🌐 Market Structure Shift – Professional Market Structure Oscillator

Identify True Trend Direction. Filter Noise. Trade with Confidence.

Market Structure Shift is a next-generation structural trend oscillator built for traders who want clarity, accuracy, and reliability in all market conditions.

Instead of relying on lagging moving averages or volatility-based tools, this indicator focuses on the core of price behavior: swing highs and swing lows.

The result is a clean, highly responsive trend model that helps you instantly identify:

- True market bias

- Structure transitions

- Trend continuation strength

- Hidden momentum shifts

Whether you swing trade, intraday trade, or run algorithmic systems, Market Structure Shift brings a professional-grade structural framework directly into your chart.

🔥 Why Market Structure Matters

Most indicators analyze price after it has already moved.

Market structure works differently — it measures the foundation of trend development:

- Higher Highs / Higher Lows → Bullish structure

- Lower Highs / Lower Lows → Bearish structure

This reveals the direction the market is building toward, not just what price is doing moment to moment.

Market Structure Shift automates this entire process and transforms it into an easy-to-read oscillator.

📊 What the Indicator Shows

✔ 1. Structure Oscillator Line (White)

A smoothed EMA-based trend line that clearly displays dominant structure:

- Above 0 → Bullish structure

- Below 0 → Bearish structure

- Near 0 → Structure instability or trend transition

One glance reveals where the market truly stands.

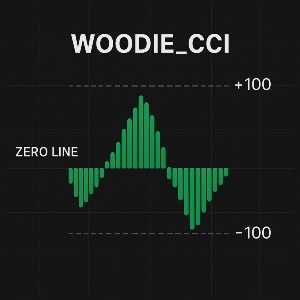

✔ 2. Bullish Histogram (Green)

Displays strength and momentum inside a bullish structure.

Stronger bars = stronger upward pressure.

Perfect for confirming long setups.

✔ 3. Bearish Histogram (Red)

Shows the momentum and strength of bearish structure.

Stronger bars = stronger downward trend.

Ideal for validating short opportunities.

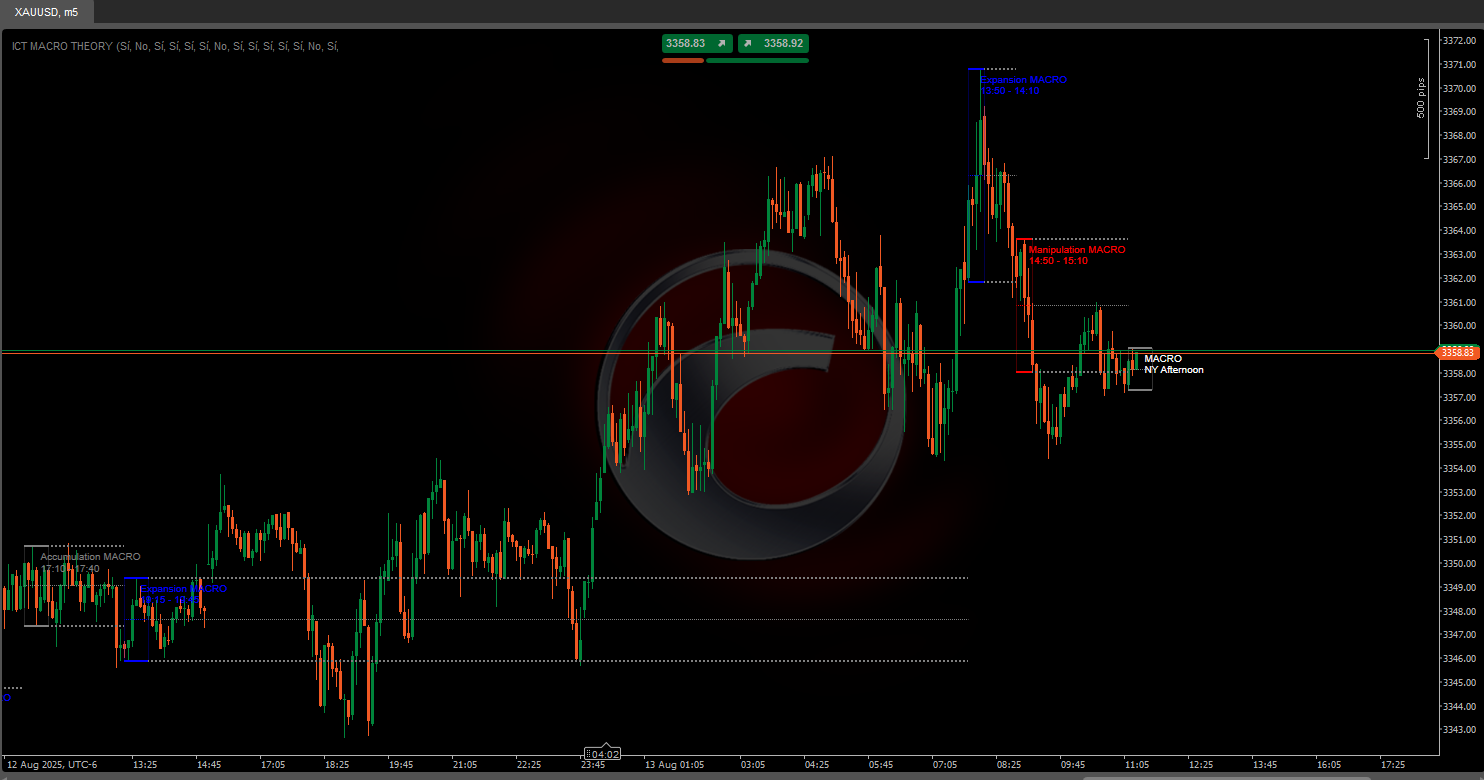

🎯 How Traders Use It (Professional Workflow)

A. Trend Confirmation Filter

Only trade in the direction of structural momentum:

- Long trades when the oscillator is above 0

- Short trades when the oscillator is below 0

This simple rule alone eliminates many false setups.

