.png)

.png)

.png)

.png)

.png)

.png)

.png)

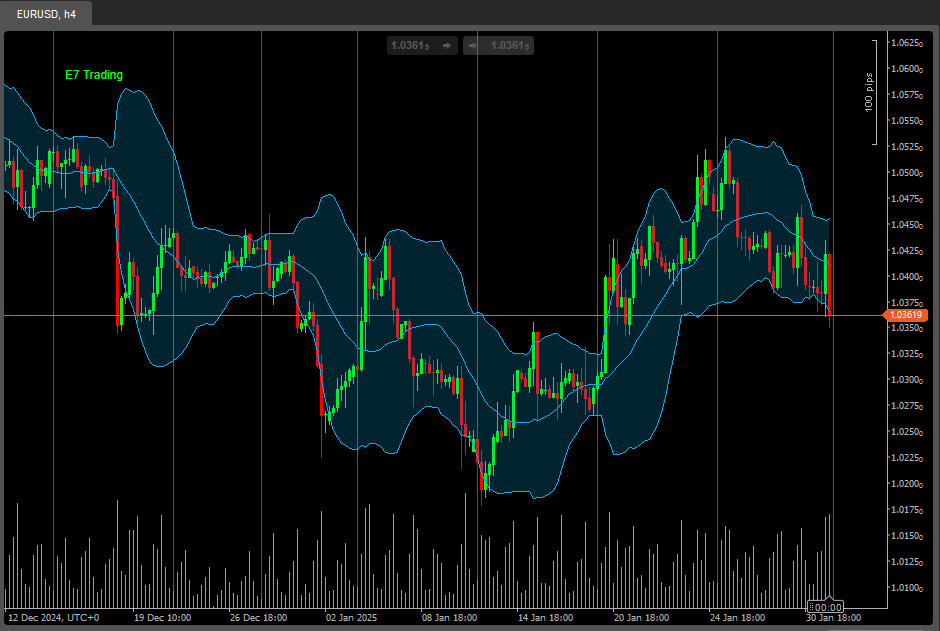

🚀 ICT Order Block Advanced - Professional Trading Indicator

Master ICT Concepts with the Most Complete Order Block System Available

ICT Order Block Advanced is the ultimate tool for traders following ICT (Inner Circle Trader) methodology. This isn't just an order block indicator - it's a complete institutional trading system that identifies Order Blocks, Fair Value Gaps, Liquidity Zones, Breaker Blocks, and Market Structure all in one powerful package.

💎 Why This is the Most Advanced Order Block Indicator

This indicator combines FIVE critical ICT concepts into one seamless system:

✅ Order Blocks (OBs) - Where institutions placed their orders

✅ Fair Value Gaps (FVGs) - Imbalances institutions must fill

✅ Liquidity Zones - Where stops accumulate (sweep targets)

✅ Breaker Blocks - Failed OBs that become reversal zones

✅ Market Structure - HH, HL, LH, LL identification with BOS/CHoCH

This is ICT methodology in its purest, most actionable form.

✨ Key Features That Set This Apart

🎯 Smart Order Block Detection

- Automatically identifies institutional order blocks

- Shows last 6 most recent blocks (customizable 1-15)

- Color-coded by direction (Green = Bullish, Red = Bearish)

- Auto-removes when mitigated

📊 Quality Scoring System (A+ to C)

- Grades each Order Block by quality (A+, A, B, C)

- Considers volume, size, structure, and confluence

- Higher grade = higher probability trade

- Visual transparency shows quality instantly

🎨 Fair Value Gaps (FVG) Detection

- Identifies bullish and bearish imbalances

- Customizable colors (Green/Red zones)

- Auto-removes when filled

- Shows where price will likely return

💰 Liquidity Zone Mapping

- Marks recent highs/lows (liquidity pools)

- Shows where institutions will sweep stops

- Line thickness = strength of liquidity

- Perfect for liquidity grab trades

🔄 Breaker Block Identification

- Detects when Order Blocks fail and flip

- Former support becomes resistance (and vice versa)

- Shows institutional trap zones

- Advanced traders' secret weapon

📈 Complete Market Structure

- Marks HH (Higher High), HL (Higher Low)

- Marks LH (Lower High), LL (Lower Low)

- Draws trend lines automatically

- Identifies BOS (Break of Structure) and CHoCH (Change of Character)

⚡ Volatility Filter

- Optional ATR-based filter

- Only shows OBs during high volatility

- Filters out weak/low-quality blocks

- Focus on institutional-grade setups only

🎯 How Professional ICT Traders Use This

Strategy 1: High-Quality Order Block Entry

The Setup: Market creates Order Block, indicator grades it "A+" or "A"

The Trade:

- Wait for price to return to the OB zone

- Enter when price touches OB (shows as green/red rectangle)

- Stop loss: Beyond the OB

- Target: Next liquidity zone or opposite OB

Why It Works: A+ rated blocks have highest institutional interest - volume, structure, and confluence all align. These are the blocks institutions will defend.

