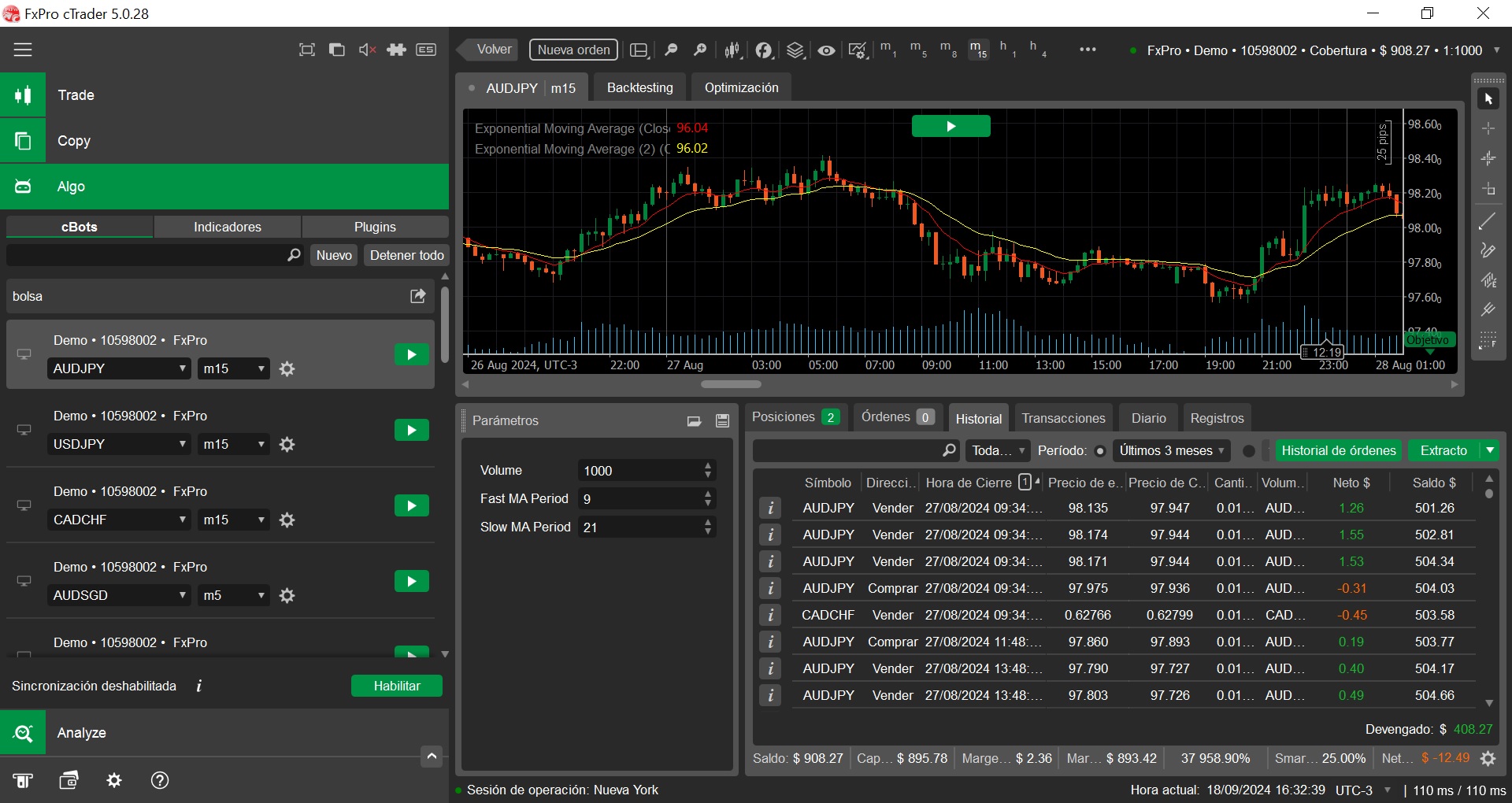

As requested by many of you, we are now working hard to provide examples of some of our machine learning code and packages.

TensorFlow, PyTorch, Keras, Numpy, Pandas and many more .NET packages to get going inside of cTrader.

Our mission is to make Machine Learning inside cTrader easier for everyone.

Happy hunting!

*** This code does not trade anything (it only prints out data etc). It is simply sample code of how you can start creating your own AI models using our Machine Learning packages.

.......................................................

using System;

using System.Collections.Generic;

using System.Linq;

using System.Text;

using cAlgo.API;

using cAlgo.API.Collections;

using cAlgo.API.Indicators;

using cAlgo.API.Internals;

using NumSharp;

using np = NumSharp.np;

using Shape = NumSharp.Shape;

using PandasNet;

using static PandasNet.PandasApi;

namespace cAlgo.Robots

{

[Robot(TimeZone = TimeZones.UTC, AccessRights = AccessRights.None)]

public class E7BBKGNumSharpSample : Robot

{

[Parameter("Version 1.01", DefaultValue = "Version 1.01")]

public string Version { get; set; }

[Parameter("Source")]

public DataSeries Source { get; set; }

[Parameter("Bars Required", DefaultValue = 50, MinValue = 1, MaxValue = 10000, Step = 1)]

public int BarsRequired { get; set; }

[Parameter("Method Name", DefaultValue = MethodName.DataSplitPrints)]

public MethodName Mode { get; set; }

public enum MethodName

{

DataSplitPrints,

PandasPrints,

NDArrayPrints

}

protected override void OnStart()

{

// Initialize any indicators

}

protected override void OnBar()

