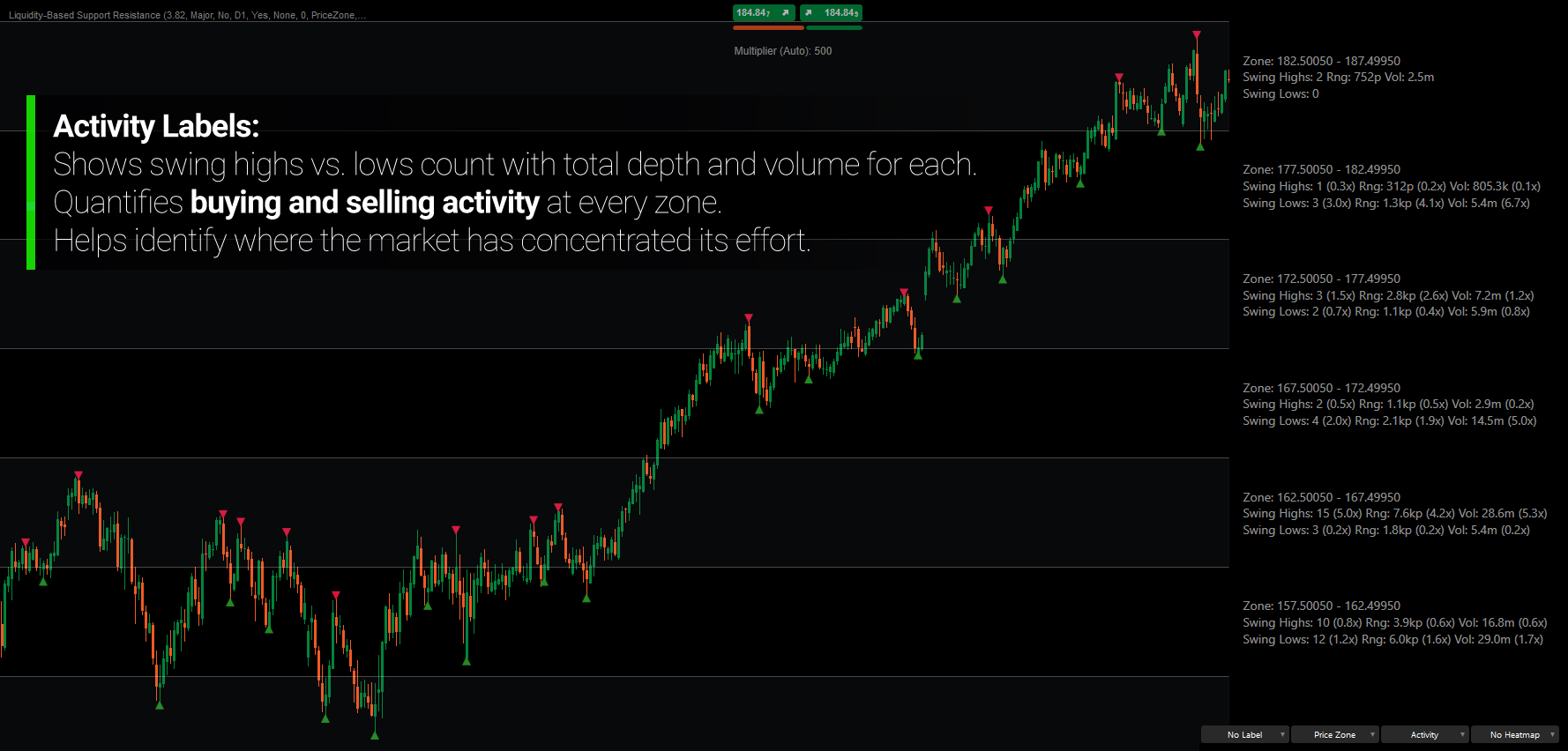

Liquidity Metrics

At each zone, the indicator calculates:

- Depth — How far price traveled from the swing point (in pips)

- Volume — Total tick activity during the swing

- Efficiency — Price movement per unit of volume (measures execution efficiency)

- Absorption — Volume required to contain price movement (effort to hold level)

- Conviction — Price movement per bar (momentum and commitment)

Directional Analysis

Each zone is analyzed for:

- Bias — Is this a supply zone (more swing highs) or demand zone (more swing lows)?

