Liquidity Cluster Order (LCO) 🔍💧

1. What LCO shows

Liquidity Cluster Order automatically detects and draws:

- Bullish liquidity clusters (potential demand / accumulation zones) ✅

- Bearish liquidity clusters (potential supply / distribution zones) 🔻

Each cluster is:

- anchored on a volume pivot bar (a local maximum of volume),

- classified as bullish or bearish based on the recent price extension,

- extended forward in time until price mitigates (consumes) the cluster.

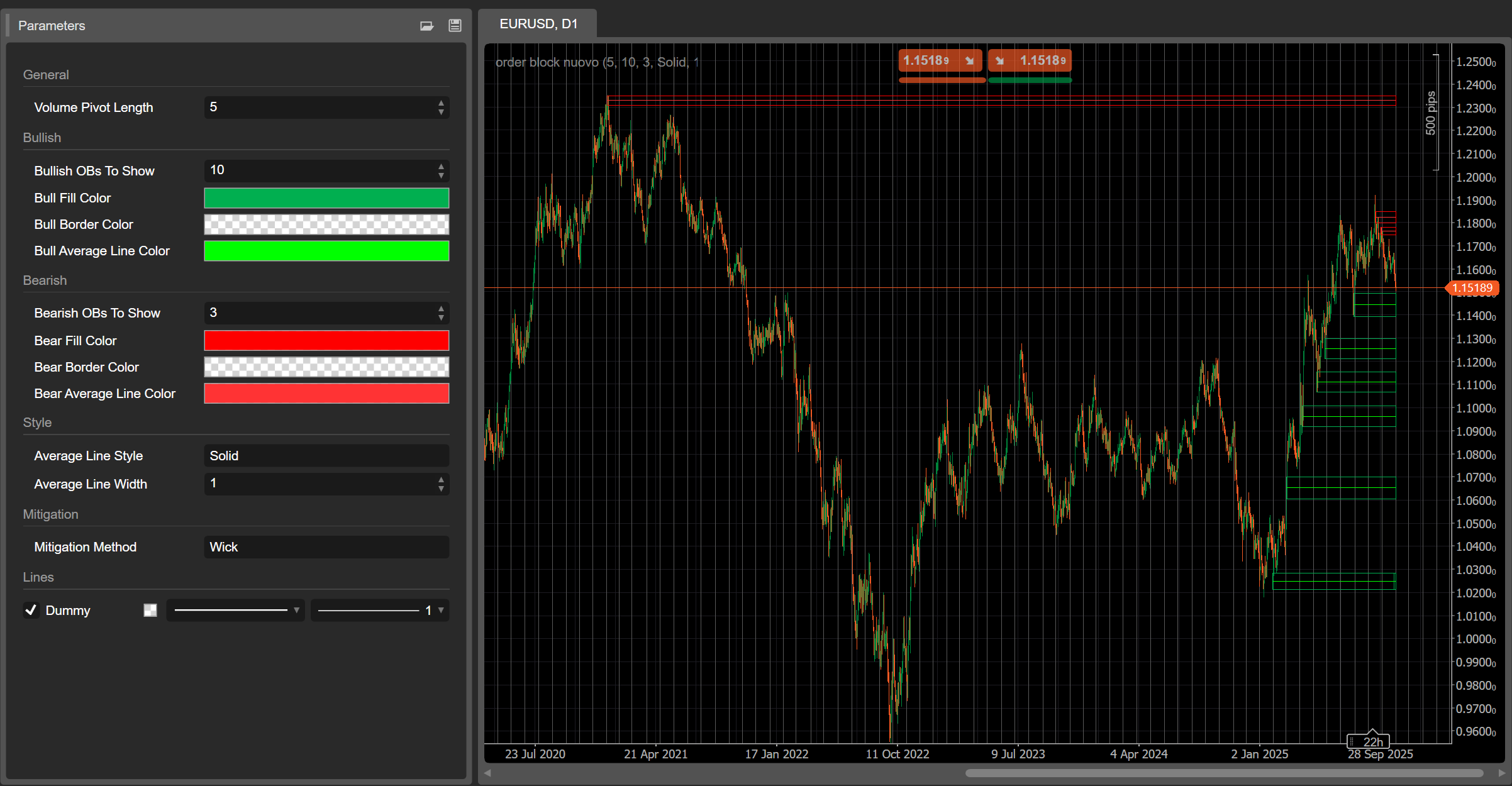

On the chart you see:

- Green rectangles → bullish liquidity clusters

- Red rectangles → bearish liquidity clusters

- A grey line inside each rectangle → the average price level of that cluster

Once a cluster is considered mitigated, it disappears from the chart and only active clusters remain.

