.png)

.png)

.png)

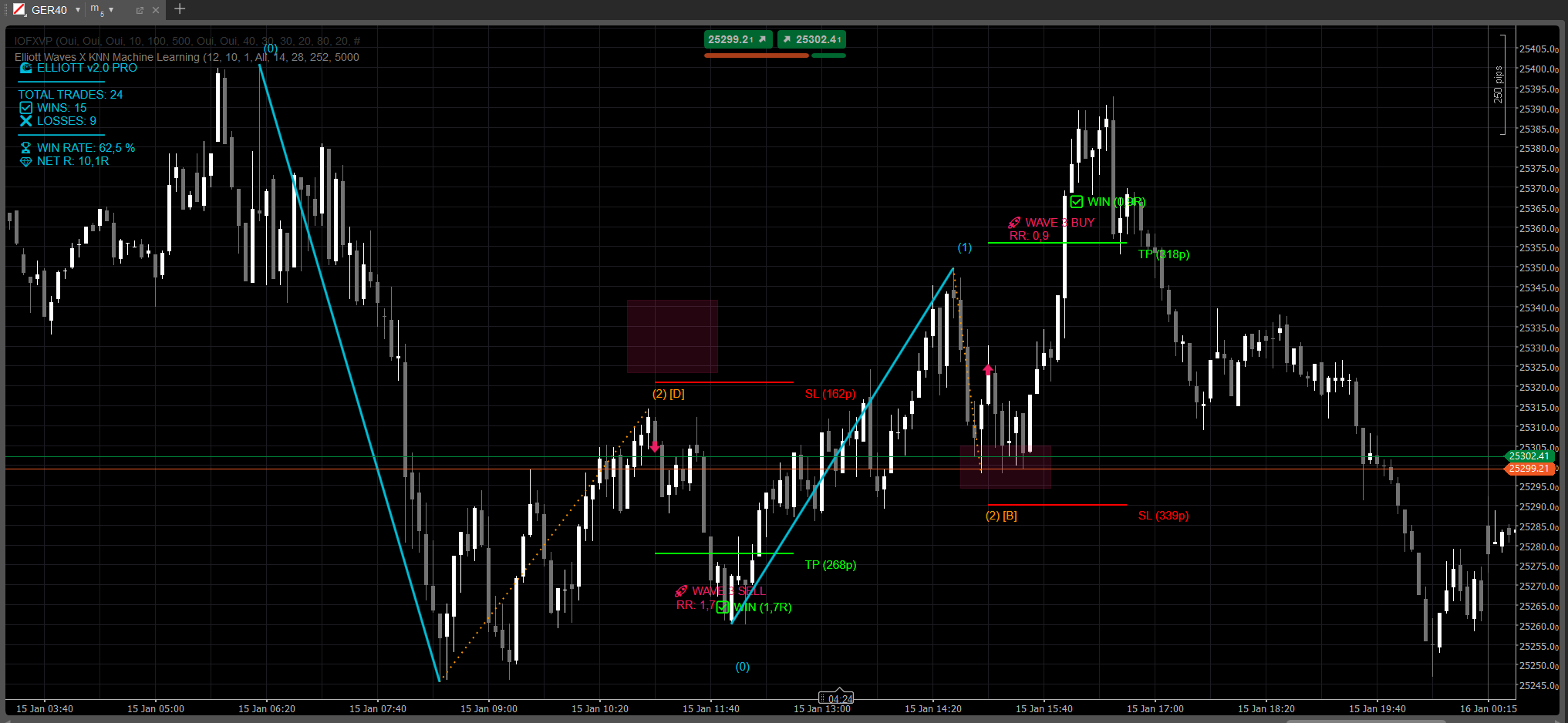

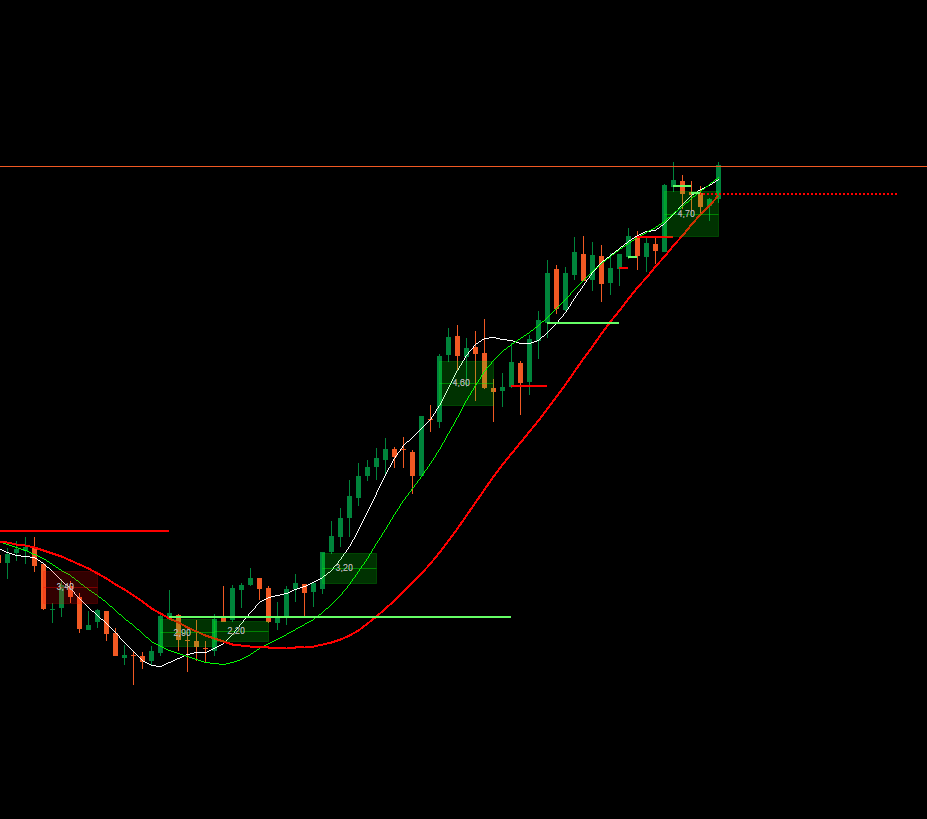

Elliott Wave-3 Continuation & Elliott Reversals

Elliott Wave Structure is an indicator designed to analyze market structure with the Elliott Wave theory.

It combines confirmed swing analysis, market structure, Elliott impulse detection, and a dedicated Wave-2 to Wave-3 continuation.

This tool was built for traders who require clarity, confirmation, and rule-based execution, not subjective drawing.

Non-Repainting Swing Engine

All calculations are based on confirmed swing points using:

- Adjustable swing depth

- Minimum price deviation (pip filter)

- Confirmation bars

Once a swing is printed, it never moves, ensuring full historical reliability.

Market Structure Analysis:

Automatically identifies and labels:

- Higher High (HH)

- Higher Low (HL)

- Lower High (LH)

- Lower Low (LL)

Elliott Wave Impulse Detection:

The indicator automatically detects complete 5-wave Elliott impulses in both directions:

- Bullish: L-H-L-H-L-H

- Bearish: H-L-H-L-H-L

It validates impulses using internal rules:

- Wave 3 strength

- Wave 2 and Wave 4 retracement logic

- Wave 5 proportionality

Each impulse is graded using a quality score (0–100) and labeled directly on the chart.

Wave-3 Continuation Setup (Primary Trading Module)

This is the core trading component of the indicator.

The system identifies Wave 0-1-2 continuation structures and prepares entries for Wave 3:

- Bullish: Low → High → Higher Low

- Bearish: High → Low → Lower High

Validation criteria include:

- Wave 2 retracement between 23.6% and 88.6%

- No invalidation through Wave 0

- Trend alignment using market structure

- Wave 1 strength relative to ATR

- Price must be sitting on OB

When validated, the indicator automatically draws:

- Wave 1 and Wave 2 structure

- OB entry zone

- Entry signal

- Stop Loss based on ATR beyond Wave 2

- Take Profit based on ATR projection

Risk & Trade Management

- Stop Loss and Take Profit are calculated dynamically using ATR

- Risk-Reward ratio is displayed directly on the chart

- Designed to avoid over-extended or low-quality setups

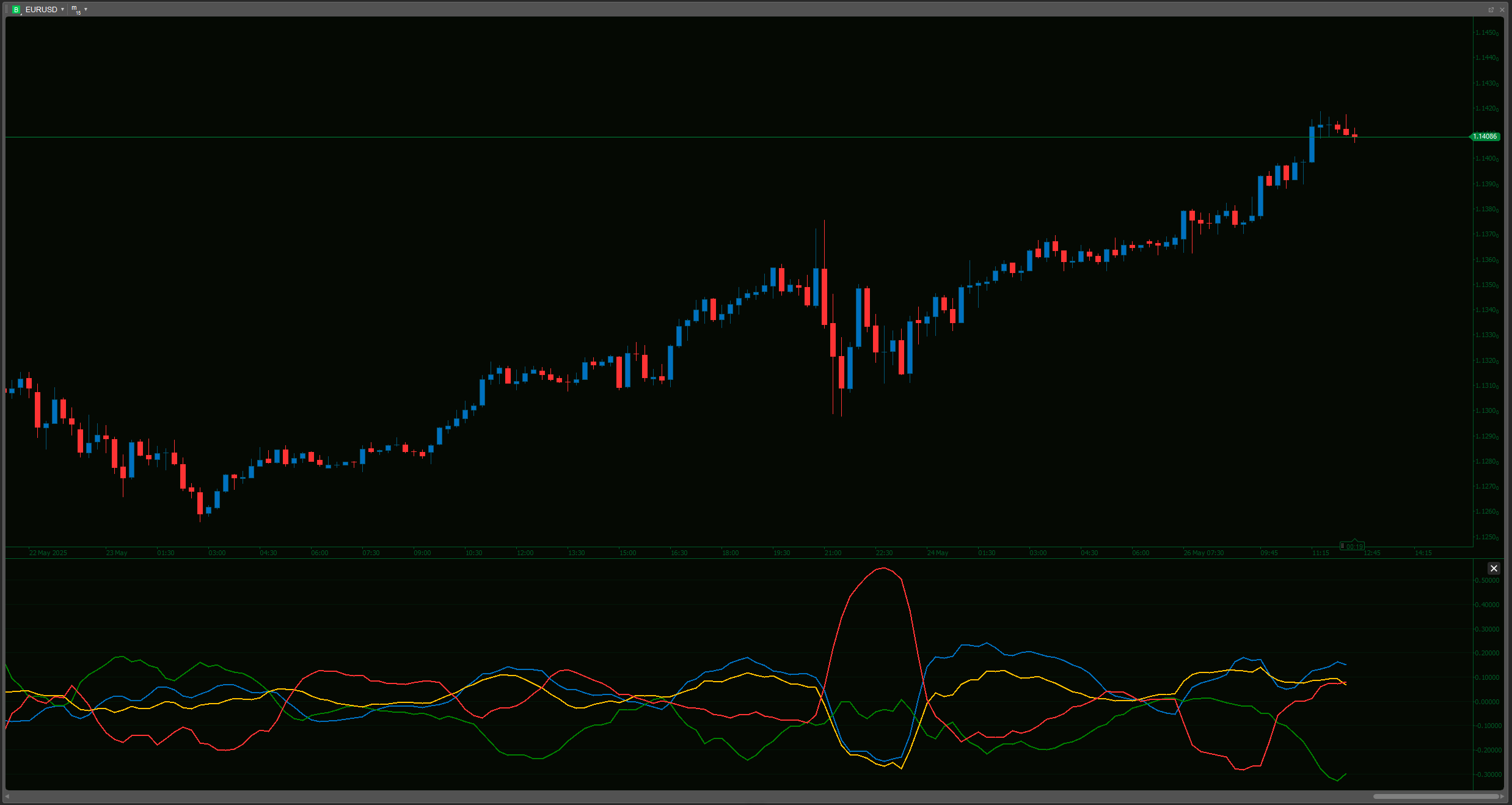

