Heikin Ashi Structure Bias (cTrader Indicator)

Automatic supply–demand zones with multi-timeframe bias.

What it does – in plain English

This indicator automatically:

- Reads Heikin Ashi price action and detects meaningful pivot shifts.

- Builds dynamic support and resistance zones around those pivots, using both the wick extreme and the candle body (not just random lines).

- Merges nearby zones intelligently so you see clean, tradable levels instead of a forest of horizontal lines.

- Generates a clear bullish or bearish bias whenever price fully breaks the latest support or resistance zone.

- Shows you the bias for:

- Your chart timeframe, and

- An optional higher timeframe (default H2) — without drawing HTF clutter on your chart.

Result: one glance tells you where the real levels are and whether the market is currently leaning up or down.

The problem it solves

Most traders have the same issues:

- Support/resistance lines drawn by hand are:

- subjective,

- inconsistent,

- and often overdone.

- Simple “zigzag + horizontal line” indicators:

- don’t handle zone width properly,

- stack levels on top of each other,

- or extend zones so far they cover half the chart.

- Bias is often “in your head” – not something you can clearly see or use in a rule-based way.

This indicator is built to:

- Turn Heikin Ashi structure into clear, objective zones,

- Give you a rule-based trend/bias based on those zones,

- While keeping the chart clean and readable.

How the zones are built (trader-friendly explanation)