Strategy 2: Fair Value Gap + Order Block Confluence

The Perfect Setup:

- Order Block forms (green rectangle)

- Fair Value Gap appears at same level (lighter green zone)

- Price pulls back to this confluence zone

The Entry: Enter LONG when both zones align. Double institutional interest = double probability.

Why It's Powerful: Institutions left TWO types of inefficiencies at the same price - they WILL return here.

Strategy 3: Liquidity Sweep into Order Block

The ICT Classic:

- Identify liquidity zone (dotted line at recent low)

- Price sweeps below it (takes retail stops)

- Price immediately reverses into bullish Order Block

- ENTER LONG - institutions just grabbed liquidity and are now buying

Why This is Gold: This is how institutions operate: sweep liquidity (retail stops), then push price the other way. You're catching the reversal.

Strategy 4: Breaker Block Reversal

The Setup:

- Bullish Order Block gets mitigated (broken)

- Indicator shows it as Breaker Block (darker green dotted line)

- Price returns to test it from above

The Trade: SHORT when price touches the Breaker Block from above. What was support is now resistance.

Why It Works: Institutions failed to hold that level - they're now defending it from the opposite side.

Strategy 5: Market Structure Confirmation

Using HH, HL, LH, LL:

- Market shows HL (Higher Low) + HH (Higher High) = Bullish structure

- Order Block forms at the HL

- LONG bias only - structure confirms direction

BOS vs CHoCH:

- BOS (Break of Structure) = Trend continuation

- CHoCH (Change of Character) = Trend reversal

- Only trade OBs aligned with current structure

🔥 What Makes This Different from Basic Order Block Indicators

Basic OB indicators show order blocks only, no quality rating, no Fair Value Gaps, no liquidity zones, no breaker blocks, no market structure, and treat all OBs equally.

ICT Order Block Advanced shows complete ICT system (5 concepts), grades OB quality (A+ to C), identifies Fair Value Gaps automatically, maps liquidity zones, detects breaker blocks, marks complete market structure (HH/HL/LH/LL), has volatility filtering, and shows confluence zones.

This is the difference between a tool and a complete trading system.

🎓 Who Needs This Indicator?

✅ ICT Students - Learn and apply ICT concepts correctly

✅ Order Block Traders - Get quality-rated OBs with confluence

✅ Smart Money Traders - See all institutional footprints

✅ Liquidity Traders - Identify sweep opportunities

✅ Structure Traders - Automated HH/HL/LH/LL marking

✅ Serious Traders - Complete system, not just one concept

⚙️ Fully Customizable

Order Block Settings:

- Show last X blocks (1-15, default 6)

- Mitigation method (Close or Wick)

- Volatility filter on/off

- Custom colors (Bullish/Bearish)

Quality Scoring System:

- Enable/disable scoring

- Adjust weights: Volume, Size, Structure, Confluence

- Custom transparency by quality

Confluence Features:

- Show/hide Fair Value Gaps (custom colors)

- Show/hide Liquidity Zones (custom colors)

- Show/hide Breaker Blocks (custom colors)

Market Structure:

- Show/hide HH/HL/LH/LL markers

- BOS/CHoCH sensitivity (1-10)

- Label offset adjustment

- Automatic trend line drawing

🛡️ Risk Management Built-In

Stop Loss Placement:

- Just beyond the Order Block boundary

- Below/above the Breaker Block

- Outside the Fair Value Gap

Entry Confirmation:

- Wait for A or A+ rated blocks

- Look for confluence (OB + FVG + Liquidity)

- Confirm with market structure (HH/HL for longs)

Position Sizing:

- Larger on A+ blocks with confluence

- Medium on A-rated blocks

- Smaller on B/C blocks or standalone setups

Profit Targets:

- Next liquidity zone

- Opposite Order Block

- Fair Value Gap on other side

- Market structure levels (HH/LL)

🚀 The Complete ICT System You Need

This indicator answers every ICT trader's questions:

✅ Where are the Order Blocks? (Green/Red rectangles with grades)

✅ Which OBs are highest quality? (A+, A, B, C ratings)

✅ Where are the Fair Value Gaps? (Light green/red zones)

✅ Where's the liquidity? (Dotted lines at highs/lows)

✅ Any Breaker Blocks active? (Darker dotted lines)

✅ What's the market structure? (HH, HL, LH, LL markers)

✅ Is this BOS or CHoCH? (Trend lines show structure breaks)

Stop piecing together multiple indicators. Get the complete ICT system.

📈 Works on All Markets and Timeframes

- Forex - All pairs (ICT's primary market)

- Indices - NAS100, US30, UK100, SPX500, GER40

- Commodities - Gold, Silver, Oil

- Cryptocurrencies - Bitcoin, Ethereum

- Timeframes - 1min to Daily (5min-1H optimal for ICT)

Note: ICT concepts work best on liquid markets with institutional participation.

🎁 Master ICT Trading Today

Stop struggling with partial systems. Get the complete ICT methodology in one indicator.

See Order Blocks. Rate quality. Find confluence. Trade structure. Follow liquidity.

Compatible with cTrader. One-time purchase, lifetime updates.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)