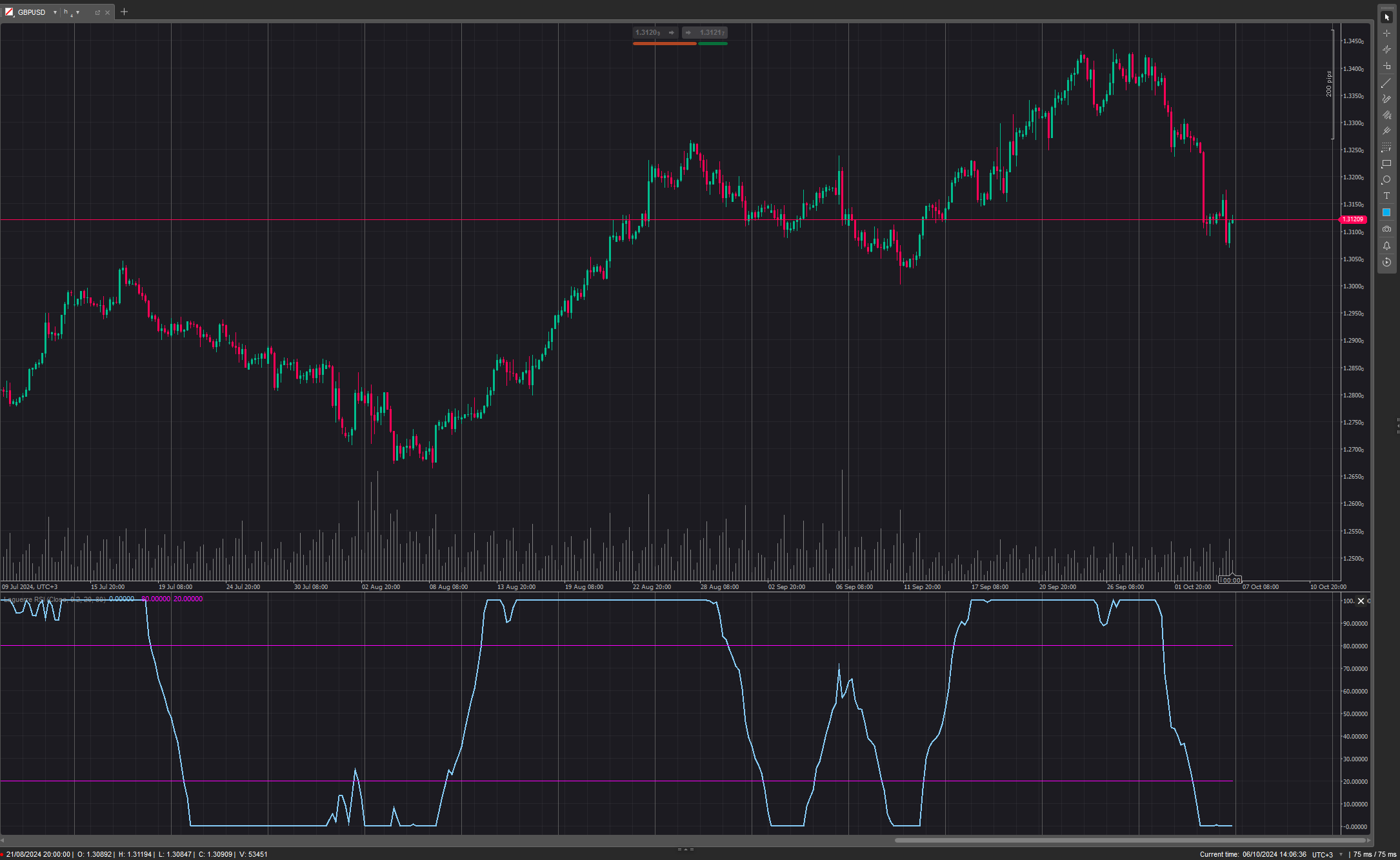

StochasticRSI

مؤشر

1.01K التنزيلات

Version 1.0, Nov 2024

Windows, Mac

5.0

التقييمات: 1

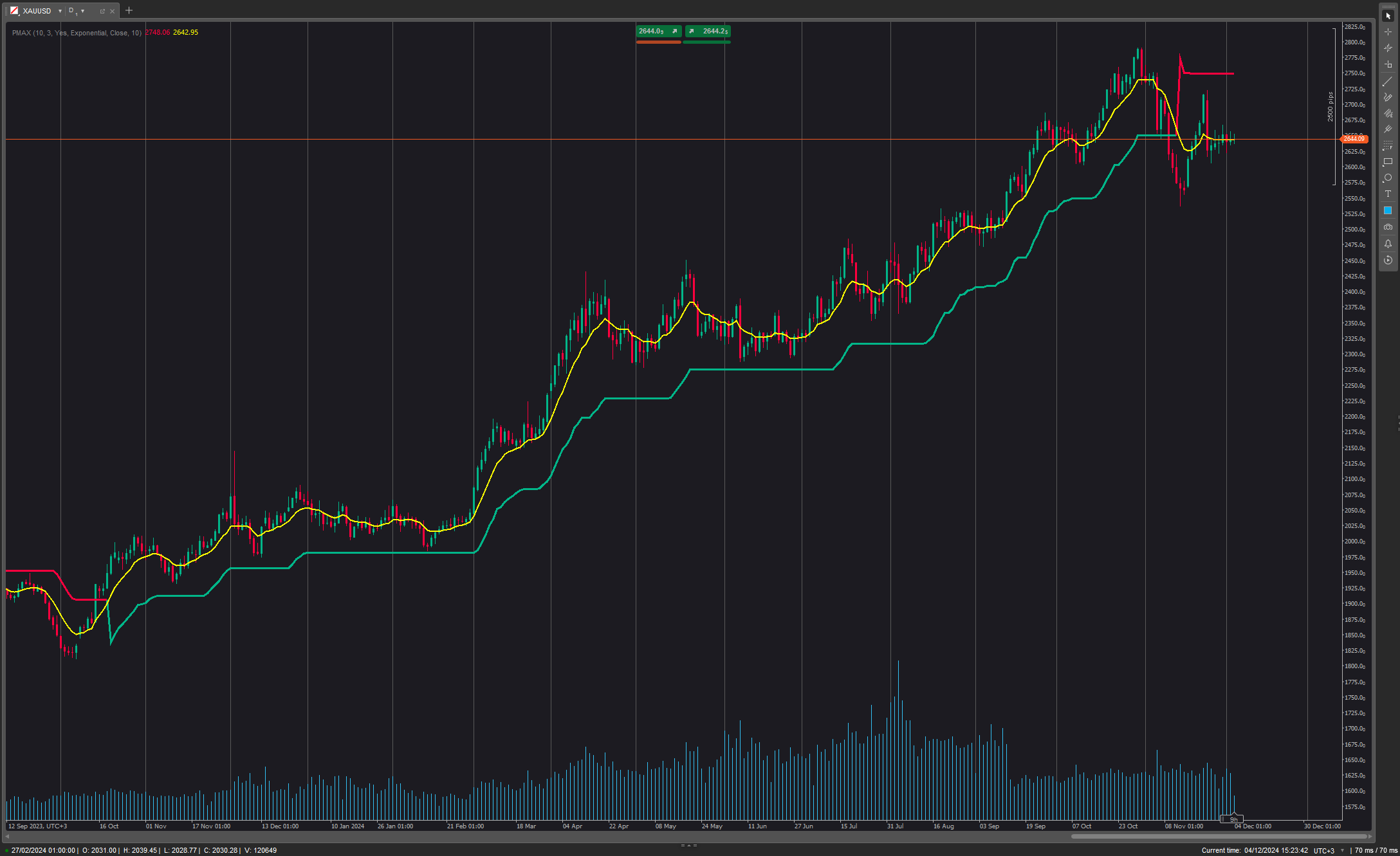

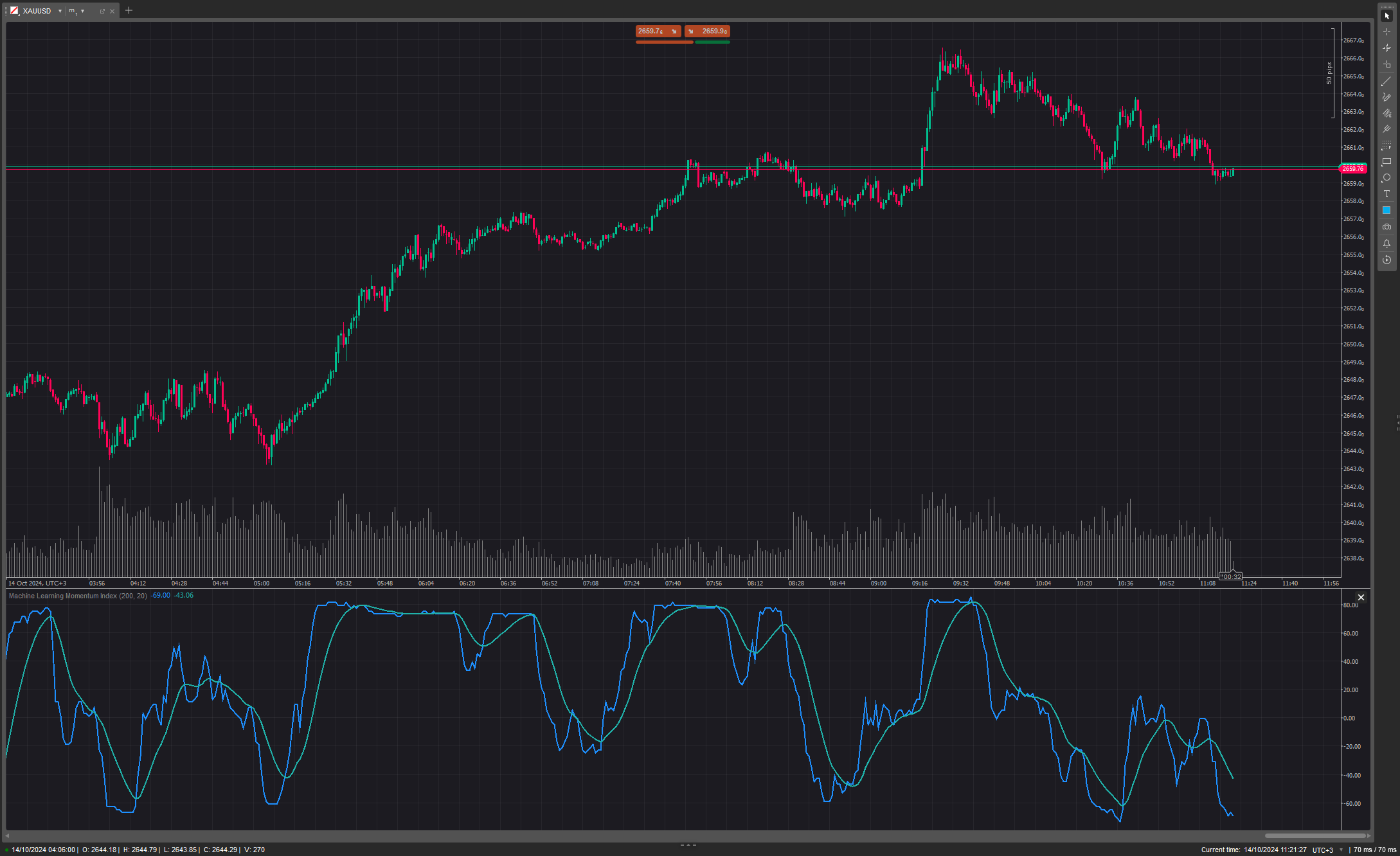

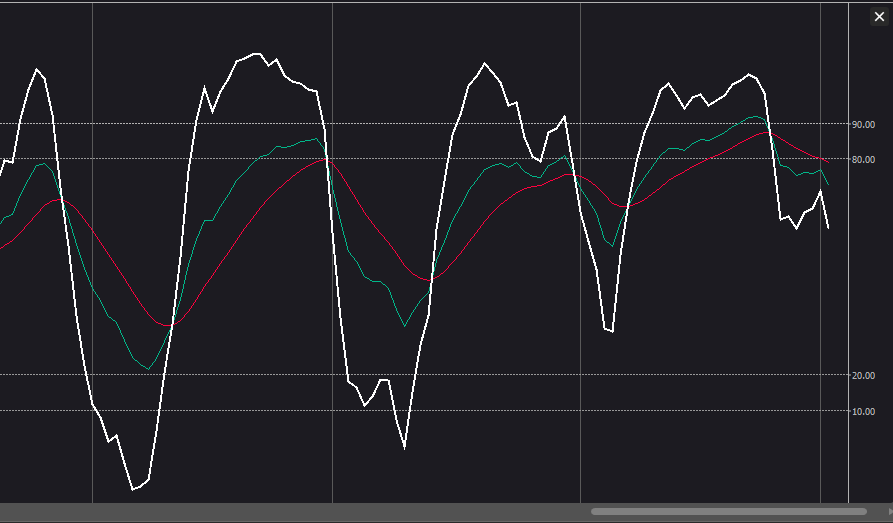

