AlgoCorner McGinley Dynamic

Indikator

47 muat turun

Version 1.1, Jan 2026

Windows, Mac

McGinley Dynamic is one of those underrated technical tools that actually came from a very practical observation about moving averages.

It was created by John R. McGinley, CMT, and its main purpose is to solve the common problems of traditional moving averages — namely, lag and whipsaw caused by market speed fluctuations.

Here’s what it tries to address specifically:

🧩 1. Lag in moving averages

- Regular moving averages (SMA, EMA) lag behind price because they’re based on fixed lookback periods.

- The McGinley Dynamic automatically adapts its smoothing based on market speed.

When the market moves quickly, it speeds up its adjustment; when the market slows, it smooths more gently.

👉 Result: it tracks price more closely without overreacting.

🌪️ 2. Whipsaws during volatile periods

- Traditional MAs can give false signals in choppy markets.

- McGinley introduced a dynamic denominator that adjusts in proportion to how fast the market is moving.

This helps reduce noise and avoid unnecessary crossover signals.

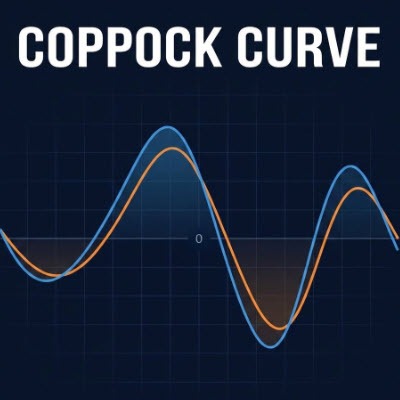

⚙️ 3. Smoother, self-correcting behavior

- It acts almost like an auto-adjusting moving average, meaning you don’t need to fine-tune the period as much.

- This makes it less sensitive to user input and market volatility — kind of a “smart” moving average.

0.0

Ulasan: 0

Ulasan pelanggan

Belum ada ulasan untuk produk ini. Anda sudah mencuba produk tersebut? Jadilah yang pertama untuk berkongsi pendapat anda!

Forex

EURUSD

GBPUSD

Lebih banyak produk daripada penulis ini

Anda juga mungkin suka

8

Jualan

264

Pemasangan percuma

![Logo "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo "Session Volume Profile (SVP) [Iridio Capital]"](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![Logo "High-Low Divergence [Iridio Capital]"](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)