.png)

📌 What the Indicator Does

MarketStructureOscSignals is a pure price-action signal tool.

It:

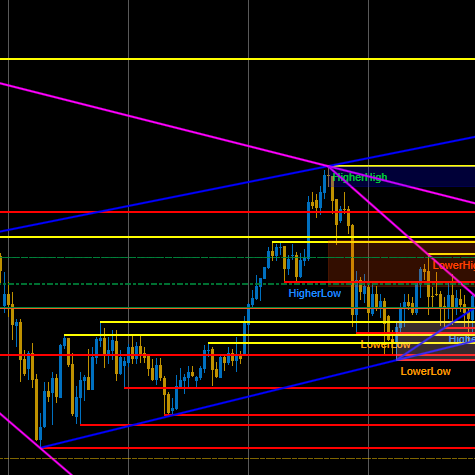

- Detects swing highs and swing lows using a left/right lookback.

- Tracks whether those swings are forming:

- Higher Highs + Higher Lows → Bullish structure

- Lower Highs + Lower Lows → Bearish structure

- When the structure switches:

- From bearish → bullish → it plots a BUY signal

- From bullish → bearish → it plots a SELL signal

So every signal represents a true change in market structure, not just a moving average crossover.

⚙️ Inputs & How to Set Them

1. Swing Left / Swing Right

These control how “strict” a swing high/low is.

- Swing Left (default 2)

Number of bars to the left of the swing that must have lower highs (for a swing high) or higher lows (for a swing low). - Swing Right (default 2)

Number of bars to the right that must also confirm the swing.

How to use:

- Small values (1–2):

- More swings, more signals

- Works well on higher timeframes (H1, H4, D1)

- Larger values (3–4+):

- Only major structural turns

- Fewer but stronger signals

- Good on lower timeframes to avoid noise

2. Min Bars Between Signals

Minimum number of bars that must pass between two signals.

- Avoids clustering of arrows on every tiny pullback.

- Example:

- Set to

3→ at least 3 bars between one signal and the next. - On very fast charts (M1–M5) you might want

5–10. - On H1 or higher,

2–3is usually enough.

- Set to

3. Arrow Offset (pips)

How far the arrow and label are placed from the candle (in pips).

- For Forex:

5–10pips usually looks good.

- For indices (US500, US100, etc.):

- Use a larger offset (e.g. 20–50 “pips” depending on broker pip size).

If the arrows overlap the candles, increase this value.

If they are too far away, decrease it.

4. Show BUY/SELL Text

true→ shows both an arrow (↑/↓) and the text “BUY” or “SELL”.false→ only arrows.

If the chart feels cluttered, you can hide the text and keep just the arrows.

🔍 How Signals Are Generated (Logic)

Internally the indicator:

- Keeps track of the two most recent swing highs and two most recent swing lows:

_prevHigh,_lastHigh_prevLow,_lastLow

- From these it checks:

- Are highs and lows both rising?

- → Bullish trend (

StructureTrendSignal.Bullish)

- → Bullish trend (

- Are highs and lows both falling?

- → Bearish trend (

StructureTrendSignal.Bearish)

- → Bearish trend (

- If they’re not aligned, the previous trend is kept.

- Every time the structural trend changes:

Bearish → Bullish→ BUY signalBullish → Bearish→ SELL signal

- It also ensures:

- Trend was not

Unknown(so not at the very beginning). - Enough bars have passed since the last signal (

MinBarsBetweenSignals).

- Trend was not

This means each arrow marks a true structural shift, not random noise.

📈 How to Read BUY/SELL Signals on the Chart

✅ BUY Signal

What you see:

- An up arrow

↑under the candle - Optionally the text “BUY” near the arrow

What it means:

- Structure changed from bearish → bullish.

- Recent swing highs and lows are now both moving up.

- Market is likely transitioning into a new uptrend or resuming bullish structure.

How to use it:

- Look for long entries:

- On the signal candle or on the next few candles.

- Preferably after a small pullback to a support level (previous swing low, demand zone, VWAP, VA low, etc.).

- Use tools like Kalman Trend / EMA / Volume Profile to filter:

- Only take BUYs when higher timeframe or Kalman is also bullish.

✅ SELL Signal

What you see:

- A down arrow

↓above the candle - Optionally the text “SELL”

What it means:

- Structure changed from bullish → bearish.

- Swing highs and lows are now both moving down.

- Market is likely entering a downtrend or resuming bearish structure.

How to use it:

- Look for short entries:

- On the signal candle or on following candles near resistance.

- Ideal after a retest of a broken support (now resistance), VAH, supply zone, etc.

🎯 Practical Trading Uses

1. As a Standalone Entry Tool

Simple rule-set:

- Buy Setup

- Wait for a BUY arrow.

- Place a long order at/near the signal candle.

- Stop loss below recent swing low.

- Target previous swing high or a key resistance.

- Sell Setup

- Wait for a SELL arrow.

- Place a short order at/near the signal candle.

- Stop loss above recent swing high.

- Target previous swing low or key support.

This is the most basic usage and works best on H1, H4, and D1, where structure is cleaner.

2. As a Confirmation Tool with Your Other Indicators

This is where it gets powerful.

🔹 With Kalman Filter Trend

- Only take BUY signals when:

- Kalman Trend is sloping up and price is at or above the Kalman line.

- Only take SELL signals when:

- Kalman Trend is sloping down and price is at or below the Kalman line.

Effect:

Kalman gives you a smooth trend, MarketStructureOscSignals gives you precise structure shifts. Together they filter out a lot of bad trades.

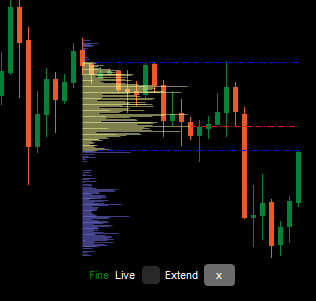

🔹 With Volume Profile / Support & Resistance

- Strong BUY:

- BUY arrow appears near VA Low, previous swing low, or liquidity sweep, with rejection.

- Strong SELL:

- SELL arrow appears near VA High, previous swing high, or liquidity sweep at the top.

Here the signal is not just a technical pattern but is also anchored in liquidity and order flow zones.

3. For Scaling In / Out

You can also use new signals as:

- Scale-In Points

Add to a position when a new signal appears in the same direction as your existing trade and the higher timeframe is aligned. - Early Exit / Partial Exit

If you’re long and a SELL signal appears against your position (especially near key structure), you can: - Close a part of the position

- Or tighten stops

🧪 Recommended Starting Settings

For Forex H1 / H4:

Swing Left = 2Swing Right = 2Min Bars Between Signals = 3Arrow Offset = 5–10 pips

For Indices M15 / H1:

Swing Left = 2–3Swing Right = 2–3Min Bars Between Signals = 5Arrow Offsetadapted to symbol (e.g. 20–50 “pips” depending on broker)

For Crypto H1 / H4:

- Slightly higher swings to filter noise:

Swing Left = 3Swing Right = 3Min Bars Between Signals = 4–6

Always backtest with your preferred instrument and timeframe to fine-tune Swing and MinBarsBetweenSignals.

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

.png)