Hammer Pattern Indicator

Indikator

259 muat turun

Version 1.0, Mar 2025

Windows, Mac

5.0

Ulasan: 1

Sejak 21/02/2025

461.42M

Volum yang didagangkan

178.3K

Pip dimenangi

9

Jualan

5.44K

Pemasangan percuma

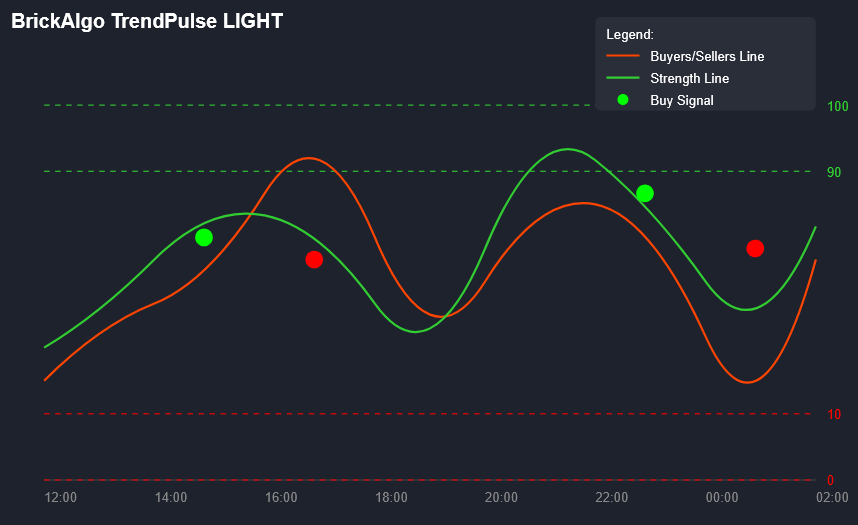

Hammer Pattern Indicator – Strategy Explanation