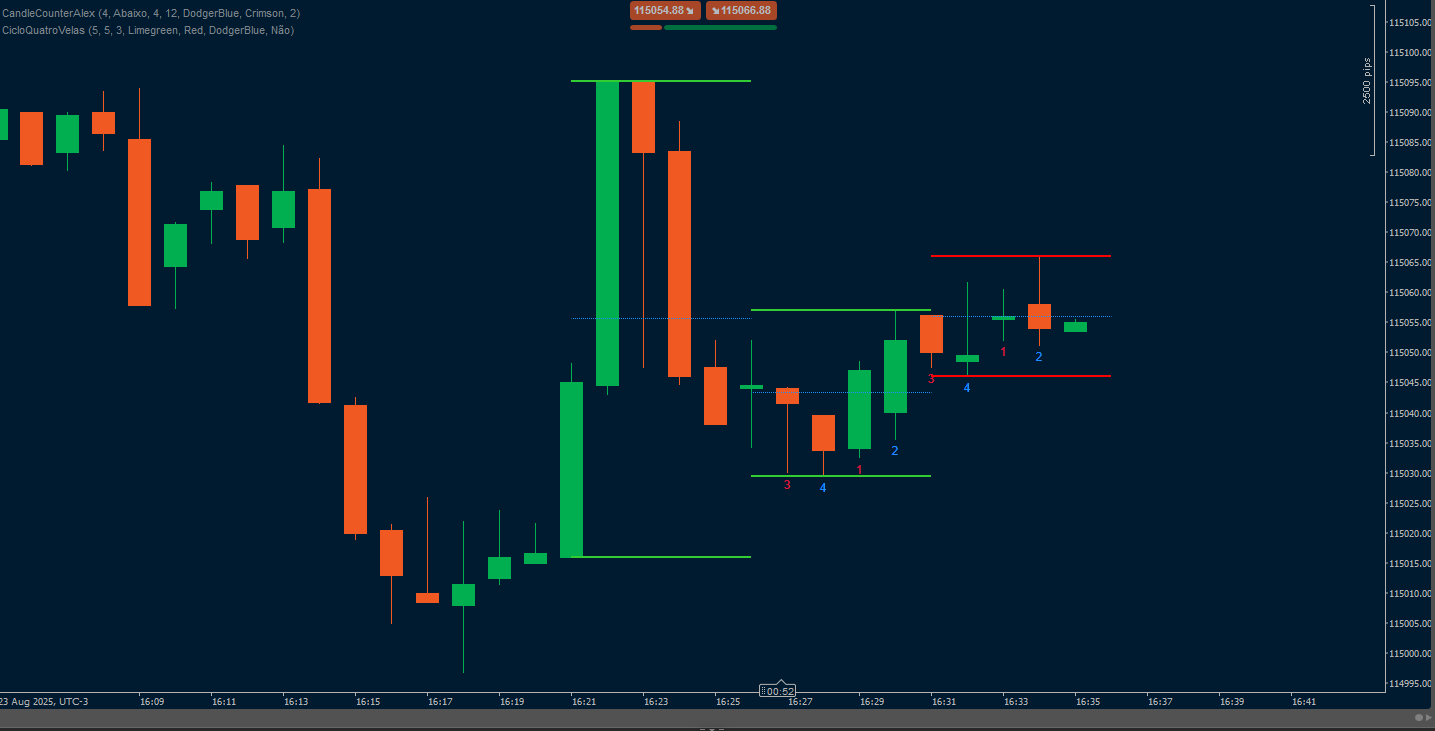

For each Heikin Ashi pivot, the indicator looks at a 3-candle structure:

- When HA flips from red to green, it marks a support pivot.

- When HA flips from green to red, it marks a resistance pivot.

Then it builds the zone:

Support zones

- Finds the lowest wick among the 3 candles (true extreme).

- Finds the next-lowest low that’s still higher than that extreme.

- Uses the candle body (open/close) near that inner low to define the “tradable” side of the zone.

- Final support zone:

- Bottom = extreme wick low,

- Top = body-based inner level.

Resistance zones

- Finds the highest wick among the 3 candles.

- Finds the next-highest high that’s still lower than that extreme.

- Uses the body near that inner high.

- Final resistance zone:

- Top = extreme wick high,

- Bottom = body-based inner level.