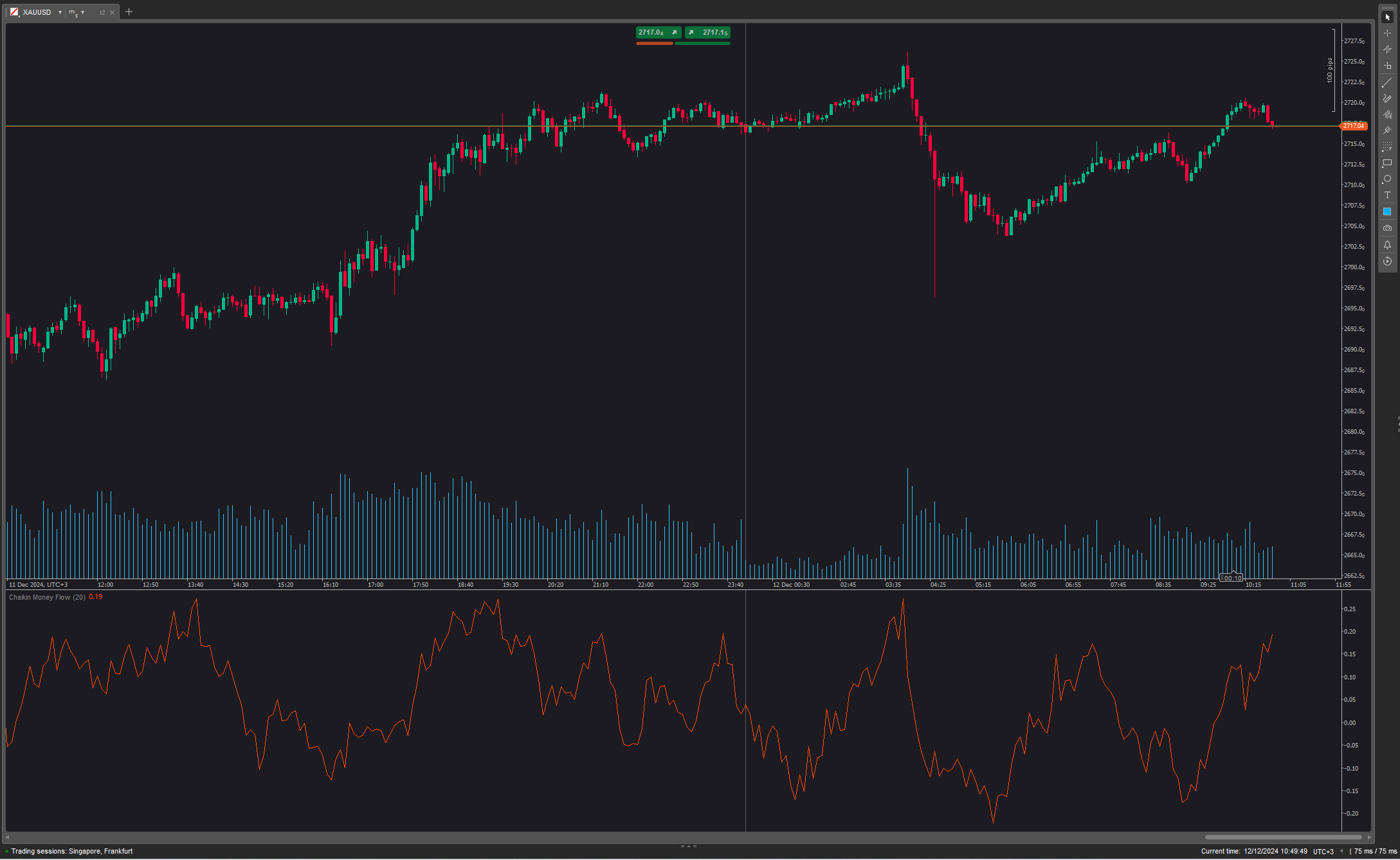

Stochastic RSI (StochRSI) is a technical analysis indicator used to support stock market prediction by comparing a security's price range to its closing price. StochRSI is unique in that it focuses on market momentum and is good at reading overbought and oversold market conditions. StochRSI differs from other technical indicators, such as the Relative Strength Index (RSI), because it moves from overbought to oversold prices faster than the RSI.

5.0

التقييمات: 1

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

تقييمات العملاء

July 9, 2025

Pros: Combines Stochastic Oscillator and RSI for improved overbought/oversold detection. Easy to set up, stable on all timeframes. Cons: No tooltips or alerts. Requires confirmation from trend indicators to avoid false signals. Limited customization options.

