TrendStrengthSignals

Indicador

Version 1.0, Aug 2025

Windows, Mac

Desde 26/05/2025

336.12M

Volume negociado

58.45K

Pips ganhos

11

Vendas

873

Instalações gratuitas

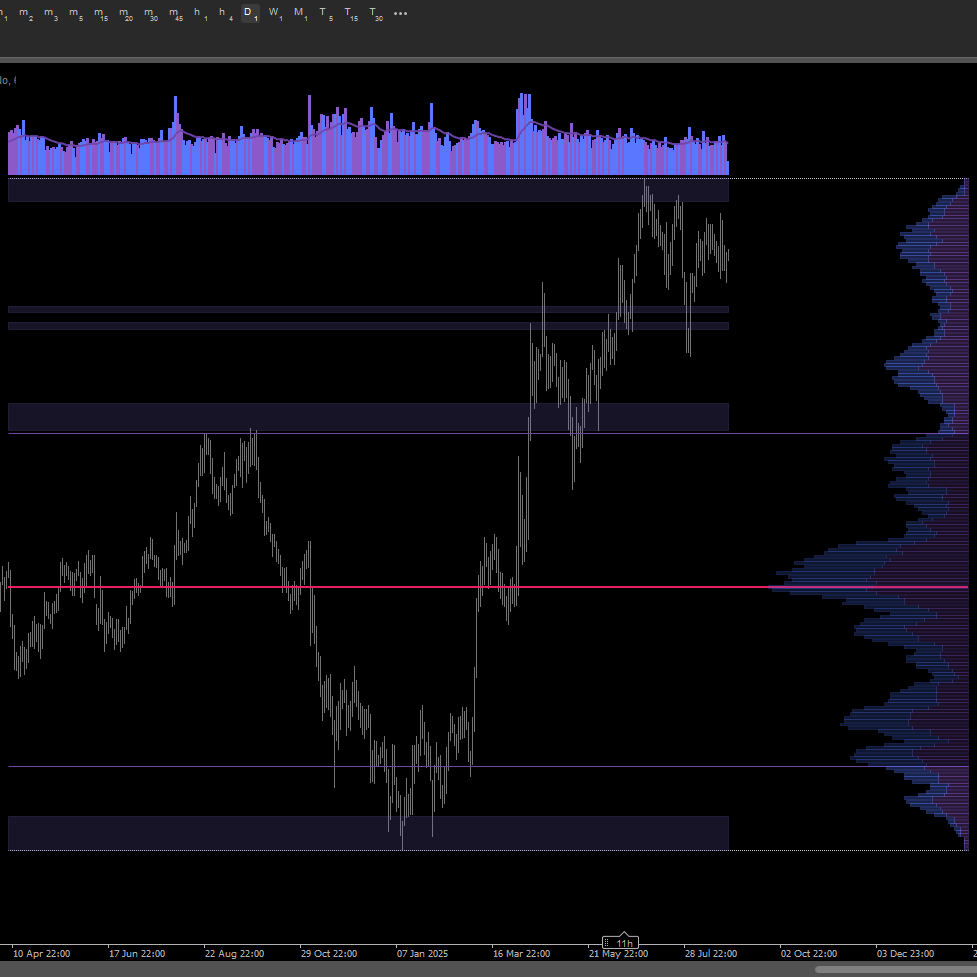

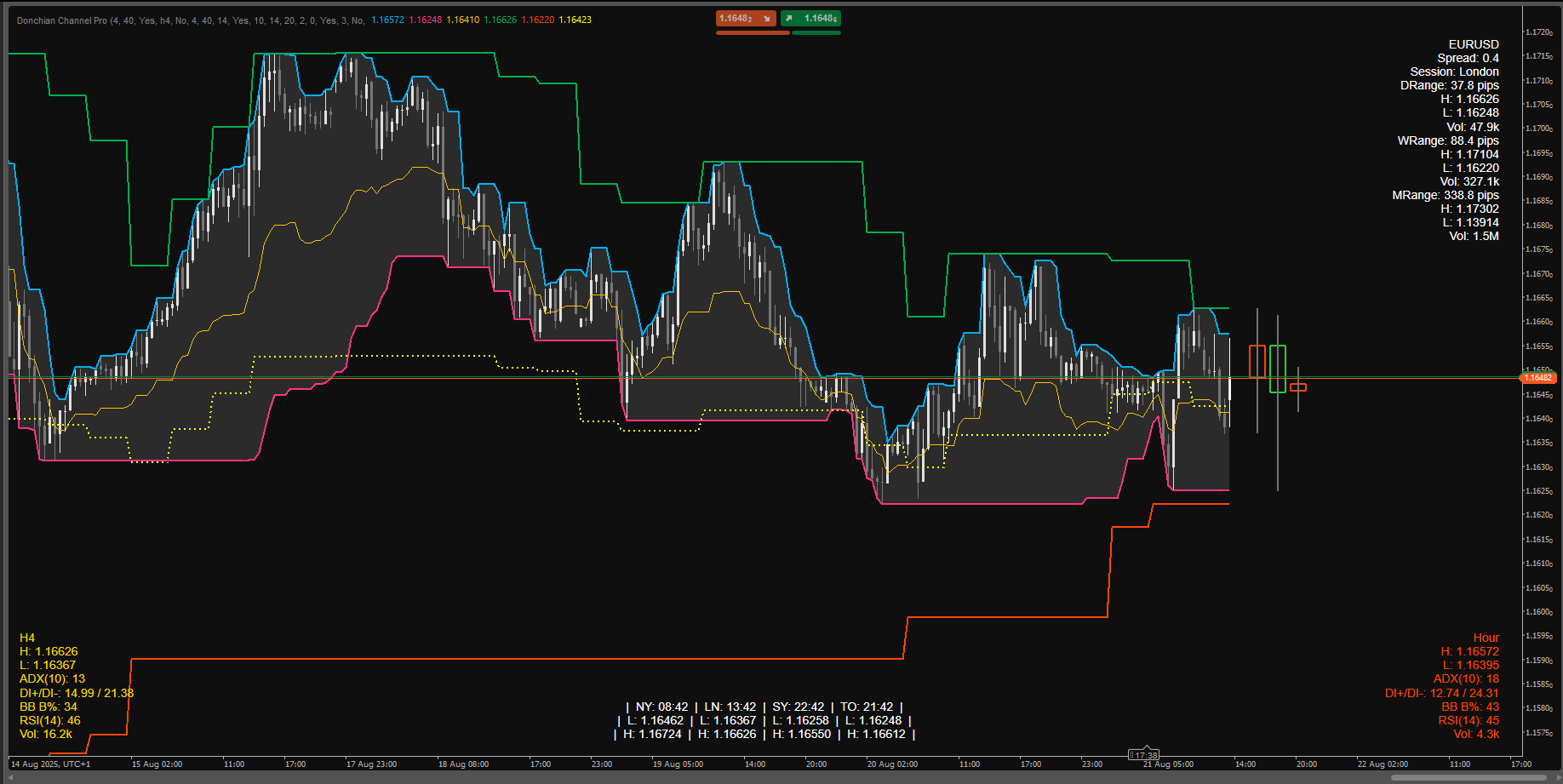

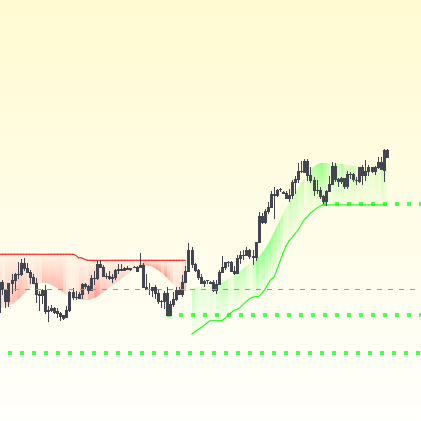

A visual toolkit for trend trading that blends a volatility envelope with a cycle-aware channel to show regime, timing, and risk at a glance. It’s designed to be readable on any background (light/dark) and to keep the screen clean while still giving you the “what to do next” hints.

