A sophisticated trading system combining martingale strategy with multi-layered technical analysis and comprehensive protection features.

Key Features:

- - 11 Built-in Strategy Templates

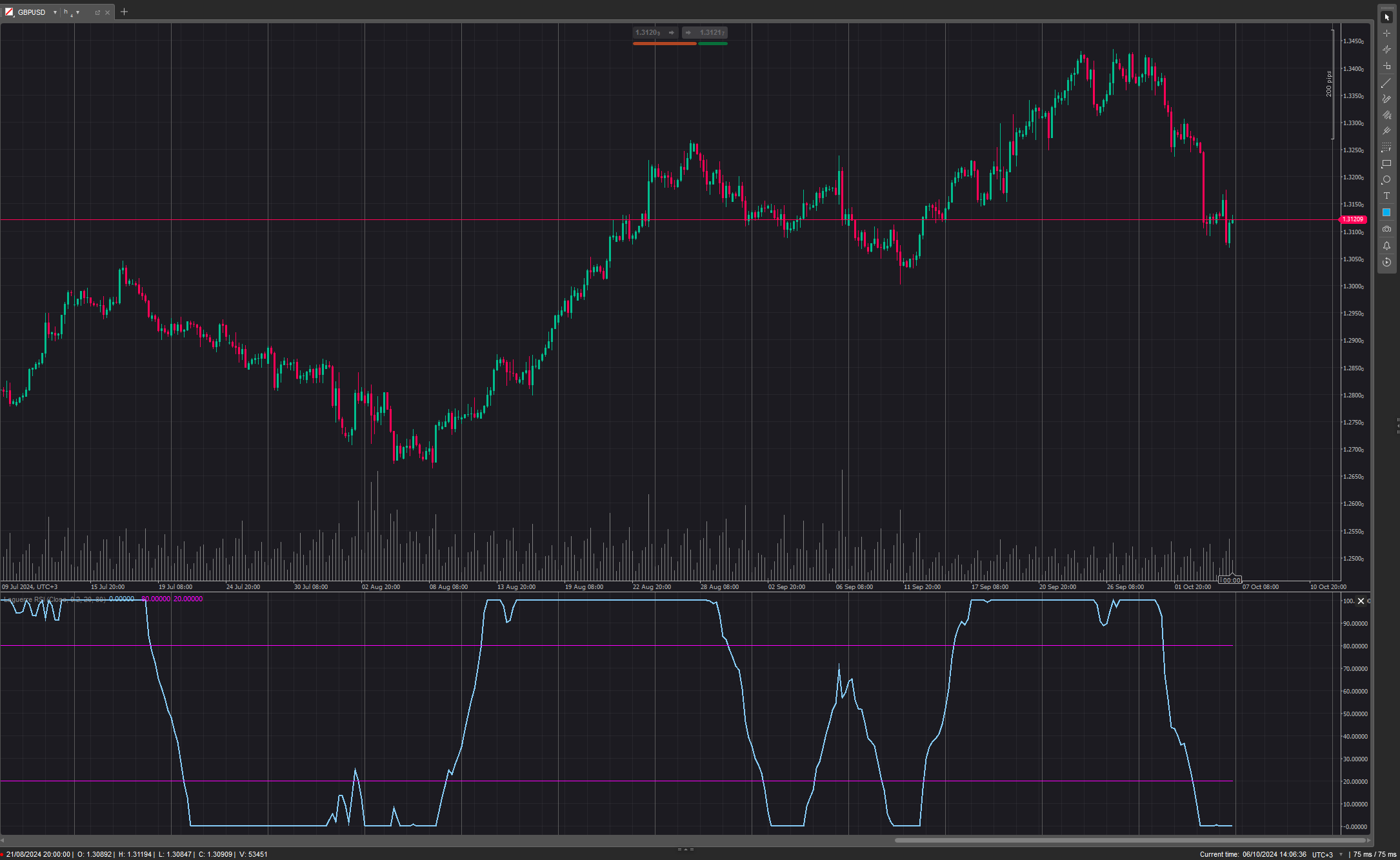

