KDJ

Indicateur

214 téléchargements

Version 1.0, Dec 2024

Windows, Mac

5.0

Avis : 1

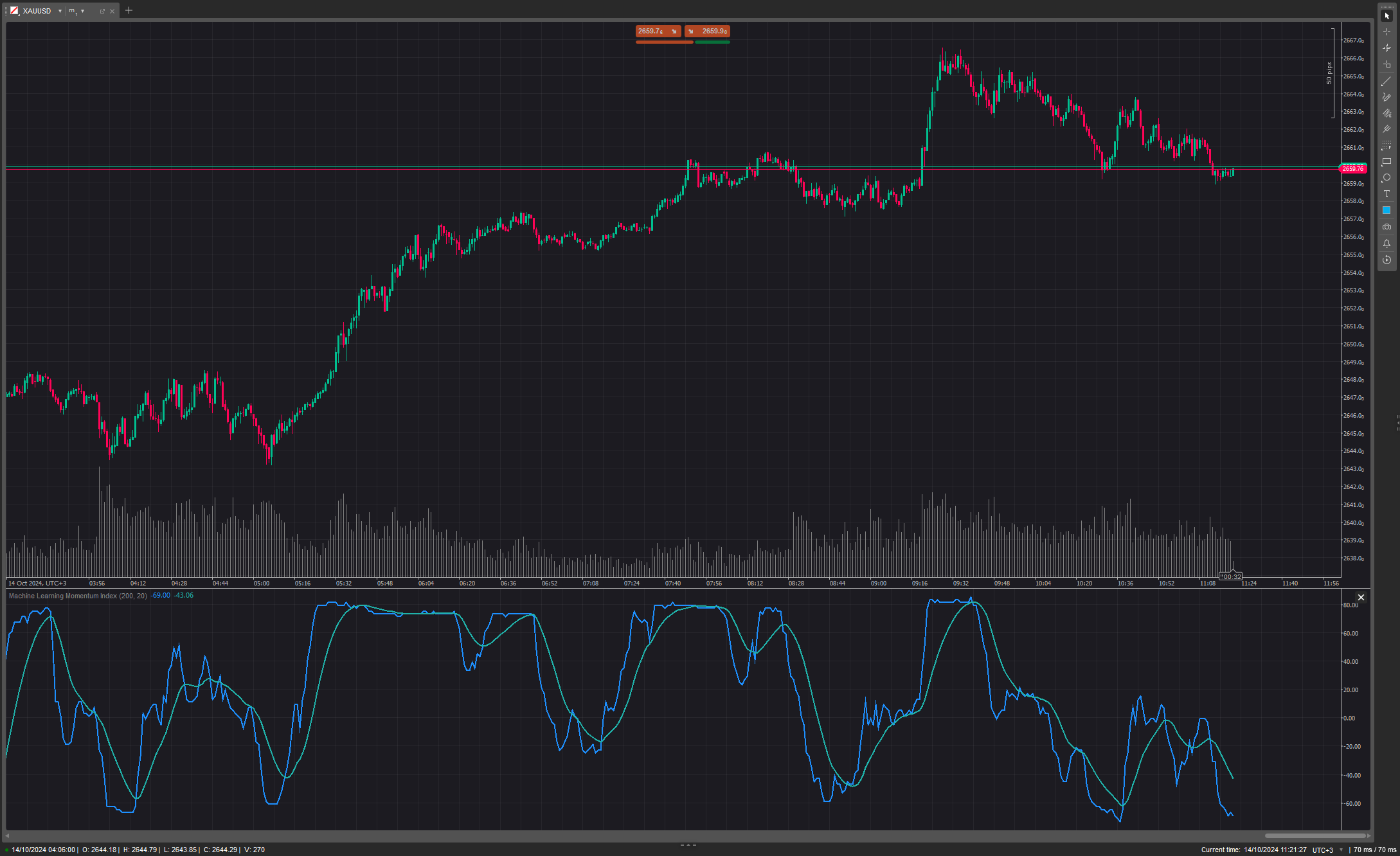

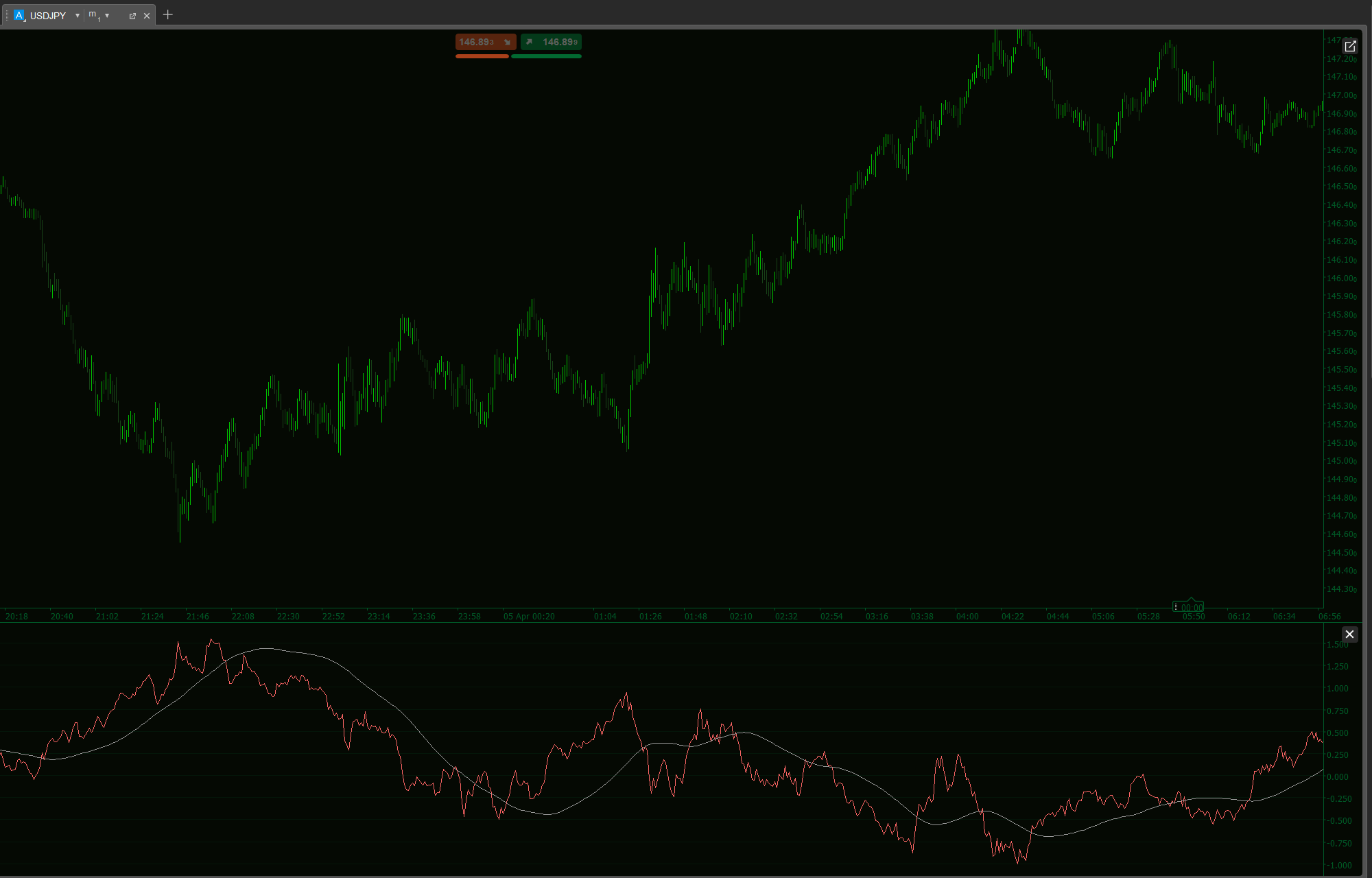

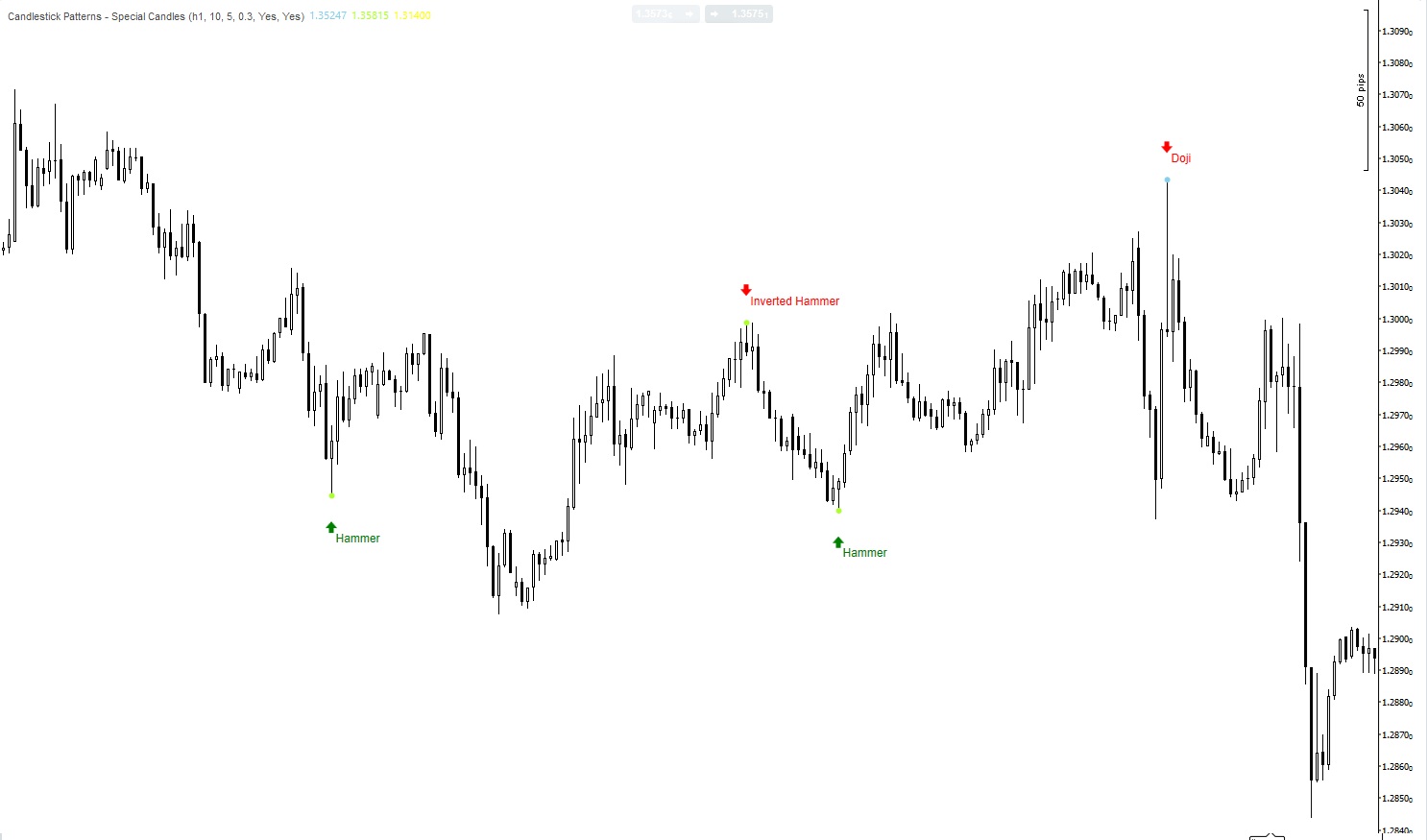

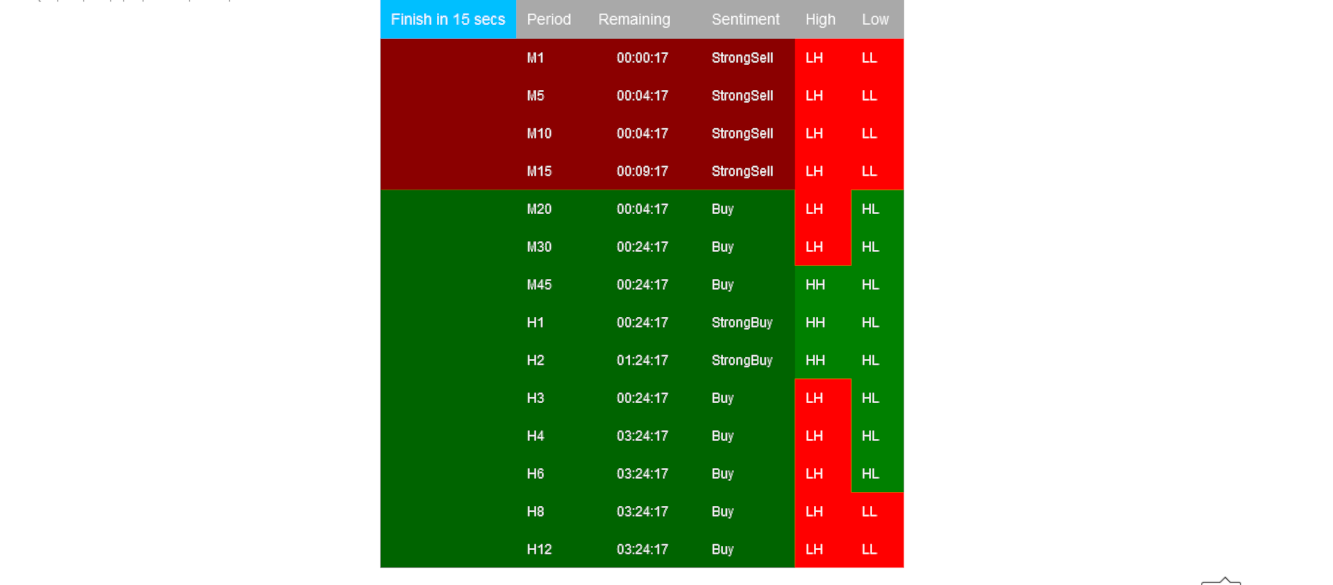

