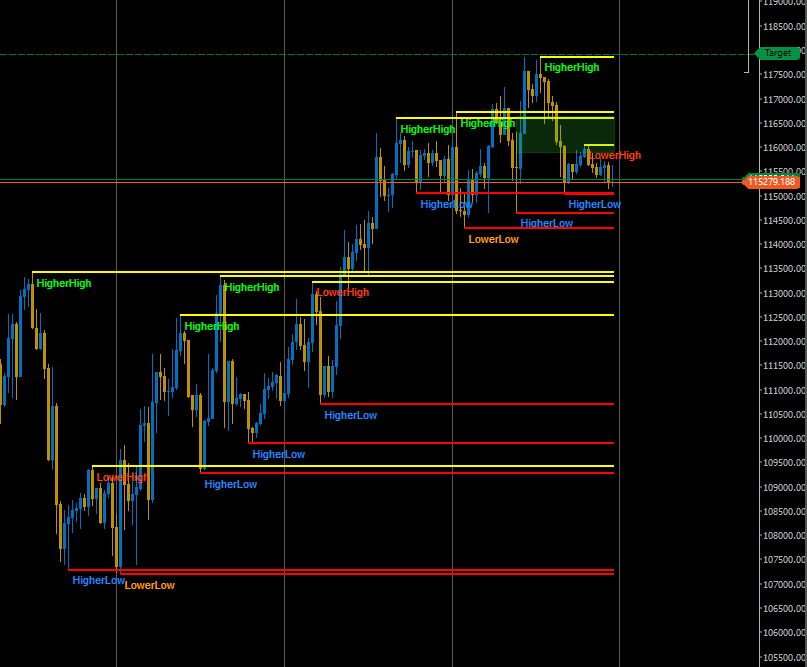

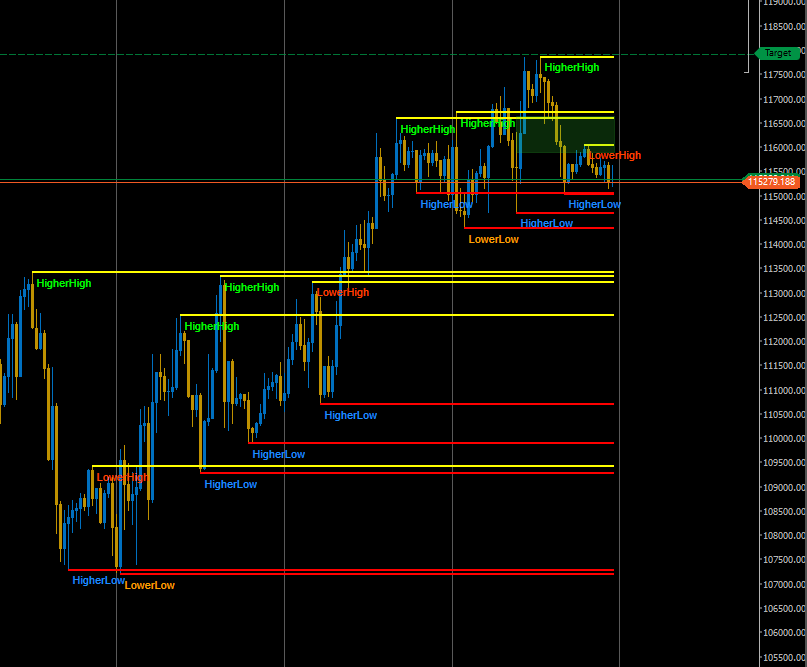

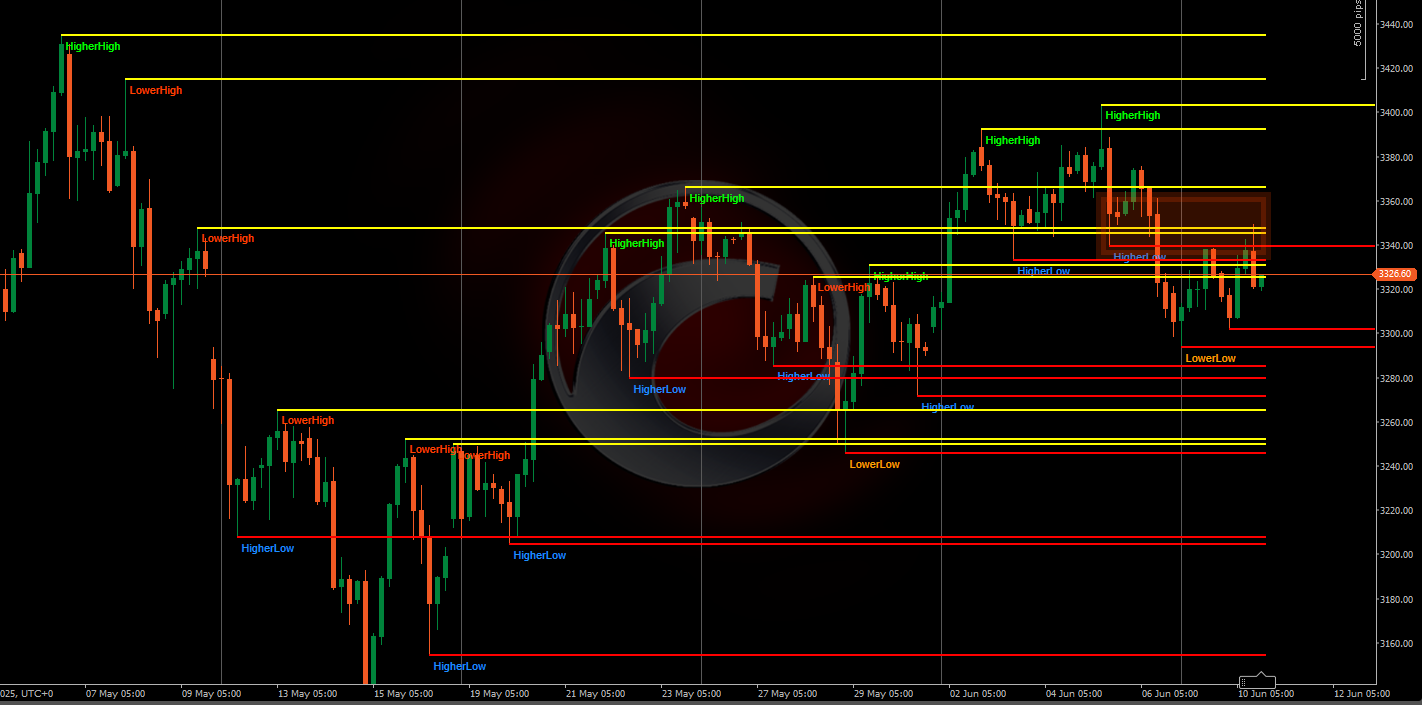

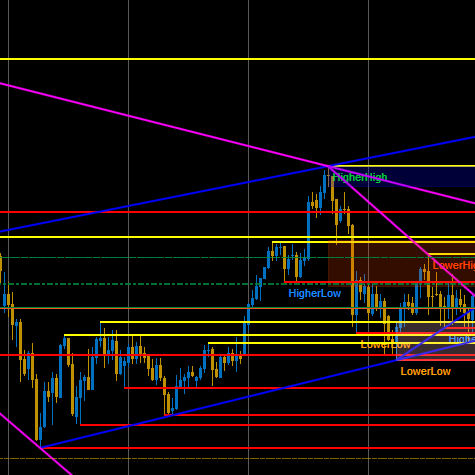

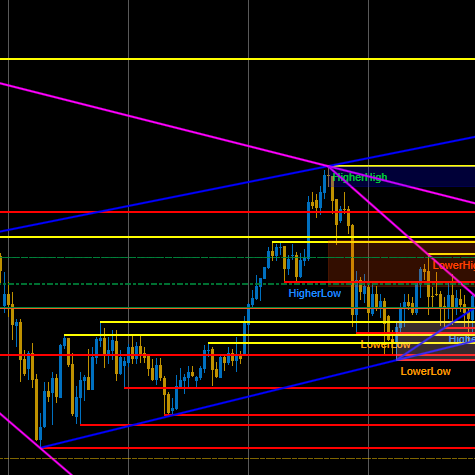

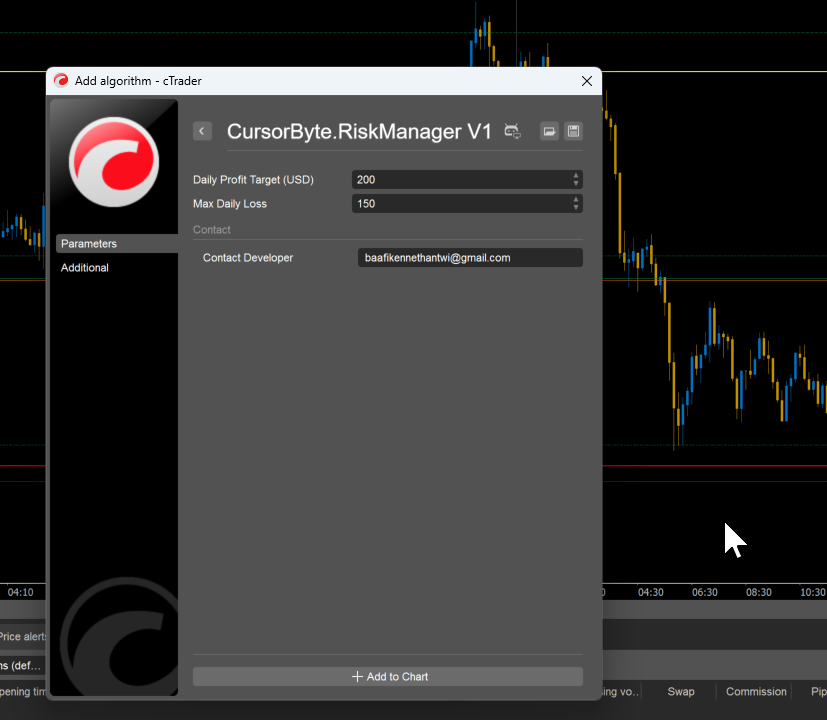

