.jpeg)

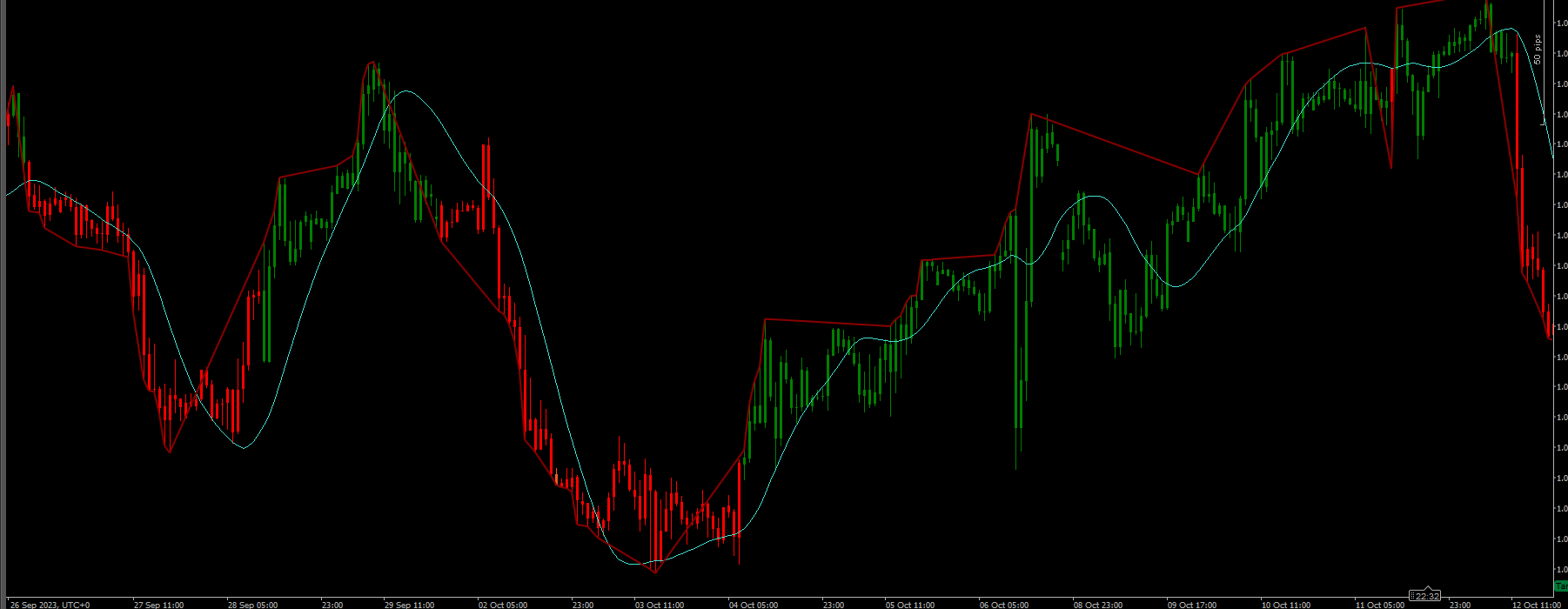

The best way to think of the Composite Index as it applies to the RSI is to think of the RSI as Windows 3.0 and the Composite Index as Windows 10. Constance Brown discovered that the RSI, while it does create and detect divergences, is not as accurate as it could be. It’s a bit of an oxymoron to say this but the RSI is a momentum indicator without any momentum calculation attached to it. The RSI misses a significant amount of important moves and even generates some bad moves. What Constance Brown did with the RSI was to input a momentum calculation within the RSI itself. This index removes the normalization range restrictions in RSI. This means it is not bound within the 0-100 range.