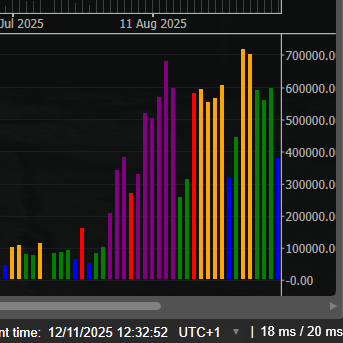

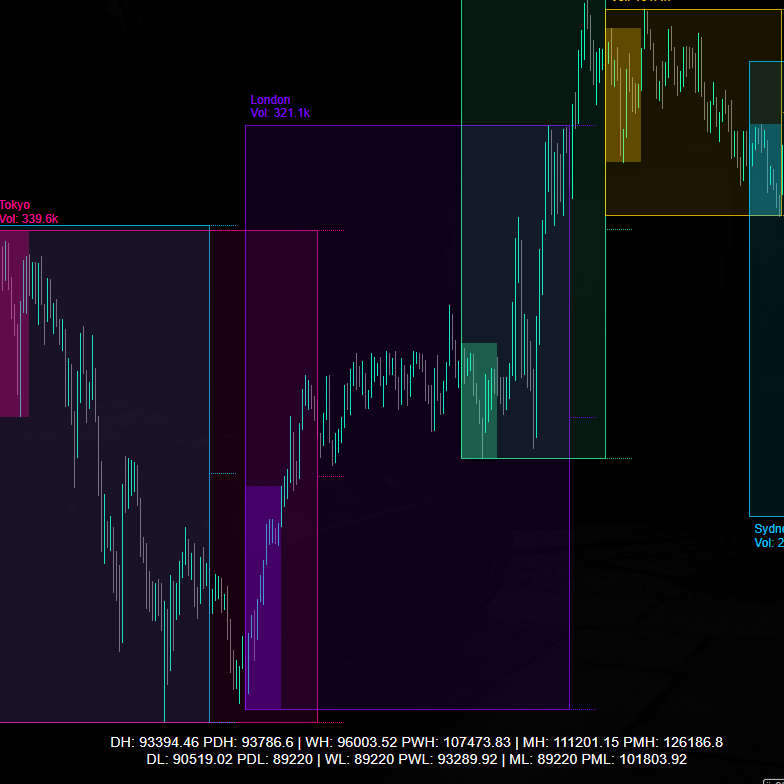

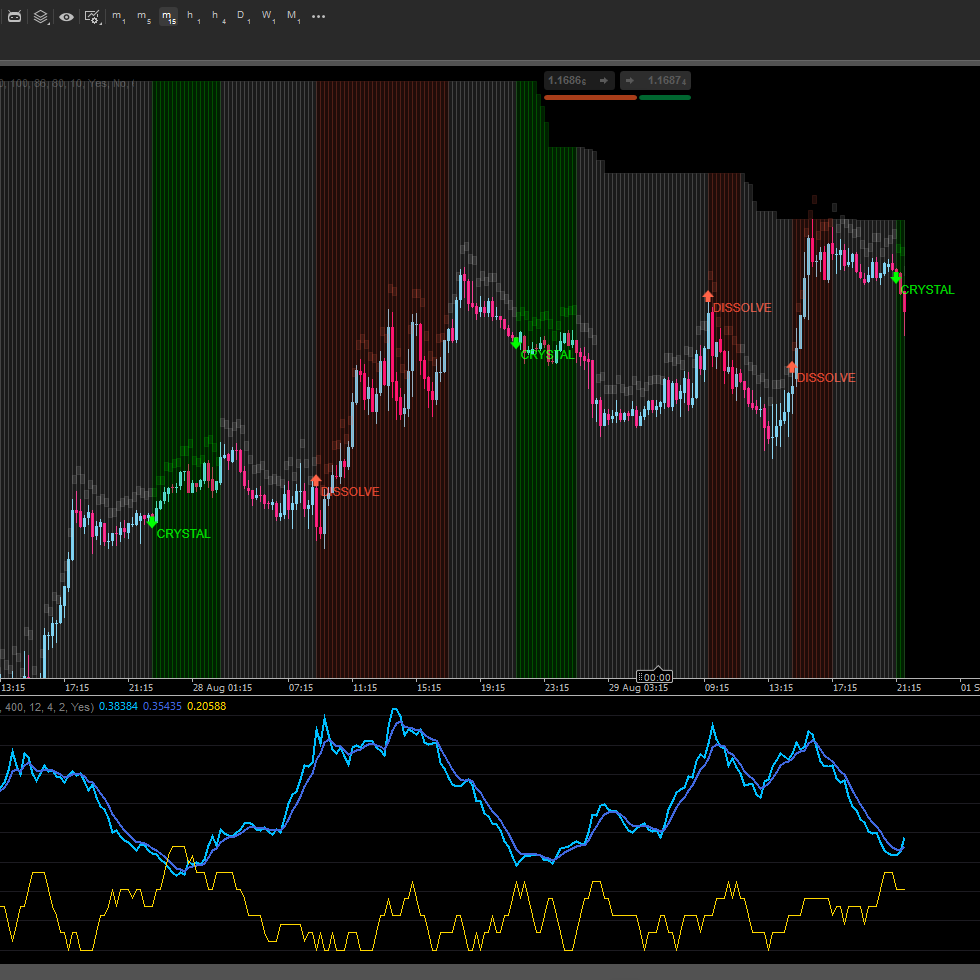

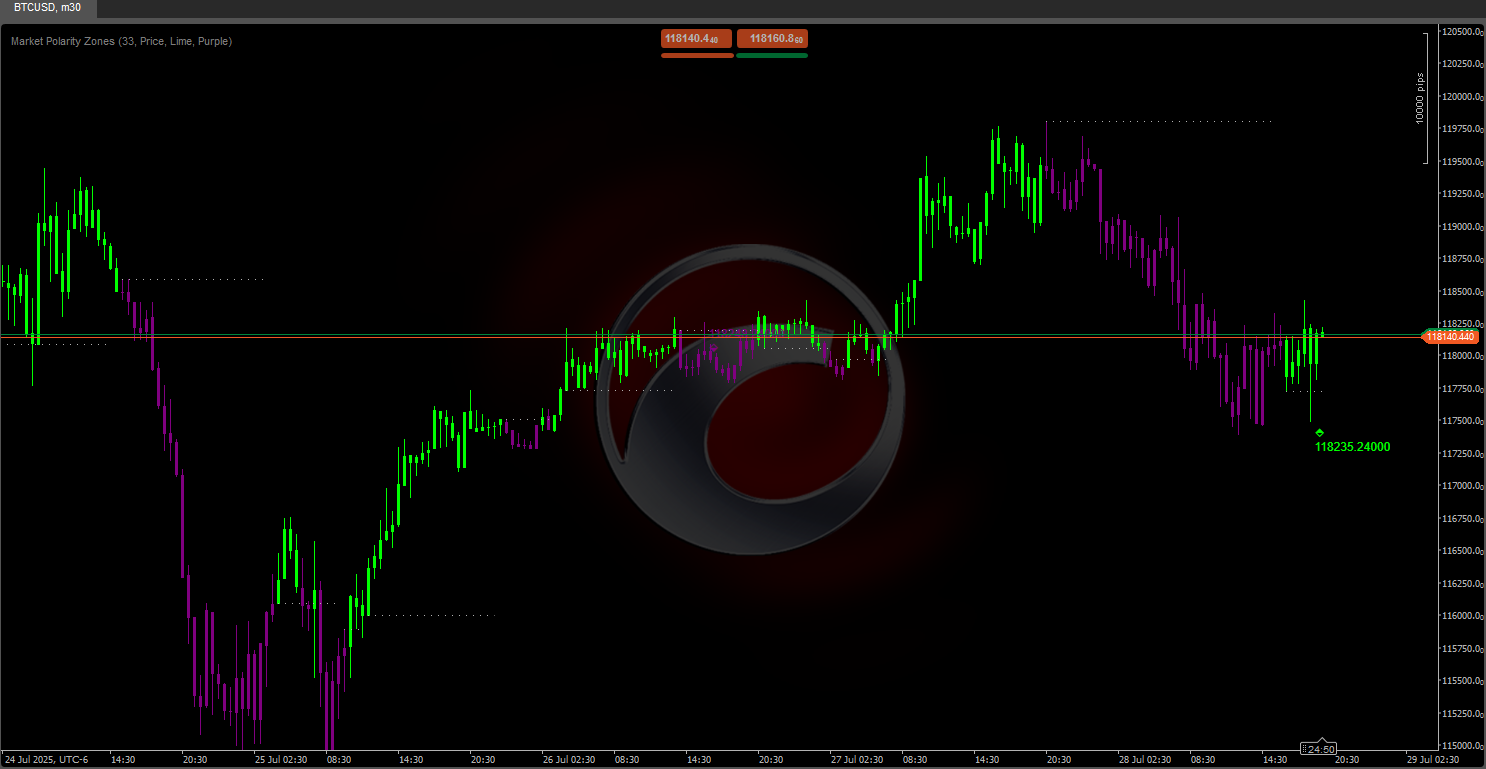

