Free Smart Money Concepts (SMC) from TradingView

指标

1.73K 下载

版本 1.0, Oct 2025

Windows 版、Mac 版

5.0

评价:4

- 🔷 What is Smart Money Concepts (SMC)?

- SMC is a price-action framework focused on how institutional “smart money” accumulates and distributes positions.

- It replaces basic patterns with a logical map of market structure (BOS/CHoCH), liquidity (EQH/EQL), Order Blocks (OB), Fair Value Gaps (FVG), and premium/discount zones to anticipate likely continuations or reversals.

- 🚀 What this indicator does

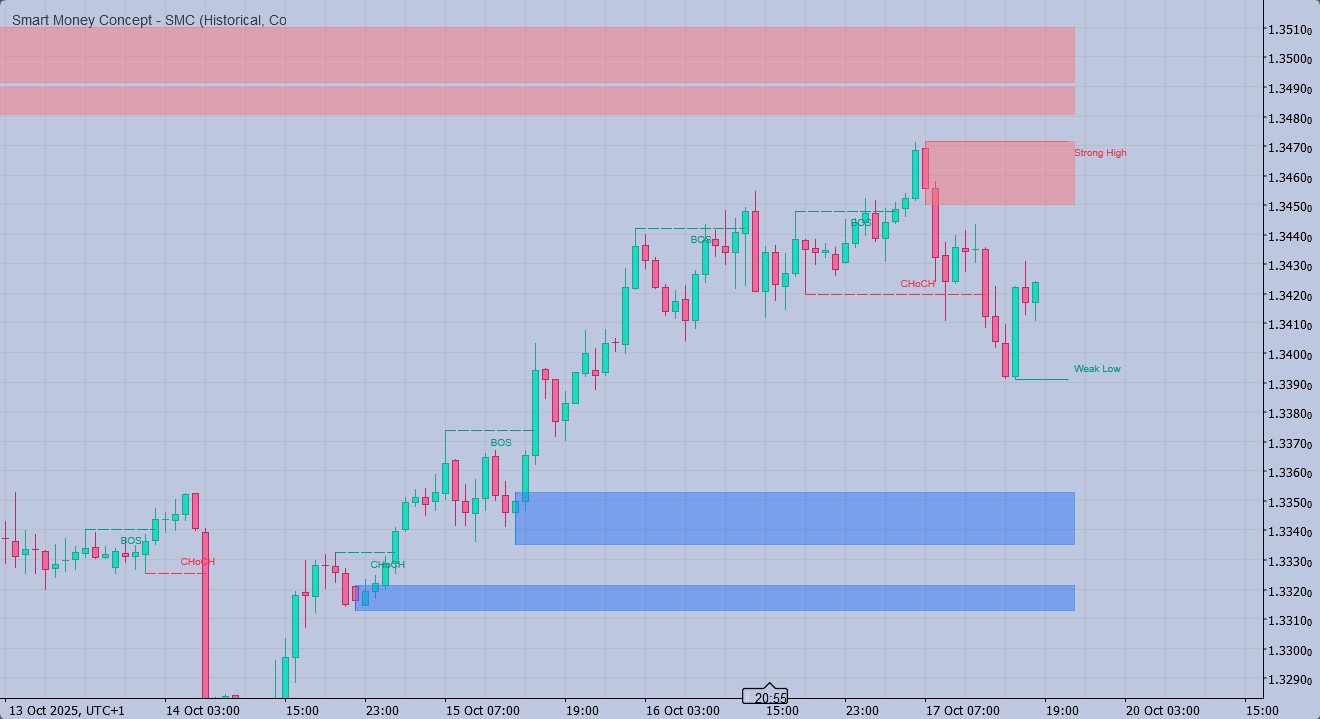