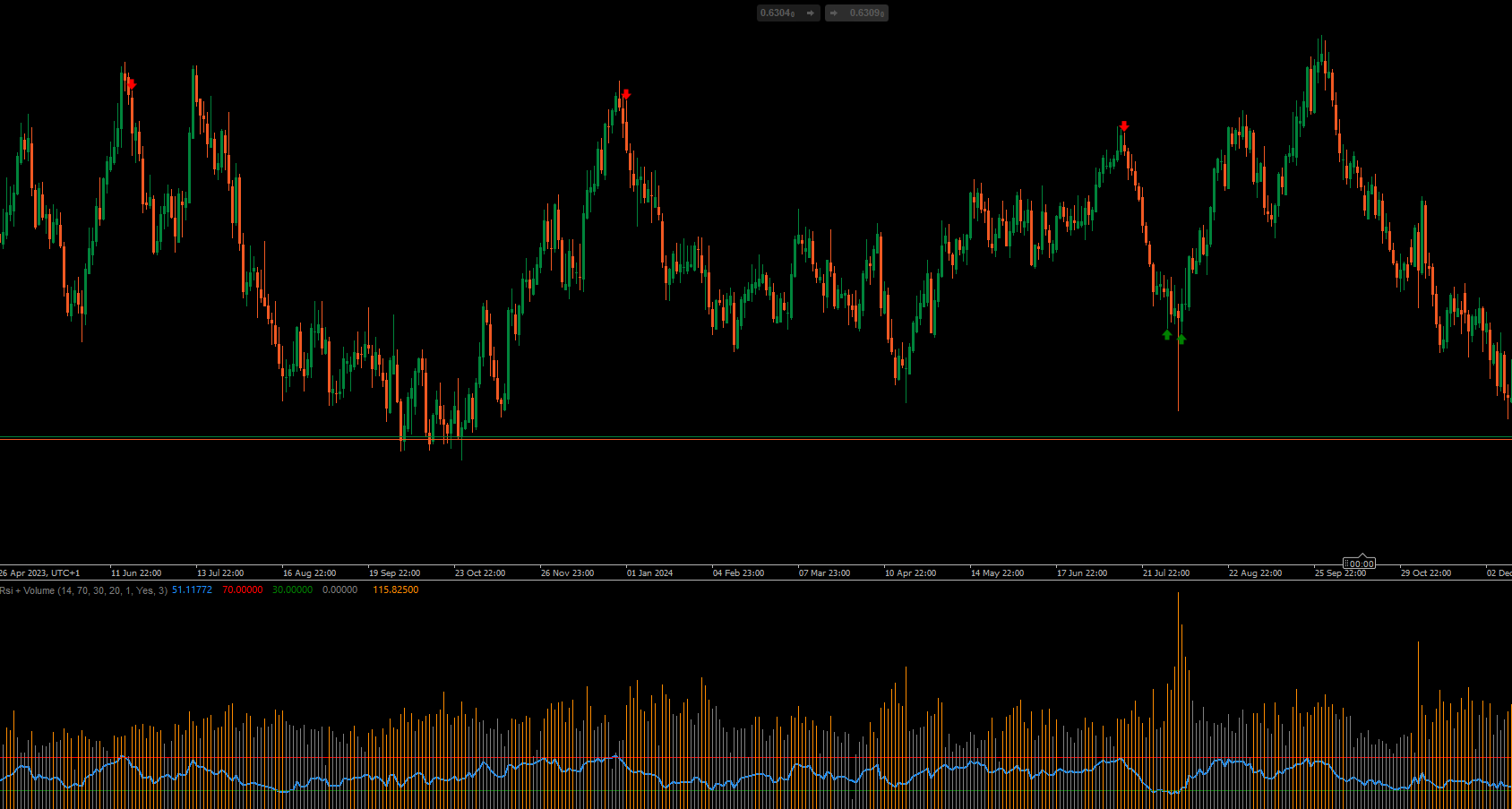

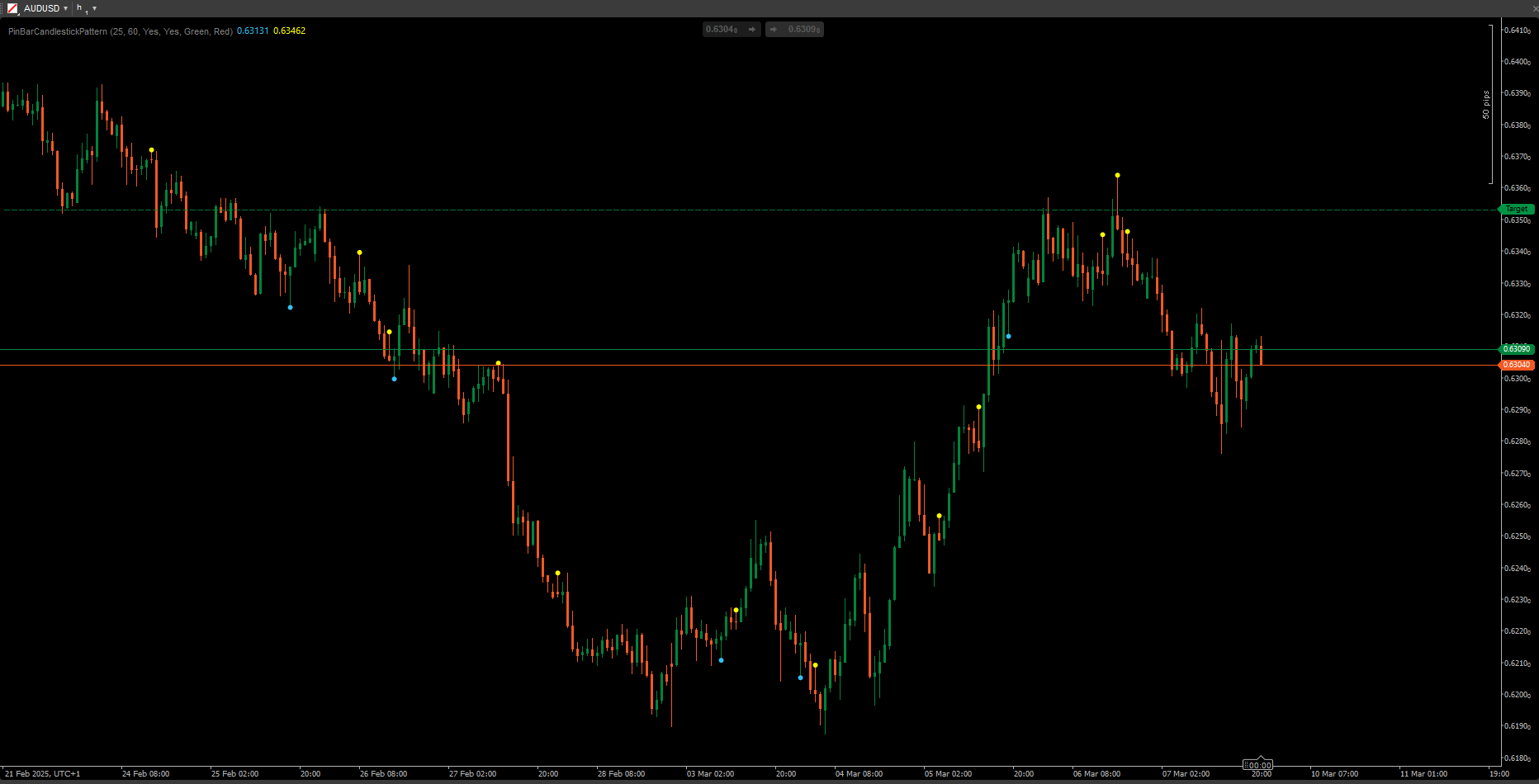

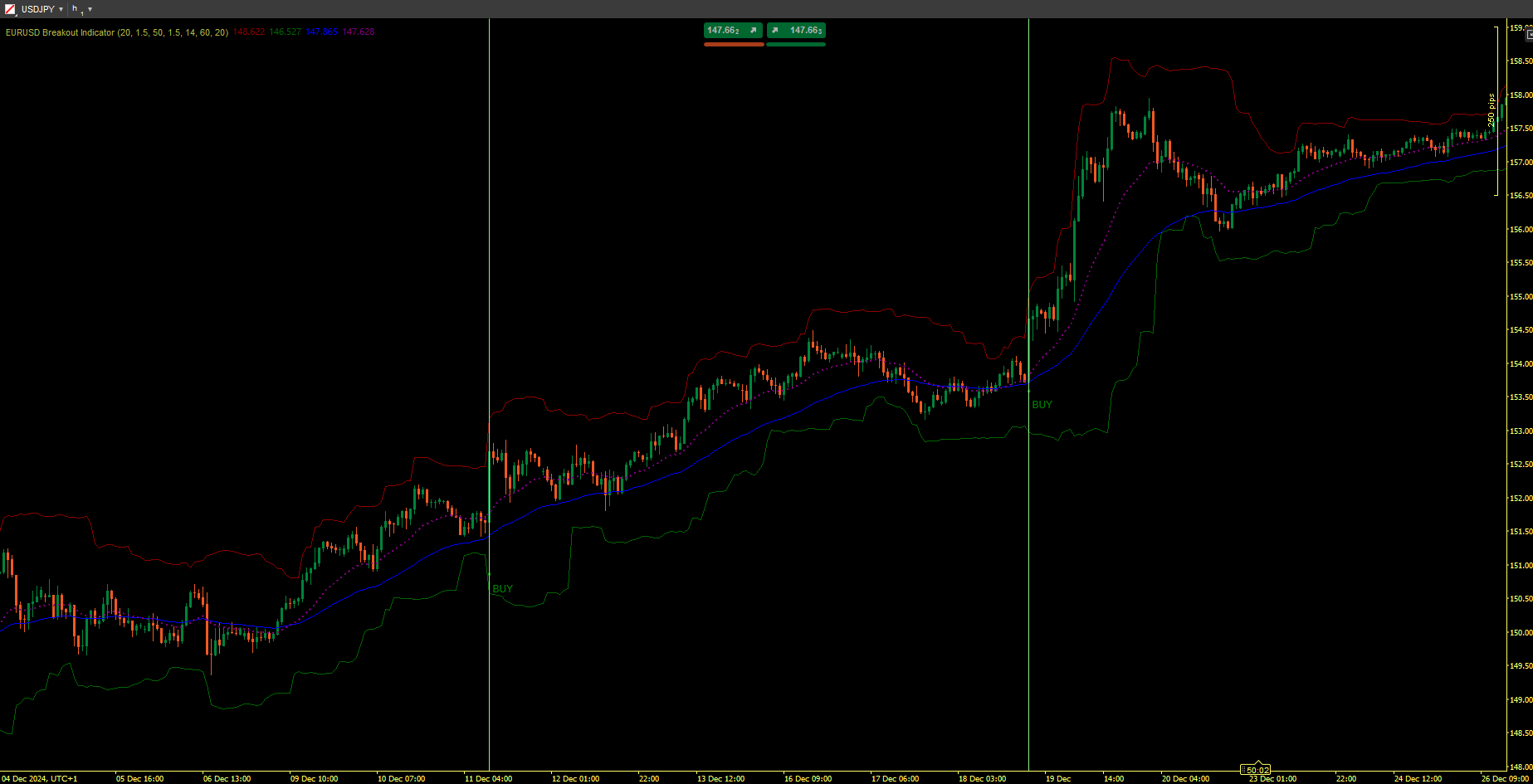

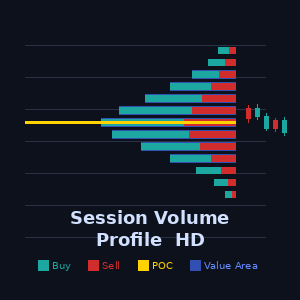

This Hammer Pattern Indicator is a candlestick-based reversal signal that identifies bullish hammer patterns in a downtrend. It is designed to detect potential trend reversals and highlight buying opportunities.

How It Works

1️⃣ Detects Downtrend

- The candle’s closing price must be lower than the close 3 bars ago, indicating a potential downtrend.

2️⃣ Validates Hammer Candlestick Structure

- Small Body: The body of the candle is relatively small (≤ 30% of total range).

- Long Lower Shadow: The lower wick is at least 2 times the body size (shows strong rejection of lower prices).

- Short Upper Shadow: The upper wick is ≤ 30% of the body size (indicating little resistance at the top).