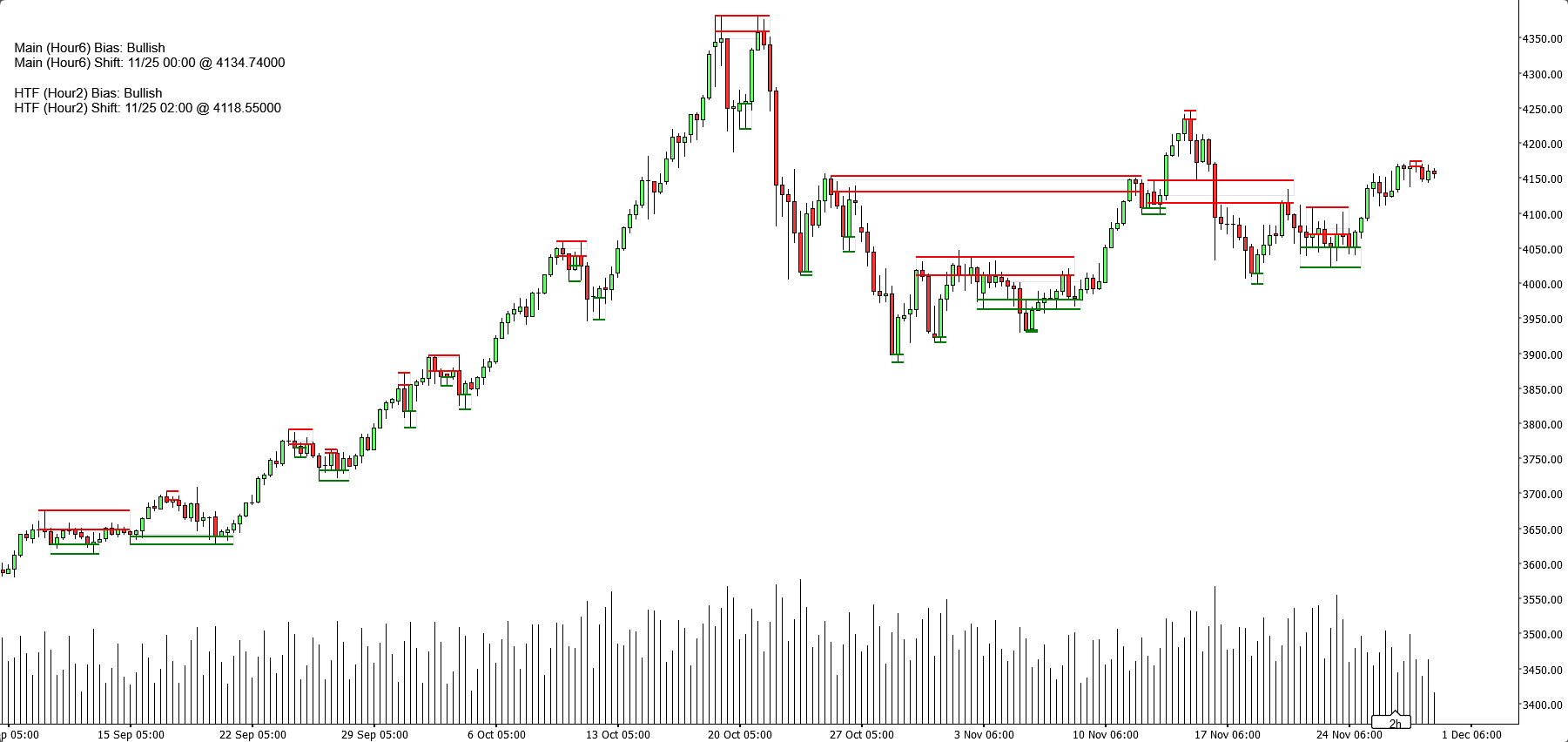

So each zone is not just an arbitrary band:

It’s a wick-to-body range that represents where price really rejected or reversed.

Merging logic (why the chart stays clean)

Zones of the same type (support with support, resistance with resistance):

- Are treated as units on a timeline.

- Can only merge if they actually overlap in price.

- Merging is strictly local:

- A new zone can merge with:

- the most recent zone (back-to-back), or

- the second-most recent zone (+1 gap), and

- One additional “anchor” merge behind that if the new combined zone now overlaps the previous structure.

This keeps behaviour intuitive:

- Zones don’t “swallow” the entire history.

- Older levels are respected but not allowed to create giant mega-zones.

- Local structure like A–B–C or A–C+D is handled in a controlled way.