2. Detection logic (in simple terms)

- Volume pivot

- LCO scans for bars where volume is higher than the previous and next

Volume Pivot Lengthbars. - These bars are volume pivots – potential anchors for liquidity clusters.

- LCO scans for bars where volume is higher than the previous and next

- Context: bullish vs bearish

- The recent price behaviour defines a context:

- Bullish context → downside extension has dominated.

- Bearish context → upside extension has dominated.

- This context decides whether the next volume pivot will create a bullish or bearish liquidity cluster.

- Bullish liquidity cluster

In a bullish context: - Cluster bottom = low of the pivot bar

- Cluster top = midpoint of the bar (

(high + low) / 2) - Interpretation: zone where downside pressure was absorbed and buyers stepped in aggressively.

- Bearish liquidity cluster

In a bearish context: - Cluster bottom = midpoint of the pivot bar

- Cluster top = high of the pivot bar

- Interpretation: zone where upside pressure was absorbed and sellers took control.

- Average line

- For each cluster, LCO computes the mean of top & bottom and draws a grey mid-line.

- This acts as an internal equilibrium level of the cluster.

- Mitigation (cluster consumption)

On every new bar, LCO checks if a cluster is mitigated: - For bullish clusters:

- It tracks a downside target price over the last

Volume Pivot Lengthbars: Mitigation Method = Wick→ lowest low.Mitigation Method = Close→ lowest close.

- If this target price goes below the cluster bottom, the bullish cluster is considered mitigated and removed.

- It tracks a downside target price over the last

- For bearish clusters:

- It tracks an upside target price:

Wick→ highest high.Close→ highest close.

- If this target price goes above the cluster top, the bearish cluster is mitigated and removed.

Mitigated = liquidity in that cluster is assumed consumed / invalidated.

3. How to read LCO on the chart

You’ll see mainly:

- Green clusters below price → potential demand liquidity zones

- Red clusters above price → potential supply liquidity zones

Typical reading (not trading advice):

- Fresh clusters

- Recently created clusters are often more relevant:

- Bullish cluster below price → area where buyers last absorbed sell pressure.

- Bearish cluster above price → area where sellers last absorbed buy pressure.

- Retests of a cluster

- Price returns to a bullish cluster from above:

- If price reacts and holds the bottom → possible bounce / long reaction zone.

- Price returns to a bearish cluster from below:

- If price fails to trade above the top → possible rejection / short reaction zone.

- Mitigated vs active clusters

- When price cuts through a cluster beyond its boundaries according to the chosen mitigation method,

→ that liquidity cluster is removed on subsequent bars. - Clusters still visible are active liquidity zones not yet fully traded through.

- When price cuts through a cluster beyond its boundaries according to the chosen mitigation method,

- Using the mid-line

- That grey mid-line can be used as:

- a profit-taking or partial exit level inside the cluster,

- a “fair price” reference within the liquidity zone,

- a quick way to see if price is trading in the upper or lower half of the cluster.

4. Parameters (English)

Volume Pivot Length

- Bars used to:

- detect volume pivots,

- compute extremes and mitigation target.

- Lower values → more clusters, more noise;

- Higher values → fewer, more significant clusters.

Bullish Liquidity Clusters To Show

(former Bullish OBs To Show)

- Maximum number of bullish clusters displayed on the chart.

Bearish Liquidity Clusters To Show

(former Bearish OBs To Show)

- Maximum number of bearish clusters displayed.

Bull Fill Color / Bear Fill Color

- Fill color of bullish/bearish clusters.

- You can include alpha (opacity) values.

Bull/Bear Average Line Color

- Color of the internal mid-line for each cluster.

Average Line Style

- Visual style for the mid-line:

"Solid","Dashed","Dotted".

Average Line Width

- Thickness of the mid-line.

Mitigation Method

"Wick"→ mitigation based on high/low wicks (more sensitive)."Close"→ mitigation based on closing prices (more conservative).

0.0

评价:0

客户评价

该产品尚无评价。已经试过了?抢先告诉其他人!

NAS100

NZDUSD

Martingale

Forex

Fibonacci

EURUSD

MACD

BTCUSD

SMC

Indices

ATR

Stocks

Grid

RSI

Breakout

XAUUSD

FVG

Commodities

Signal

Bollinger

GBPUSD

AI

VWAP

Prop

Supertrend

Crypto

USDJPY

Scalping

该作者的其他作品

猜您喜欢

42.09M

交易量

6.13M

盈利点数

101

销售

4.75K

免费安装

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.png)

.png)

(2).png)

.png)

(1).png)

!["Smart Money Concepts (SMC) [Iridio Capital]" 标识](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

!["Session Volume Profile (SVP) [Iridio Capital]" 标识](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)