.png)

.png)

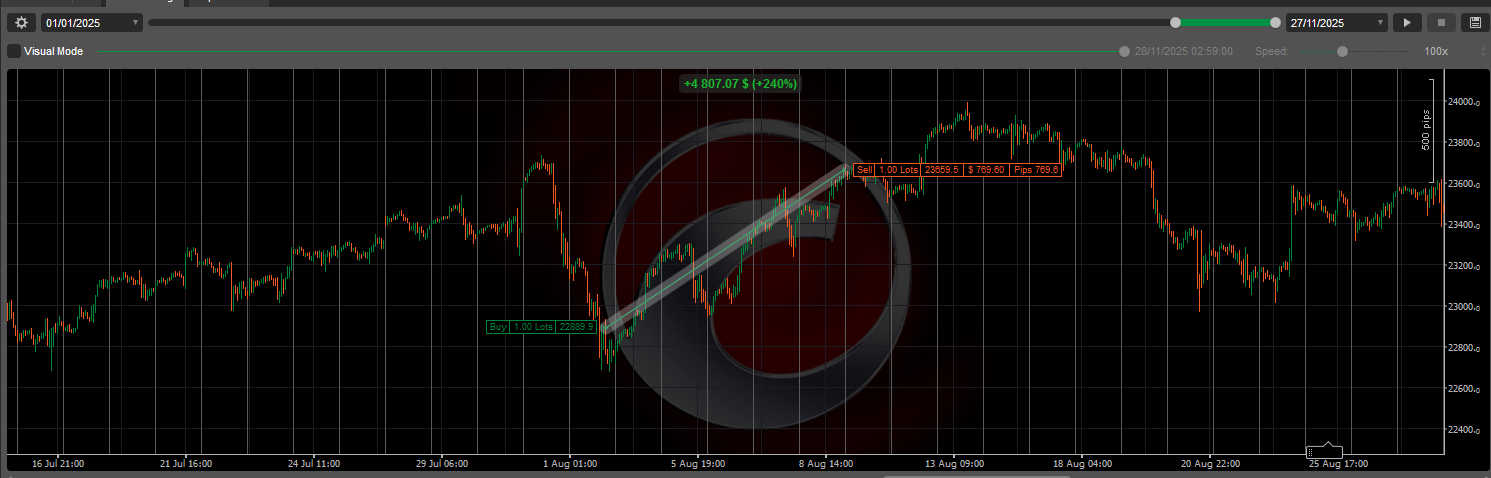

BUY THE DIP – NASDAQ cBot - 6 out of 7 success - 5,76% DD - 19,19 PF

Let the index fall. Then strike with precision.

1. What this cBot does

BUY THE DIP is a focused Nasdaq 100 swing-trading cBot built for traders who prefer few but powerful trades instead of constant noise.

It waits patiently for strong uptrends on NAS100, then enters only when the market delivers deep, emotional dips – combining higher-timeframe trend with intraday exhaustion signals. No grid. No martingale. Single, clean positions aimed at asymmetric reward.