- Control — Are buyers or sellers operating more efficiently here?

- Energy — How much total activity compared to baseline?

These metrics combine to produce plain-language interpretation of what's happening at each level.

KEY FEATURES

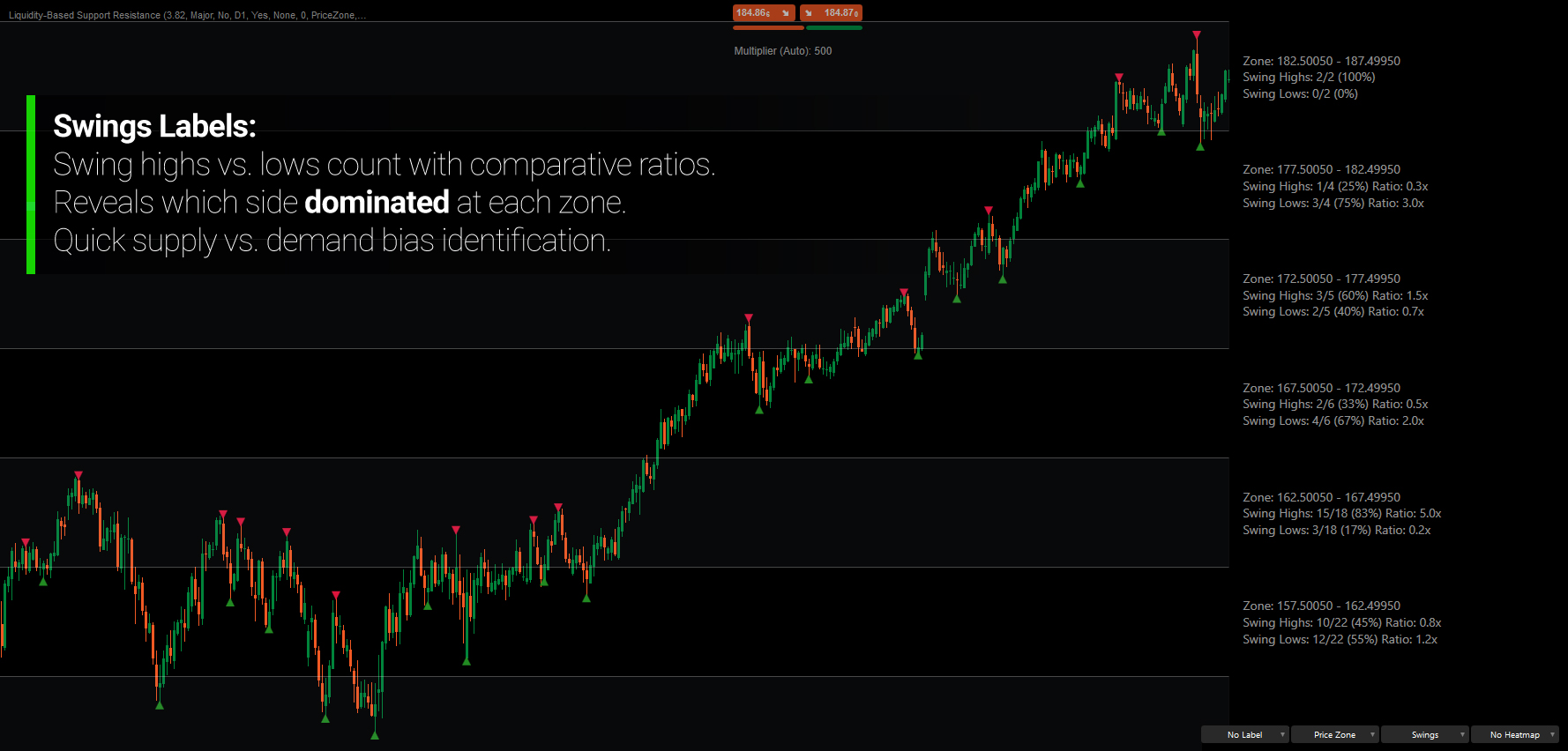

Multiple Label Modes

- Price — Simple zone identification

- Swings — Count of swing highs vs. lows with ratios

- Activity — Depth, volume, and comparative ratios