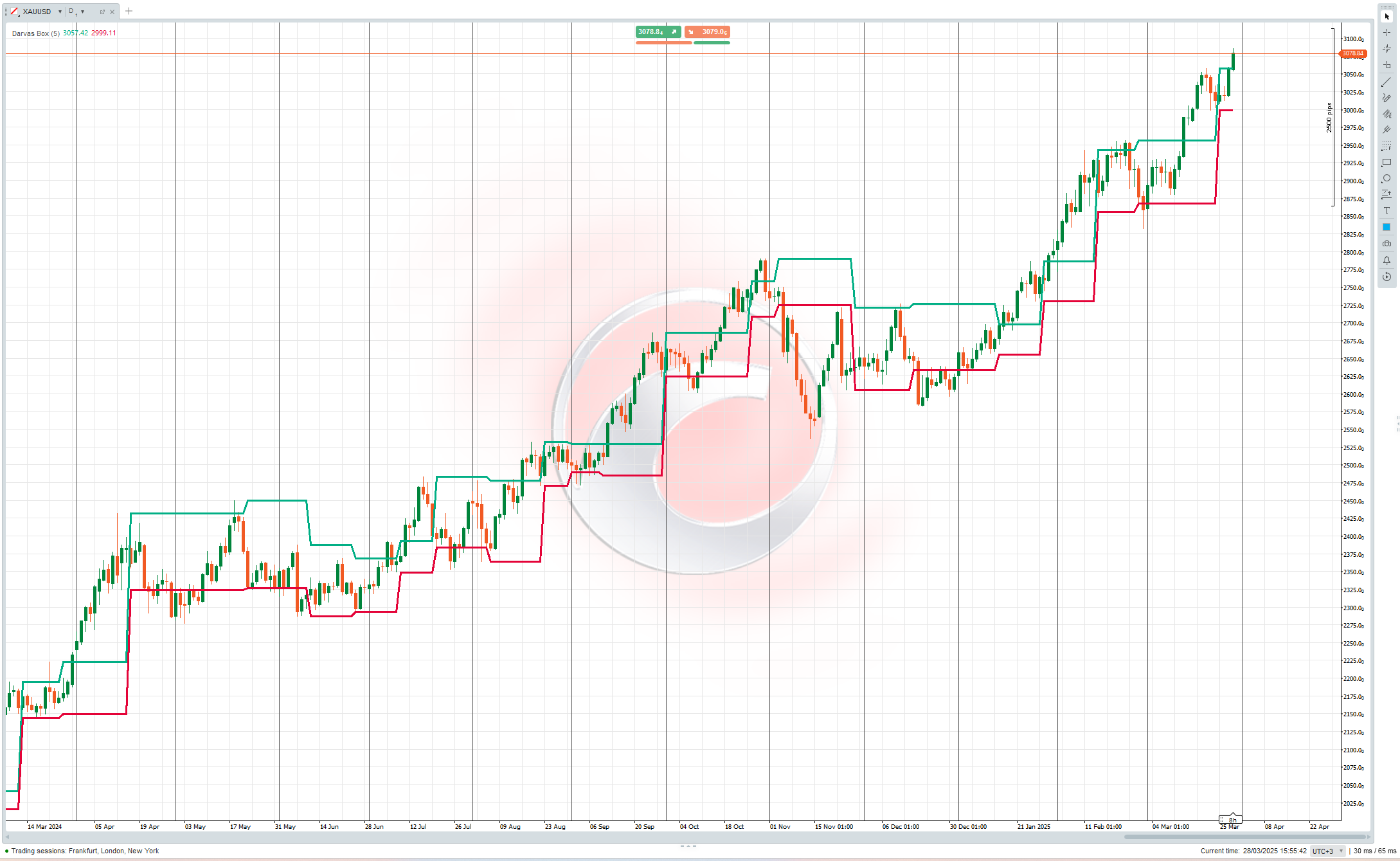

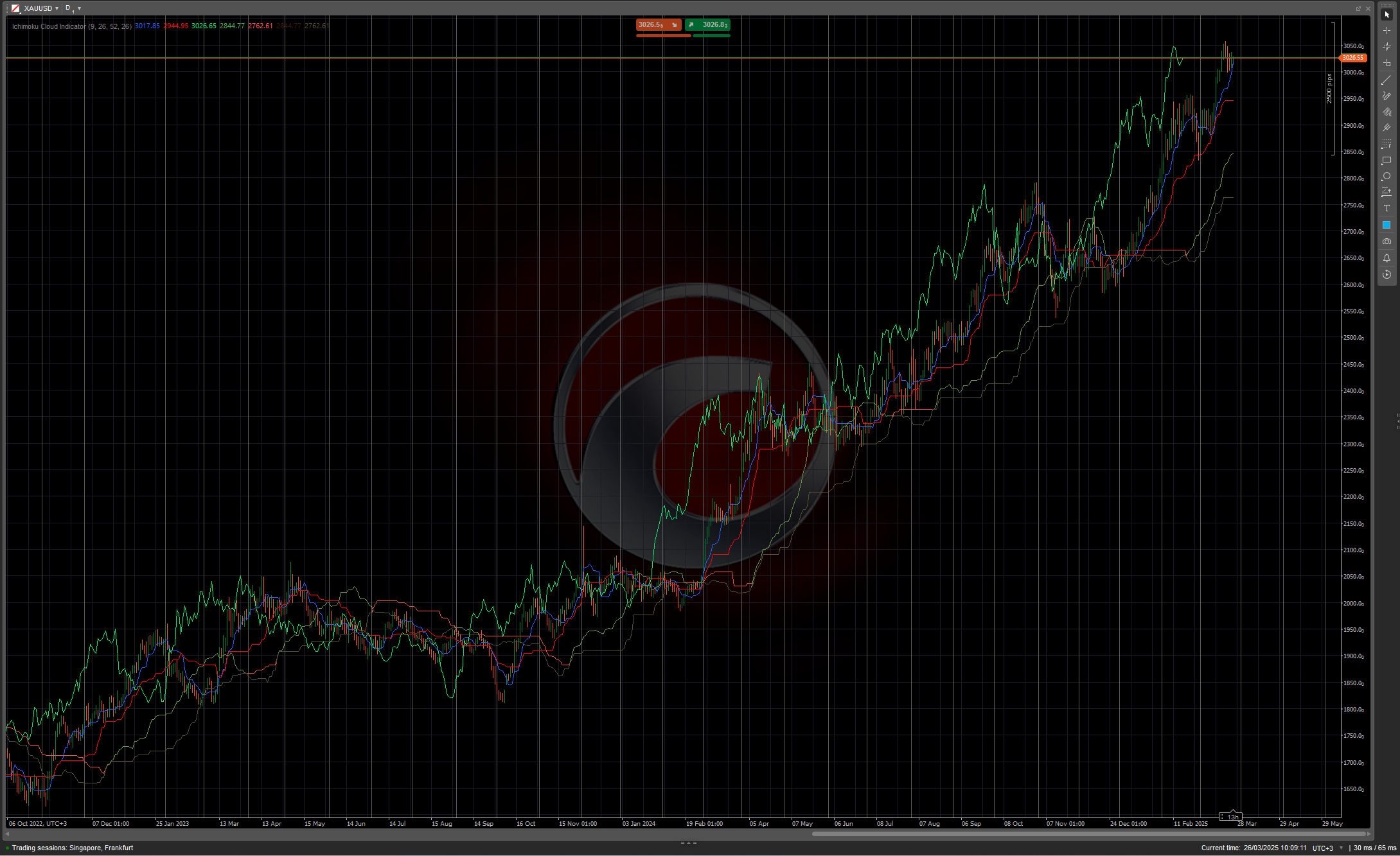

- - Multi-Timeframe Analysis

- - Advanced Volume Control

- - Flexible Filter System

- - Dynamic Risk Management

- - Smart Position Sizing

Protection Mechanisms:

- - Volume-based Entry Validation

- - Time Restriction Options

- - Multiple Risk Layers

- - Trailing Stop System

- - Maximum Exposure Control

Advanced Filter Framework:

- - Up to 10 Customizable Filters

- - Individual Weight Assignment

- - Priority-based Execution

- - Multiple Timeframe Confirmation

- - Custom Threshold Settings

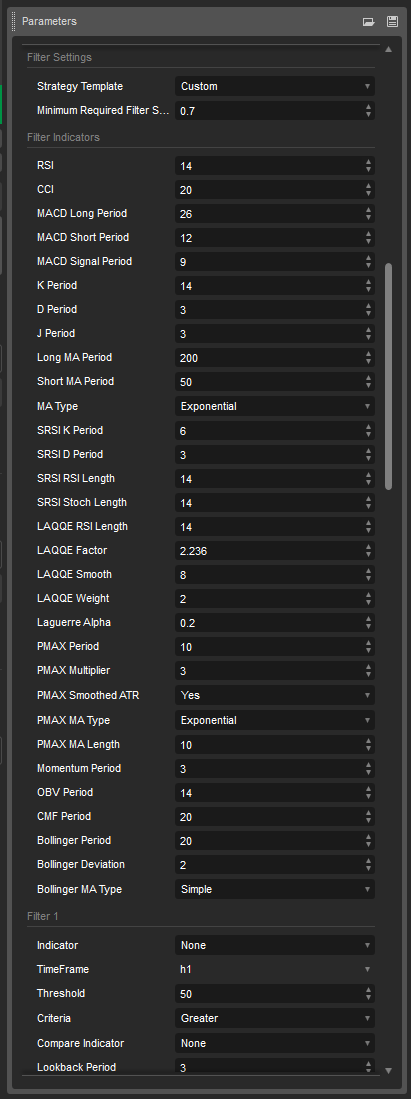

Available Indicators:

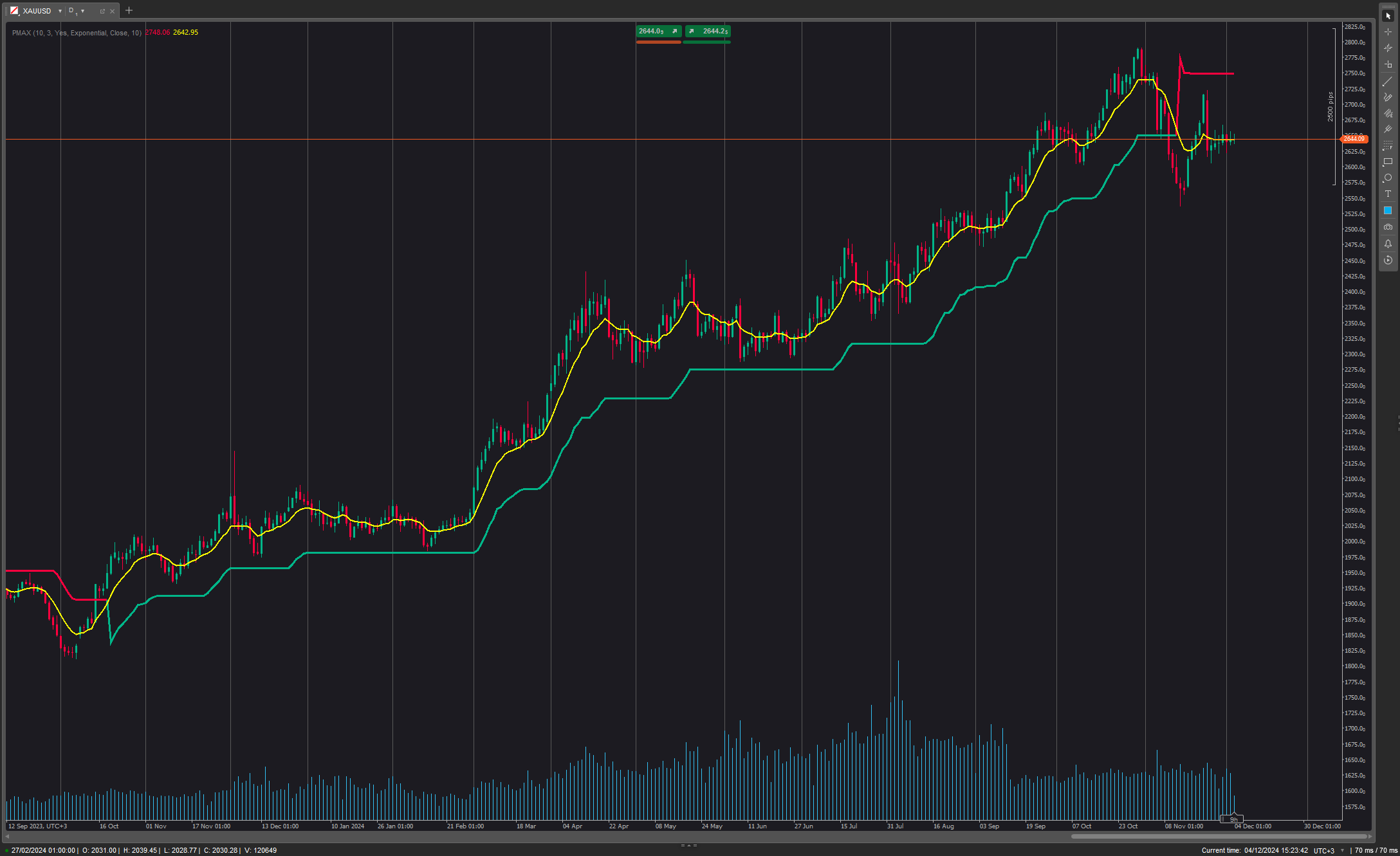

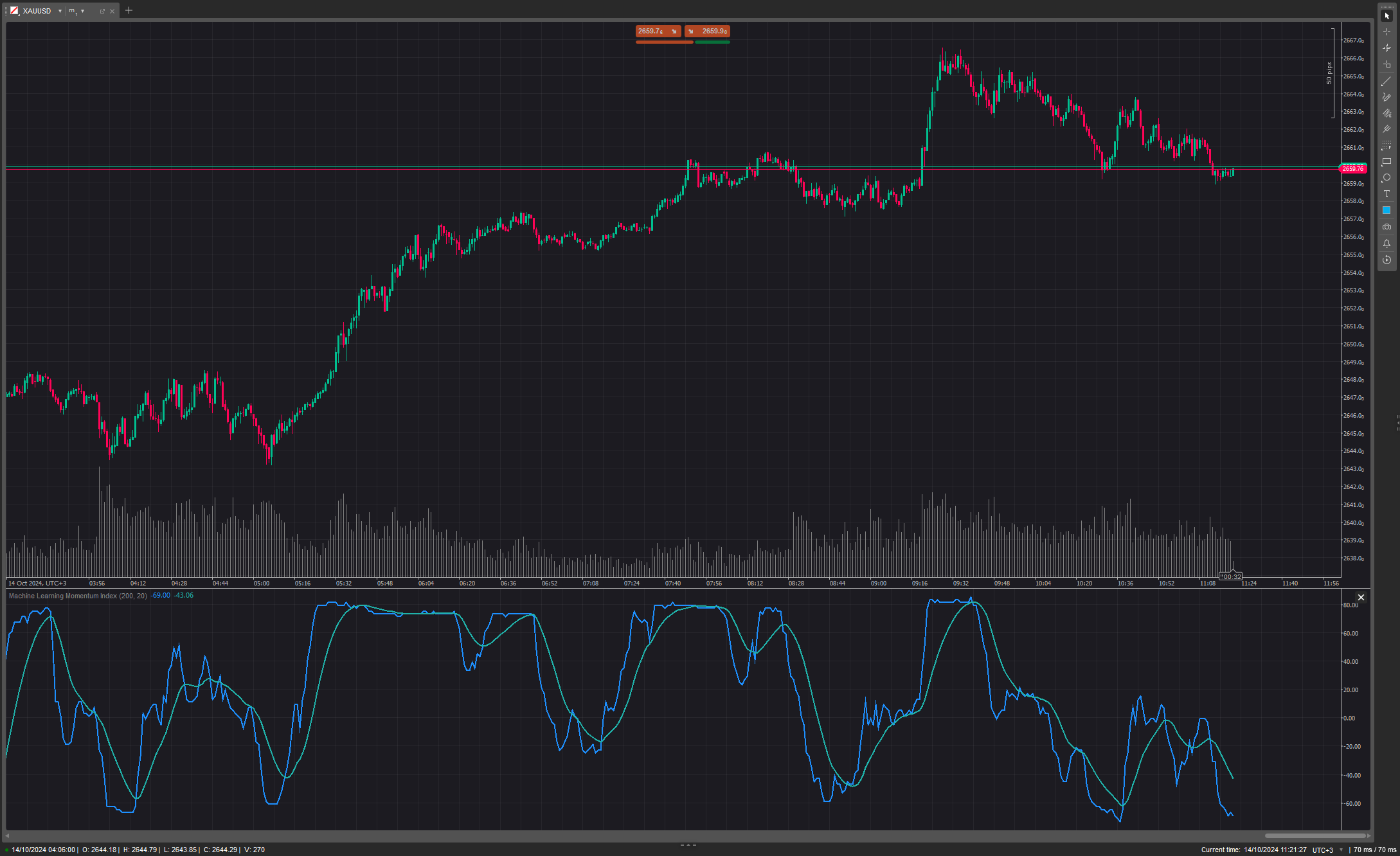

- - Trend: PMAX, Moving Averages, Bollinger Bands

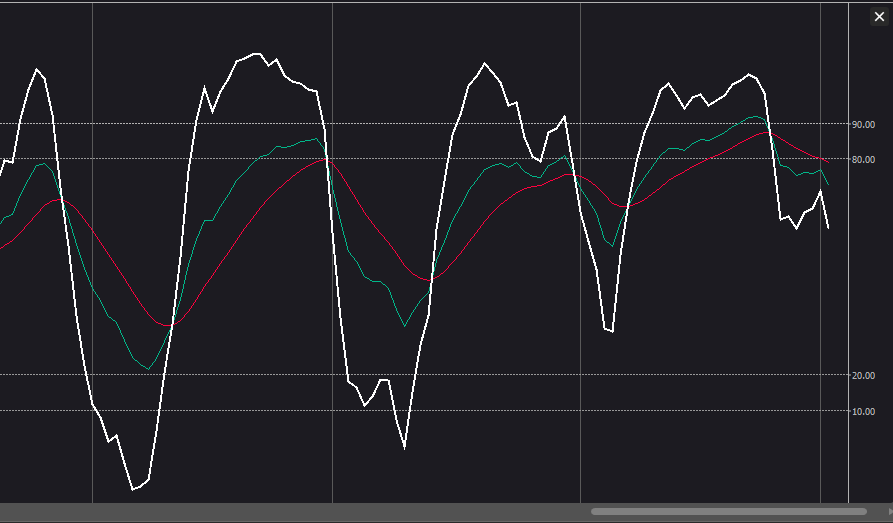