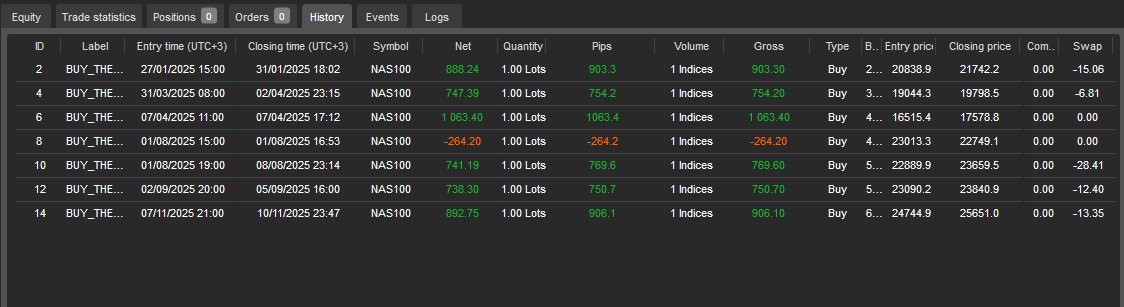

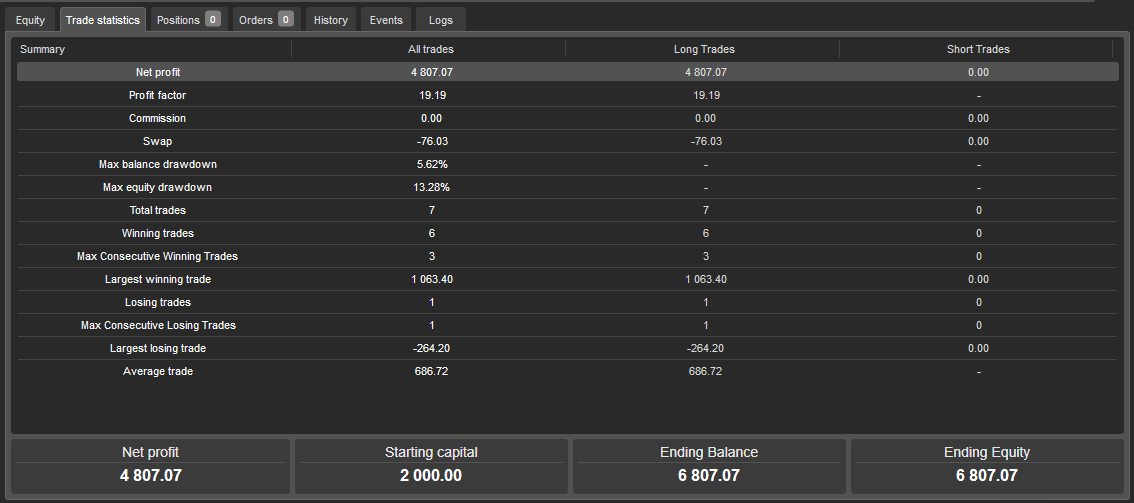

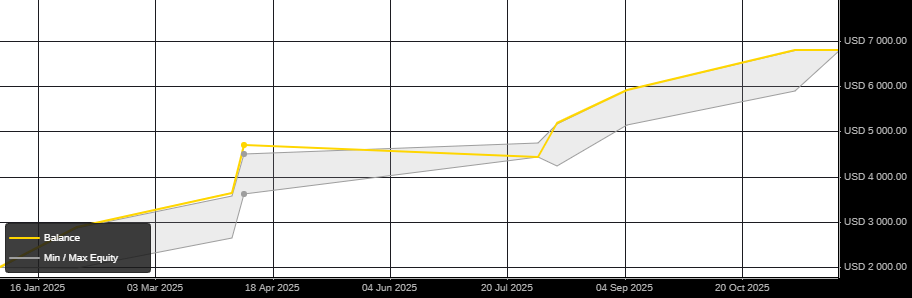

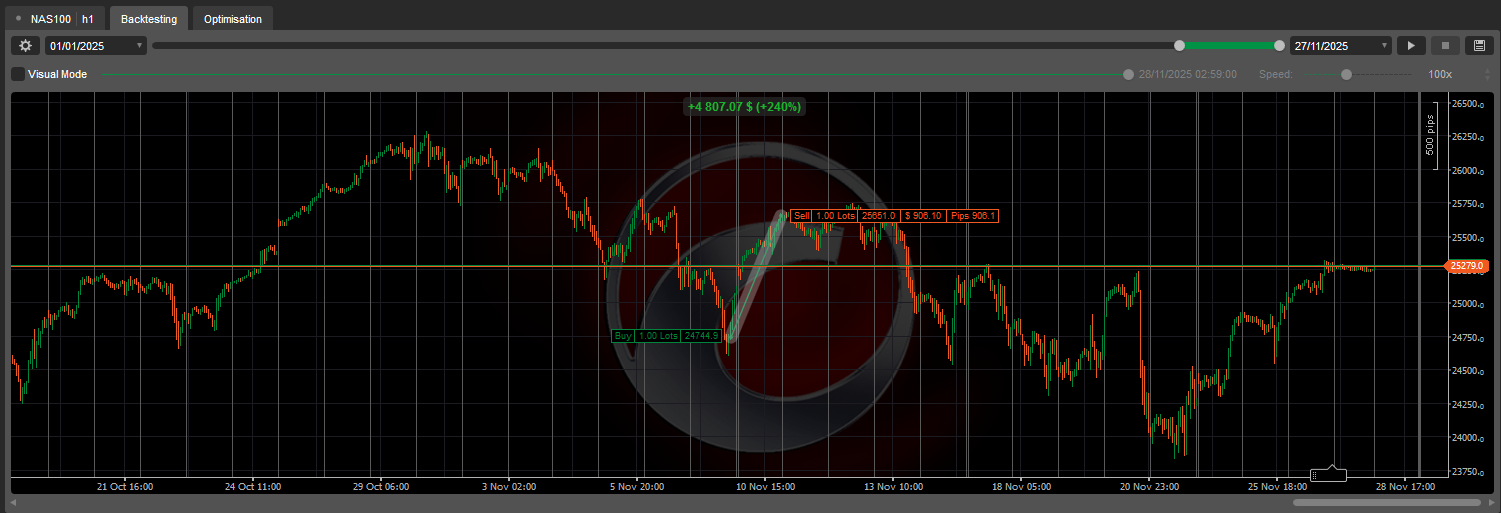

2. Backtest snapshot (cTrader Historical Replay)

- Instrument: NAS100

- Timeframe: H1

- Test period: 01/01/2025 – 27/11/2025 (10 months 24 days)

- Starting capital: 2000,00 USD

- Ending balance: 6807,00 USD

- Net profit: 4807 USD

- Total ROI: ≈ +240%

- Profit factor: 19,19

- Total trades: 7 (all long; 6 winners / 1 losers)

- Max balance drawdown: ≈ 5,76%

With doubling the size you can reach 480% roi, 2000 > 10600 usd with only 11% DD

This is a low-frequency, high-conviction strategy: around 1 trade per month over the test window, each designed with a strongly positive R:R ratio.

3. Trading style & frequency

- Style: Swing / position trading on NAS100

- Frequency: Low – 7 trades over ~11 months

- Side: Long-only (buy-the-dip logic in bullish trends)

- Holding time: From hours to several days, capturing sections of the uptrend after extreme dips.

- No pyramiding, no stacking: Maximum 1 open position.

If you are looking for a scalper that fires hundreds of trades per month, this is not that bot.

If you want a disciplined, rules-based swing system that waits for rare, high-quality opportunities, this is exactly its design.

.png)

.png)

.png)

.png)