The RSI and the Composite Index Together

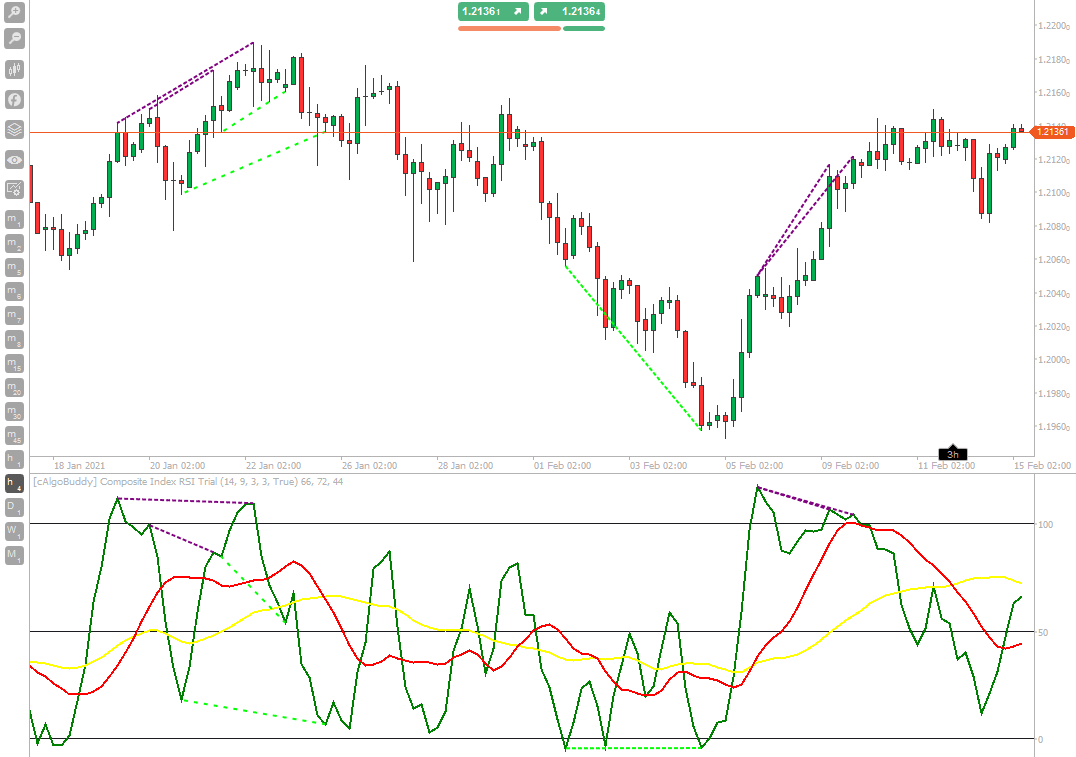

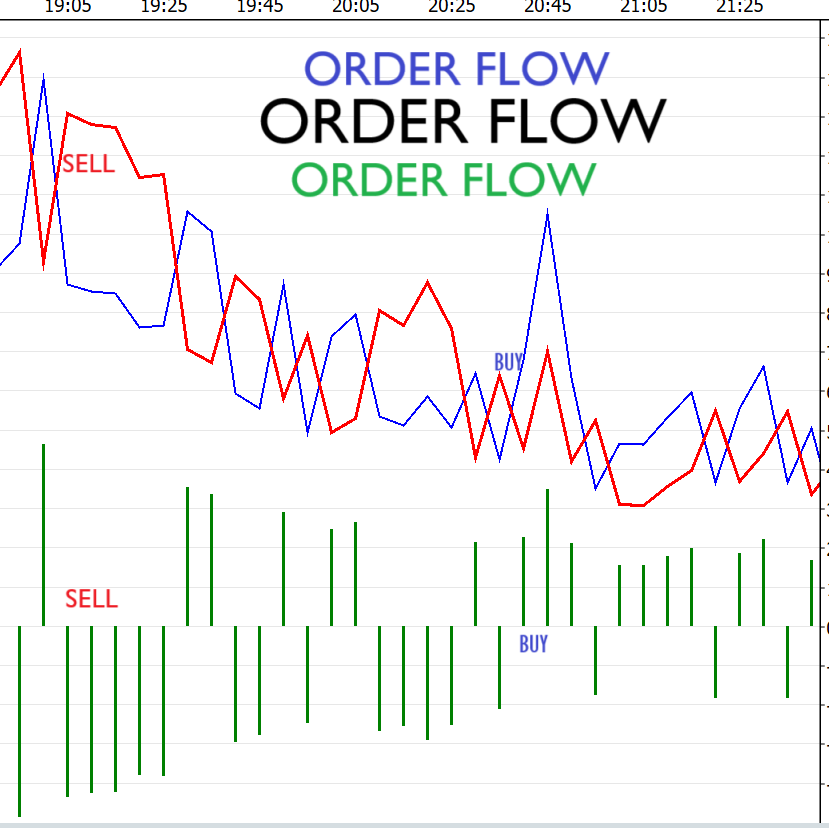

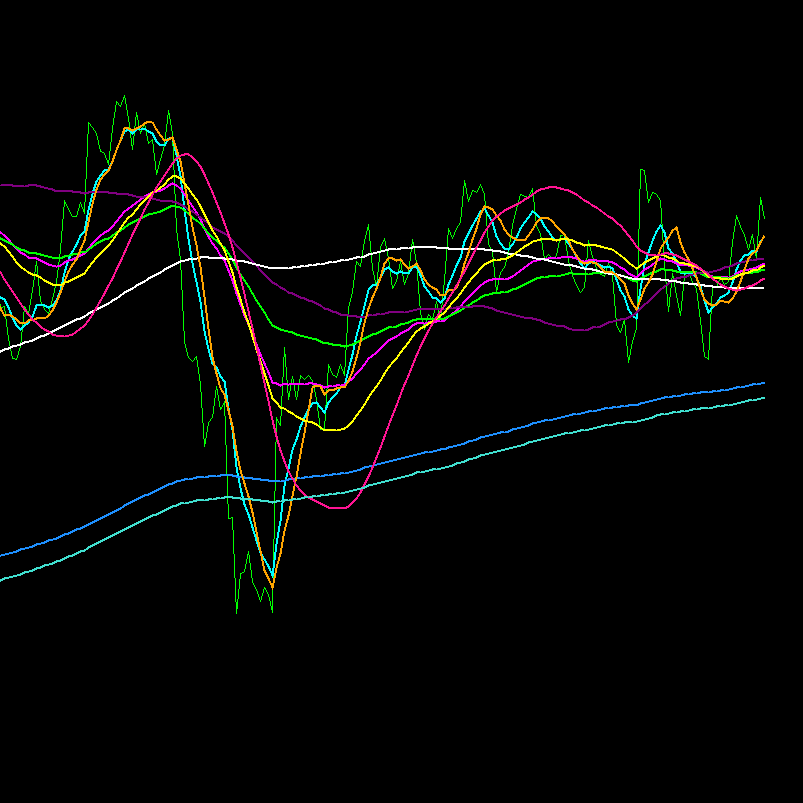

One of the strategies that Constance Brown employed with the Composite Index was to compare the Composite Index against the RSI. When we look for divergences, we look for things like bullish divergence. A bullish divergence occurs when the price creates higher highs, but the oscillator shows lower highs. When we use the RSI and the Composite Index together, we treat RSI like we would a price chart and the Composite Index is the oscillator.

The indicator has an internal normal RSI line to spot divergences, so the work has been done for you. Trade the divergence signals as you would with any other oscillator.

