Overview

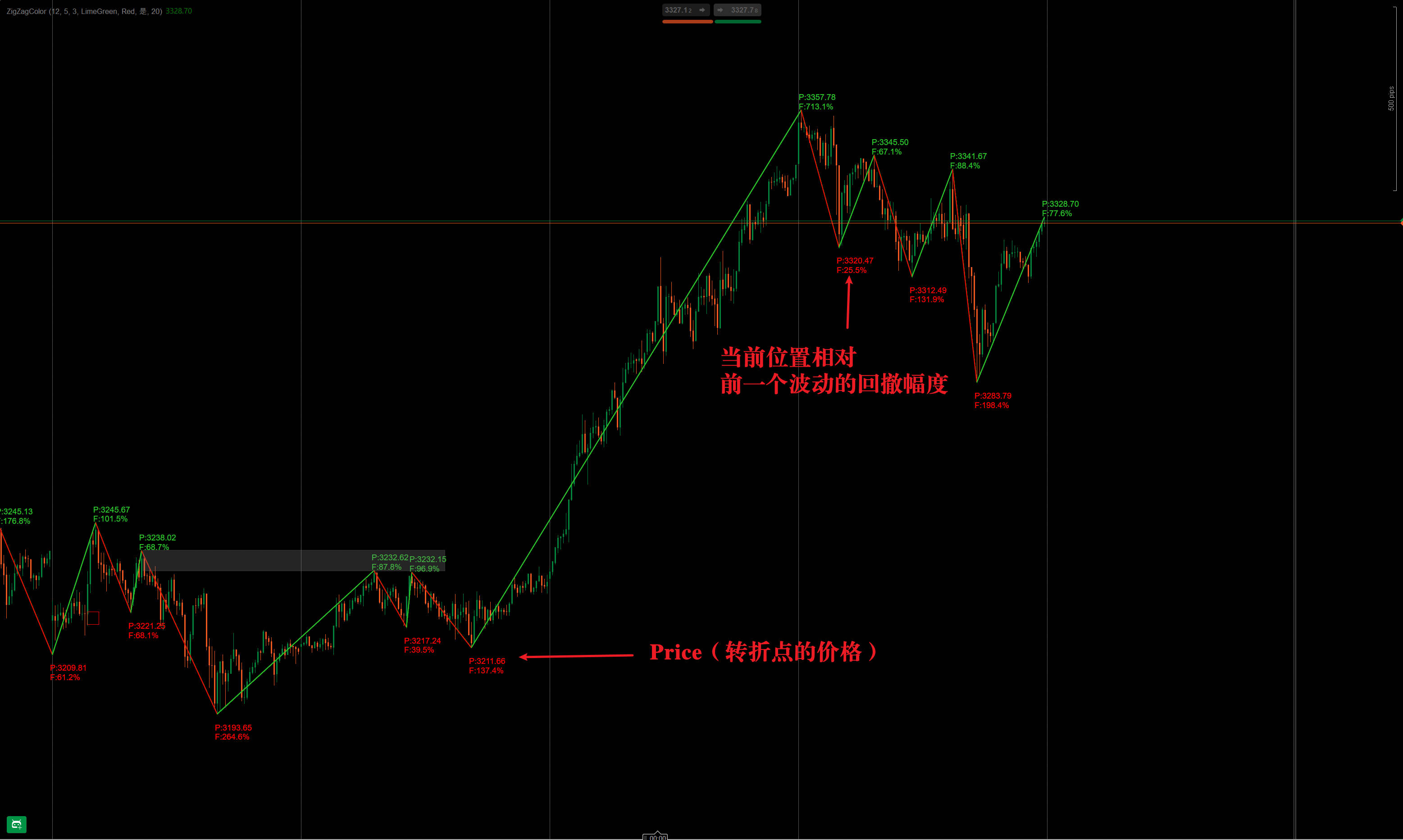

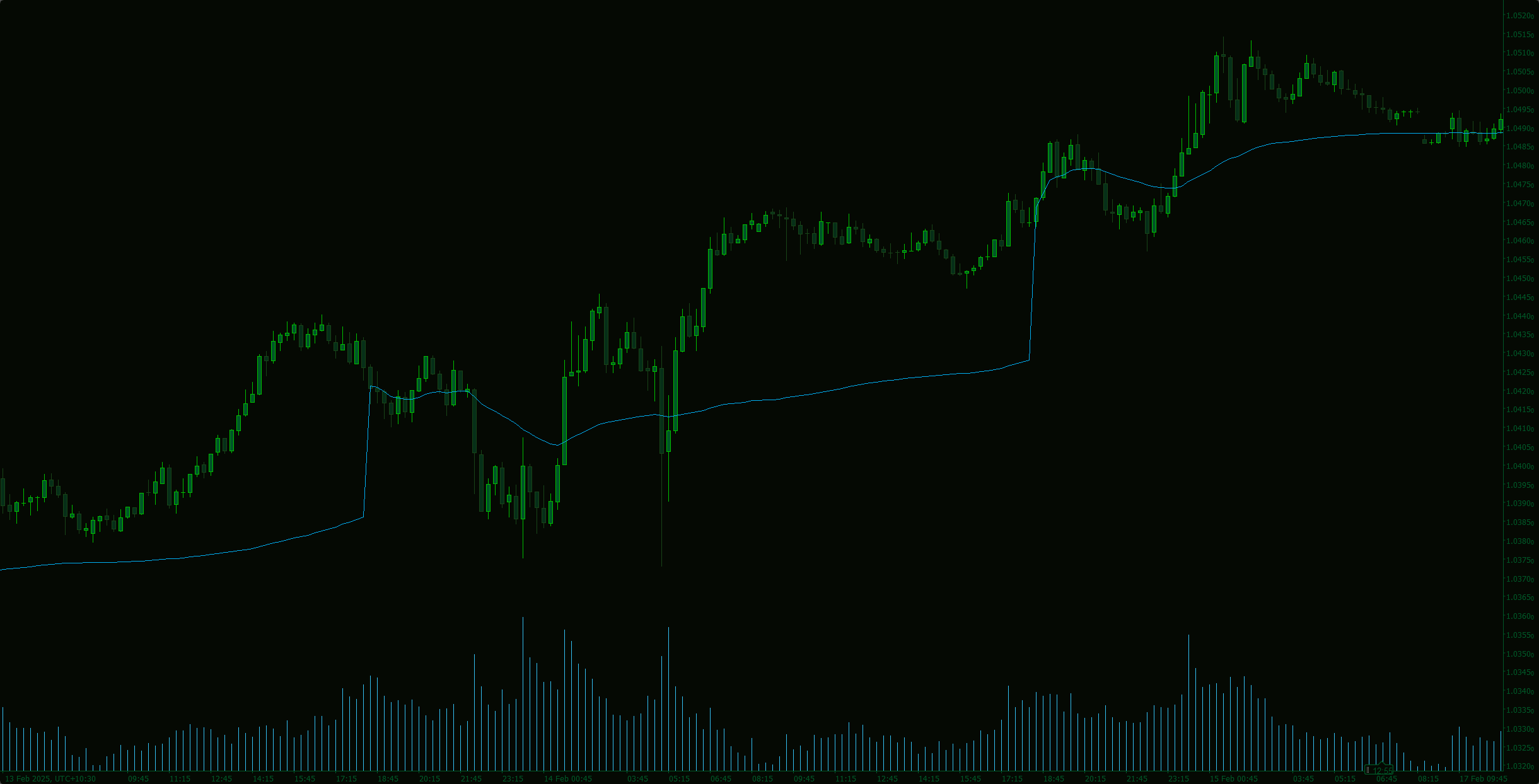

The ZigZag indicator is a technical analysis tool primarily used to identify key price reversal points by filtering out market noise. It connects significant highs and lows with ZigZag lines, helping traders visualize trends and potential breakouts.

How ZigZag Works

- Core Functionality

- It eliminates minor price fluctuations by setting a minimum price change threshold (percentage or fixed value).