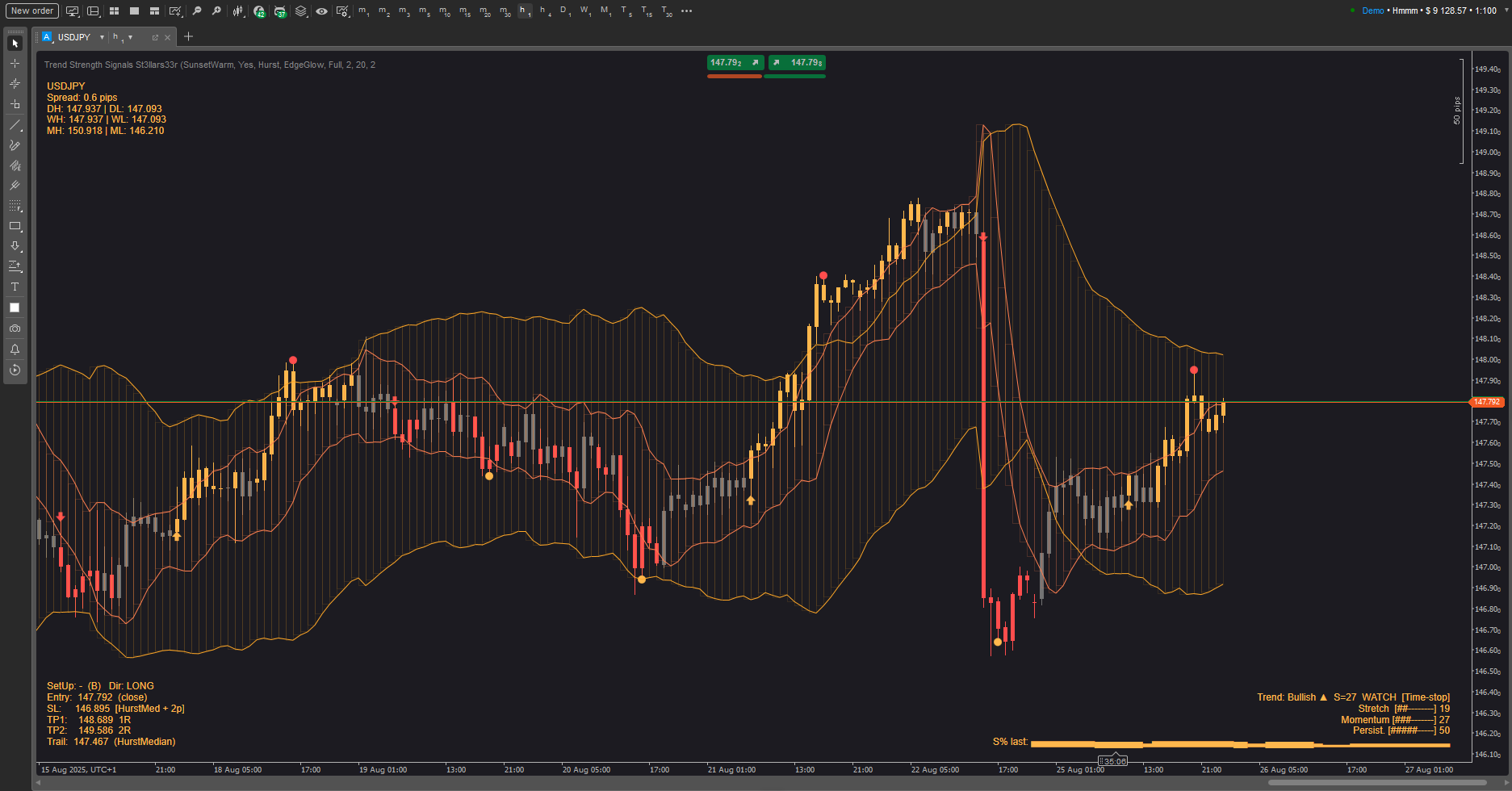

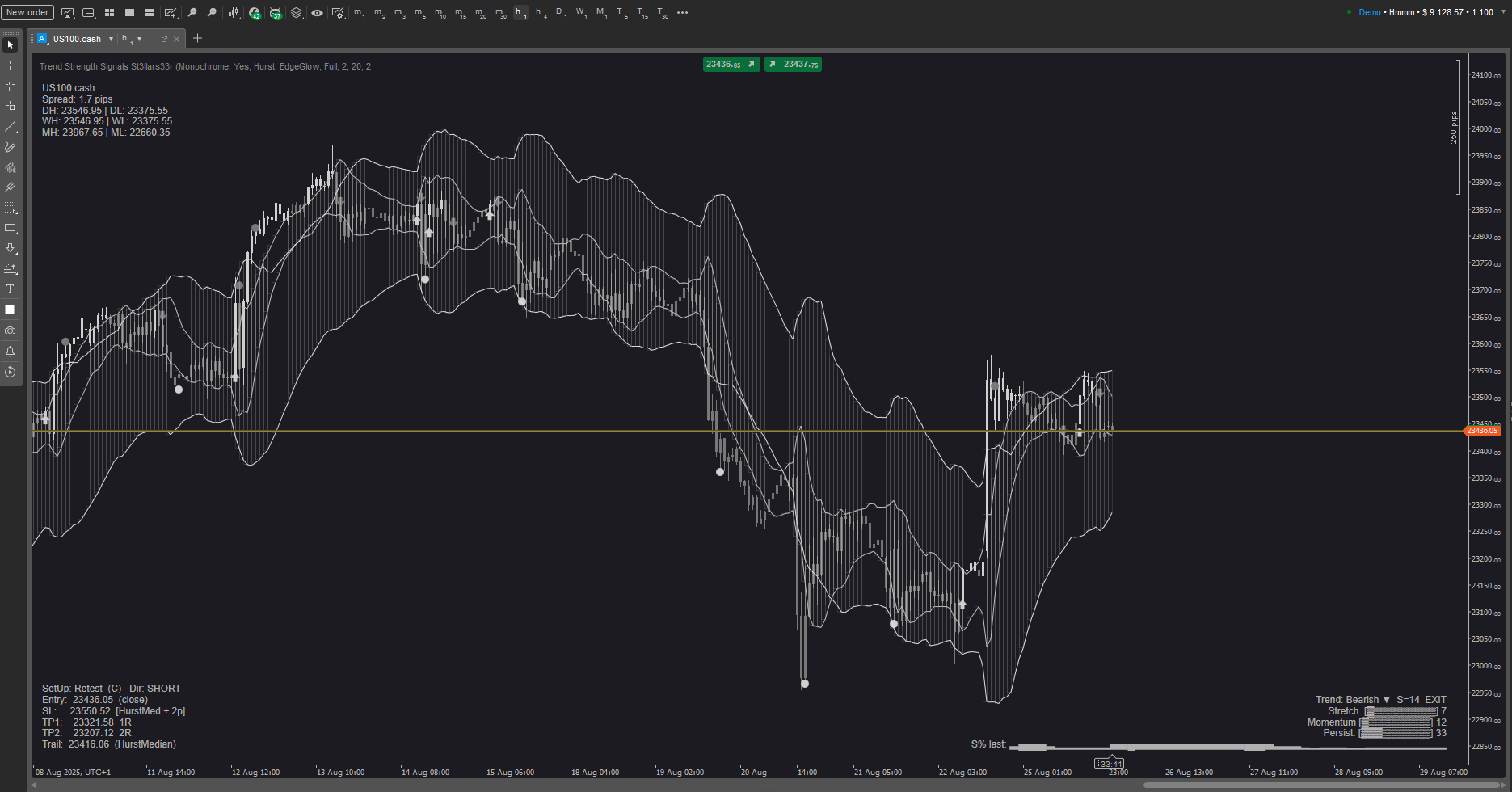

What you see on the chart

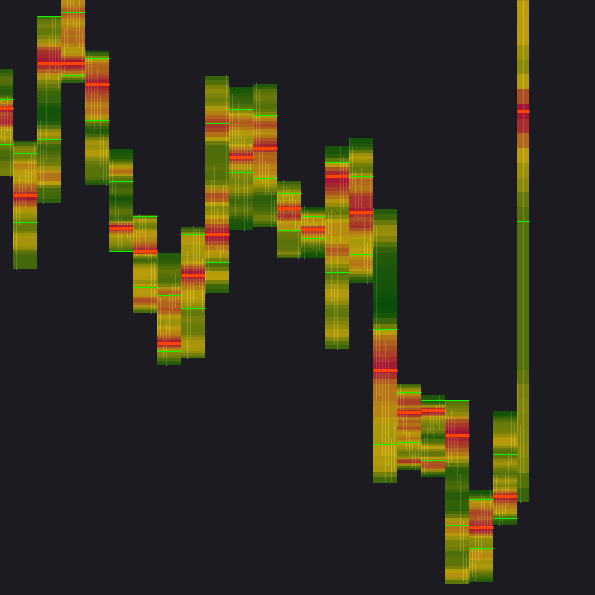

