.png)

Breakout channel

อินดิเคเตอร์

366 ดาวน์โหลด

Version 1.0, Nov 2025

Windows, Mac

Breakout Channels

What it does

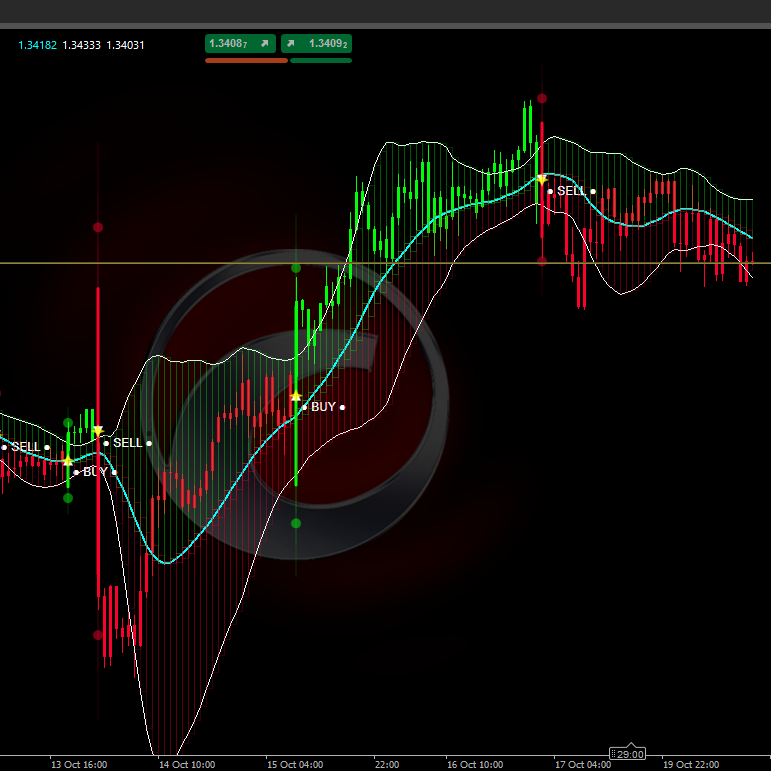

Breakout Channels automatically detects consolidation ranges (price “boxes”) and marks breakout points when price escapes those ranges.

It draws:

- A grey channel box around the consolidation zone

- A red upper band (potential resistance)

- A green lower band (potential support)

- A white dotted midline (channel midpoint)

- Coloured dots when a breakout occurs:

- Green/cyan dot below the box → bullish breakout

- Red dot above the box → bearish breakout

The idea is to visually highlight areas where price is coiling and where strong moves are likely to start when the range breaks.

How it calculates

- Price normalisation

- Over the last Normalization Length bars it finds the highest high and lowest low.

- It normalises the close into a 0–1 range:

normalizedPrice=Close−LowestLowHighestHigh−LowestLow\text{normalizedPrice} = \frac{\text{Close} - \text{LowestLow}}{\text{HighestHigh} - \text{LowestLow}}normalizedPrice=HighestHigh−LowestLowClose−LowestLow

- Volatility measure

- It computes the standard deviation of the normalised price over 14 bars.

- This gives a volatility series used to detect turning points in the market structure.

- Upper / Lower “volatility lines”

- Over the last (Box Detection Length + 1) bars, it finds:

- the bar where volatility was highest

- the bar where volatility was lowest

- From how many bars ago these extremes occurred, it builds two synthetic lines: Upper and Lower.

- Crosses between these lines signal potential start/end of a channel phase.

- Channel start & duration

- When Lower crosses above Upper, the indicator marks a potential channel start.

- From that bar it tracks the duration and the highest high / lowest low in the period.

- Channel creation

- When later Upper crosses back above Lower, and the duration is greater than 10 bars:

- It defines the channel Top as the highest high in that period.

- It defines the channel Bottom as the lowest low.

- It measures the current ATR/2 to separate a thin zone at the top and bottom:

- Red band at the top (bearish band)

- Green band at the bottom (bullish band)

- It draws:

- Grey outline rectangle (full channel)

- Red top outline

- Green bottom outline

- A dotted white midline through the centre

- Channels remain on the chart as historical structure (they are not deleted after breakout).