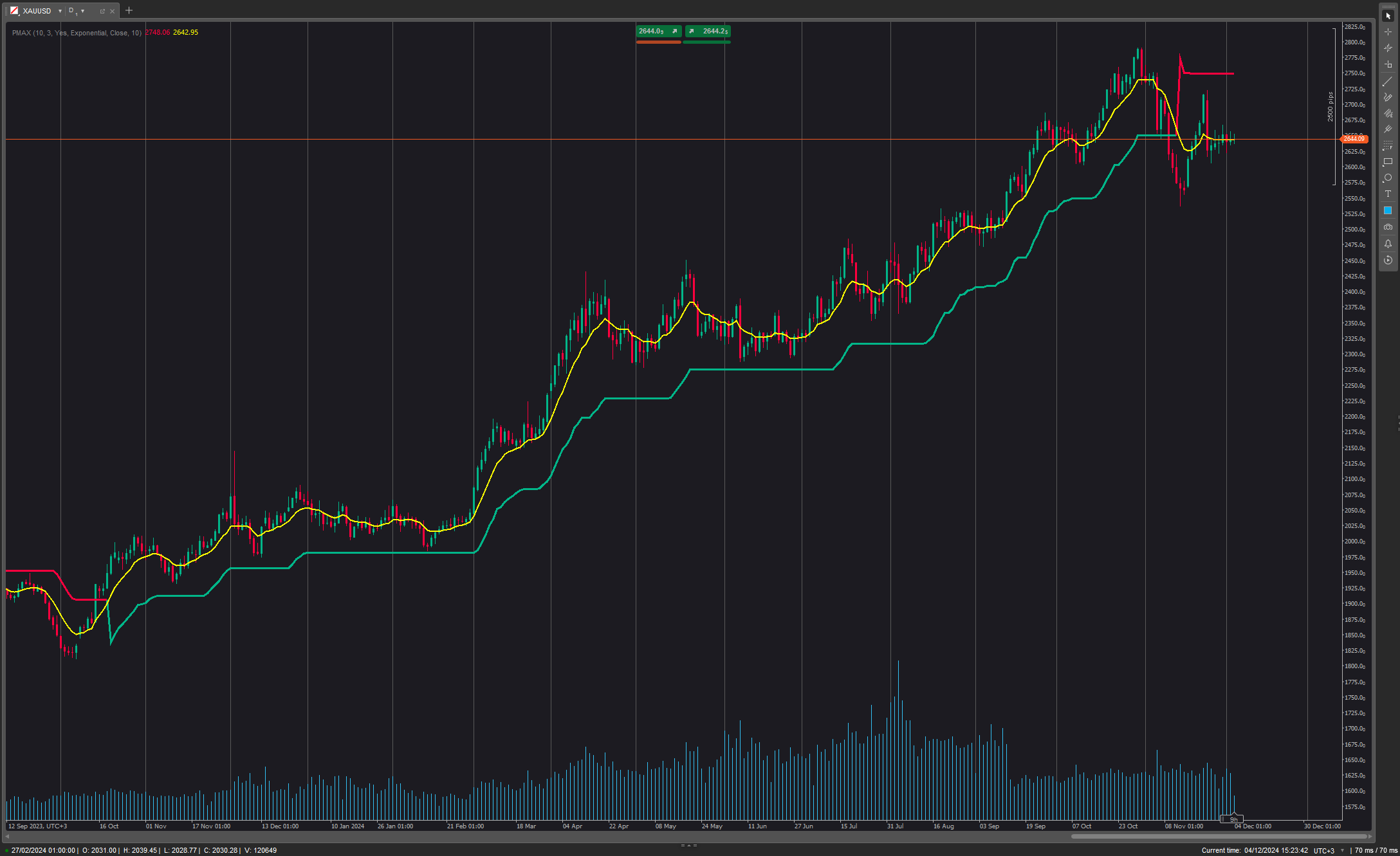

I personally use it for scalping indices on M1 & M5, but it does work with FX, commodities, stocks, etc... The dashboard shows if it has been profitable on a particular asset.

The free version let you try on major FX M15.

.png)

![Logo „[Hamster-Coder] Pivot Points”](https://market-prod-23f4d22-e289.s3.amazonaws.com/3c48c5d9-506b-4c95-a900-819a312f8649_Icon300.jpg)

(512x512).png)