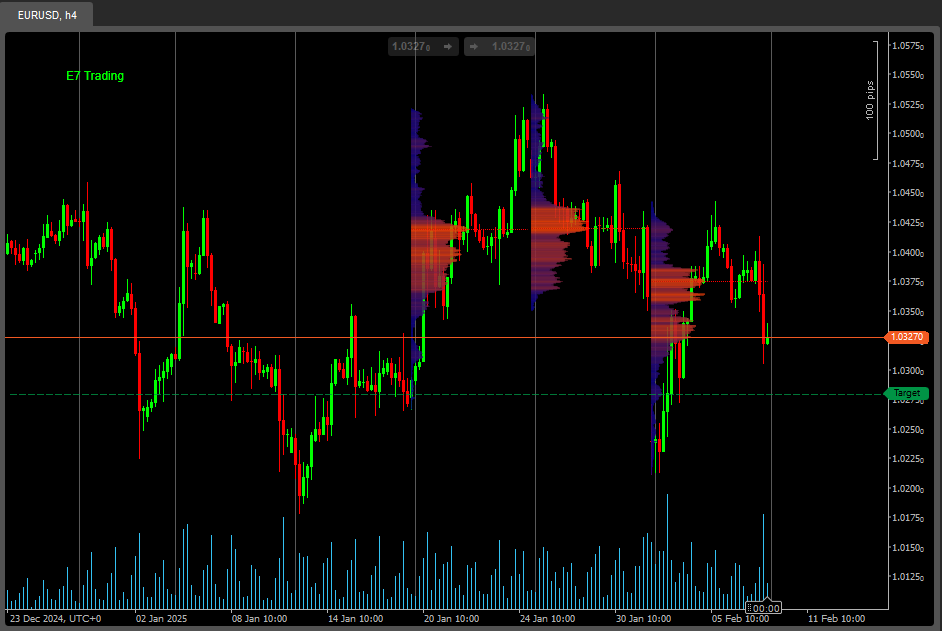

- Clouds (toggleable):

- A volatility cloud that expands/contracts with market activity.