- Breakout detection

- For each active channel, on every new bar it calculates a reference price:

- If Strong Closes Only = true → uses the midpoint of the candle body:

refPrice=(Open+Close)/2\text{refPrice} = (\text{Open} + \text{Close})/2refPrice=(Open+Close)/2

This requires more than half of the body to be outside the box. - If Strong Closes Only = false → uses simple Close.

- If Strong Closes Only = true → uses the midpoint of the candle body:

- Breakout rules:

- If

refPrice > Top→ bullish breakout - Plots a green dot at the channel Bottom.

- Deactivates this channel (stops extending it), but the box stays visible.

- If

refPrice < Bottom→ bearish breakout - Plots a red dot at the channel Top.

- Deactivates the channel.

- Otherwise, the channel is still active and its right edge is extended to the current bar.

- If

- Nested Channels option

- If Nested Channels = true, multiple channels can overlap in time and price.

- If false, the indicator blocks creation of a new channel that would overlap an existing one.

How to read and use it

- Grey box (channel)

- Represents a consolidation / balance zone where price has been trading for a while.

- The longer and taller the box, the more significant the range.

- Red upper band (resistance zone)

- The top portion of the channel, visually emphasised as a potential resistance area.

- Repeated rejections near this band suggest selling pressure inside the range.

- Green lower band (support zone)

- The bottom portion of the channel, highlighted as potential support.

- Repeated bounces suggest buyers defending the lower edge of the range.

- White dotted midline

- The midpoint of the channel – a kind of local “fair value”.

- Price oscillating around this line indicates balance; strong moves away often precede a test of the opposite band.

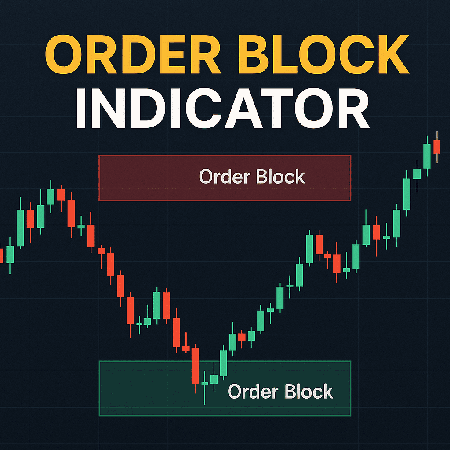

- Breakout dots

- Green dot below the box:

- Price has closed strongly above the top of the channel (or simply closed above, depending on Strong Closes Only).

- Suggests a bullish breakout – potential start of an up-move from a volatility squeeze.

- Red dot above the box:

- Price has closed strongly below the bottom of the channel.

- Suggests a bearish breakout – potential start of a down-move.

- Typical ways to use it (idea-level)

- Trend-following breakouts

- Trade in the direction of the breakout (buy after green dot, sell after red dot), ideally in confluence with higher-timeframe trend or other indicators.

- Filter & confirmation

- Use the channel and its breakout only as a filter for your existing strategy (e.g. only take long setups if the last signal was a bullish breakout).

- Risk placement

- For bullish breakouts, many traders place stops inside or just below the former channel; for bearish, inside or above the box.

0.0

รีวิว: 0

รีวิวจากลูกค้า

ยังไม่มีรีวิวสำหรับผลิตภัณฑ์นี้ หากเคยลองแล้ว ขอเชิญมาเป็นคนแรกที่บอกคนอื่น!

NAS100

NZDUSD

Martingale

Forex

Fibonacci

EURUSD

MACD

BTCUSD

SMC

Indices

ATR

Stocks

Grid

RSI

Breakout

XAUUSD

FVG

Commodities

Signal

Bollinger

GBPUSD

AI

VWAP

ZigZag

Prop

Supertrend

Crypto

USDJPY

Scalping

เพิ่มเติมจากผู้เขียนคนนี้

นอกจากนี้คุณยังอาจชอบ

42.09M

ปริมาณการเทรด

6.13M

Pips ที่ได้กำไร

98

การขาย

4.63K

ติดตั้งฟรี

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

(2).png)

(3).png)

.png)

.png)

.png)

.jpg)