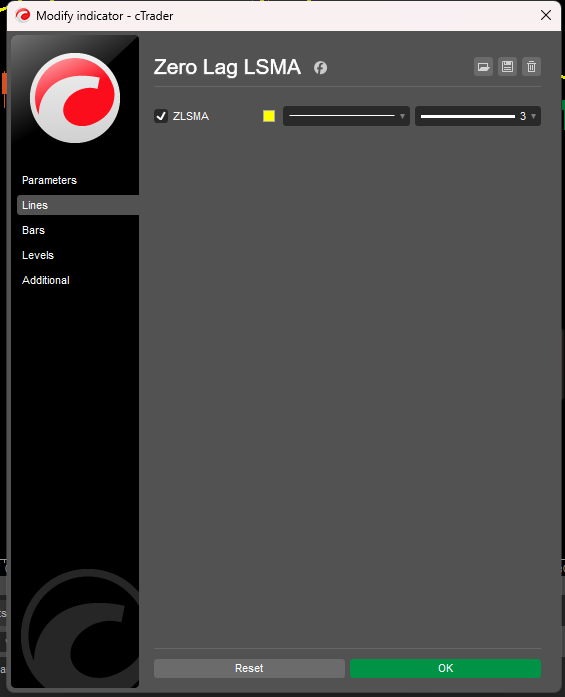

Zero Lag LSMA

Indikator

6 käufe

Version 1.0, Aug 2025

Windows, Mac

5.0

Bewertungen: 1

The Zero Lag LSMA (Least Squares Moving Average) is a cutting-edge technical indicator designed for traders seeking enhanced responsiveness and precision in trend analysis. Unlike traditional moving averages that lag behind price action, It minimizes lag by applying a double linear regression process, making it ideal for identifying trend direction and potential reversals in real-time. This indicator is perfect for forex, stocks, commodities, and other markets.

Key Features

- Zero-Lag Performance: Reduces the delay inherent in traditional moving averages, providing faster signals for trend changes.

- Customizable Parameters: Adjust the length, offset, and price source (Open, High, Low, Close) to suit your trading strategy.

- Visually Intuitive: Displays as a smooth, yellow line overlaid on the price chart for easy interpretation.

- Versatile Application: Suitable for scalping, day trading, swing trading, and long-term strategies across various timeframes.

How to Use

- Trend Identification:

- When the ZLSMA line slopes upward, it indicates a bullish trend.

- A downward slope suggests a bearish trend.

- Flat or choppy movement may indicate consolidation or lack of trend.

- Entry/Exit Signals:

- Buy Signal: Enter a long position when the price crosses above the ZLSMA line, especially after a confirmed uptrend.

- Sell Signal: Enter a short position when the price crosses below the ZLSMA line during a downtrend.

- Exit Signal: Consider exiting when the price crosses back through the ZLSMA or when the line flattens, indicating a potential trend reversal.

- Confirmation:

- Combine ZLSMA with other indicators (e.g., RSI, MACD) or support/resistance levels to confirm signals and avoid false breakouts.

- Use on higher timeframes (H1, H4, D1) for stronger trend signals or lower timeframes (M5, M15) for scalping.

Trading Strategies

- Trend Following: Use ZLSMA to ride strong trends by entering on pullbacks to the ZLSMA line in the direction of the trend.

- Reversal Trading: Look for price divergence from the ZLSMA line combined with candlestick patterns (e.g., pin bars, engulfing candles) for reversal setups.

- Breakout Trading: Monitor price breakouts above/below the ZLSMA during high volatility periods for potential entry points.

Tips for Optimal Use

- Adjust Length for Market Conditions: Use a shorter length (e.g., 10-20) for faster markets or scalping, and a longer length (e.g., 50-100) for smoother trends in higher timeframes.

- Test on Demo Account: Before using in live trading, backtest the ZLSMA on a demo account to understand its behavior in your preferred markets.

- Avoid Overtrading in Choppy Markets: ZLSMA performs best in trending markets; use additional filters (e.g., ADX) to avoid whipsaws in sideways markets.

5.0

Bewertungen: 1

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

Kundenbewertungen

October 10, 2025

Zero lag, full clarity ⚡ LSMA tracks price action like a scalpel — sharp, fast, and smooth. Great trend filter for any timeframe!

Mehr von diesem Autor

Das könnte Sie auch noch interessieren

Seit 14/07/2025

48

Verkäufe

![„Smart Money Concepts (SMC) [Iridio Capital]“-Logo](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![„Session Volume Profile (SVP) [Iridio Capital]“-Logo](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![„High-Low Divergence [Iridio Capital]“-Logo](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)