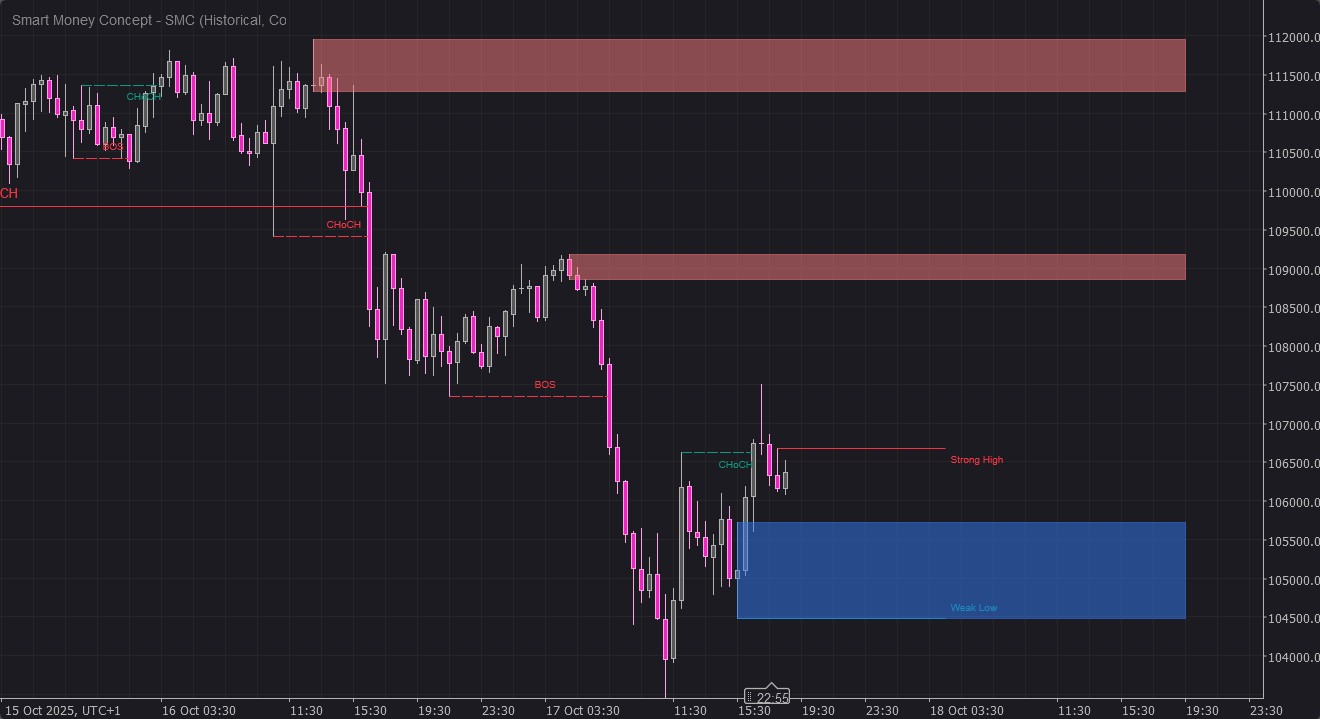

- Detects Break of Structure (BOS) and Change of Character (CHoCH) in both swing and internal structure.

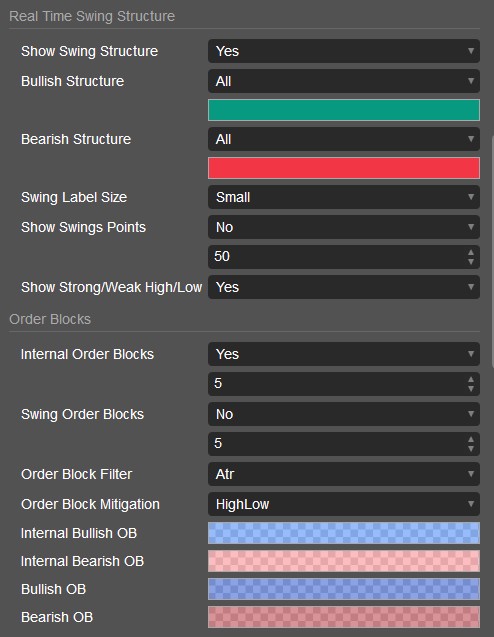

- Draws Order Blocks (OB) and Fair Value Gaps (FVG) as semi-transparent zones (RGBA colors—opacity is fully user-controlled).

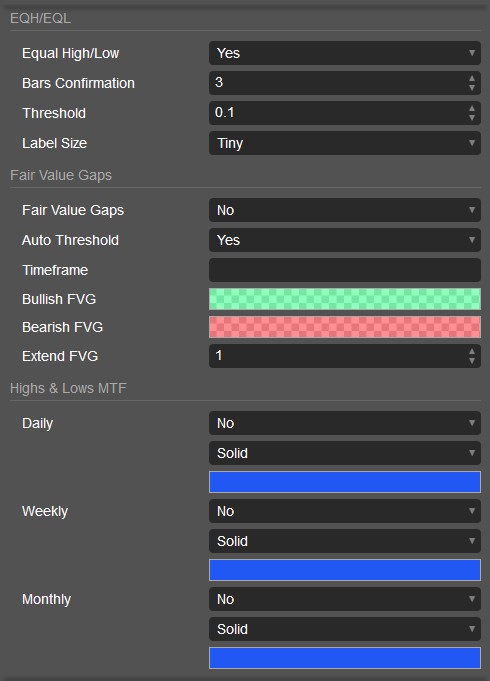

- Marks Equal Highs/Equal Lows (EQH/EQL) to show liquidity pools.

- Labels Strong/Weak High/Low so you can see which side is likely to be targeted or protected.