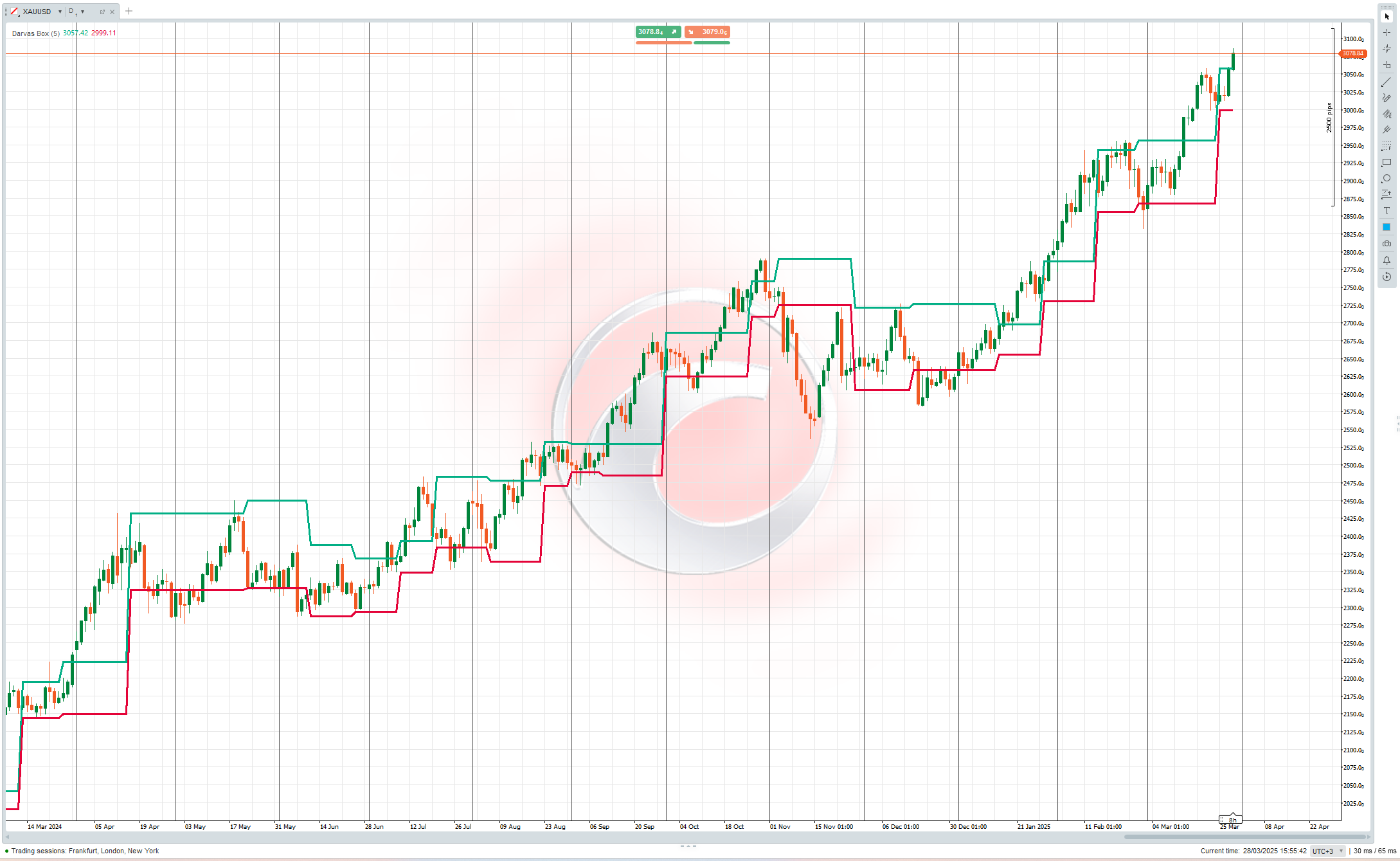

RSI

Indices

المزيد من هذا المؤلف

مؤشر

RSI

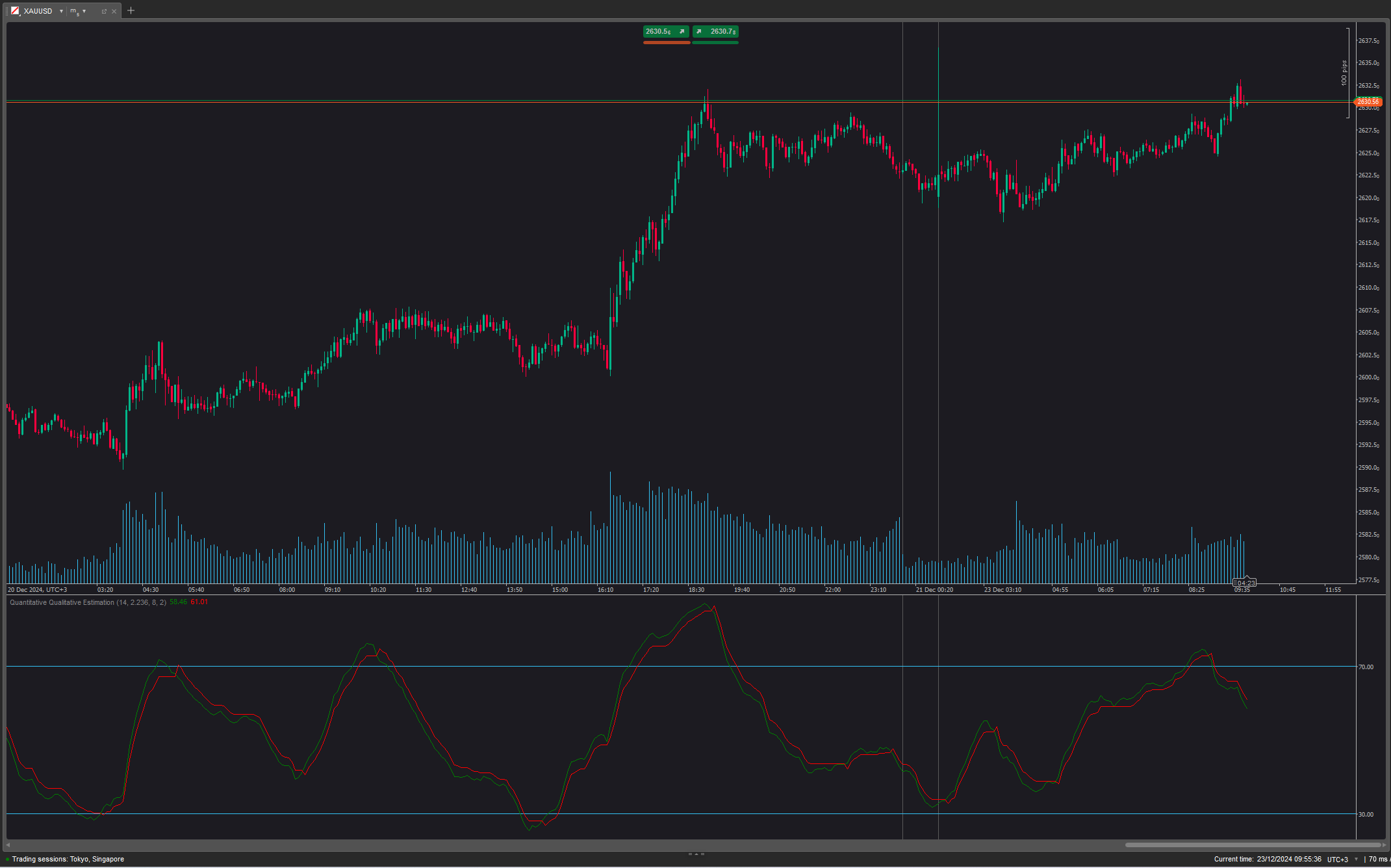