- Only connects meaningful swing highs/lows, simplifying trend analysis.

- Often used to detect support/resistance levels, reversals (e.g., head & shoulders, double tops/bottoms).

- Key Parameters

- Minimum Price Movement (%): Determines sensitivity (e.g., 5% ignores moves smaller than this).

- Lookback Depth: Controls how many past candles are analyzed, affecting lag.

Primary Applications

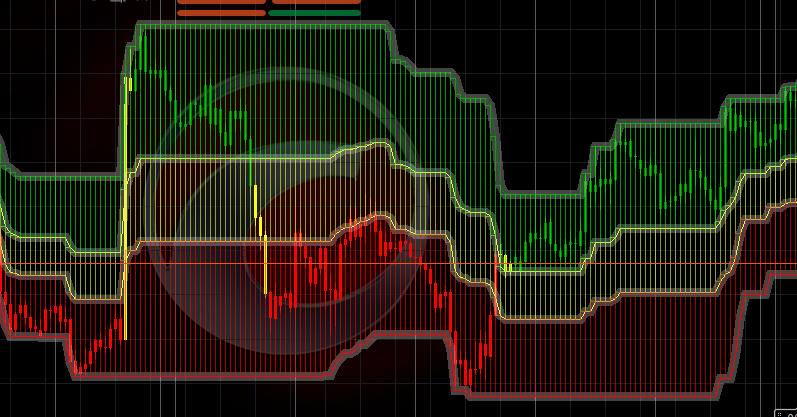

1. Trend Identification

- Uptrends: Higher highs (HH) + higher lows (HL).

- Downtrends: Lower highs (LH) + lower lows (LL).