- A cycle cloud that tracks the rolling rhythm of price.

- You can show either, both, or none.

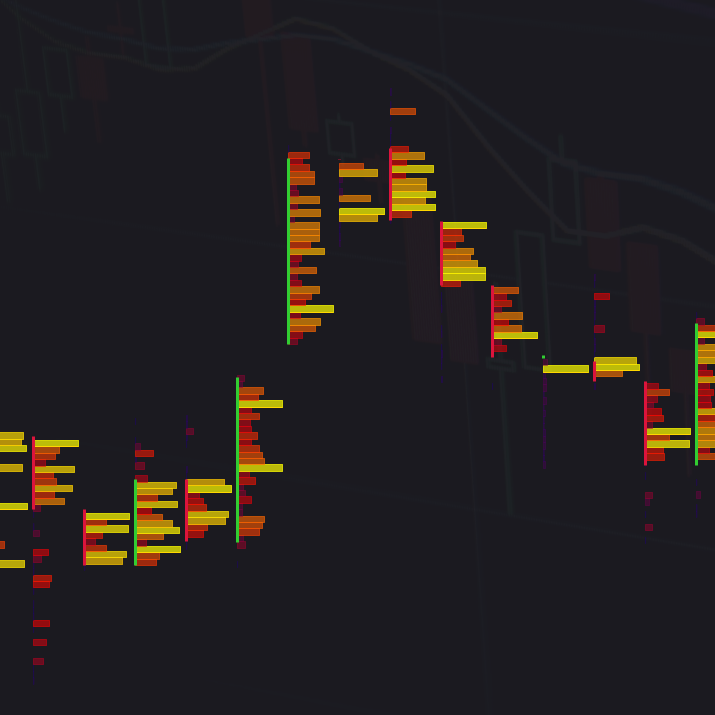

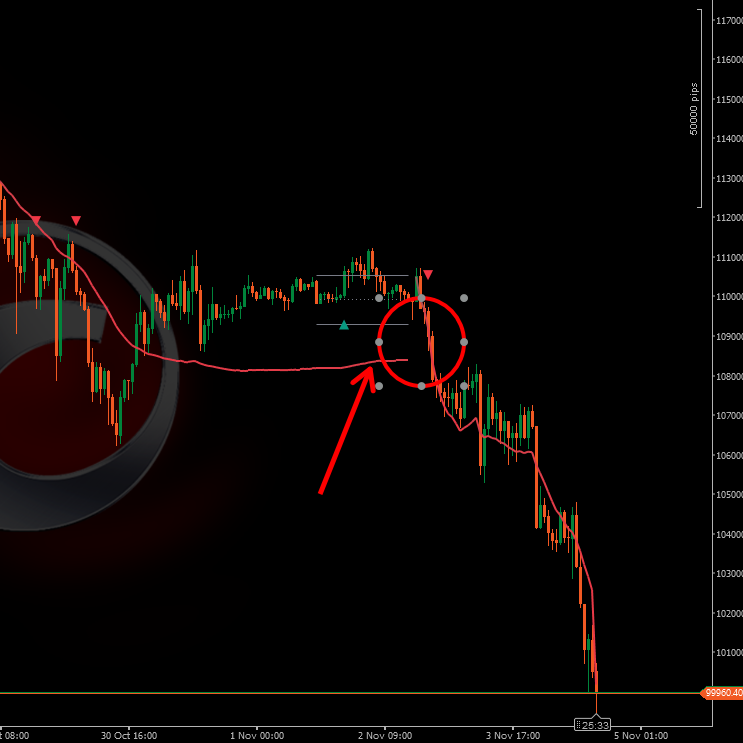

- Signals: unobtrusive up/down arrows for potential trend shifts; small dots for take-profit nudges.