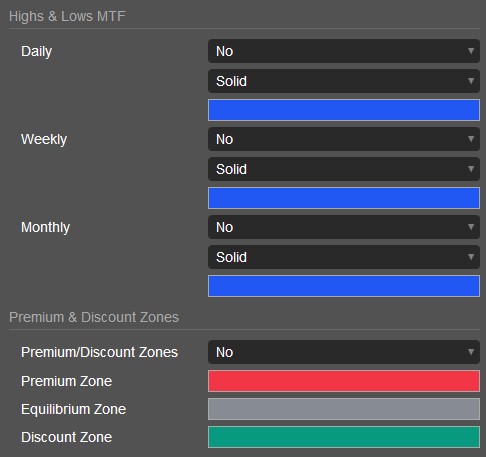

- Plots Premium/Equilibrium/Discount zones across the current swing range for value-area context.

- Overlays Daily/Weekly/Monthly highs & lows for multi-timeframe confluence.

- Offers Present/Historical drawing modes and Monochrome/Colored styles.

- 🧭 How to use it (practical workflow)

- 1) Read structure first:

- Look for BOS/CHoCH on swing and internal levels to establish bias.

- A bullish BOS + internal BOS often signals continuation; a CHoCH warns of potential reversal.

- 2) Map imbalances and blocks:

- Use FVG as “efficiency targets” where price often rebalances.

- Use OB as likely mitigation zones where entries can form (e.g., limit or confirmation entries).

- 3) Align with liquidity:

- Watch EQH/EQL for liquidity sweeps; the sweep + BOS is a strong SMC narrative.

- Note Strong/Weak High/Low to gauge which side is vulnerable.

- 4) Add confluence:

- Check premium/discount: buy setups are higher-probability in discount; sell setups in premium.

- Add MTF levels (D/W/M) and your own session timing for precision.

- 5) Execute and manage:

- Entries: OB mitigation or FVG fills with structure alignment.

- Stops: beyond the invalidation of the OB/FVG or the most recent strong pivot.

- Targets: opposite liquidity, opposing OB/FVG, or equilibrium of the swing.

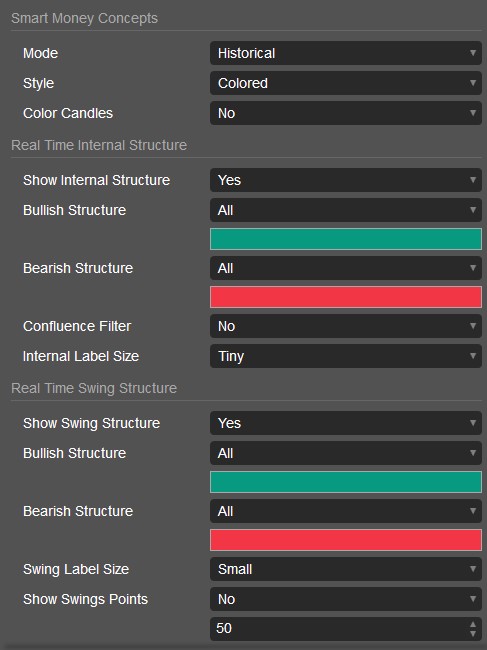

- ⚙️ Key settings you control

- Mode: Historical vs Present (clean real-time look).

- Structure filters: Show BOS/CHoCH for swing vs internal; label sizes; optional confluence (wick logic).

- OB/FVG colors: Choose any RGBA color; the alpha channel sets transparency directly.

- Counts/limits: Max number of visible OBs; FVG extension; EQH/EQL sensitivity.

- MTF levels: Toggle Daily/Weekly/Monthly and pick line styles.

- Style: Colored or Monochrome, plus optional candle coloring by trend.

- 🧩 Why traders like it

- 1:1 parity logic with the popular TradingView SMC approach (BOS/CHoCH, OB/FVG parity).

- Clean visuals: zones and labels stay readable and update smoothly in real time.

- Flexible: works for scalping to swing trading, on any symbol or timeframe supported by cTrader.

- ✅ Best practices

- Combine SMC context with risk management and a clear playbook (entry, stop, target rules).

- Use alerts or watchlists around HTF levels and session opens for higher-quality moves.

- Always validate with market session and news calendar to avoid random volatility.

- 📌 Notes

- Visuals depend on broker data (bid feeds/sessions can vary).

- This tool is not financial advice; trading involves risk. Use on a demo account before going live.

5.0

评价:4

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

客户评价

March 4, 2026

December 11, 2025

November 4, 2025

Superfantastic 3 in one zones, one of the best indicators on here ,and for free. If you cant figure it out after this, you got something wrong with ya :). Nicely done my friend, how did you code it C# or python?

NAS100

NZDUSD

Breakout

XAUUSD

FVG

Commodities

Forex

Fibonacci

Signal

EURUSD

GBPUSD

BTCUSD

SMC

ZigZag

Indices

Prop

ATR

Stocks

Crypto

USDJPY

Scalping

该作者的其他作品

猜您喜欢

27

销售

2.13K

免费安装

!["Smart Money Concepts (SMC) [Iridio Capital]" 标识](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

!["Session Volume Profile (SVP) [Iridio Capital]" 标识](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

!["High-Low Divergence [Iridio Capital]" 标识](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)