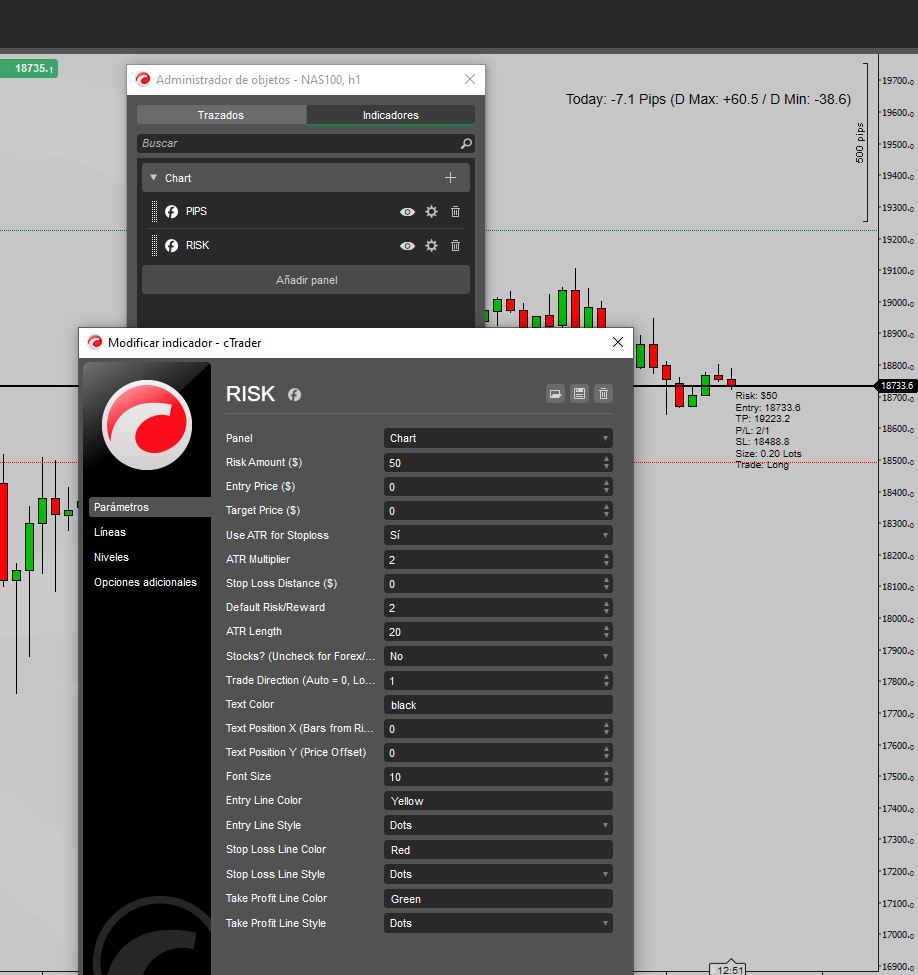

The given cAlgo indicator, AutoPositionSizingRR, is designed to help traders automatically calculate and manage position sizes based on risk, stop loss, and take profit levels. It is customizable and can be applied to both stock and forex markets, providing detailed information about a trade setup. Here's a breakdown of its key functionality and features:

Key Features:

- Risk-based Position Sizing: Calculates the optimal lot size based on the specified risk amount and the distance between the entry price and the stop loss.

- Customizable Parameters: Users can set parameters such as risk amount, entry price, target price, stop loss distance, ATR multiplier, and more, allowing for tailored risk management.

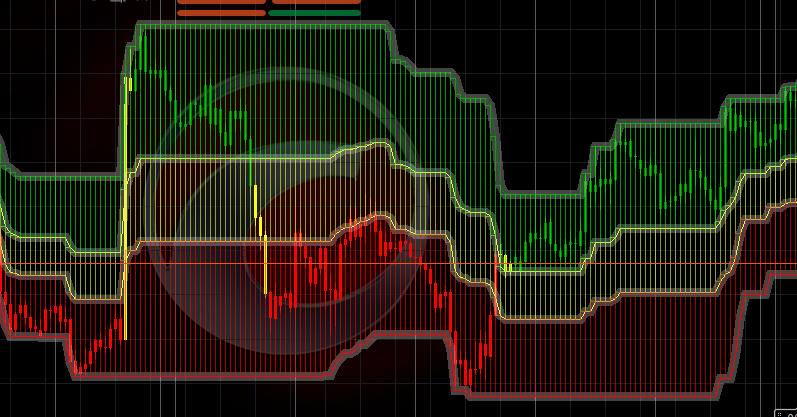

- Dynamic Stop Loss and Take Profit: It can calculate stop loss and take profit based on either a fixed distance, ATR (Average True Range), or a predefined risk/reward ratio.

- Forex & Stock Support: Supports both forex and stock markets, adjusting calculations based on the instrument being traded.

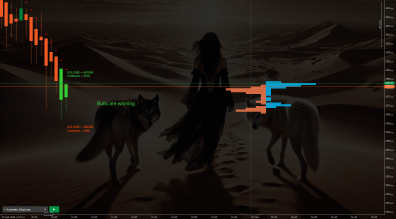

- Visual Setup: It draws horizontal lines on the chart for entry, stop loss, and take profit, allowing for an easy visual representation of the trade setup. It also displays key information like entry price, stop loss, take profit, lot size, and trade type directly on the chart.

How It Works:

- Inputs: The user sets the risk amount (in USD), entry price, target price, and stop loss distance (either fixed or based on ATR). The ATR (Average True Range) can be used for calculating stop loss distance in volatile markets.

- Calculation: The script automatically calculates the position size by dividing the risk amount by the stop loss distance (in pips or dollar value, depending on whether it's a forex or stock trade).

- Trade Information: Displays real-time information on the chart, such as the entry price, stop loss, take profit, and the lot size required to maintain the specified risk level.

Visual Features:

- Chart Lines: Draws the entry, stop loss, and take profit levels as horizontal lines on the chart.

- Text Overlay: Displays formatted trade details (risk, entry, TP, SL, lot size, etc.) on the chart with customizable text positioning, color, and font size.

Usage:

- This indicator is useful for day traders, swing traders, and scalpers who want to automate the process of calculating position sizes based on a defined risk threshold. It simplifies trade management by providing visual cues and trade information directly on the chart, which can lead to more efficient decision-making.

Example:

- A trader can set a risk amount of $50, an entry price of $100, and use ATR for stop loss calculation. The script will calculate the optimal position size, draw entry, stop loss, and take profit levels on the chart, and display important trade details like risk amount, stop loss, and potential profit.

This tool is ideal for traders who prioritize risk management and want a visually integrated way to manage their trades.

0.0

Ulasan: 0

Ulasan pelanggan

Belum ada ulasan untuk produk ini. Sudah mencobanya? Jadilah pemberi ulasan pertama!

ATR

Forex

.png)

.png)