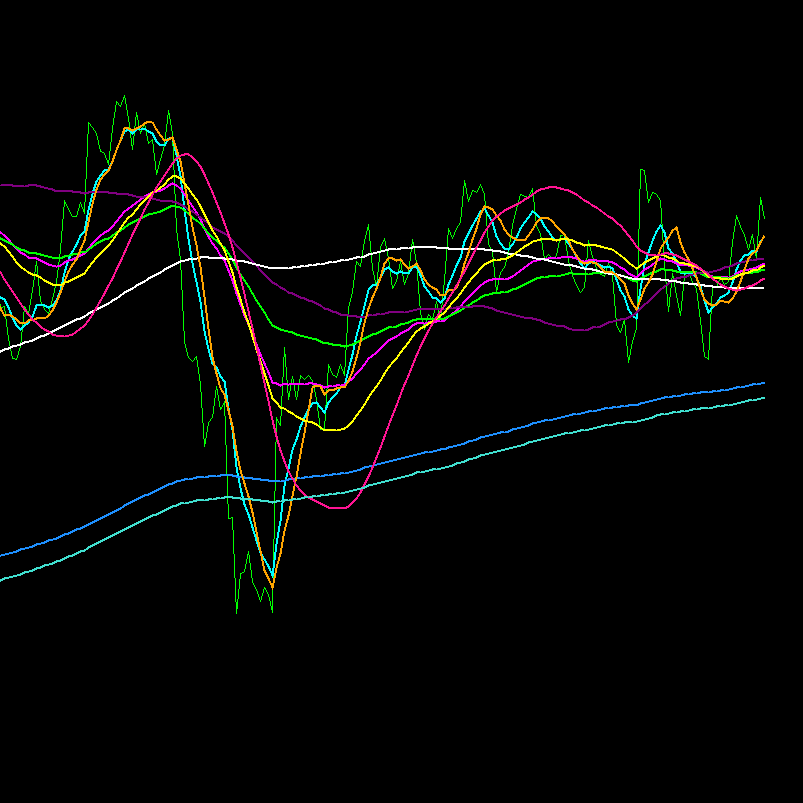

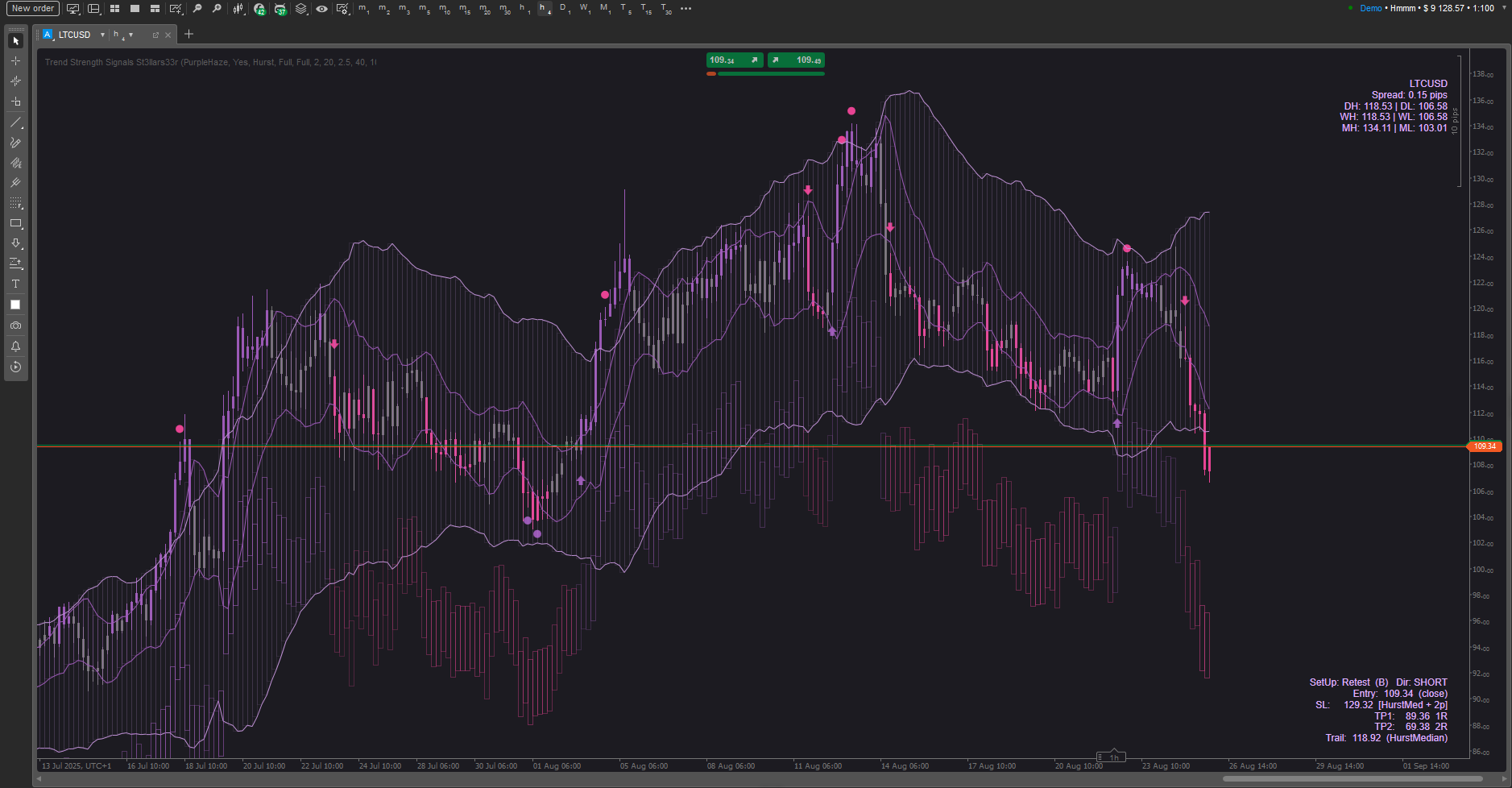

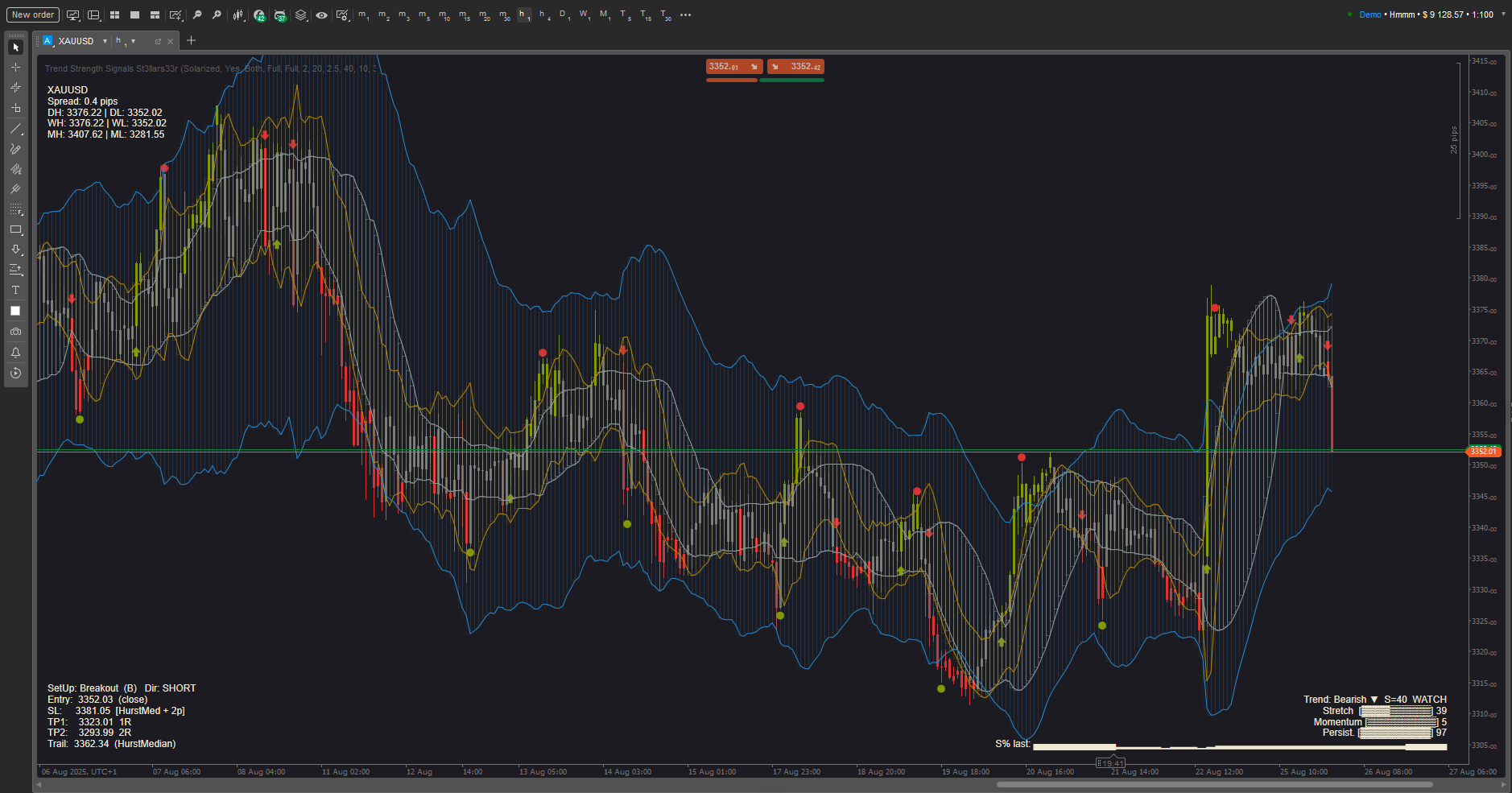

- Trend Strength HUD (three styles):

- Light — a compact status tag.

- Pro — a small dashboard with three meters (stretch, momentum, persistence) plus a mini history sparkline.

- Ribbon — a soft bar near price whose intensity follows trend strength.