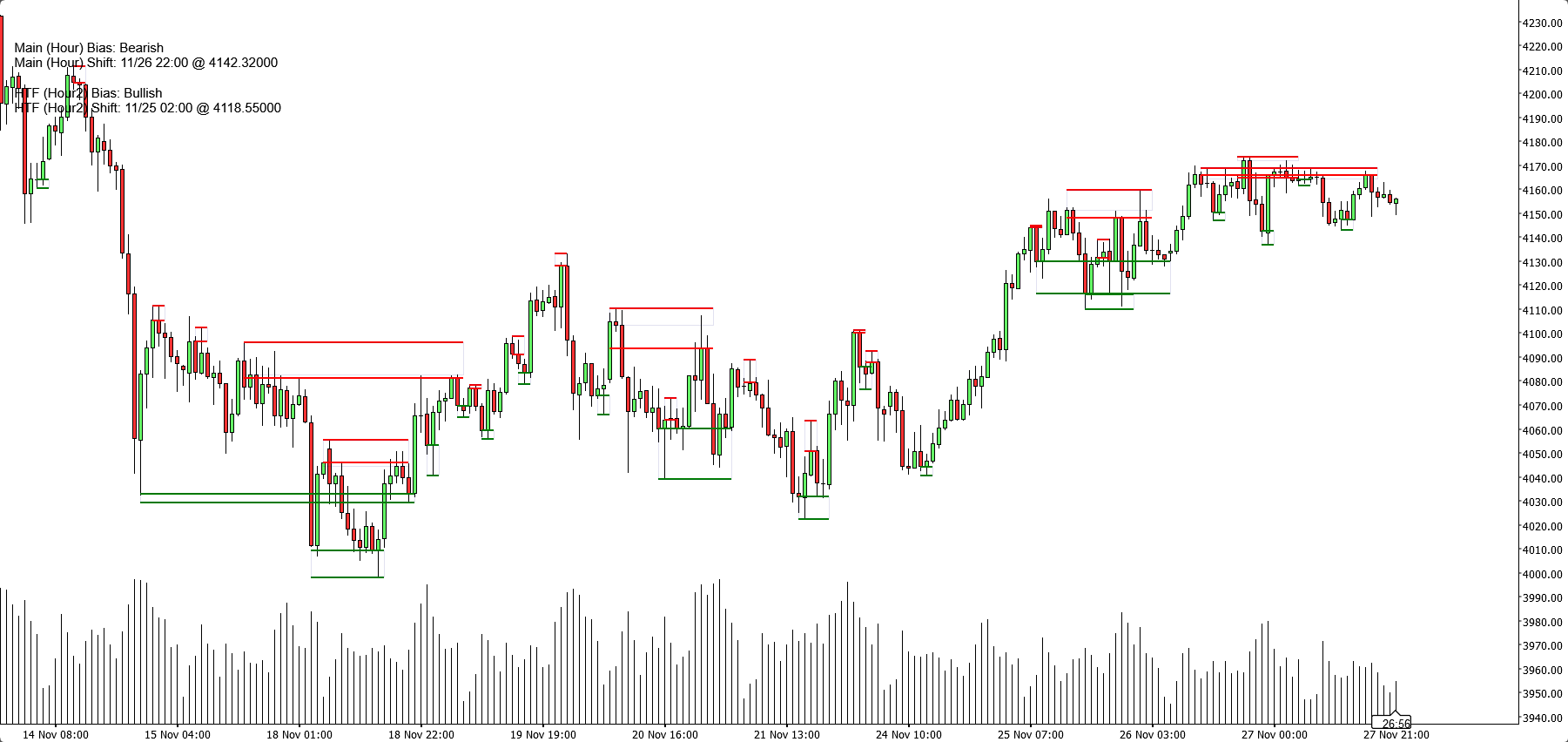

Bias logic (how you actually trade with it)

For each timeframe (main and HTF):

- The indicator tracks the latest merged support zone and the latest merged resistance zone.

- Then, on each closed candle:

- If price closes above the latest resistance zone → bias becomes Bullish.

- If price closes below the latest support zone → bias becomes Bearish.

It stores:

- The time of the last bias flip,

- The price level at which price broke the zone.