B. Structural Reversal Detection

Major transitions are visible when the oscillator crosses the zero line:

- Red → Green = New bullish structure

- Green → Red = New bearish structure

This offers early insight into trend shifts long before traditional tools react.

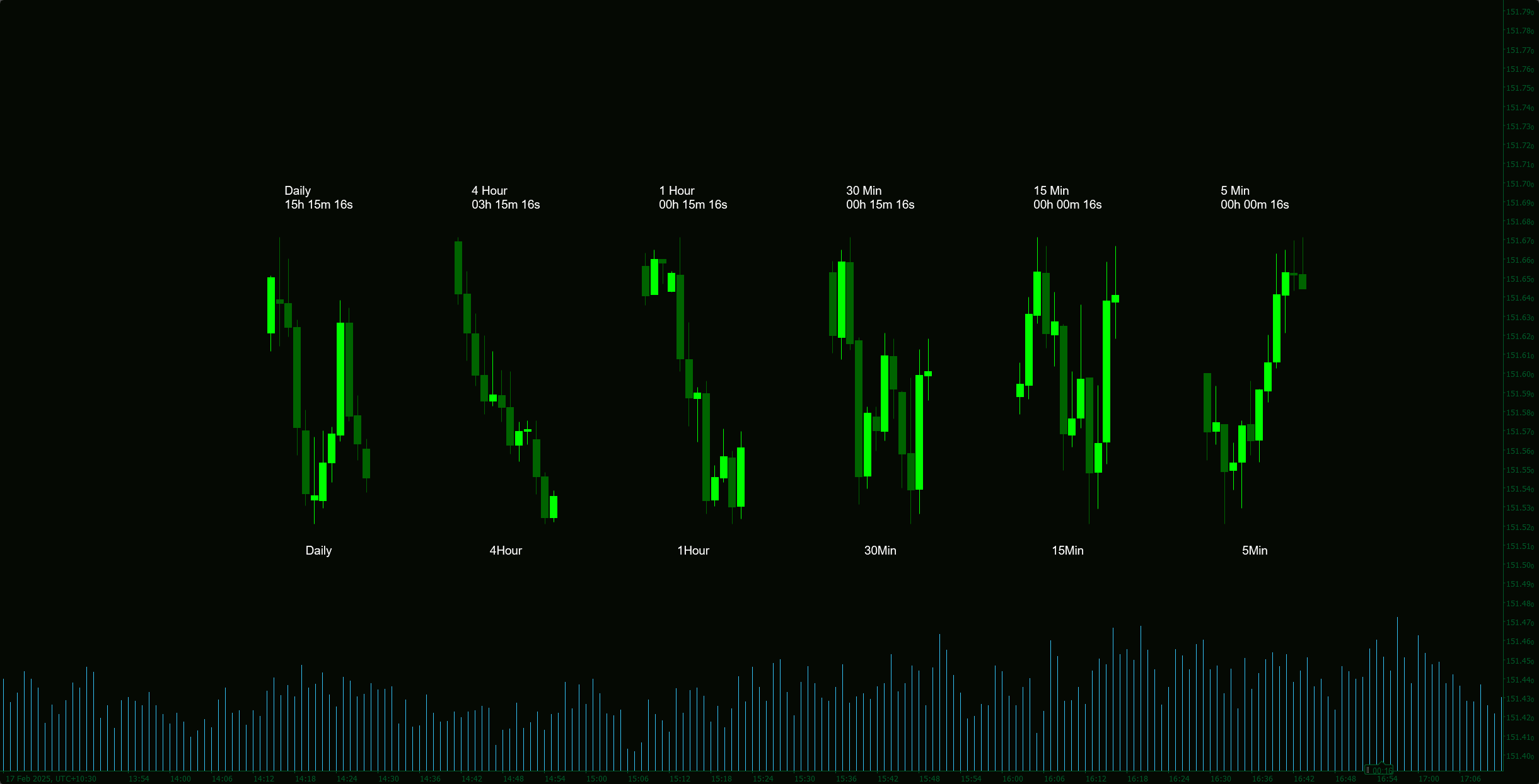

C. Multi-Timeframe Optimization

The indicator is exceptionally powerful in MTF workflows:

- Use H4/H1 for trend framework

- Use M30/M15 for entries

Prevent counter-trend trades and maximize accuracy.

D. Synergy With Market Structure Signals

Market Structure Shift becomes a complete trading system when combined with Market Structure Signals, which provides:

- BUY/SELL arrows

- Visual shift markers

- Structural break alerts

Together they create a full top-down structure-based methodology.

⚙️ Designed for All Markets

✔ Forex

✔ Indices

✔ Crypto

✔ Metals

✔ Synthetic markets

✔ Futures (via CFD proxies)

Highly adaptable due to parameter control over:

- Swing detection

- Smoothing strength

- Sensitivity to structural changes

📈 Recommended Settings

- Swing Left/Right: 2–3 for Forex and Indices, 3–3 for Crypto

- Oscillator Smoothing: 5–8 for balanced responsiveness

Built to work out-of-the-box, but fully customizable.

💬 Join Our Community for Free Tools & Optimizations

Click the link in my profile to join our trading community, where you’ll find:

- Optimized parameter sets

- Extra tools

- Structure-based strategies

- Exclusive resources for AlgoTrend indicators

A great space to grow your system and improve consistency.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

(2).png)

.png)

.png)

.png)

.png)

.png)