{

try

{

if (Mode == MethodName.DataSplitPrints)

{

DataSplitPrints();

}

else if (Mode == MethodName.PandasPrints)

{

PandasPrints();

}

else if (Mode == MethodName.NDArrayPrints)

{

NDArrayPrints();

}

}

catch (Exception ex)

{

Print($"Error: {ex.Message}");

if (ex.InnerException != null)

{

Print($"Inner Exception: {ex.InnerException.Message}");

throw;

}

}

}

private float[,] GetDataSet()

{

int startBar = Bars.ClosePrices.Count - BarsRequired;

float[,] inputSignals = new float[BarsRequired, 5];

for (int i = 0; i < BarsRequired; i++)

{

int barIndex = startBar + i;

inputSignals[i, 0] = (float)Bars.OpenPrices[barIndex];

inputSignals[i, 1] = (float)Bars.HighPrices[barIndex];

inputSignals[i, 2] = (float)Bars.LowPrices[barIndex];

inputSignals[i, 3] = (float)Bars.ClosePrices[barIndex];

inputSignals[i, 4] = (float)Bars.TickVolumes[barIndex];

}

return inputSignals;

}

private float[,] GetTargetDataSet()

{

int startBar = Bars.ClosePrices.Count - BarsRequired;

float[,] inputSignals = new float[BarsRequired, 5];

for (int i = 0; i < BarsRequired; i++)

{

int barIndex = startBar + i;

inputSignals[i, 0] = (float)Bars.OpenPrices[barIndex];

inputSignals[i, 1] = (float)Bars.HighPrices[barIndex];

inputSignals[i, 2] = (float)Bars.LowPrices[barIndex];

inputSignals[i, 3] = (float)Bars.ClosePrices[barIndex];

inputSignals[i, 4] = (float)Bars.TickVolumes[barIndex];

}

return inputSignals;

}

/// NumSharp Data Split Prints

public void DataSplitPrints()

{

// Reshape input data to match the model's expected input shape

//var inputShape = new Shape(-1, BarsRequired, 5);

NDArray inputData = np.array<float>(GetDataSet());

Print("Input NDarray: " + string.Join(", ", inputData));

// Reshape target data to match the target shape expected by the model

//var targetShape = new Shape(-1, 5);

NDArray targetData = np.array<float>(GetTargetDataSet());

Print("Target NDarray: " + string.Join(", ", targetData));

// Split data into training and test sets

int testSize = (int)(0.2 * inputData.shape[0]); // 20% for testing

var (x_train, x_test) = (inputData[$":{inputData.shape[0] - testSize}"], inputData[$"{inputData.shape[0] - testSize}:"]);

var (y_train, y_test) = (targetData[$":{targetData.shape[0] - testSize}"], targetData[$"{targetData.shape[0] - testSize}:"]);

Print("X_train data: " + string.Join(", ", x_train));

Print("X_test data: " + string.Join(", ", x_test));

Print("Y_train data: " + string.Join(", ", y_train));

Print("Y_test data: " + string.Join(", ", y_test));

}

/// PandasNet Prints

public void PandasPrints()

{

// Convert float[,] to List<Series>

var inputData = GetDataSet();

var targetData = GetTargetDataSet();

var inputSeriesList = new List<Series>();

var targetSeriesList = new List<Series>();

for (int col = 0; col < inputData.GetLength(1); col++)

{

List<float> columnData = new List<float>();

for (int row = 0; row < inputData.GetLength(0); row++)

{

columnData.Add(inputData[row, col]);

}

inputSeriesList.Add(new Series(columnData.ToArray()));

}

for (int col = 0; col < targetData.GetLength(1); col++)

{

List<float> columnData = new List<float>();

for (int row = 0; row < targetData.GetLength(0); row++)

{

columnData.Add(targetData[row, col]);

}

targetSeriesList.Add(new Series(columnData.ToArray()));

}

// Create DataFrames

DataFrame inputDataFrame = new DataFrame(inputSeriesList);

DataFrame targetDataFrame = new DataFrame(targetSeriesList);

Print("Input DataFrame: " + inputDataFrame);

Print("Target DataFrame: " + targetDataFrame);

//Print("Input DataFrame: " + string.Join(", ", inputDataFrame));

//Print("Target DataFrame: " + string.Join(", ", targetDataFrame));

}

/// Simple NumSharp NDArrays Prints

public void NDArrayPrints()

{

if (Bars.ClosePrices.Count < BarsRequired)

return;

try

{

// Calling your Input Data float[,]

float[,] inputData = GetDataSet();

// Convert to NDArray and reshape to (BarsRequired, 5)

NDArray inputNDArray = np.array(inputData); // NumSharp

Print("Input NumSharp NDarray Data : " + string.Join(", ", inputNDArray));

Print("Input NumSharp NDarray Shape: " + string.Join(", ", inputNDArray.shape));

int expectedLength = BarsRequired * 5;

Print($"Expected NumSharp NDarray Length: {expectedLength}");

Print($"Input NumSharp NDarray Size: {inputNDArray.size}");

if (inputNDArray.size != expectedLength)

{

Print($"Length MisMatch: Expected Length {expectedLength}, but got Size {inputNDArray.size}");

return;

}

}

catch (Exception ex)

{

Print("Exception: " + ex.Message);

Print("StackTrace: " + ex.StackTrace);

Exception innerException = ex.InnerException;

while (innerException != null)

{

Print("Inner Exception: " + innerException.Message);

Print("Inner Exception StackTrace: " + innerException.StackTrace);

innerException = innerException.InnerException;

}

}

}

}

}