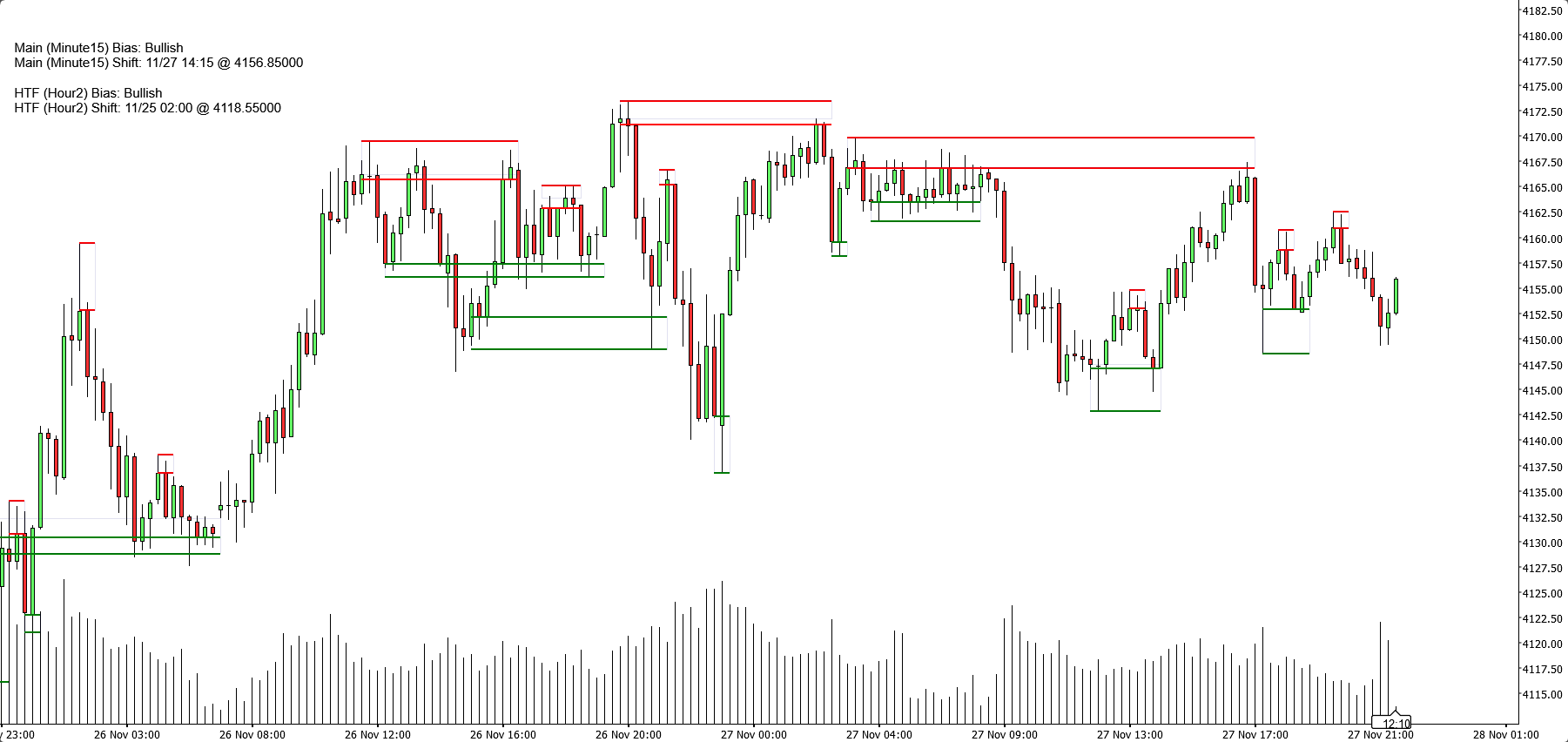

On the chart, a small text panel shows:

Main (H1) Bias: BullishMain (H1) Shift: 11/26 15:00 @1.08750

If HTF is enabled, you’ll also see something like:

HTF (H2) Bias: BearishHTF (H2) Shift: 11/25 08:00 @1.09200

You can also enable a sound alert when the main timeframe bias flips.

