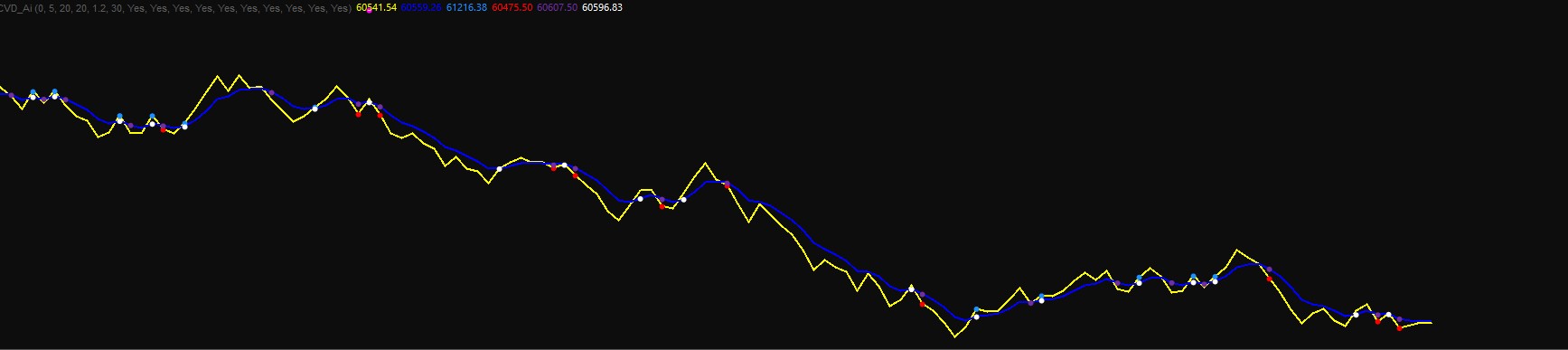

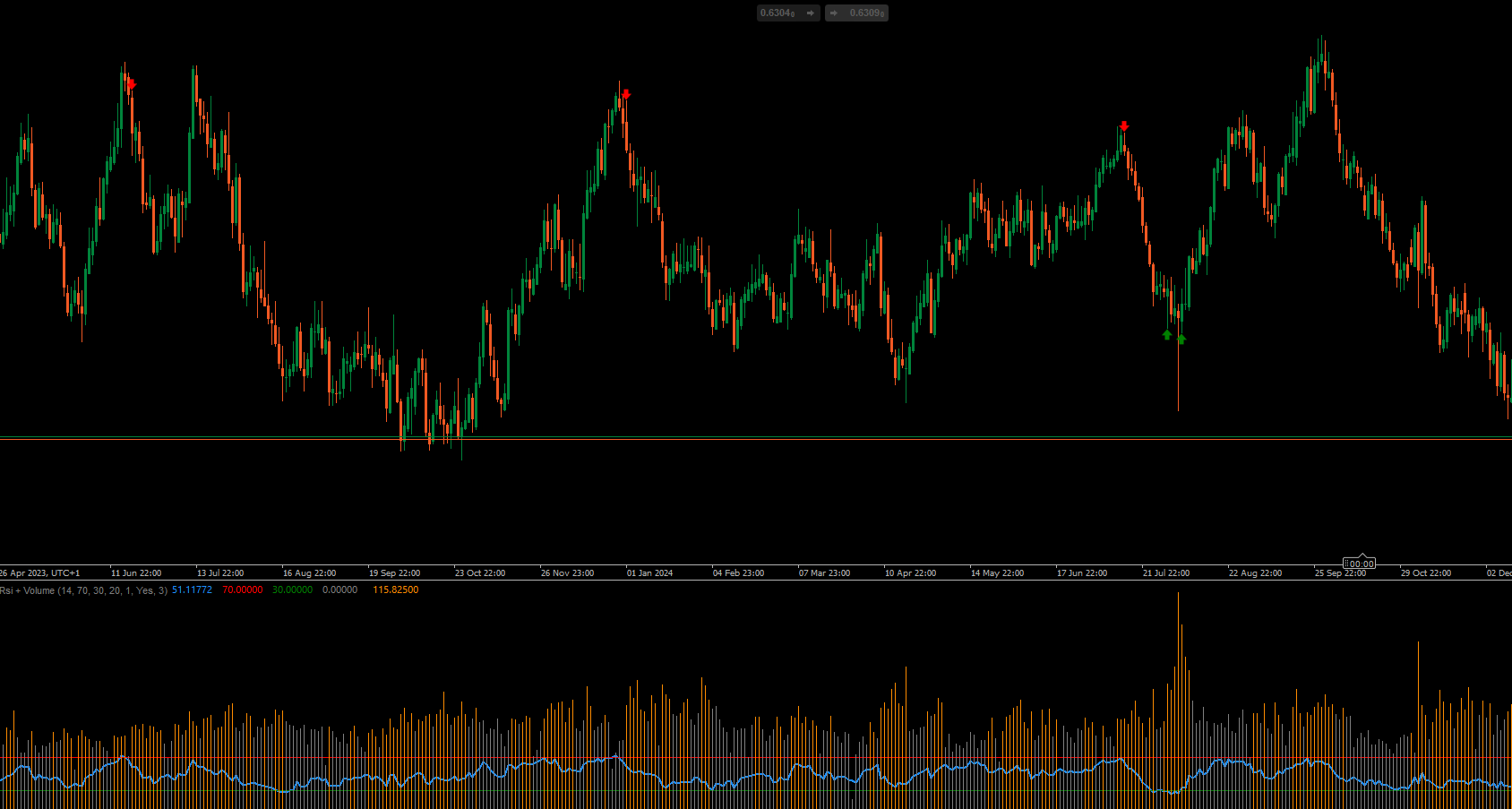

The CVD Ai is a sophisticated trading indicator for cTrader that combines Volume Spread Analysis (VSA), Cumulative Volume Delta (CVD), and key Support/Resistance levels to identify high-probability reversal setups.

Version 5.0 introduces Pivot Points into the "A+ Setup" logic, making the filtering of trades even more precise by combining market structure with volume flow.