- - Momentum: RSI, MACD, Stochastic RSI

- - Custom: LAQQE, KDJ, Laguerre RSI

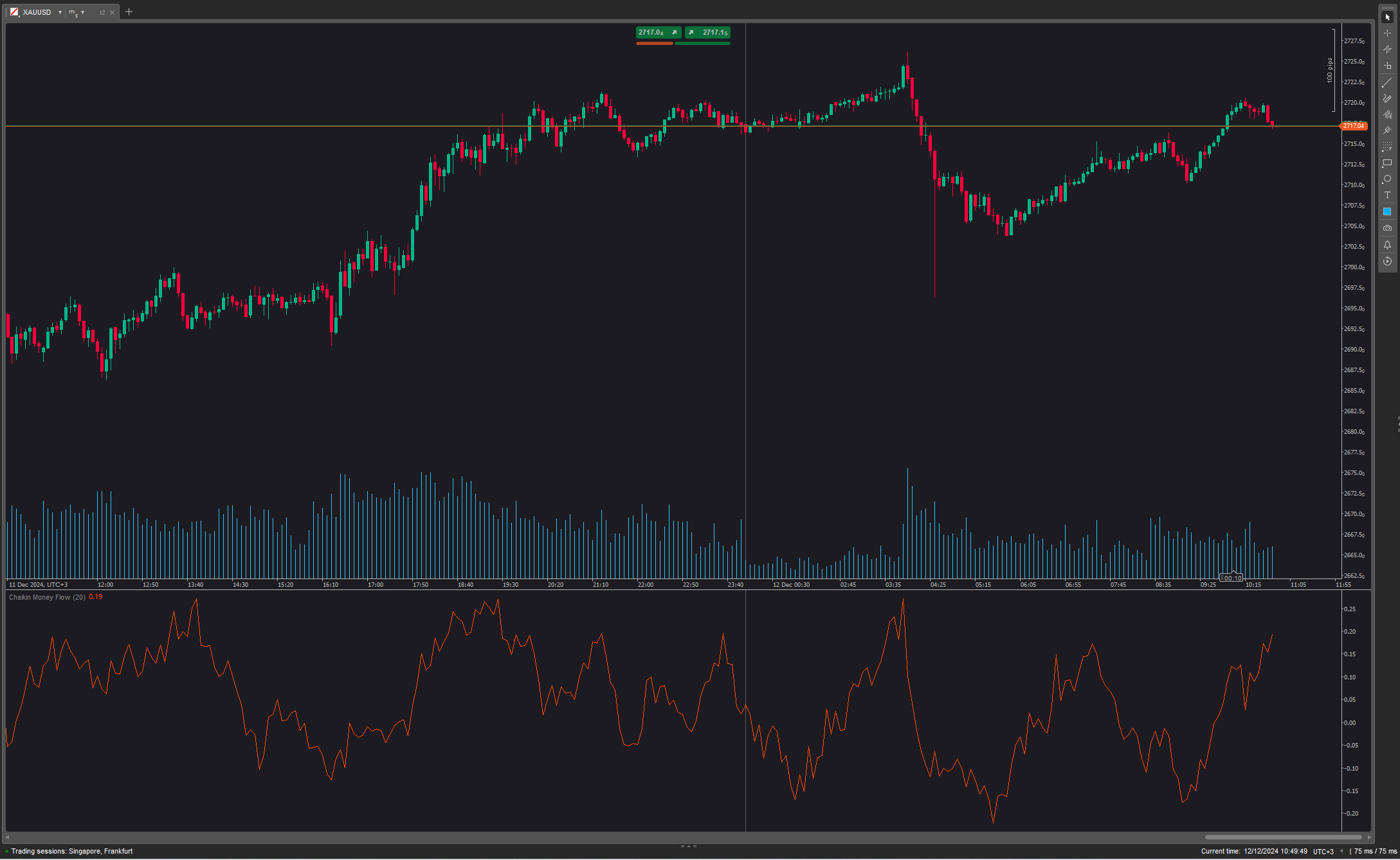

- - Volume: OBV, CMF

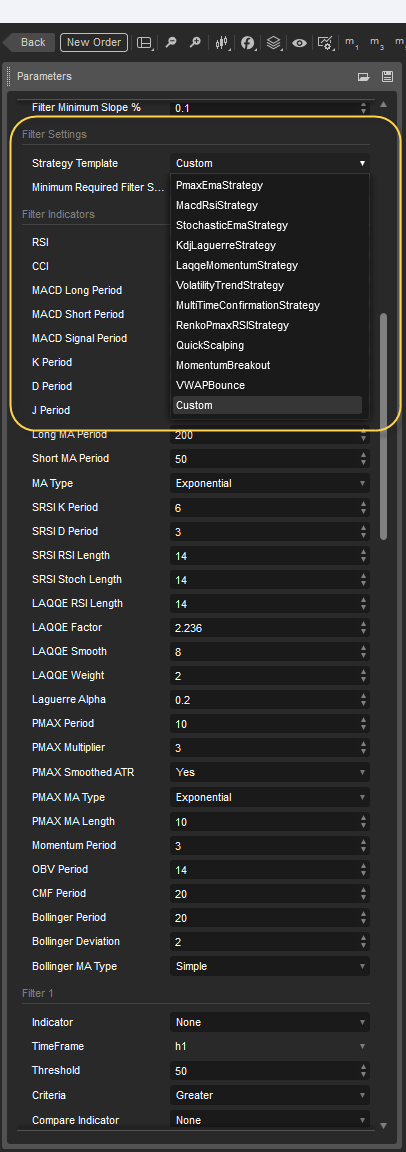

Strategy Templates:

- ✓ PMAX/EMA Strategy: Strong trend following

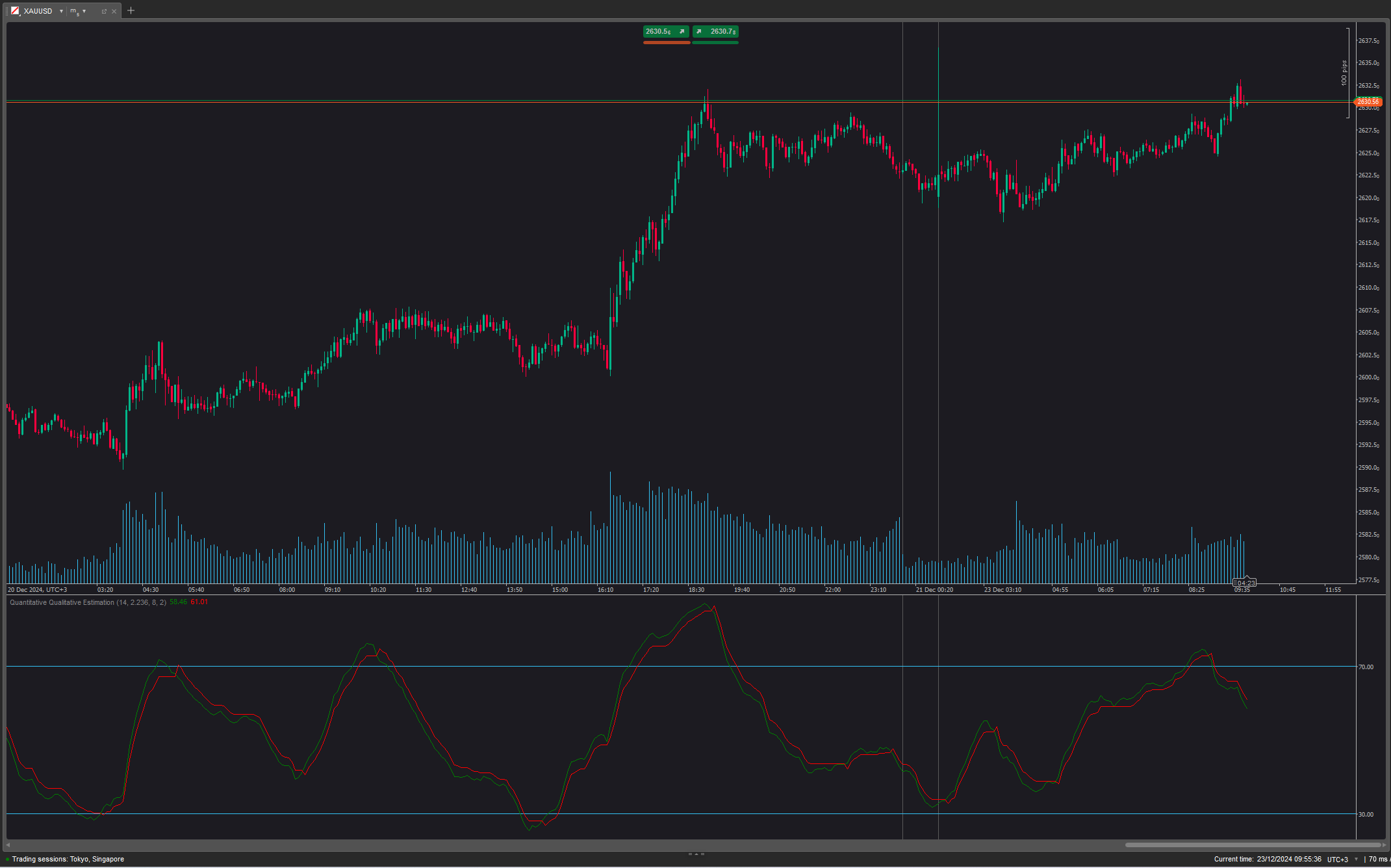

- ✓ MACD/RSI Strategy: Momentum trading

- ✓ Stochastic/EMA Strategy: Trend reversal

- ✓ KDJ/Laguerre Strategy: Advanced oscillator

- ✓ LAQQE Momentum Strategy: Quick momentum capture

- ✓ Volatility Trend Strategy: Breakout trading

- ✓ Multi-Time Confirmation: Multiple timeframe analysis

- ✓ Renko PMAX/RSI: Noise reduction trading

- ✓ Quick Scalping Strategy: Rapid trading

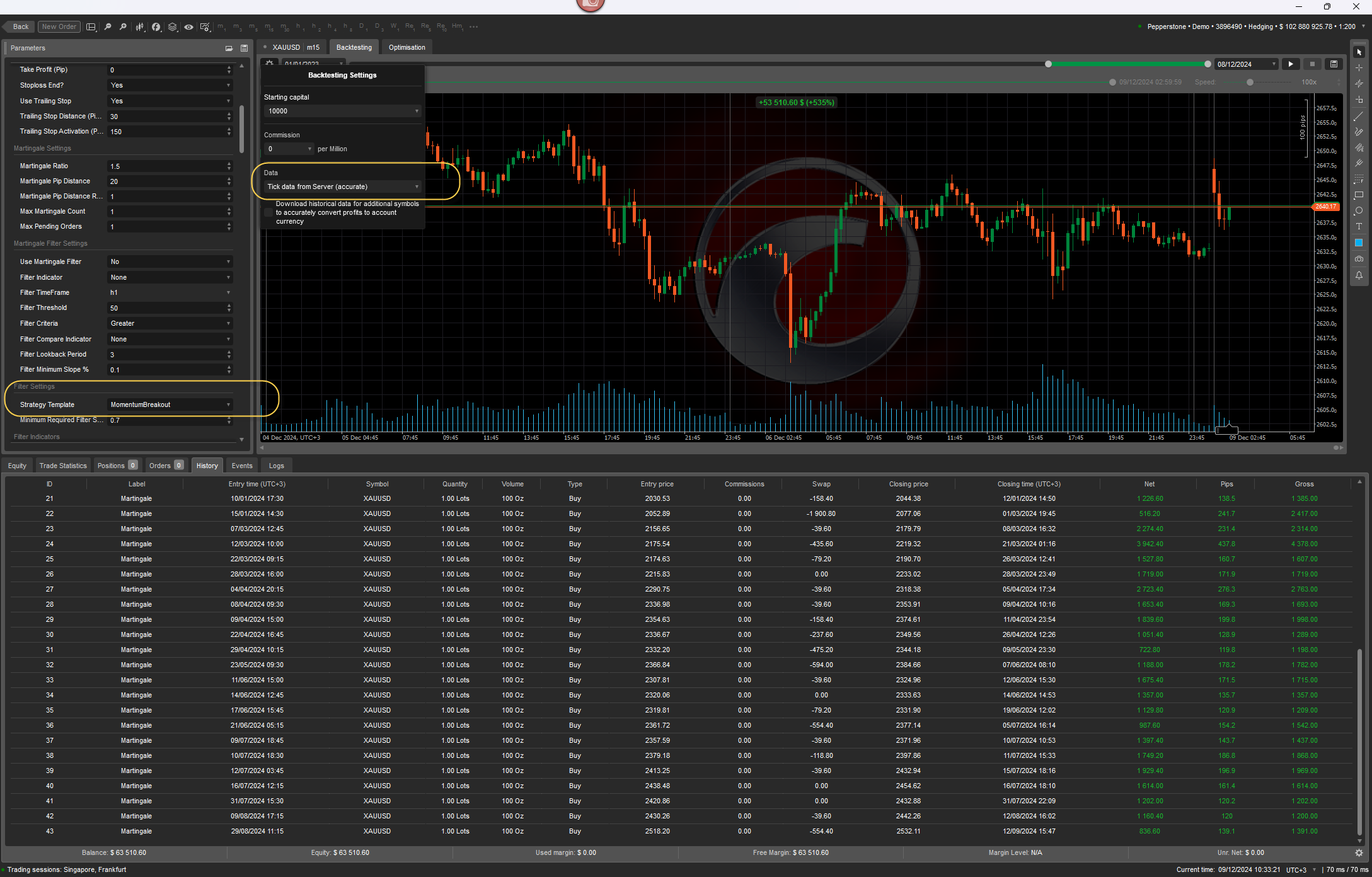

- ✓ Momentum Breakout Strategy: Volume confirmation

- ✓ VWAP Bounce Strategy: Price level trading

