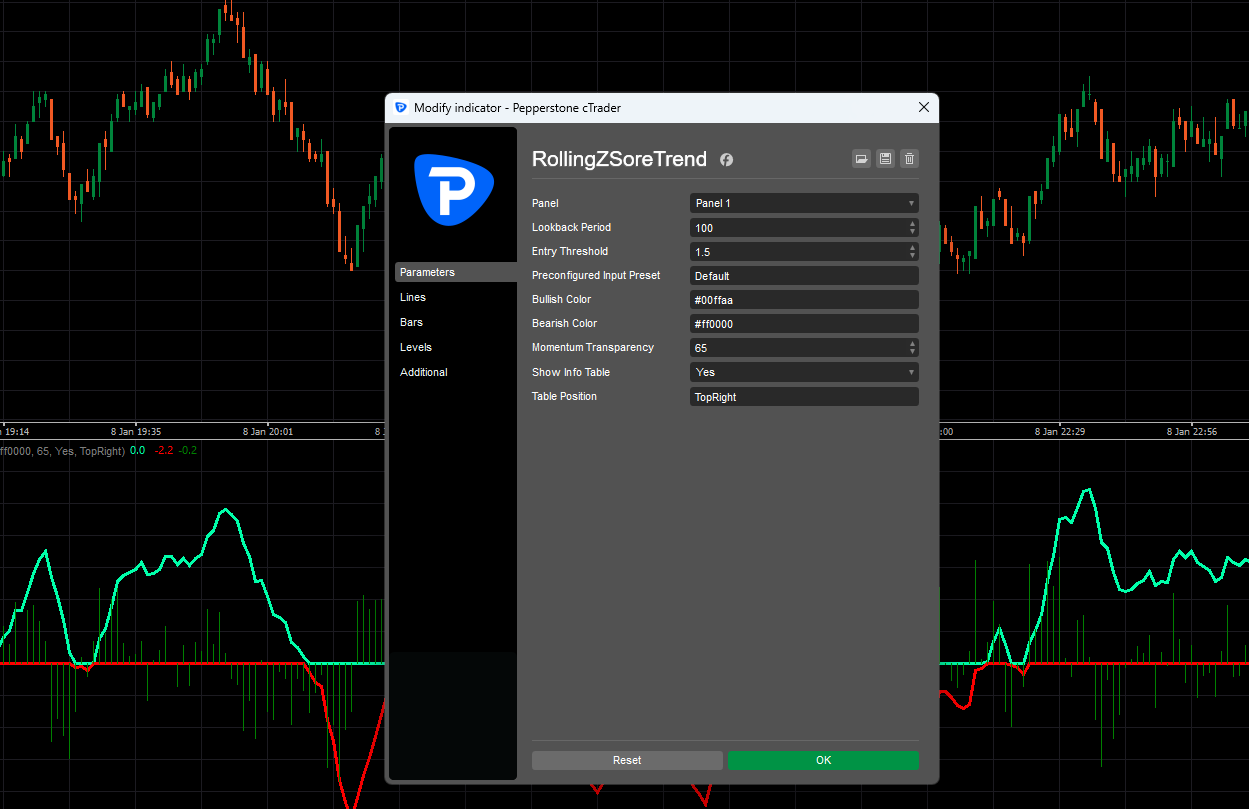

Rolling Z-Score Trend

A clean, statistical trend & momentum indicator that transforms price into a rolling Z-Score—making regime shifts, momentum bursts, and threshold events easy to spot.

Overview

Rolling Z-Score Trend normalizes price relative to its recent mean and volatility using a rolling Z-Score. This makes market conditions easier to compare across instruments and sessions, because the indicator adapts to changing volatility automatically.

Instead of guessing whether a move is “big enough,” you see how far price is from its statistical average in standard deviations—then get a smoothed signal and clear threshold levels.

How It Works

- Rolling Mean + Volatility

The indicator calculates a moving average (mean) and standard deviation over the selected Lookback Period. - Z-Score Calculation

Z-Score = (Price − Mean) / Standard Deviation

This shows whether price is statistically above or below its recent “normal range.” - Smoothing for Readability

A short EMA is applied to reduce noise and produce a cleaner trend signal. - Momentum Background

A momentum histogram tracks the change in the smoothed Z-Score to highlight acceleration and deceleration.