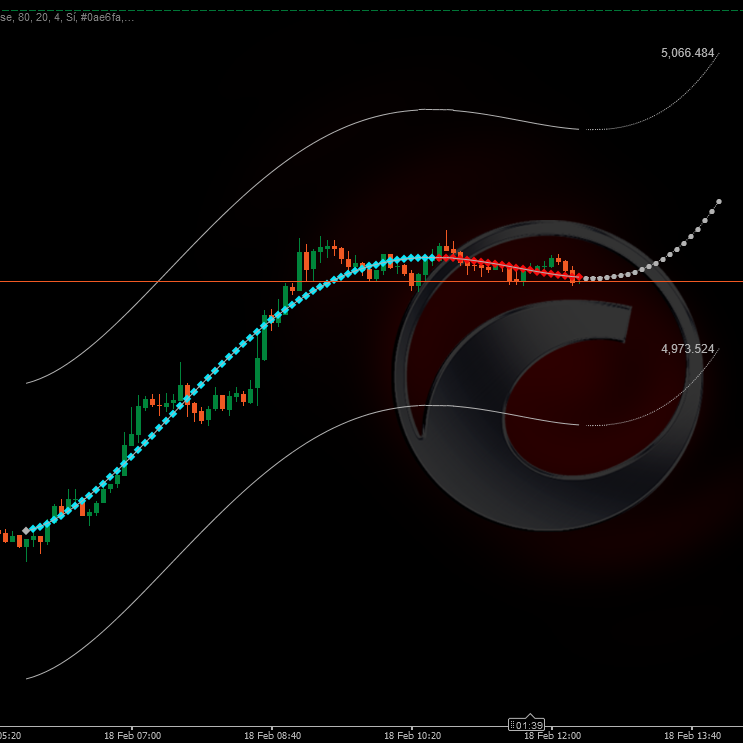

- Helps draw trendlines for potential breakout trades.

2. Pattern Recognition

- Reveals classic chart patterns (triangles, flags, wedges) by defining swing points.

3. Fibonacci Retracement Levels

- Marks clear swing highs/lows for Fibonacci extensions or retracements.

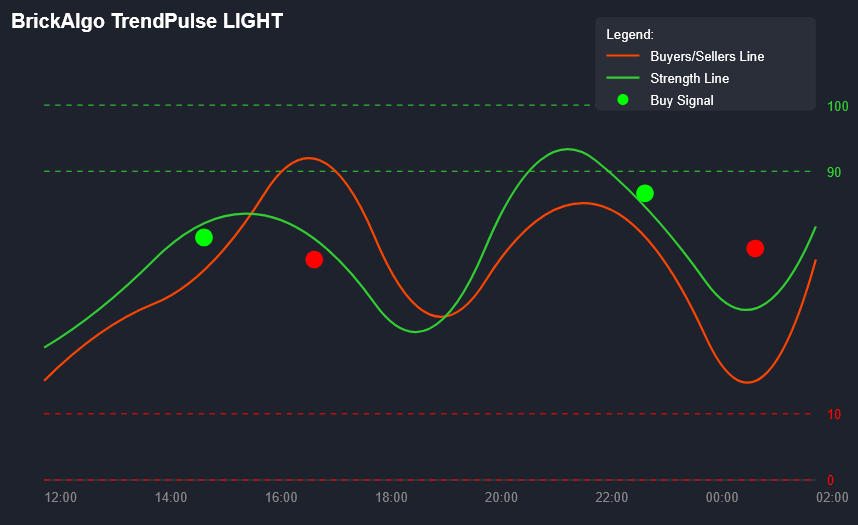

4. Divergence Detection

- Highlights divergences between price and oscillators (RSI, MACD).

ZigZag 指标是一种用于技术分析的工具,主要用于识别价格趋势中的关键转折点,帮助交易者过滤市场噪音,突出重要的高点和低点。以下是其核心要点及用法:

ZigZag 指标的原理

- 基本功能:

- 通过设定价格波动的阈值(百分比或固定值),自动忽略小幅波动,仅连接显著的高点和低点,形成折线(ZigZag 形态)。

- 常用于辅助识别支撑/阻力位、趋势反转(如头肩顶、双底等形态)。

- 核心参数:

- 最小波动幅度(如5%或点数):决定过滤小波动的灵敏度。值越大,信号越少但更可靠。

- 回溯深度:控制计算时参考的K线数量,影响转折点的延迟性。

主要用途

- 趋势识别:

- 通过连续的高点抬高(上升趋势)或低点降低(下降趋势)判断趋势方向。

- 结合趋势线,可提前预判突破或回调。

- 形态分析:

- 识别经典价格形态(如三角形、旗形),ZigZag 线条能清晰显示形态边界。

- 斐波那契工具配合:

- 用ZipZag标记的波段高/低点,作为斐波那契回撤或扩展的起点/终点。

- 背离检测:

- 价格与指标(如RSI、MACD)出现背离时,ZipZag帮助确认背离段的起点和终点。

0.0

Recensioni: 0

Recensioni dei clienti

Questo prodotto non ha ancora ricevuto recensioni. L'hai già provato? Fallo sapere agli altri per primo!

RSI

Indices

Prop

Breakout

Commodities

Stocks

Forex

MACD

Crypto

Potrebbe interessarti anche

Da 30/09/2024

44

Vendite