Customization Options:

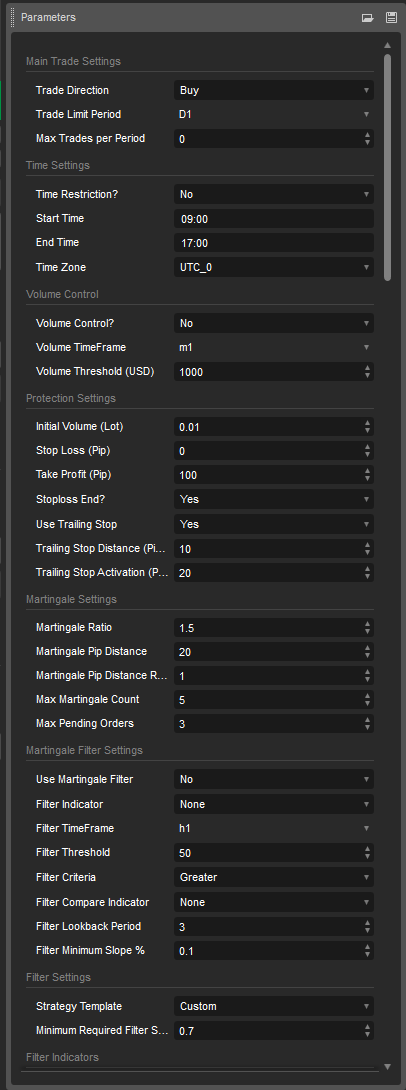

- - Main Trade Settings: Direction, limits, volume control

- - Time Settings: Trading hours, timezone

- - Protection Settings: Initial volume, stops, trailing

- - Martingale Settings: Ratio, distance, maximum steps

- - Filter Settings: Custom indicator combinations

- - Risk Parameters: All fully adjustable

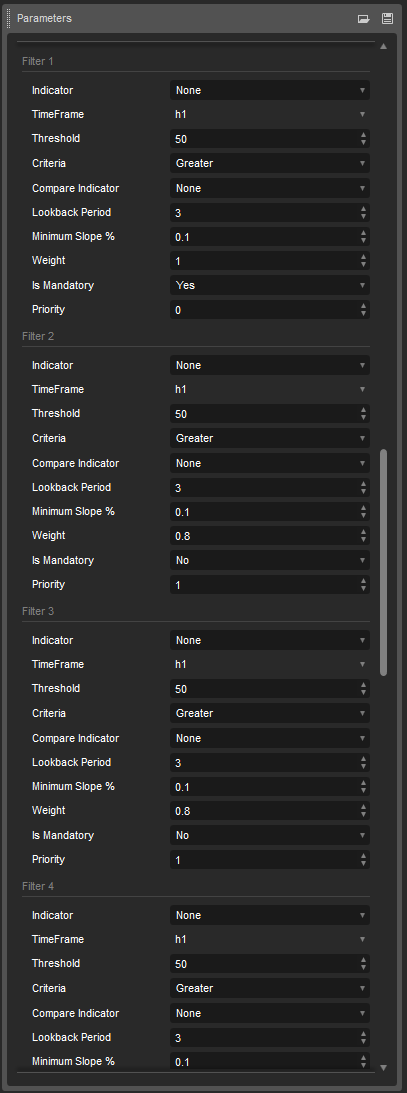

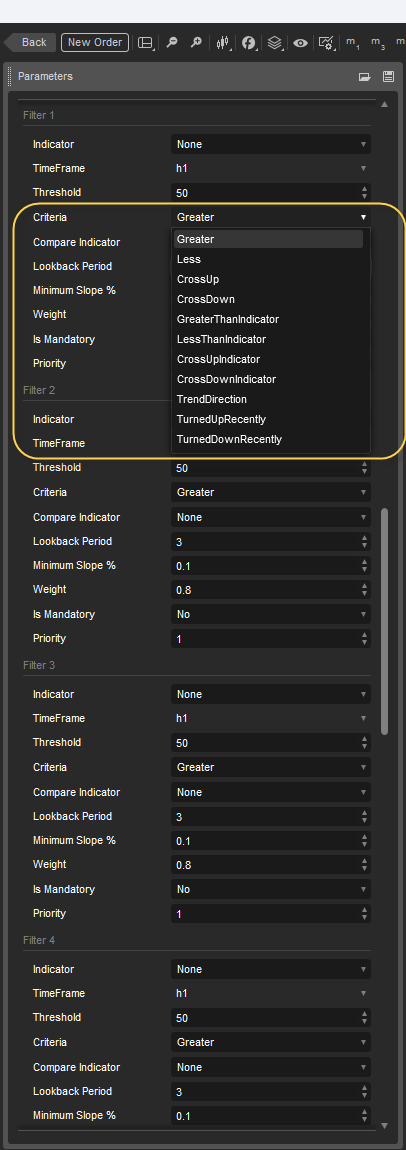

Filter Structure:

1. Basic Components:

- - Indicator: Selection of technical indicator (RSI, MACD, BB, etc.)