Key Features

✅ Directional Z-Score Lines (Split Output)

- ZScore Up displays positive values (bullish bias)

- ZScore Down displays negative values (bearish bias)

This makes direction instantly visible.

✅ Threshold Zones (Overbought / Oversold Framework)

Set an Entry Threshold (e.g., 1.5 or 2.0) and the indicator draws:

- Zero line (neutral regime)

- Upper threshold (+EntryThreshold)

- Lower threshold (−EntryThreshold)

✅ Preset-Based Configuration

Includes quick presets such as:

- Scalping

- Swing Trading

- Trend Following

Each preset adjusts lookback/threshold inputs for that style.

✅ Momentum Histogram

Shows the rate of change in the smoothed Z-Score (scaled) to help:

- identify momentum bursts early

- detect fading trends

- time entries after a reset

✅ Optional Info Table

A compact table can display:

- current Z-Score value + bias (Bullish/Bearish)

- momentum state (Rising/Falling)

- current threshold level

You can choose the table position (TopRight, BottomLeft, etc.).

✅ Event Logging (Optional)

Can print messages for key events such as:

- bullish/bearish crossover through zero

- entering/exiting the overbought zone

- entering/exiting the oversold zone

How Traders Use It (Practical)

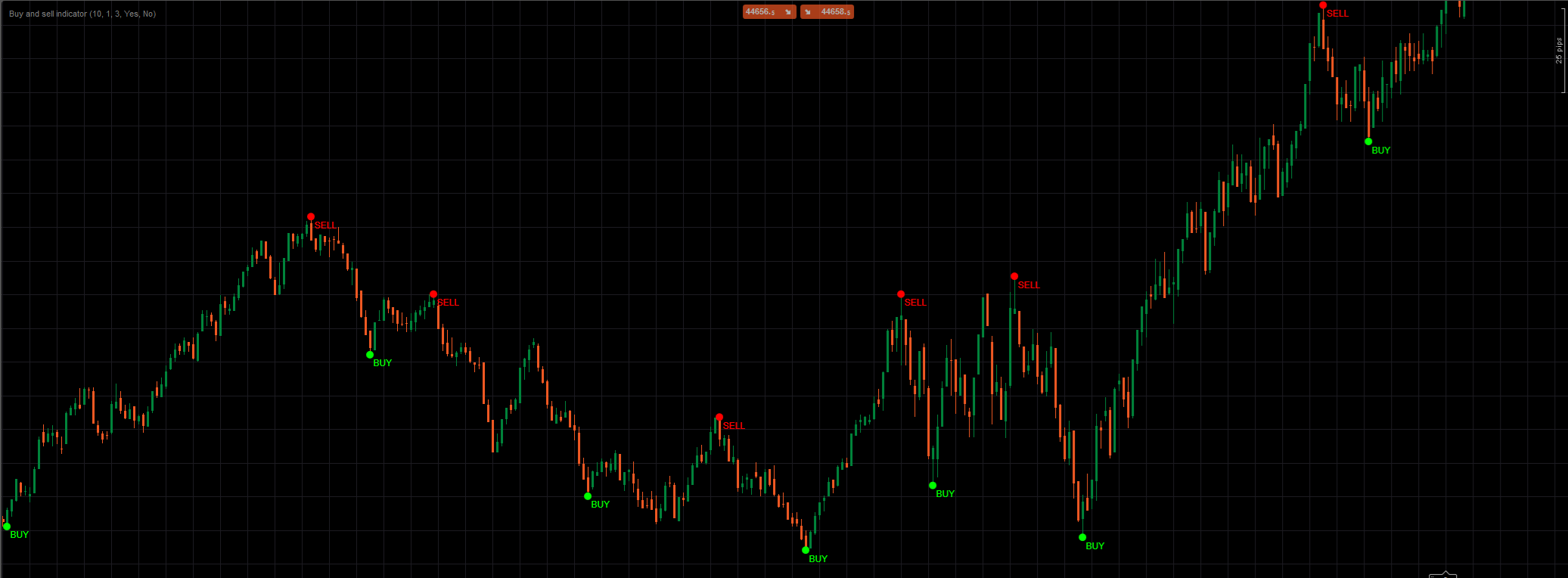

1) Regime / Bias

- Z-Score above 0 → bullish statistical regime

- Z-Score below 0 → bearish statistical regime

- Frequent flips around 0 → potential range / chop conditions

2) Extremes & Mean Reversion

- Above +threshold → statistically stretched (often “overbought”)

- Below −threshold → statistically stretched (often “oversold”)

Used for: - mean-reversion setups (fading extremes)

- confirming strong trends (holding beyond thresholds)

3) Momentum Timing

- Momentum rising → acceleration

- Momentum falling → deceleration

Useful for managing entries/exits and avoiding late signals.