- Efficiency — Calculated metrics showing institutional precision

- Interpretation — Natural language analysis of bias, control, and outlook

- Setup — Actionable trade setup with trigger, invalidation, and probability

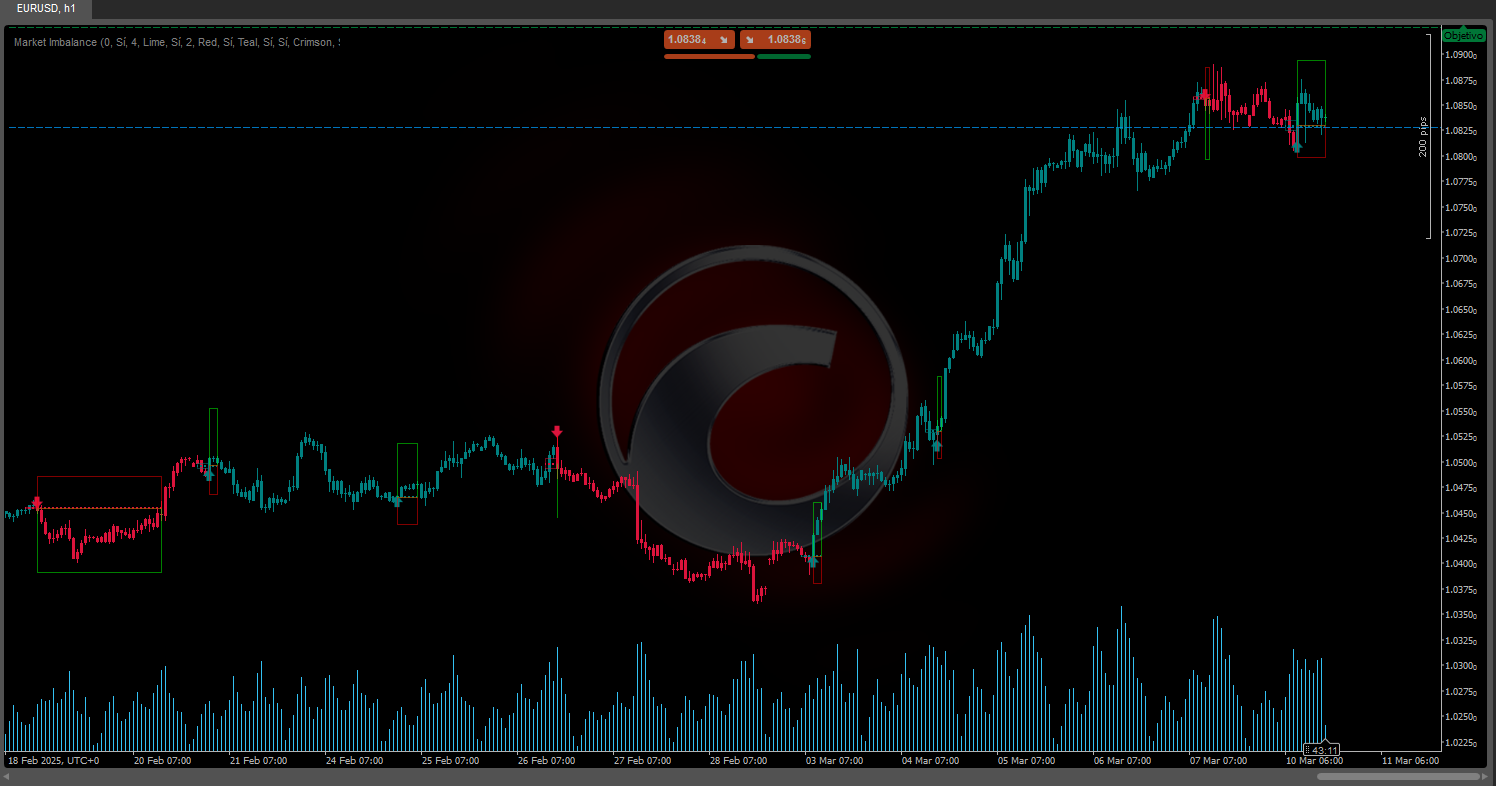

Heatmap Visualization

Transform raw data into instant visual insight. The heatmap encodes any metric across all visible zones using a three-point color gradient — cold, medium, hot.

