wt.Tick Imbalance Bars

ปลั๊กอินเดสก์ท็อป

Version 1.0, Feb 2026

Windows, Mac

เกี่ยวกับเวอร์ชันทดลองใช้

The Trial Version uses the same core TIB algorithm as the full version. It provides full access to all parameters and allows testing across all symbols. Historical bars are displayed exactly as in the full version; however, the bars are static and do not update in real time. In addition, the trial version does not include any current-day data.

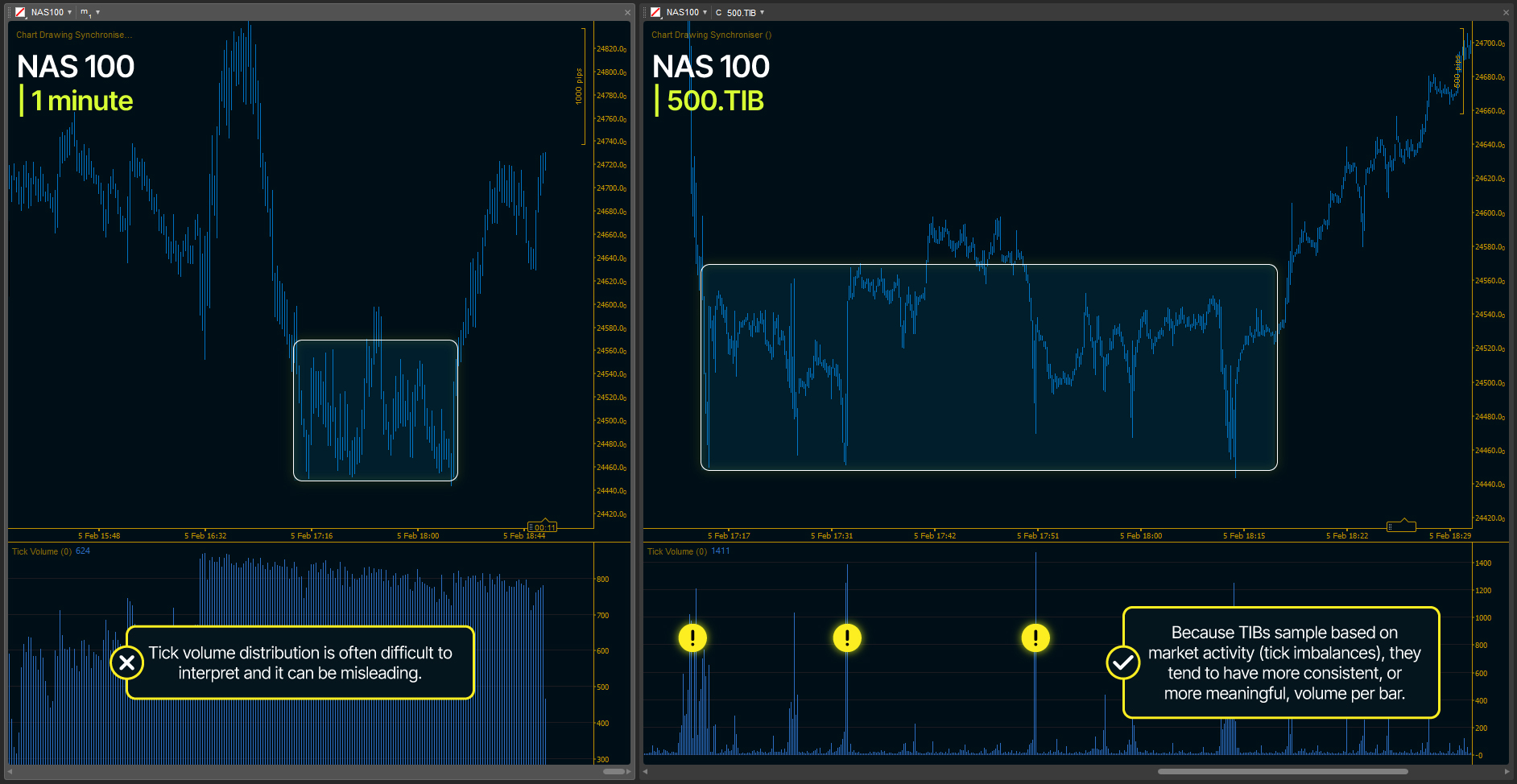

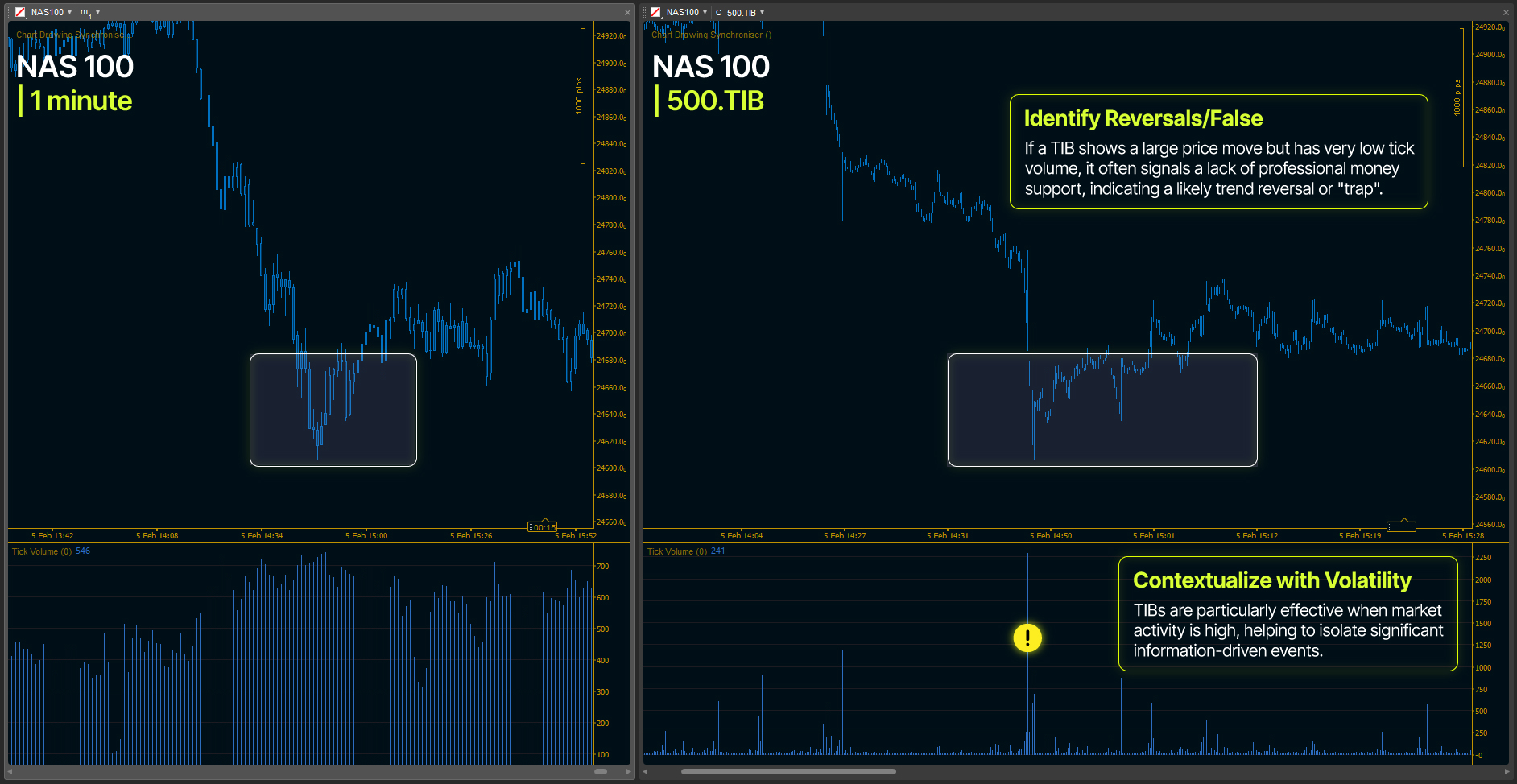

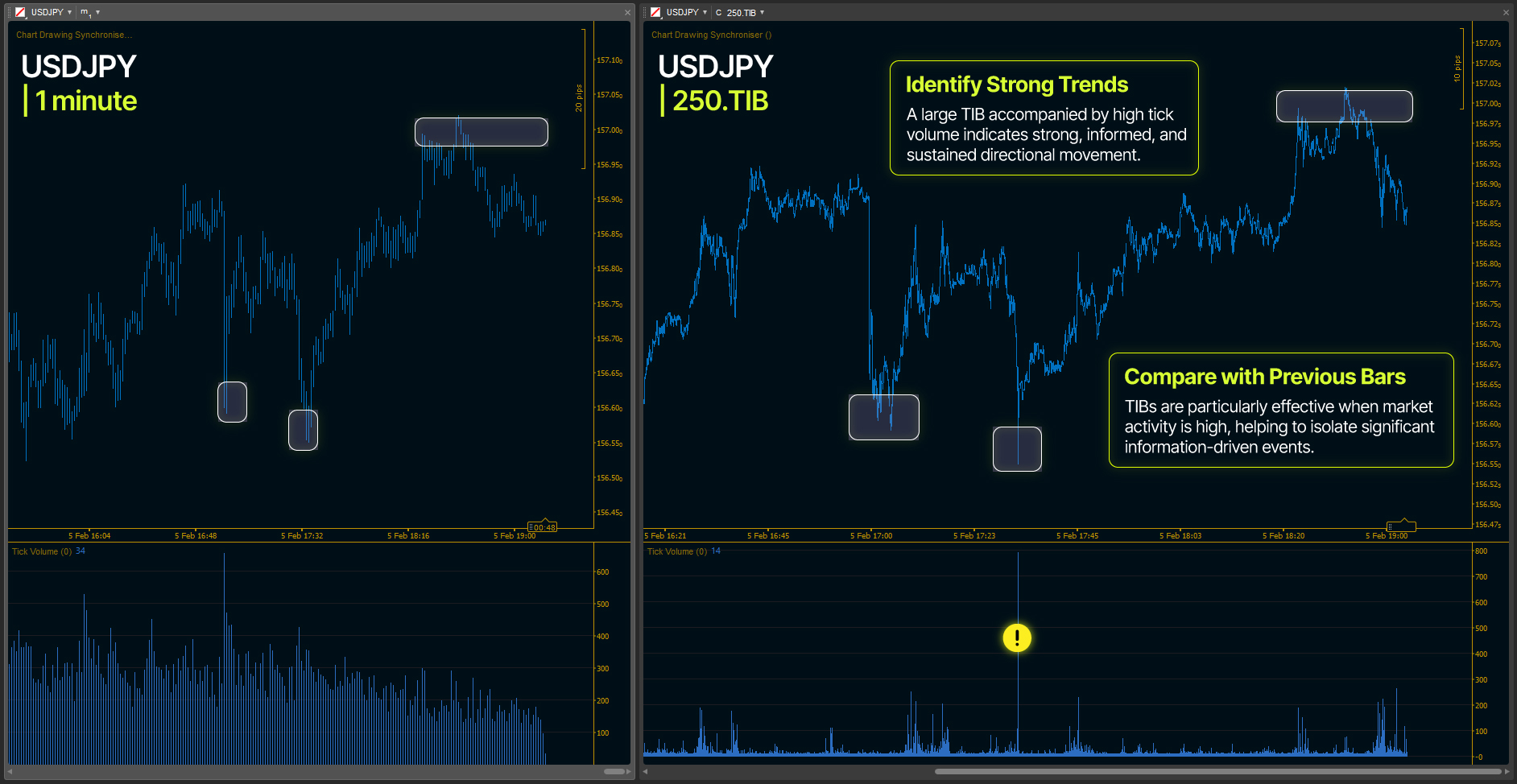

The Tick Imbalance Bars ( TIB ) Custom Timeframe Plugin creates custom timeframes based on tick flow dynamics rather than fixed time intervals. Unlike traditional timeframes (1min, 5min, 1h), TIB bars are formed when cumulative tick imbalance reaches a dynamic threshold.