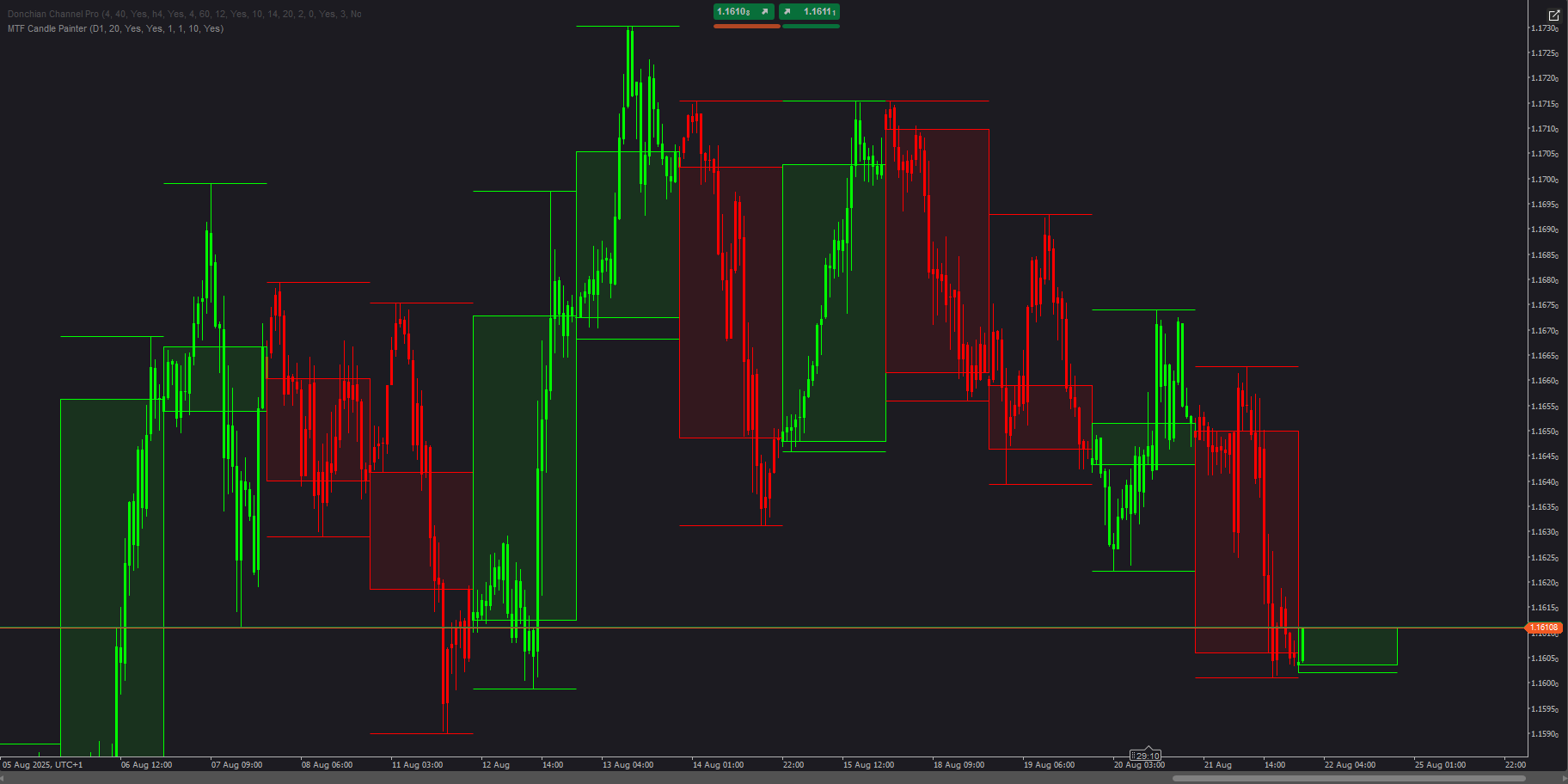

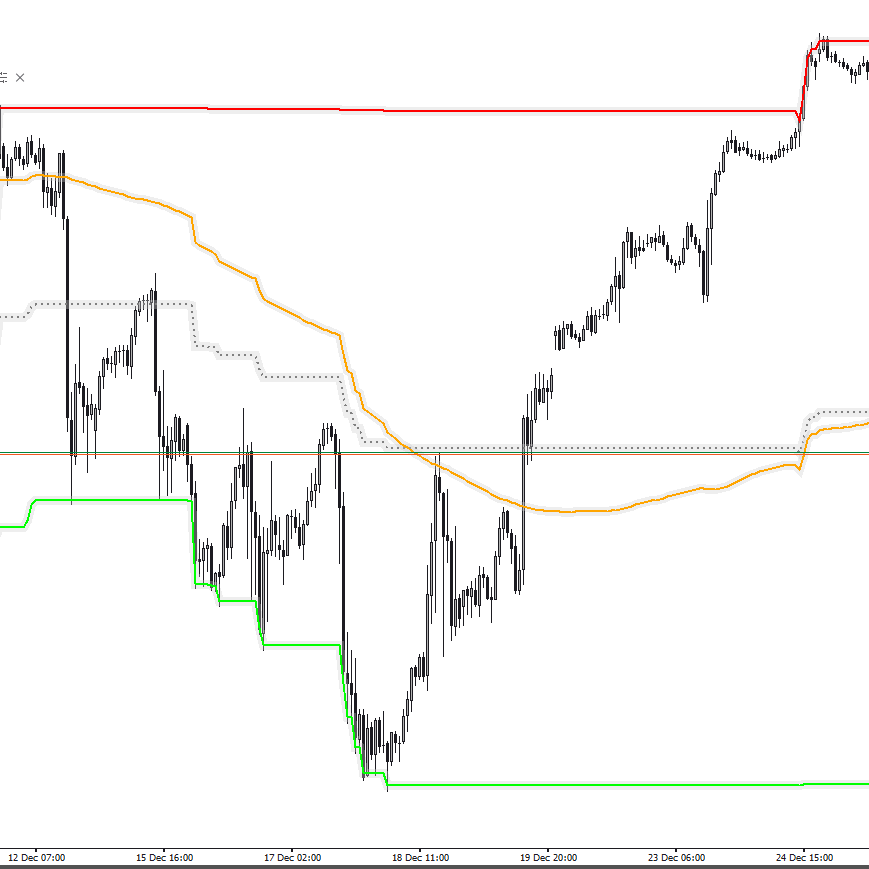

- Risk HUD: proposes a direction, a protective stop area, two layered profit targets, and an optional trailing idea. It sits in any corner you choose and updates as the bar evolves.

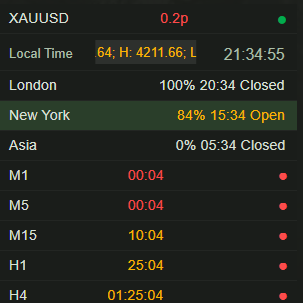

- Market HUD: symbol & spread, plus day/week/month high–low references, so you always know where you are inside the bigger map.