Instead of reading numbers at each level, you see patterns at a glance:

- Where is volume concentrating?

- Which zones show strong directional bias?

- Where is efficiency highest?

- Which levels absorbed the most effort?

17 heatmap modes available:

- Activity — Total Swings, Swing Highs, Swing Lows

- Ratios — High/Low Ratio, Depth Ratio, Volume Ratio, Duration Ratio

- Raw Metrics — Depth, Volume

- Calculated — Efficiency, Absorption, Conviction, Directional Bias

Multi-Timeframe Analysis

Analyze higher timeframe swing structure while viewing lower timeframe price action. See Daily swing activity mapped to H1 zones without switching charts.

Dual Display Mode

- Price Level — Traditional single line at round number

- Price Zone — Upper and lower boundaries showing the full zone width

Adaptive Zone Spacing

Set multiplier to zero and the indicator automatically calculates optimal zone width based on your instrument's average swing depth. Works across forex, indices, crypto, and commodities without manual tuning.

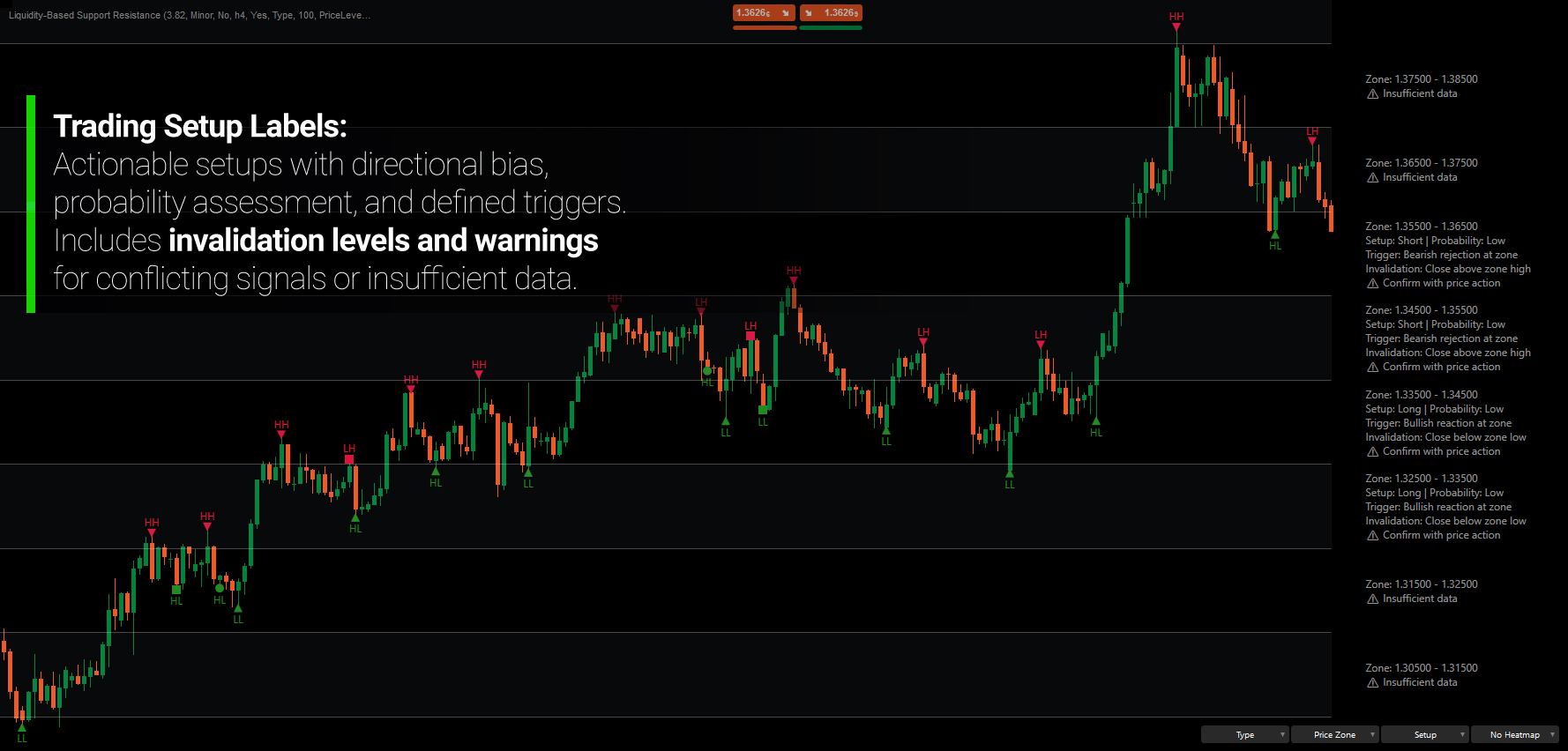

INTERPRETATION & SETUP MODE

The indicator doesn't just show data — it synthesizes metrics into analysis you can act on.

Interpretation mode provides:

- Bias assessment (Strong/Moderate/Mild Supply or Demand)

- Control identification (Buyers, Sellers, or Balanced)

- Effort analysis (who's working harder to maintain position)

- Energy level (High/Medium/Low relative to baseline)

- Outlook statement describing likely behavior

Setup mode goes further:

- Directional bias (Long, Short, or Neutral)

- Entry trigger condition

- Invalidation criteria

- Probability assessment (High/Medium/Low/Very Low)

- Warning when signals conflict

Example output:

"Setup: Long | Probability: Medium" "Trigger: Break and close above zone" "Invalidation: Close back below zone"

READING THE ZONES

Supply Zone — More swing highs than lows. Price tends to reverse downward here. Sellers have historically defended this level.

Demand Zone — More swing lows than highs. Price tends to reverse upward here. Buyers have historically defended this level.

Contested Zone — Roughly equal swing highs and lows. No clear directional bias. Often produces explosive moves once resolved.

High Energy — Significant volume absorption relative to baseline. The level is actively fought over.

Low Energy — Minimal activity. The level may break easily or simply be ignored.

Efficiency Imbalance — When one side moves price further per unit of volume, they have control regardless of who's putting in more effort.

WHO IT'S FOR