Key Concept

- Each tick is classified as +1 (uptick), -1 (downtick), or previous sign (no price change)

- These signed ticks accumulate into a running imbalance: θ (theta)

- When |θ| reaches a threshold, a new bar forms

- The threshold adapts based on recent tick flow patterns

- This creates bars that reflect actual market activity rather than arbitrary time divisions

Adaptive Threshold. The plugin uses an Exponential Weighted Moving Average (EWMA) to estimate the probability of upward vs downward ticks. This estimate continuously updates and adjusts the bar formation threshold, making the timeframe adaptive to changing market conditions.

Adaptive Aggregation. When a bar would normally close with very few ticks (micro-bar), the plugin automatically enters aggregation mode and continues accumulating ticks until reaching a minimum threshold. This prevents fragmented bars while preserving the core TIB algorithm.

Plugin Parameters Guide

Expected Bar Size

- Range: 50 - 10000

- What it does: Sets the target number of ticks per bar

- Effect: Higher values create fewer, larger bars; lower values create more, smaller bars

- Direct impact: This is the primary control for bar frequency

EWMA Alpha

- Range: 0,001 - 0.9 ( Recommended default value 0,001 )

- What it does: Controls how responsive the threshold is to recent tick patterns

- Effect:

- Higher values = more reactive, follows recent changes quickly

- Lower values = more stable, smooths over longer periods

- Impact on bars: Affects how quickly bar size adjusts to changing market conditions

Initial Imbalance

- Range: 0.0 - 1.0 ( Recommended default value 0.5 )

- What it does: Sets the starting probability estimate for upward ticks

- Effect:

- 0.5 = neutral starting point (50% up, 50% down)

- Above 0.5 = bullish bias at initialization

- Below 0.5 = bearish bias at initialization

- Impact on bars: Affects the first few bars only, then EWMA takes over

Name Extension

- What it does: Adds a custom suffix to the timeframe name

- Effect: "Live" creates "1000.TIB-Live", allowing multiple instances with different settings

- Purpose: Distinguishes between different TIB configurations in Custom Timeframe List

Max History Days

- Range: 1 - 30 ( Recommended default value >5 )

- What it does: Defines how many days of historical tick data to load

- Effect: More days = more historical bars but longer initial load time

- Trade-off: Loading 30 days of tick data can take significant time depending on tick volume

- Note: Range value is counting also weekend days.

Min Ticks Per Bar

- Range: 10 - 500

- What it does: Sets the minimum number of ticks allowed in any bar

- Effect: When a bar would close with fewer ticks, aggregation mode activates

- Purpose: Prevents micro-bars during low activity periods

- Common setting: 5-10% of Expected Bar Size

Feel free to contact me for Complete Usage Guide. I'm happy to guide you through getting everything configured just right.

This Plugin ( product ) is directly linked to the following products:

1. WT - Tick Imbalance Bars - Indicator Version

- Usage: Same core TIB algorithm used to be applied ( overlayed on native cTrader timeframes )