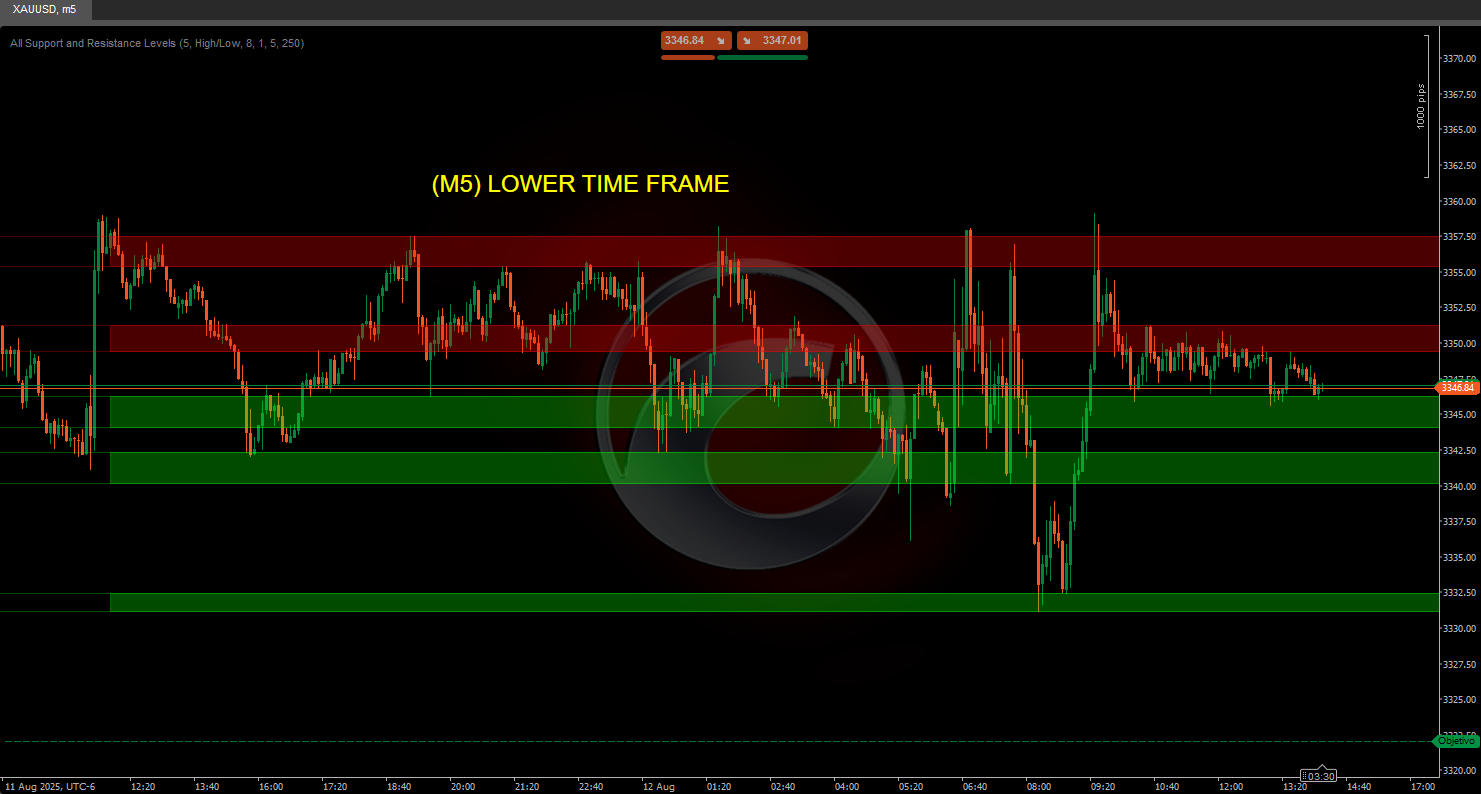

What you see on the chart

- Support zones:

- Green horizontal base/trigger lines (optional),

- A soft navy rectangle (very low opacity) showing the full support band.

- Resistance zones:

- Red lines + soft navy rectangle for the band.

- Clean display toggles:

- Show/hide support zones,

- Show/hide resistance zones,

- Turn the filled rectangles on/off,

- Turn the base/trigger lines on/off,

- Turn the bias panel on/off.

This lets different traders choose between:

- A more minimalist look (maybe just rectangles), or

- A more precise view (exact lines visible).

Typical use cases

You can position it as useful for:

- Trend filtering

- Only look for buys when both main TF and HTF biases are Bullish.

- Only look for sells when both are Bearish.

- Zone entries

- Use the zones as areas of interest for:

- Limit orders,

- Confirmation entries (e.g. price returns to a broken zone and rejects again),

- Stop placement just beyond the outer band.

- Top-down analysis

- HTF bias (H2 by default) as the big picture,

- Chart TF bias for timing,

- Zones for concrete execution levels.

What it is NOT (important for honest selling)

- It’s not a robot that auto-trades for you.

- It’s not a “holy grail” signal that guarantees profit.

- It’s a structure and bias engine:

- Objectively defines zones,

- Objectively defines trend/bias based on those zones,

- Leaves actual trade management to the trader/strategy.

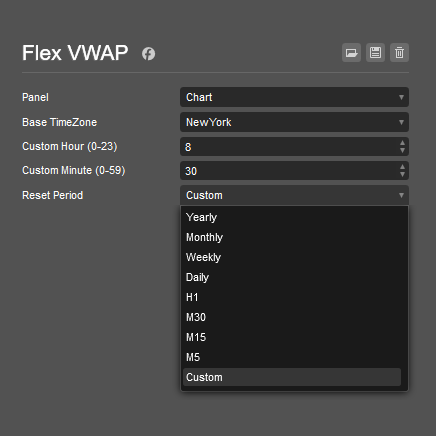

.png)

.jpg)