This indicator is designed for traders who want context behind their levels, not just lines on a chart.

It's well suited for structure-based traders who incorporate concepts like volume analysis, effort vs. result, or supply/demand dynamics into their decision-making.

Swing and position traders will benefit from seeing which levels carry institutional weight before planning entries around them.

Multi-timeframe analysts can view higher timeframe liquidity structure directly on execution charts.

This is not a signal generator. It's a contextual framework for understanding what the market has been doing at key price levels — and what that suggests about future behavior.

WHAT MAKES IT DIFFERENT

Most support and resistance indicators answer: "Where did price reverse?"

This indicator answers: "What happened when price reversed there, and what does that tell us?"

By quantifying the activity at each level — not just marking where swings occurred — you gain insight into:

- Whether a level is likely to hold or break

- Which side has been operating more efficiently

- Whether energy is building for a breakout or exhaustion

- How to structure a trade around the level with defined trigger and invalidation

The analysis adapts to your instrument automatically. No optimization required — the market structure defines the parameters.

---

UNDERSTANDING LIQUIDITY AT PRICE LEVELS

Support and resistance are not magic lines where price bounces. They are zones where opposing interests concentrate.

At a support level, buyers have historically been willing to absorb selling pressure. At resistance, sellers have absorbed buying pressure. The strength of a level depends not on how many times it was touched, but on how much was required to hold it — and whether that defense remains intact.

This is why two levels with identical price history can behave completely differently. One may have absorbed enormous volume to hold — suggesting eventual exhaustion. Another may have rejected price effortlessly — suggesting strong conviction.

Indicators built around this concept don't predict where price will go. They help you understand what's already happened at key levels, so you can make better decisions when price returns.

---

Note: This indicator models liquidity dynamics through tick volume and price interaction — not direct order book data. While tick volume represents broker-level activity rather than exchange volume, it reliably indicates relative participation levels and correlates with actual market volume patterns.

Trading involves risk. This indicator is a technical analysis tool—always apply proper risk management.

.png)

.jpg)