Key Features

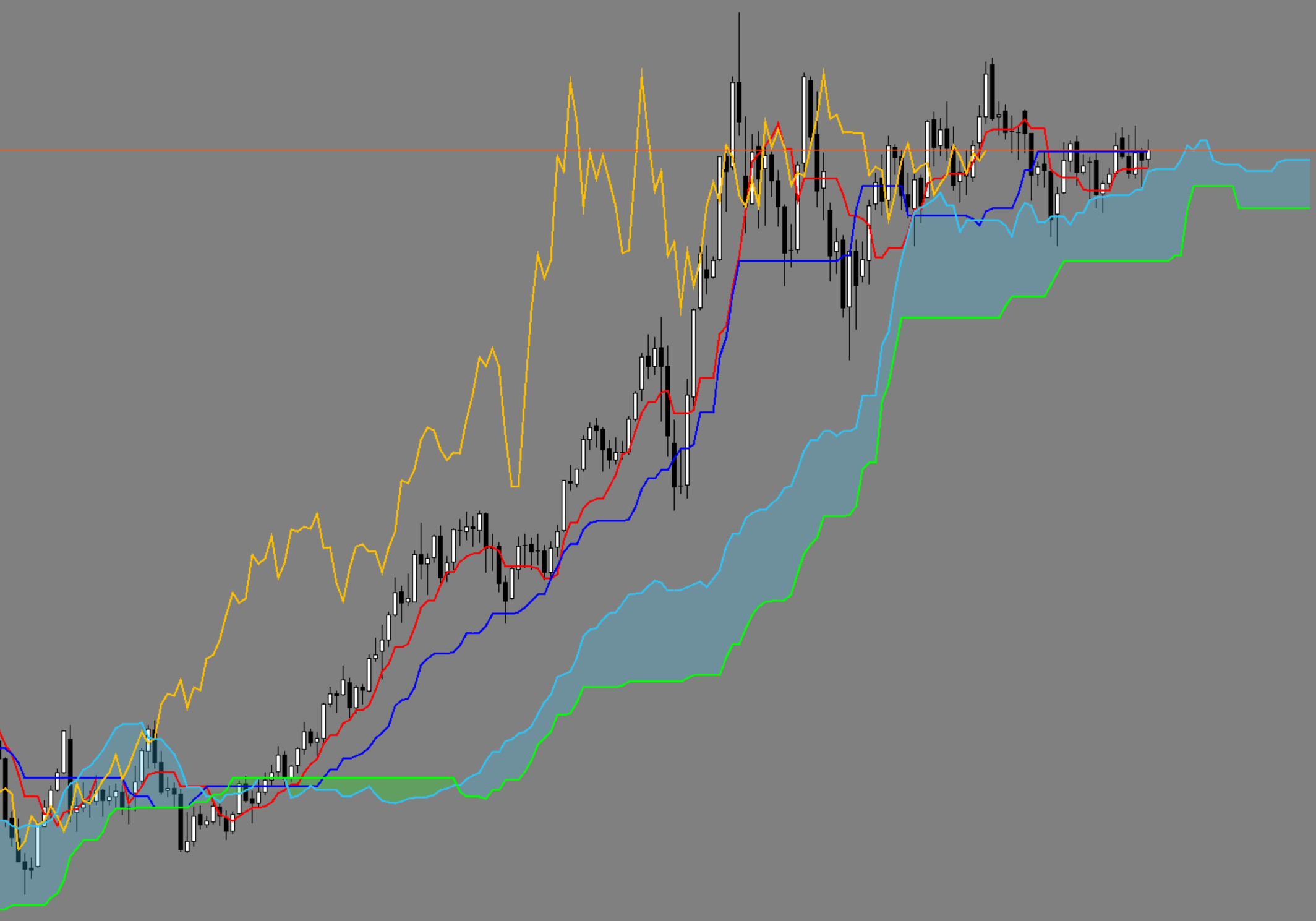

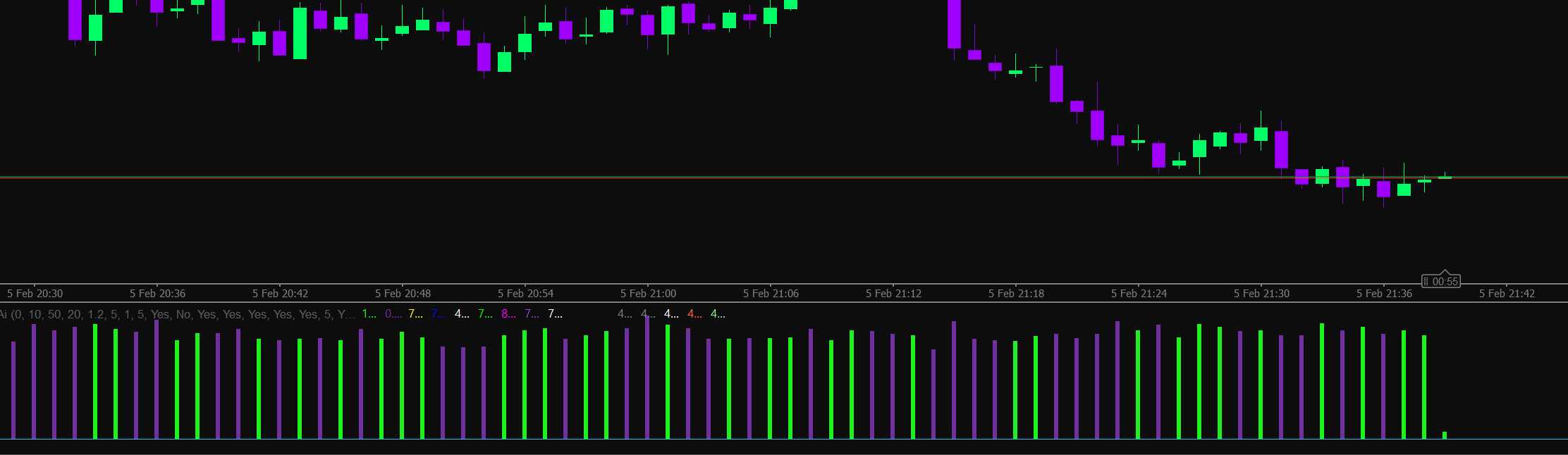

1. Cumulative Volume Delta (CVD)

- Calculation: Measures the difference between buying volume and selling volume candle-by-candle.

- Visuals: - Histograms: Green (Bullish Delta) and Red (Bearish Delta).

- Yellow Line: The cumulative CVD line.

- Blue Line: An EMA signal line applied to the CVD.

- Purpose: Identifies the underlying buying or selling pressure that may not be visible in price action alone.

2. Divergence Detection

The indicator automatically detects reversals using a "Lookback" period:

- Bullish Divergence: Price makes a lower low, but CVD makes a higher low (momentum is shifting up).

- Bearish Divergence: Price makes a higher high, but CVD makes a lower high (momentum is shifting down).