- - TimeFrame: Chart timeframe (M1 to D1)

- - Threshold: Value for comparison

- - Criteria: How to evaluate the indicator

- - Weight: Importance in decision making (0.1-1.0)

- - IsMandatory: Must pass for trade entry (Yes/No)

- - Priority: Order of evaluation (0-10)

- - Compare Indicator: Optional second indicator for comparison

2. Filter Criteria Types:

- - Greater: Indicator > Threshold

- - Less: Indicator < Threshold

- - CrossUp: Indicator crosses above Threshold

- - CrossDown: Indicator crosses below Threshold

- - GreaterThanIndicator: Indicator1 > Indicator2

- - LessThanIndicator: Indicator1 < Indicator2

- - CrossUpIndicator: Indicator1 crosses above Indicator2

- - CrossDownIndicator: Indicator1 crosses below Indicator2

- - TrendDirection: Analyze trend slope

- - TurnedUpRecently: Recent upward turn

- - TurnedDownRecently: Recent downward turn

Example Filter Configurations:

1. Simple RSI Filter:

- - Indicator: RSI

- - TimeFrame: H1

- - Threshold: 30

- - Criteria: CrossUp

- - Weight: 1.0

- - IsMandatory: Yes

- - Priority: 1

- Result: Triggers when RSI crosses above 30 on H1

2. Moving Average Crossover:

- - Indicator: Short_MA

- - TimeFrame: H1

- - Criteria: CrossUpIndicator

- - CompareIndicator: Long_MA

- - Weight: 0.8

- - IsMandatory: No

- - Priority: 2

- Result: Triggers when fast MA crosses above slow MA

3. Bollinger Band Bounce:

- - Indicator: Close

- - TimeFrame: M15

- - Criteria: CrossUpIndicator

- - CompareIndicator: BB_Lower

- - Weight: 0.7

- - IsMandatory: No

- - Priority: 3

- Result: Triggers when price crosses above lower BB

Possible Filter Combinations & Strategies

1. Available Components Per Filter

Indicators (21 total):

- - Close

- - RSI

- - CCI

- - MACD

- - MACDHistogram

- - MACDSignal

- - KDJ_K

- - KDJ_D

- - KDJ_J

- - Long_MA

- - Short_MA

- - SRSI_K

- - SRSI_D

- - LAQQE_RSI

- - LAQQE_TS

- - LaguerreRSI

- - PMAX_Upper

- - PMAX_Lower

- - Momentum

- - BB_Upper

- - BB_Lower

- - BB_Middle

TimeFrames (20 total): Standard Timeframes: - Minute (M1) - Minute2 (M2) - Minute3 (M3) - Minute4 (M4) - Minute5 (M5) - Minute10 (M10) - Minute15 (M15) - Minute30 (M30) - Hour (H1) - Hour2 (H2) - Hour3 (H3) - Hour4 (H4) - Hour6 (H6) - Hour8 (H8) - Hour12 (H12) - Daily (D1) - Weekly (W1) - Monthly (MN1) Special Timeframes: - Renko1 - Renko5 - Renko10

**There are more timeframes at Ctrader but for simple calculations we used these 20 timeframes.

Criteria Types (11 total):

- - Greater

- - Less

- - CrossUp

- - CrossDown

- - GreaterThanIndicator

- - LessThanIndicator

- - CrossUpIndicator

- - CrossDownIndicator

- - TrendDirection

- - TurnedUpRecently

- - TurnedDownRecently

2. Basic Combination Calculation

For a single filter:

- Basic combinations = Indicators × TimeFrames × Criteria 21 × 21 × 11 = 4,851 possible combinations per filter Extended combinations for single filter: 4,851 × 10 × 2 × 11 = 1,067,220 possible combinations Weight (0.1 to 1.0 in 0.1 steps) = 10 options

- IsMandatory (Yes/No) = 2 options

- Priority (0-10) = 11 options

Extended combinations for single filter:

2,772 × 10 × 2 × 11 = 609,840 possible combinations

3. Multi-Filter Strategy Possibilities

With 10 available filter slots:

Total theoretical combinations = 609,840¹⁰

However, practical limitations apply:

- Not all combinations are logical

- Some indicators work better together

- Market conditions limit effectiveness

- Computing power limitations

Filter Scoring System Explained

1. Basic Components:

- Weight: 0.1-1.0 (importance of filter)

- IsMandatory: Must-pass filters

- Minimum Required Score: User-defined threshold (e.g., 0.7 or 70%)

2. Score Calculation:

Total Score = (Sum of Successful Filter Weights) / (Sum of All Filter Weights)

Example Calculation:

Filter 1: Weight 1.0 (Success)

Filter 2: Weight 0.8 (Fail)

Filter 3: Weight 0.6 (Success)

Total Score = (1.0 + 0 + 0.6) / (1.0 + 0.8 + 0.6) = 0.67 (67%)

3. Trade Entry Requirements:

- All mandatory filters must pass

- Total score must exceed minimum required score

- Both conditions must be met for trade entry

Practical Example:

Required Score: 0.7 (70%)

Filter 1: PMAX Trend (1.0, Mandatory) ✓

Filter 2: RSI Level (0.8, Optional) ✓

Filter 3: Volume (0.6, Optional) ✗

Result = (1.0 + 0.8) / 2.4 = 0.75 (75%) → Trade Allowed

As A result

Perfect for:

- - Major & Minor Forex Pairs

- - Multiple Trading Styles

- - Various Market Conditions

- - Different Risk Appetites

Recommended:

- - Account Size: $1,000+ recommended

- - Timeframes: M5 to H4

- - Pairs: Major forex pairs

- - Demo testing before live trading

Regular updates and professional support included.

This advanced trading system offers flexibility for both beginners and experienced traders, combining powerful technical analysis with robust risk management features.

Note: Past performance does not guarantee future results. Always start with demo testing.

.png)