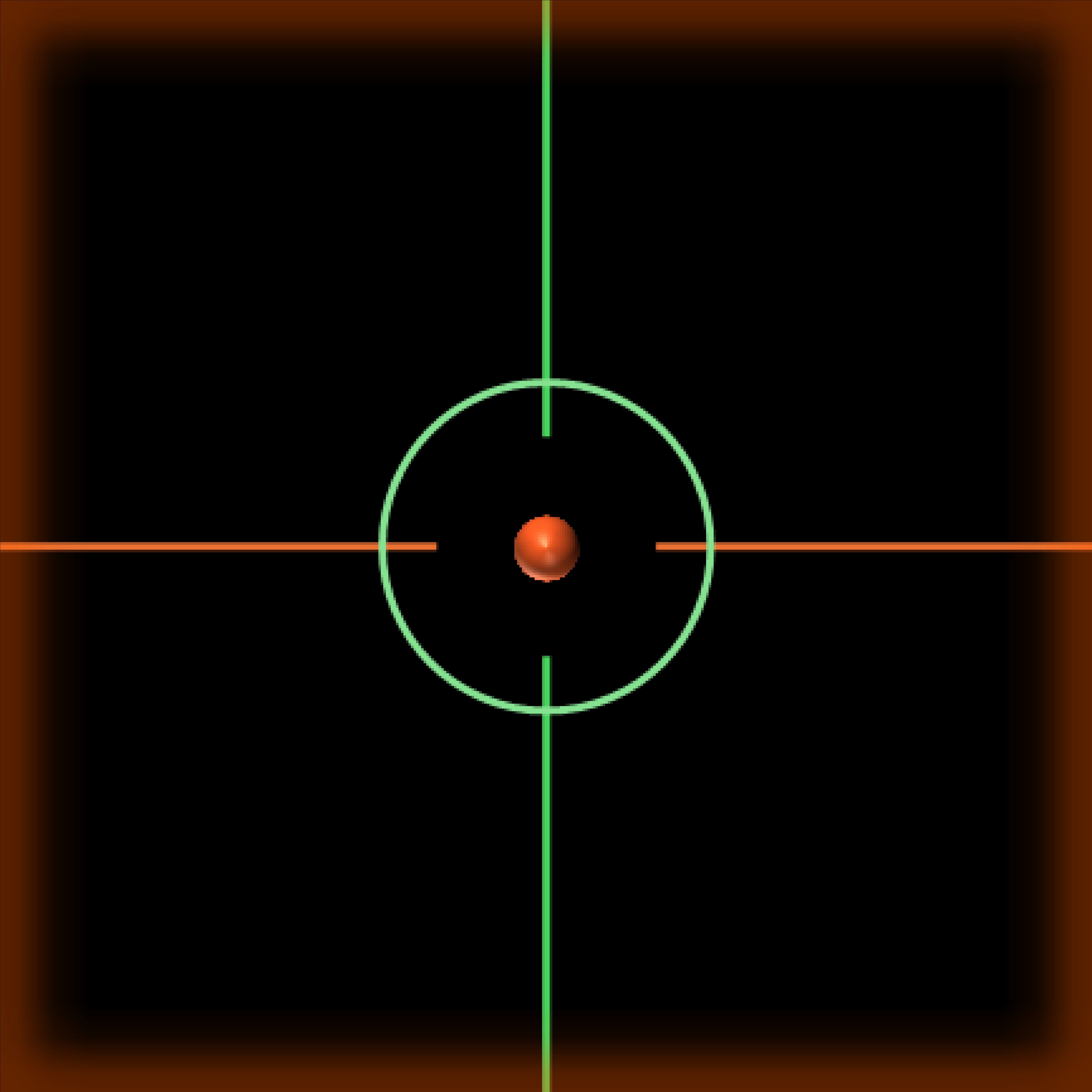

3️⃣ Plots a Buy Signal

- If all conditions are met, a red dot (or a chosen color) appears slightly below the low of the hammer candle as a visual confirmation of a potential reversal.

Key Features

✅ Filters weak signals by ensuring a prior downtrend.

✅ Customizable parameters for body size, shadow length, and colors.

✅ Simple yet effective candlestick pattern for swing traders and price action traders.

📌 Best Use: Confirm the hammer pattern with additional indicators (e.g., volume, support levels) for stronger signals! 🚀

5.0

Ulasan: 1

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

Ulasan pelanggan

August 18, 2025

Automatically detects hammer candlesticks, customizable, lightweight. Cons: No trend filter, no reliability scoring, possible false signals on low TFs.

Signal

Lebih banyak produk daripada penulis ini

Anda juga mungkin suka

Sejak 21/02/2025

461.42M

Volum yang didagangkan

178.3K

Pip dimenangi

9

Jualan

5.44K

Pemasangan percuma

![Logo "Smart Money Concepts (SMC) [Iridio Capital]"](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo "Session Volume Profile (SVP) [Iridio Capital]"](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)