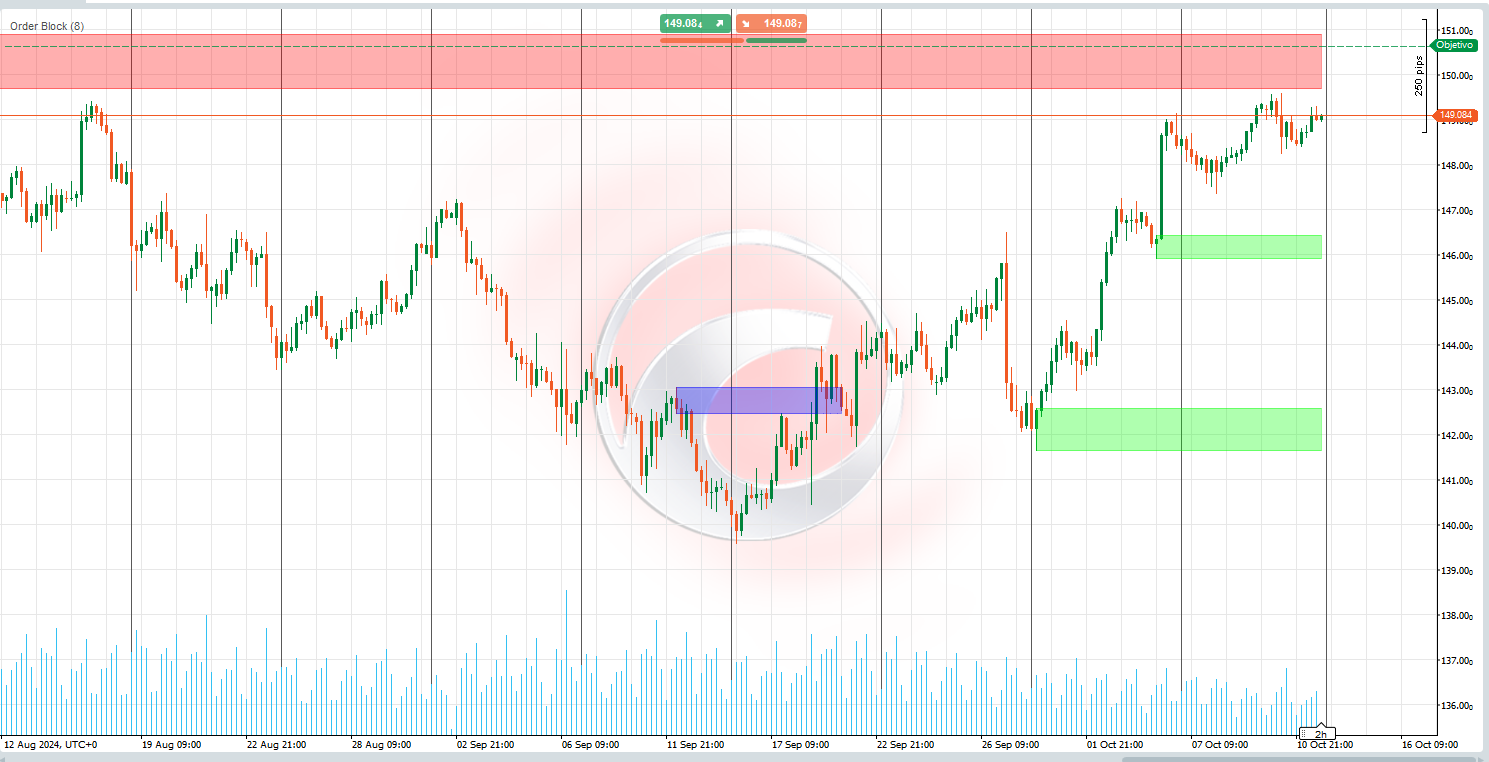

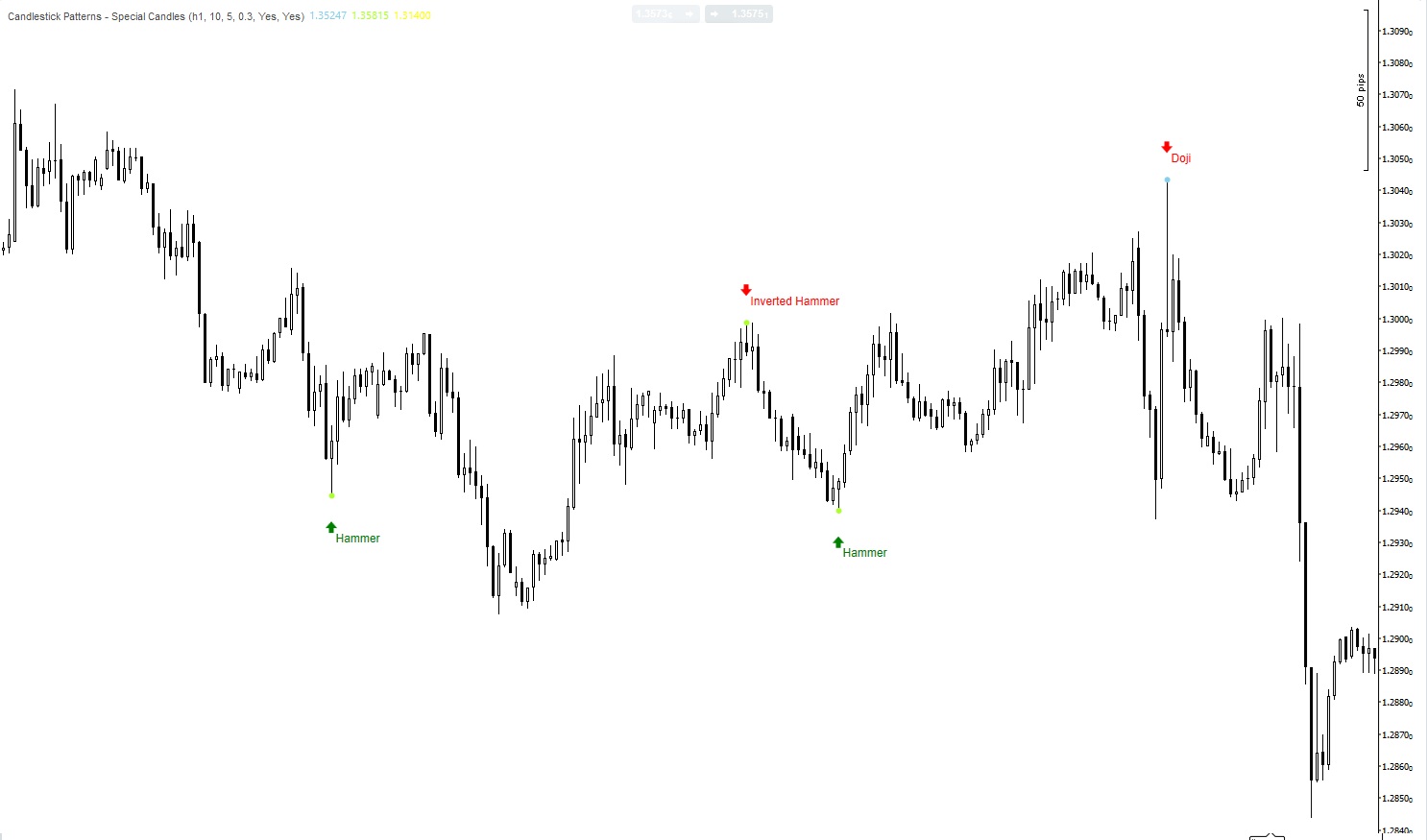

3. The "A+" Filter Strategy

This is the core of the indicator. It filters out weak signals by requiring price to be at a "Key Level" when a divergence occurs.

- Key Levels Used: - Previous Day High (PDH) & Low (PDL).

- NEW: Daily Pivot Points (PP), Resistance 1 (R1), and Support 1 (S1).

- Logic: If

Use A+ Setup Filteris enabled, a Buy signal will only appear if the price is near a Support level (PDL, S1, or PP) while in a divergence.