- Complete description available on indicator product page

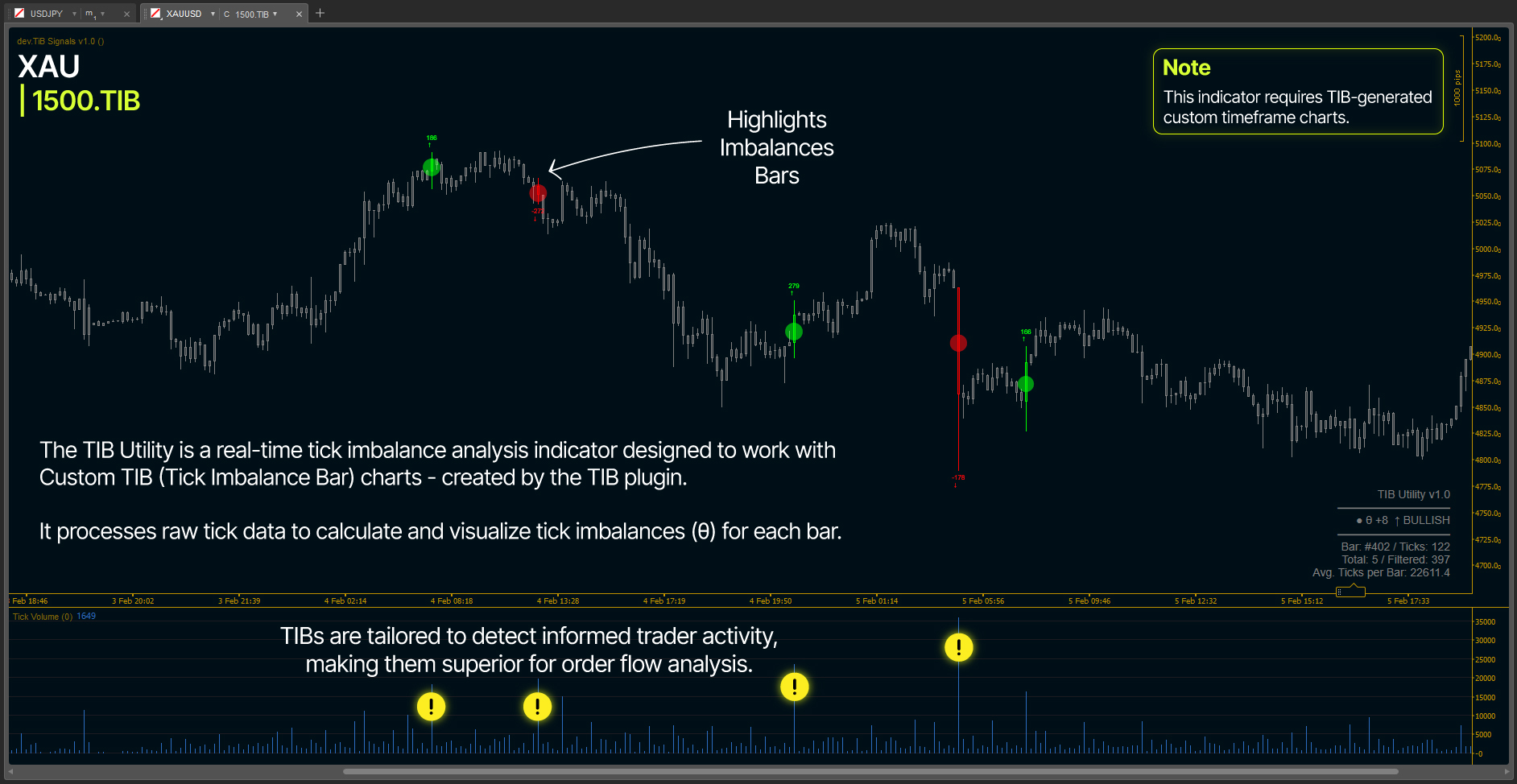

2. wt.TiB Utility - Indicator Version

- Usage: Highlights and provides notifications / alerts for TIB related events

- Complete description available on indicator product page

IMPORTANT NOTE

The TIB Indicator and TIB Plugin are included at no additional cost with the purchase of either product. Although they are listed as separate products, only one purchase is required. For example, purchasing the TIB Indicator also grants access to the TIB Plugin, and vice versa. Please contact me after purchase to receive the related file.

0.0

รีวิว: 0

รีวิวจากลูกค้า

ยังไม่มีรีวิวสำหรับผลิตภัณฑ์นี้ หากเคยลองแล้ว ขอเชิญมาเป็นคนแรกที่บอกคนอื่น!

NAS100

NZDUSD

Breakout

XAUUSD

Commodities

Forex

Signal

EURUSD

GBPUSD

BTCUSD

Indices

Prop

Stocks

Crypto

USDJPY

Scalping

เพิ่มเติมจากผู้เขียนคนนี้

41.76M

ปริมาณการเทรด

56.66K

Pips ที่ได้กำไร

29

การขาย

241

ติดตั้งฟรี