.png)

.png)

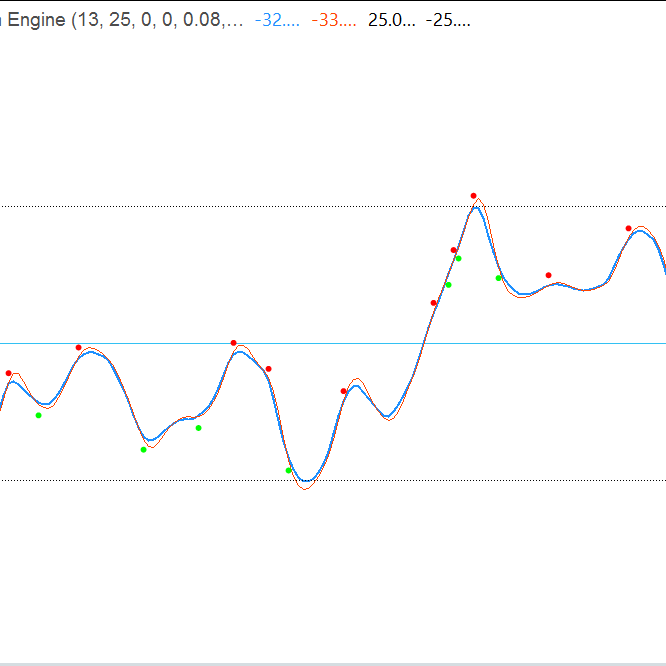

This MMXM Structure is essentially a market structure swing mapping tool that traders could use to identify sell setups (or buy setups) based on swing highs/lows and price extremes.

The MMXM Structure is an advanced price action analysis tool designed to map market structure and highlight potential trading opportunities with precision.

This indicator automatically detects and marks swing highs and swing lows over a configurable lookback period, connecting them with a ZigZag framework to make market direction and structural changes immediately visible.

For sell-side setups, the indicator emphasizes upper market extremities where price has reached significant resistance or exhaustion points. These are displayed in red, serving as potential short-entry reference levels. The tool also projects body envelope extremity lines, showing the maximum and minimum candle body reach within a swing, allowing traders to assess whether price is overextended before reversal.

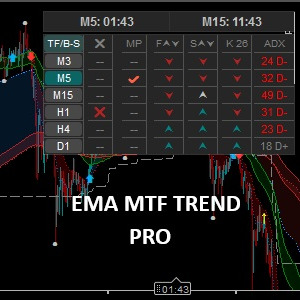

Key Features:

- Automated Swing Detection: Identifies and marks pivot highs and lows without lagging repaint artifacts.

- ZigZag Structure Visualization: Connects pivot points to make trend flow and structural breaks easy to read.

- Upper Extremity Markers (Sell Focus): Highlights significant highs that may serve as supply zones or resistance.

- Body Envelope Extremities: Plots dotted reference lines above and below swings to gauge price extension.

- Extension Line Projection: Optionally extends the latest swing line to the current bar for live price tracking.

- Labeling Option: Displays exact price levels at swing points for precision targeting.

- Customizable Appearance: Adjustable colors, lengths, and display options for individual trading styles.

How to Use for Selling or Buying:

- Wait for an upper extremity marker (red) to form at a significant high or low.

- Confirm potential reversal with additional confluence (e.g., rejection candle, divergence, or key level).

- Use the extremity and ZigZag trend line as a resistance reference.

- Enter short or long positions with stops above the last swing high or low and targets set near the next swing low or high or structure break.

If you have any questions or run into any issues, feel free to contact me. I'm happy to help You!

Disclaimer:

By using my algorithms, you acknowledge that trading involves inherent risks and that past performance does not guarantee future results. It is essential that you have a solid risk management strategy in place and, above all, that you remain disciplined in adhering to stop-loss levels. Failure to manage risk properly can lead to significant losses. I am not responsible for any financial outcomes resulting from the use of these algorithms. Trade responsibly and always follow proper risk management practices.

Bless up! 🙌

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

.jpg)

.jpg)

.jpg)

![Логотип продукта "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Логотип продукта "Session Volume Profile (SVP) [Iridio Capital]"](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![Логотип продукта "High-Low Divergence [Iridio Capital]"](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)