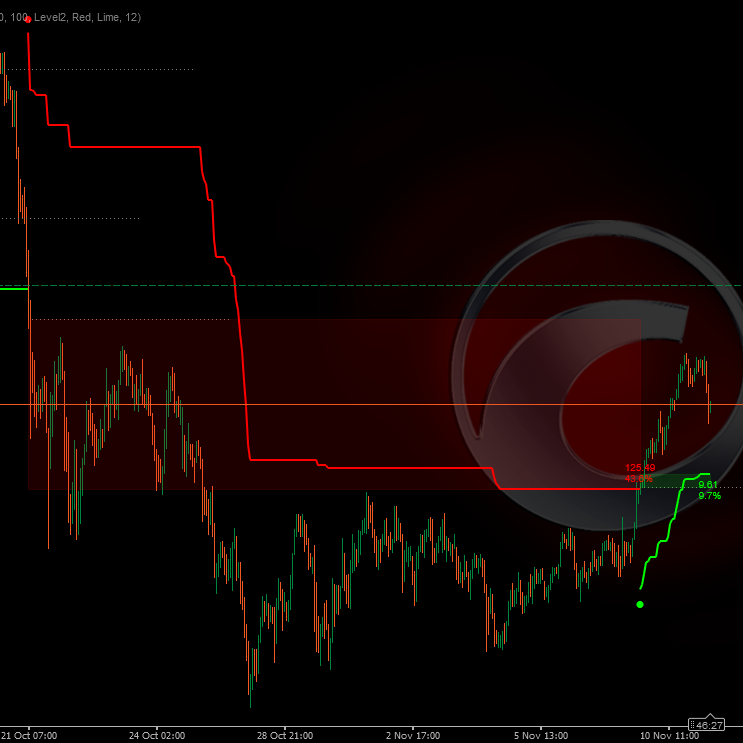

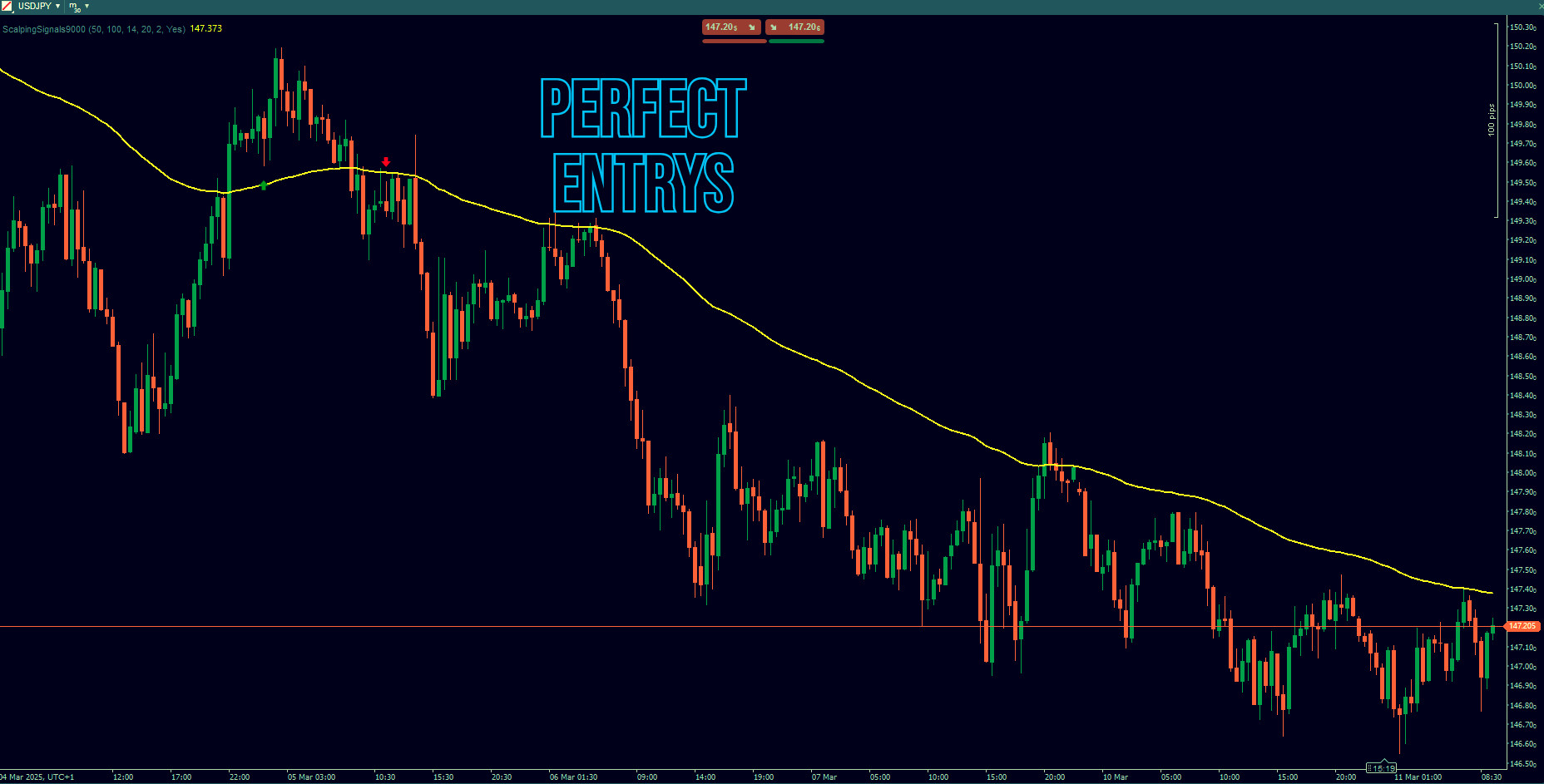

4. Trend Filtering

- Uses a Trend EMA (default 50-period) to determine the overall market direction.

- A+ Logic: You can choose to require both the Trend alignment AND the S/R proximity, or just one of them.