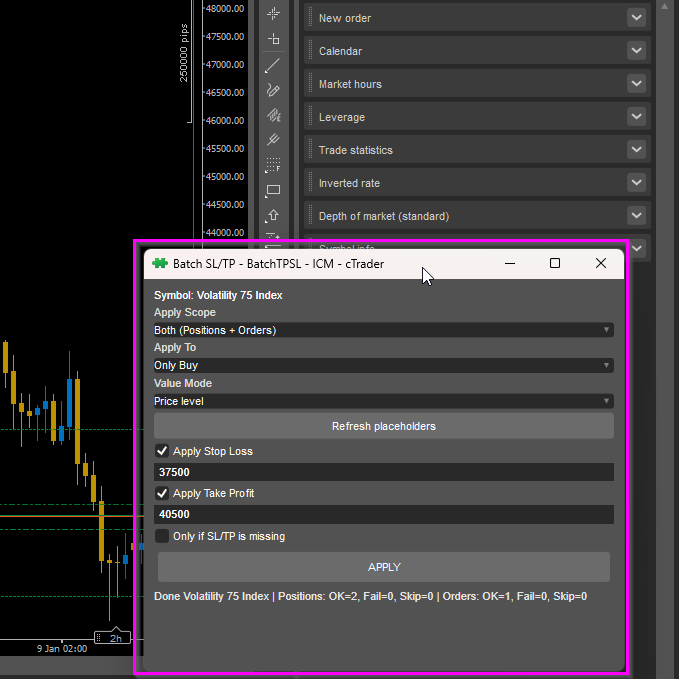

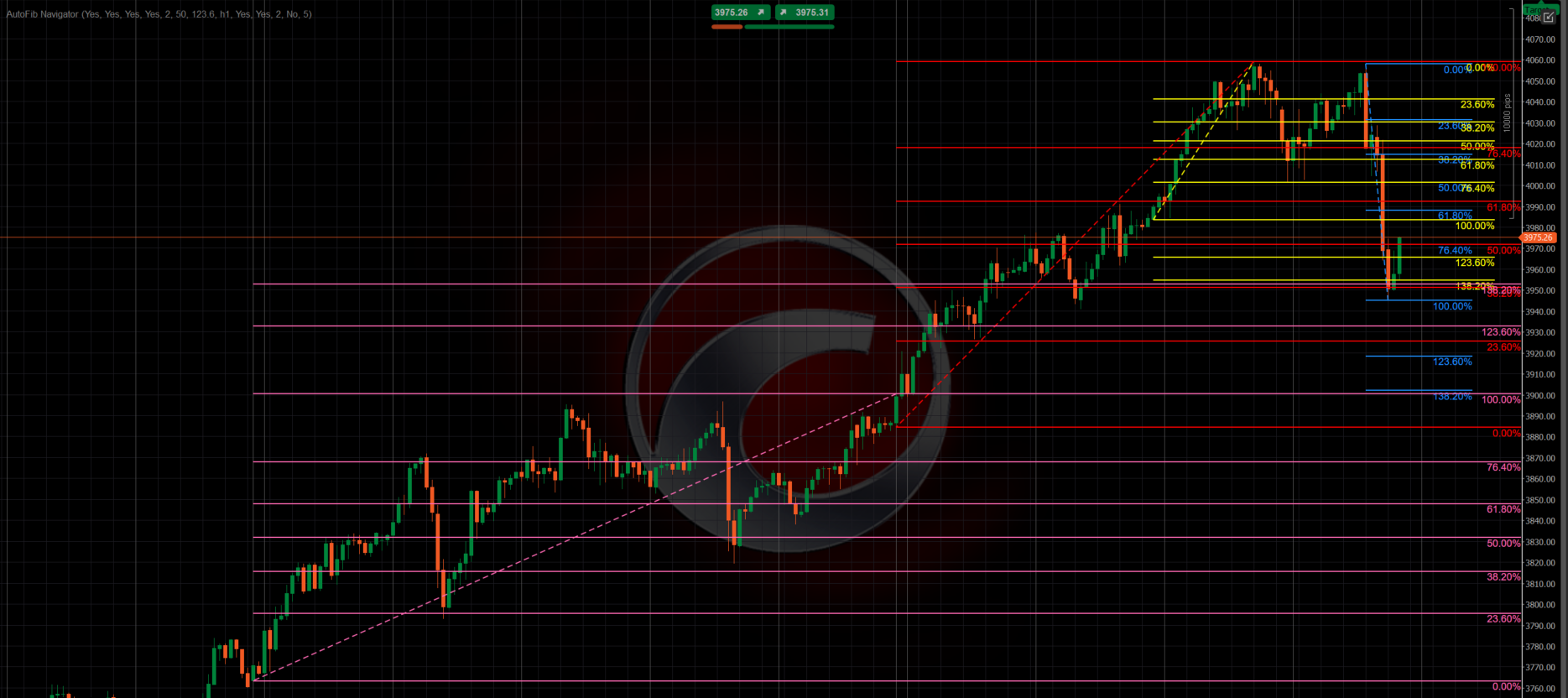

Market Swing Structure Pullback Pro

Indikator

Version 1.0, Sep 2025

Windows, Mac

"Trading involves risk. Past performance does not guarantee future results."

0.0

Bewertungen: 0

Kundenbewertungen

Bisher gibt es keine Bewertungen für dieses Produkt. Haben Sie es schon ausprobiert? Dann können Sie die erste Person sein, die andere darüber informiert!

NAS100

NZDUSD

Breakout

XAUUSD

Commodities

Forex

Signal

EURUSD

GBPUSD

BTCUSD

Indices

Prop

Stocks

Supertrend

Crypto

USDJPY

.png)

.png)

![„[Stellar Strategies] Visual Trend Momentum“-Logo](https://market-prod-23f4d22-e289.s3.amazonaws.com/3835d044-1c21-4909-9d3c-2635f984b93d_visualtrendmomentum.jpg)