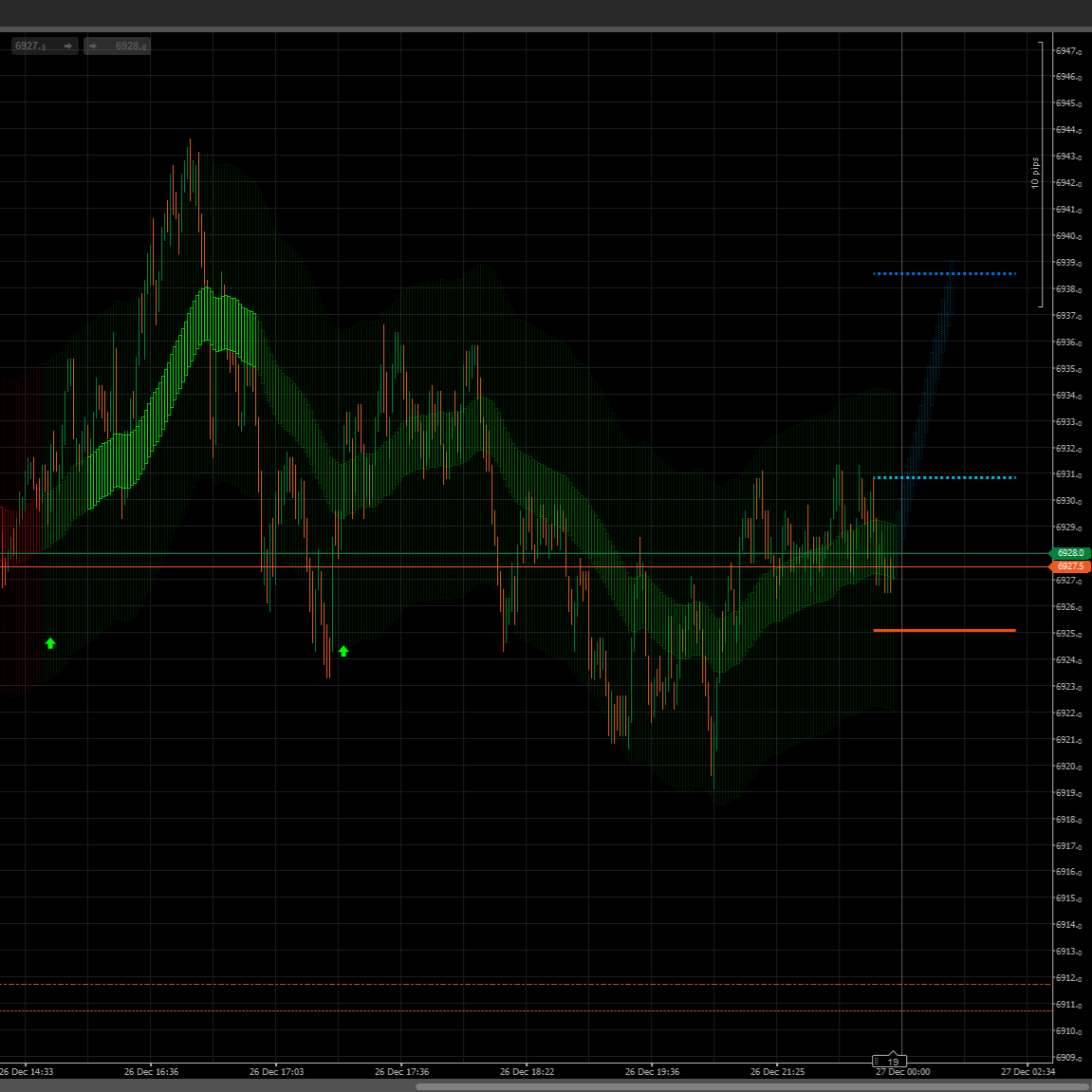

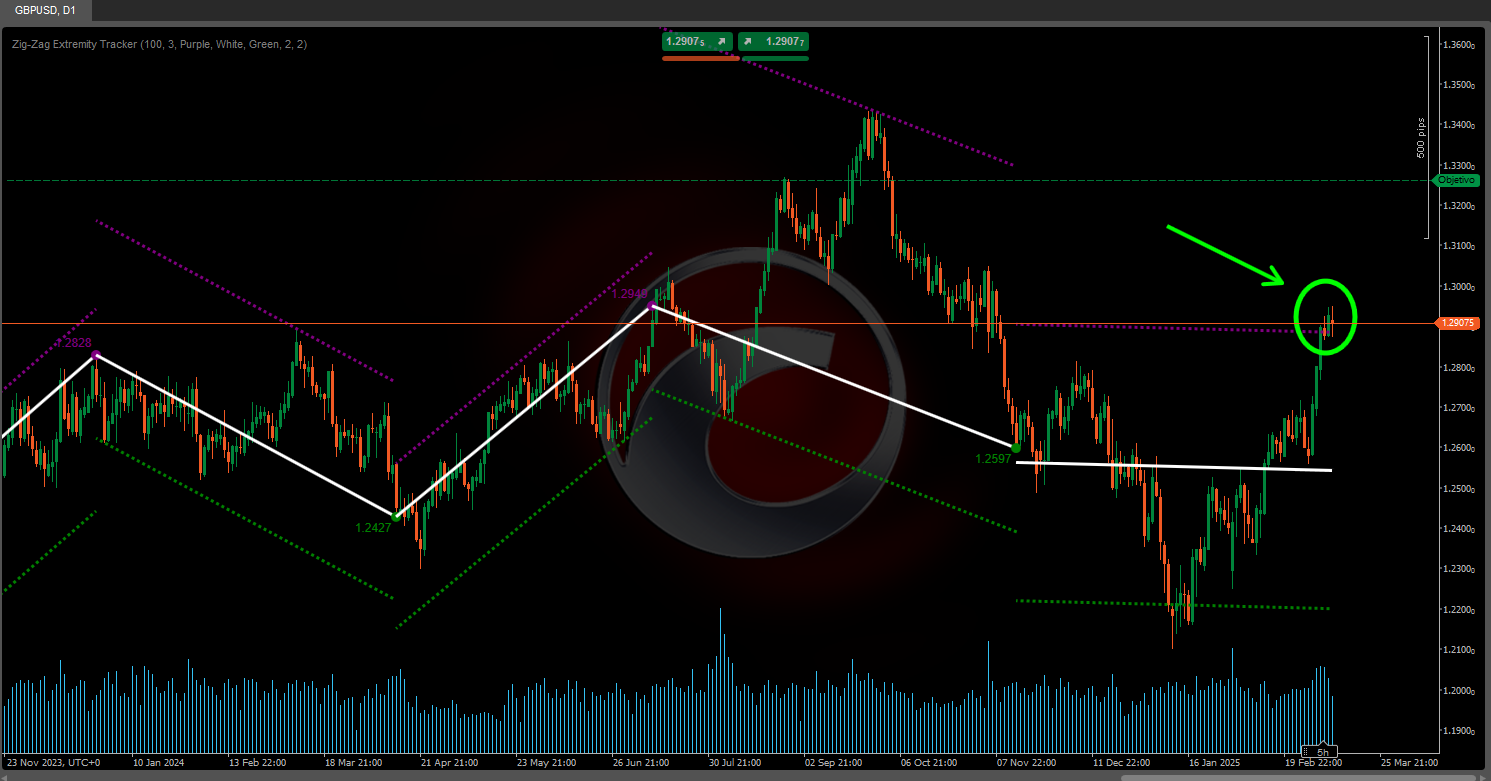

Best Markets / Timeframes

Works well across indices, FX, metals, and crypto. The volatility-normalized approach helps it adapt to different instruments and conditions.

Suggested Starting Settings

- Scalping: Lookback 10–14, Threshold 1.0–1.4

- Swing: Lookback 20–30, Threshold 1.5–2.0

- Trend: Lookback 35–50, Threshold 2.0–2.5

Disclaimer

This indicator is a tool for analysis and education. It does not guarantee results. Always use proper risk management and confirm signals with your trading plan.

.jpg)