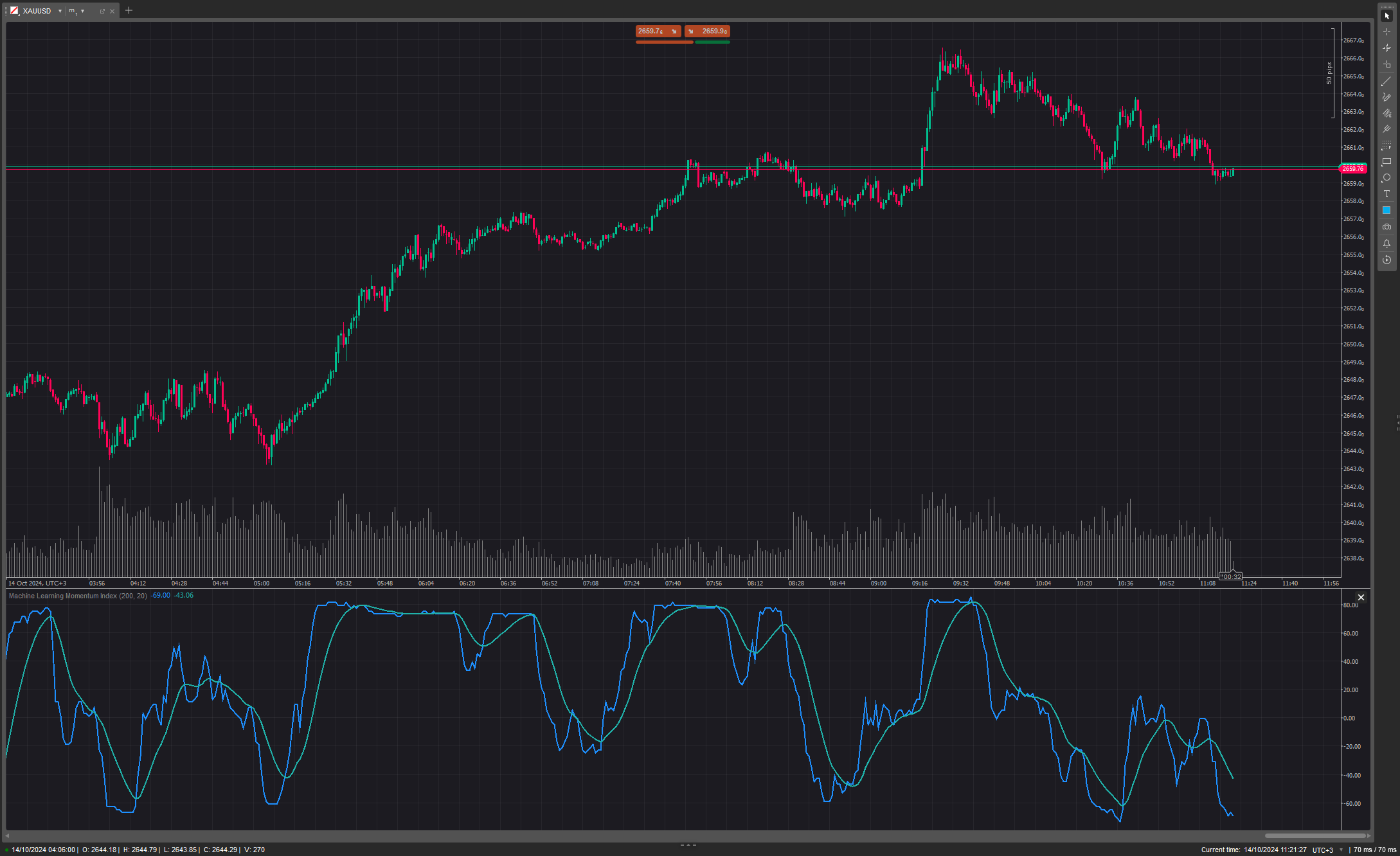

The main feature of the Composite Index is to represent the momentum with clear operating signals. So, when the RSI enters an overbought or oversold zone, the crossing of the Composite Index with its moving averages in the opposite direction represents a good trading signal, then, framing this symbiosis of the oscillator momentum with the action of the price on supports and resistances you get a very interesting and winning trading logic, which is also well suited to trading with cryptocurrencies.

How to Use

The Composite Index Strategy is a momentum price action strategy based on a combination of support and resistance levels with the overbought and oversold levels of the Relative Strength Index and the Composite Index. The Composite Index in this trading strategy is also the final entry timing.

Time Frame: H1+, Always use this with RSI.

Buy

- Price bounces on the support.

- Composite RSI Moving Averages are below the 50 level and fast MA (Red) is lower than slow MA (yellow).

- RSI creates a low and the value is near or below 30 and also Composite index has a low.

- We go long the moment the Composite Index crosses upward the moving averages.

Sell

- Price bounces on the resistance.

- Composite Moving Averages are above the 50 level and fast MA (Red) is higher than slow MA (yellow)

- RSI has a peak and the value is near or above 70 and also Composite Index has a peak.

- We go short when the Composite Index crosses downward the moving averages (this is the timing for entry in the market).

.jpeg)

.jpeg)

.png)