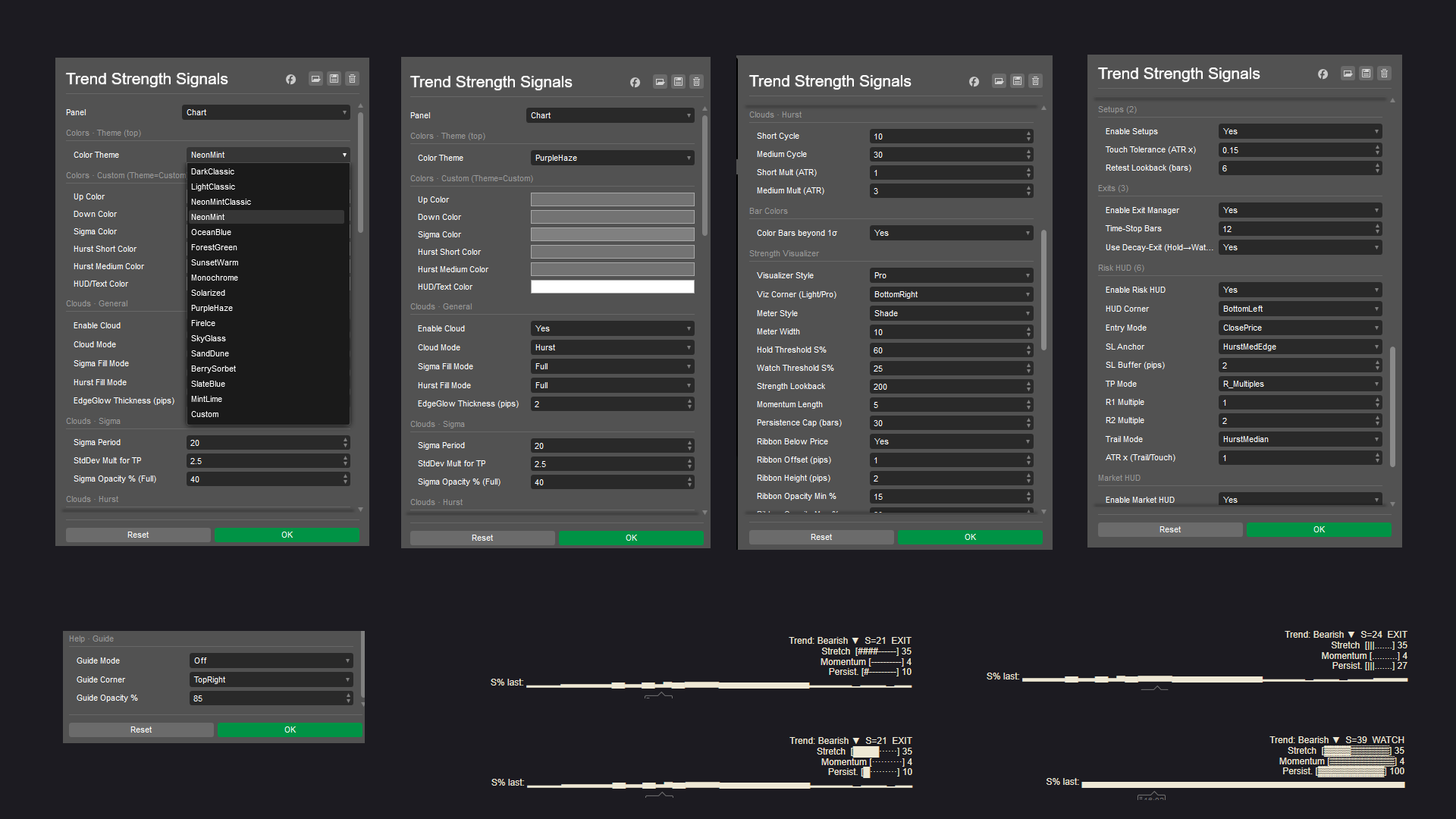

- Themes: curated color sets for light and dark charts (and a Custom mode). All graphic elements—including HUDs and signals—follow the active theme.

How to use it (practical, not technical)

- Pick your cloud view:

- Use the volatility cloud to see squeezes and expansions.

- Use the cycle cloud to judge “edge” vs “middle” rotations.

- Use both if you want context + timing.

- Read the Trend Strength:

- When the status escalates to HOLD, bias trades with the current direction; when it drops to WATCH, reduce aggression; if it shows EXIT, avoid fresh trades or tighten risk.

- In Pro mode, rising meters + rising sparkline = improving quality; fading meters = manage down risk.

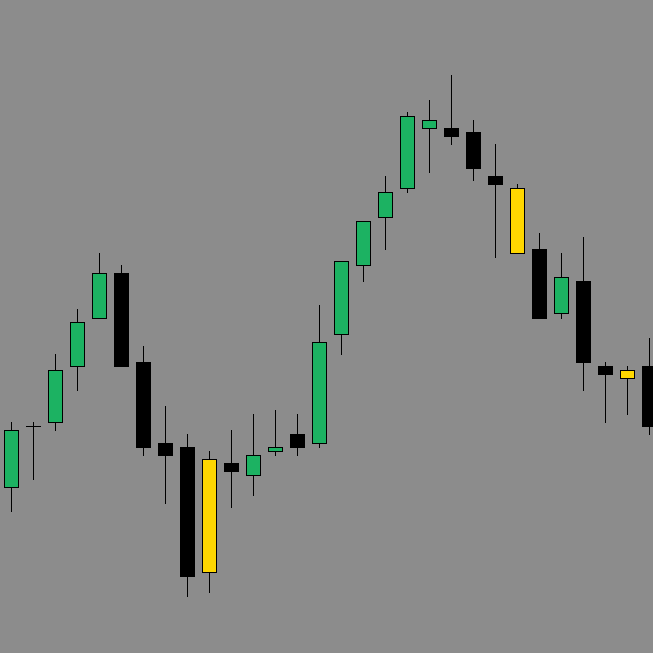

- Time entries with price vs cloud:

- Breakouts after compression, re-entries after a polite pullback to the cloud, or bounces off an outer edge are the staple patterns.

- If an early arrow appears mid-bar and then disappears, wait for bar close confirmation if you prefer fewer head-fakes.

- Manage the trade with the Risk HUD:

- Place the protective stop roughly beyond the nearest structural boundary the HUD highlights.

- Scale out at TP1, let the rest aim for TP2 or follow the suggested trailing line.

- If Trend Strength decays from strong to weak, consider exiting earlier.

- Situational filters:

- Avoid entries when clouds are thin and choppy, or when the strength status sits in EXIT.

- Favor trades when strength is building, the cloud slopes, and price is interacting cleanly with edges.

Customization

- Switch HUD corners, visualization style, and color theme to match your workspace.

- Light-friendly themes keep text visible on white backgrounds; ocean/forest/sunset palettes add subtle contrast without glare.

What it’s not

This is not a black-box autotrader. It’s a decision aid: it frames trend quality, proposes sensible risk locations, and highlights high-probability moments—but you stay in control.

0.0

Avaliações: 0

Avaliações de clientes

Ainda não há avaliações para este produto. Já o experimentou? Seja o primeiro a contar a outras pessoas!

Mais deste autor

Também poderá gostar de

Desde 26/05/2025

336.12M

Volume negociado

58.45K

Pips ganhos

11

Vendas

873

Instalações gratuitas