5. Session Filtering

Allows you to ignore signals during specific market hours:

- Asia, London, New York: Toggle on/off to trade only during high-volatility sessions.

Signal Logic Breakdown

Buy Signal (Blue Dot)

- Divergence: A Bullish Divergence is detected.

- CVD Cross: The CVD line is above its Signal EMA.

- Volume: Current volume is higher than average (optional).

- A+ Filter (if enabled): - Price is near Support (PDL, S1, or PP).

- Price is above the Trend EMA (optional/configurable).

Sell Signal (Red Dot)

- Divergence: A Bearish Divergence is detected.

- CVD Cross: The CVD line is below its Signal EMA.

- Volume: Current volume is higher than average (optional).

- A+ Filter (if enabled):

- Price is near Resistance (PDH, R1, or PP).

- Price is below the Trend EMA (optional/configurable).

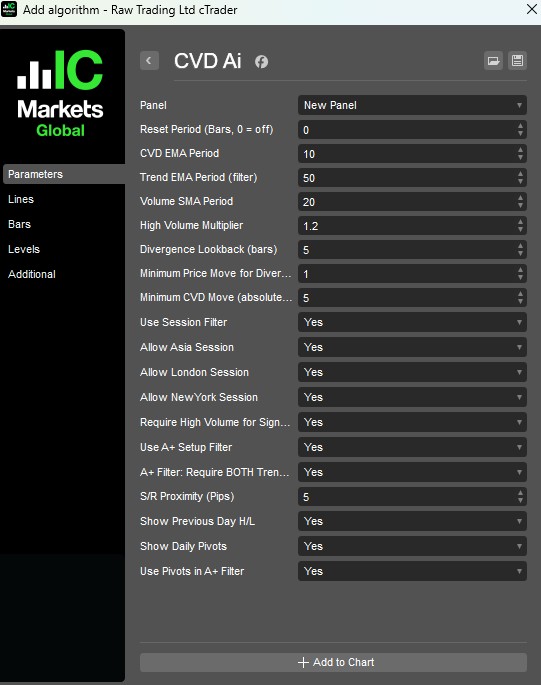

Parameter Explanations

General Settings

- Reset Period: Resets the CVD calculation every X bars (0 = continuous).

- CVD EMA Period: Smoothness of the signal line for CVD crossovers (Default: 10).

- Trend EMA Period: Moving average used to determine the main trend (Default: 50).

Divergence Settings

- Divergence Lookback: How many bars back to check for highs/lows (Default: 5).

- Min Price/CVD Move: Thresholds to ignore insignificant small movements.

A+ Strategy Settings

- Use A+ Setup Filter: Turn this ON to filter trades based on Support/Resistance.

- A+ Require Both: -

True: Signal must be WITH Trend AND AT Support/Resistance. (Very strict). False: Signal can be valid if it satisfies Trend OR Support/Resistance.

- S/R Proximity (Pips): How close (in pips) price must be to a Pivot or PDH/L to be considered "at the level" (Default: 5).

New Pivot Settings

- Show Previous Day H/L: Toggles the visibility of grey dotted lines for yesterday's range.

- Show Daily Pivots: Toggles visibility of White (PP), Red (R1), and Green (S1) lines.

- Use Pivots in Filter: If true, the A+ logic considers S1, R1, and PP as valid zones for taking trades.

Visual Legend

- Green/Red Histograms: Buying vs Selling Volume per bar.

- Lime/Magenta Dots: Raw Divergence points (Potential reversals).

- Blue/Red Dots: Confirmed Entry Signals (Filtered).

- Orange/Gold Dots: Exit signals (based on CVD crossing back over EMA).

- Horizontal Lines: - Grey: Previous Day High/Low.

- White: Daily Pivot (PP).

- Tomato: Resistance 1 (R1).

- LightGreen: Support 1 (S1).

.png)

.png)