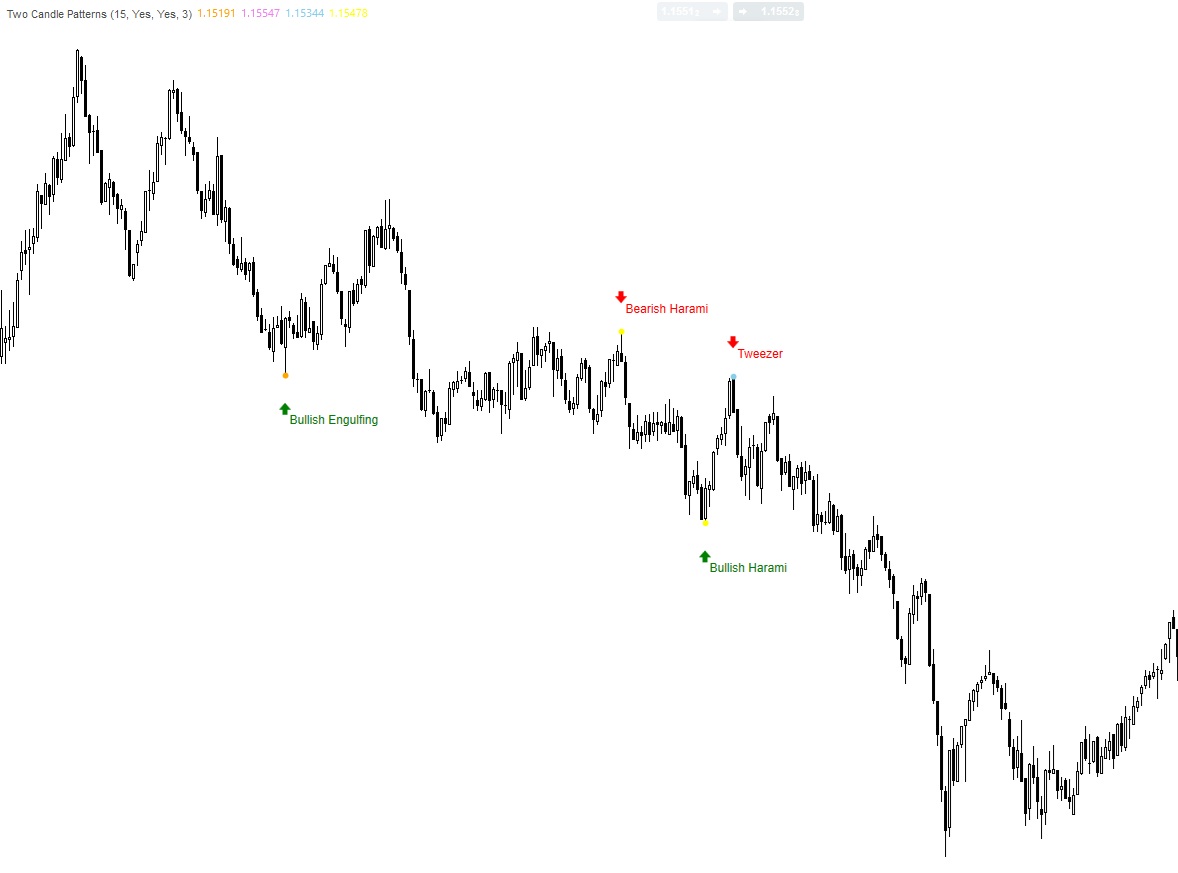

Quantitative Qualitative Estimation

The QQE (Quantitative Qualitative Estimation) Weighted Oscillator improves its original version by weighting the RSI.

قد يعجبك أيضًا

2

المبيعات

6.19K

التثبيتات المجانية

.png)

.jpg)

.jpg)