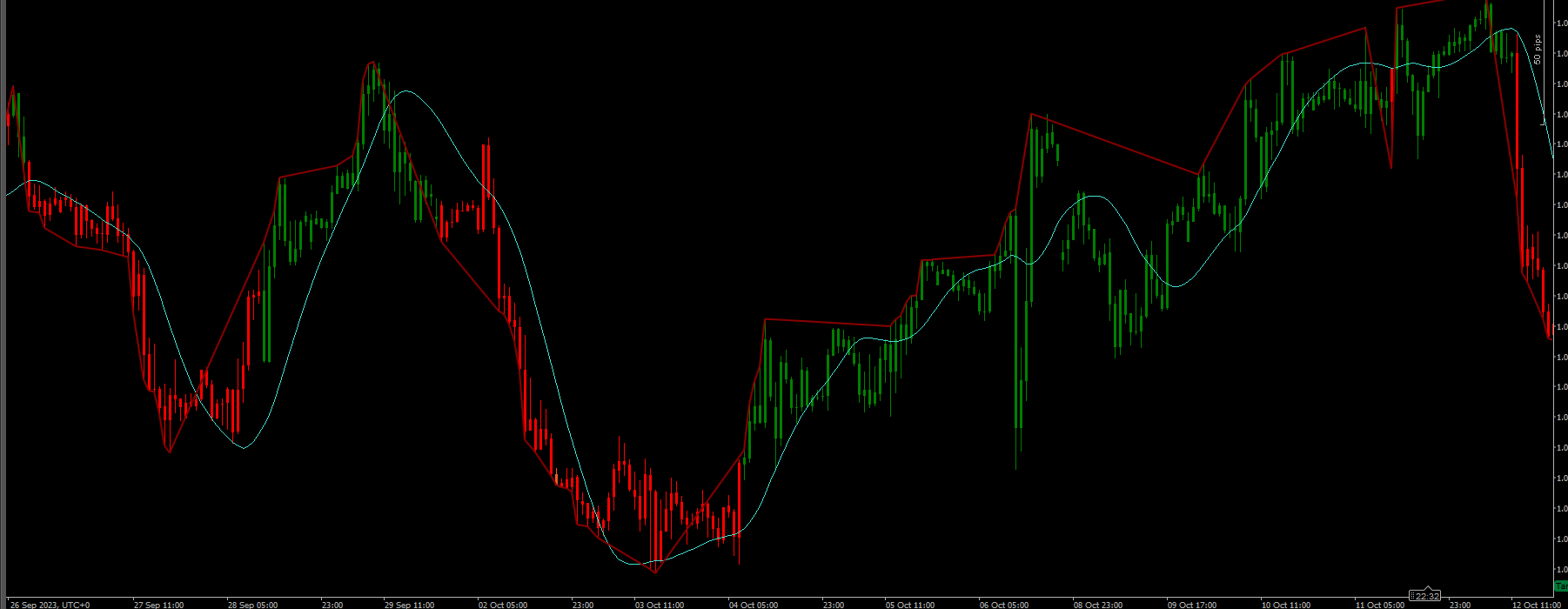

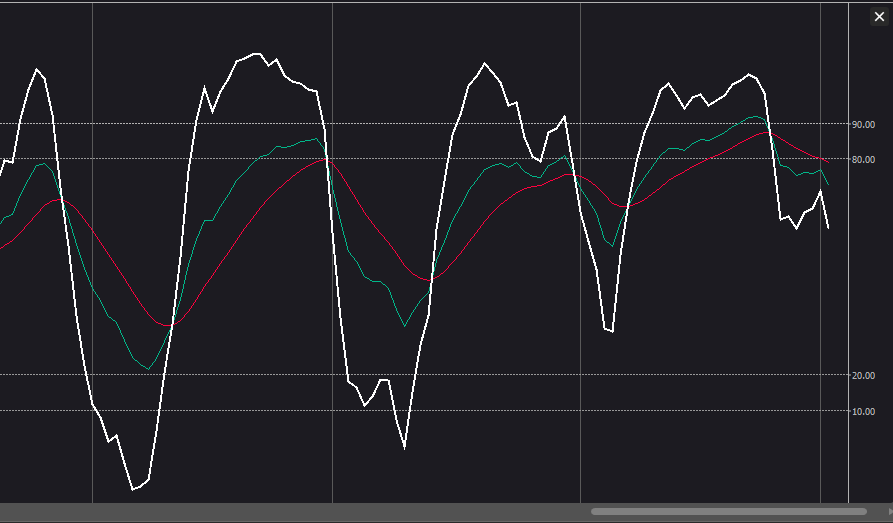

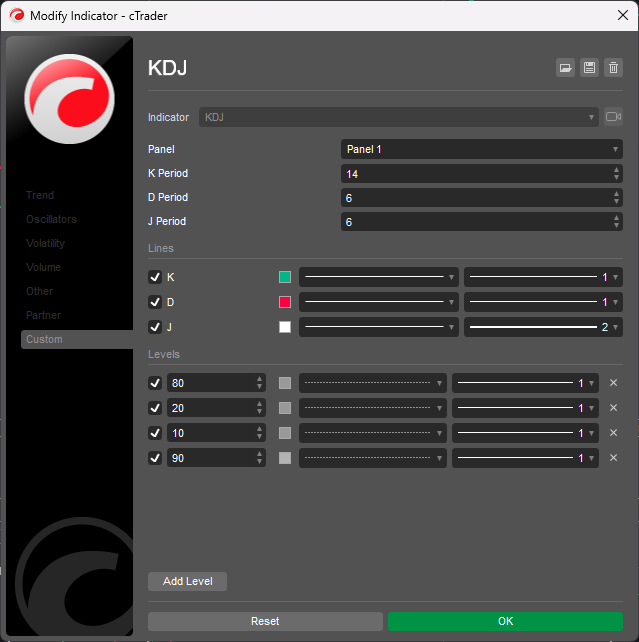

The KDJ oscillator display consists of 3 lines (K, D and J - hence the name of the display) and 2 levels. K and D are the same lines when using the stochastic oscillator. The J line represents the deviation of the D value from the K value. The convergence of these lines indicates new trading opportunities. Like the Stochastic Oscillator, oversold and overbought levels correspond to the times when the trend is likely to reverse.

5.0

Avis : 1

5 | 100 % | |

4 | 0 % | |

3 | 0 % | |

2 | 0 % | |

1 | 0 % |

Avis clients

August 18, 2025

Pros: Three-line stochastic oscillator (K, D, J) that identifies overbought/oversold levels and momentum shifts. Supports divergence analysis and crossovers between K and D as trading signals. Lightweight and responsive. Cons: No alerts, tooltips, or settings presets. J‑line can generate outlier v

Plus de cet auteur

Indicateur

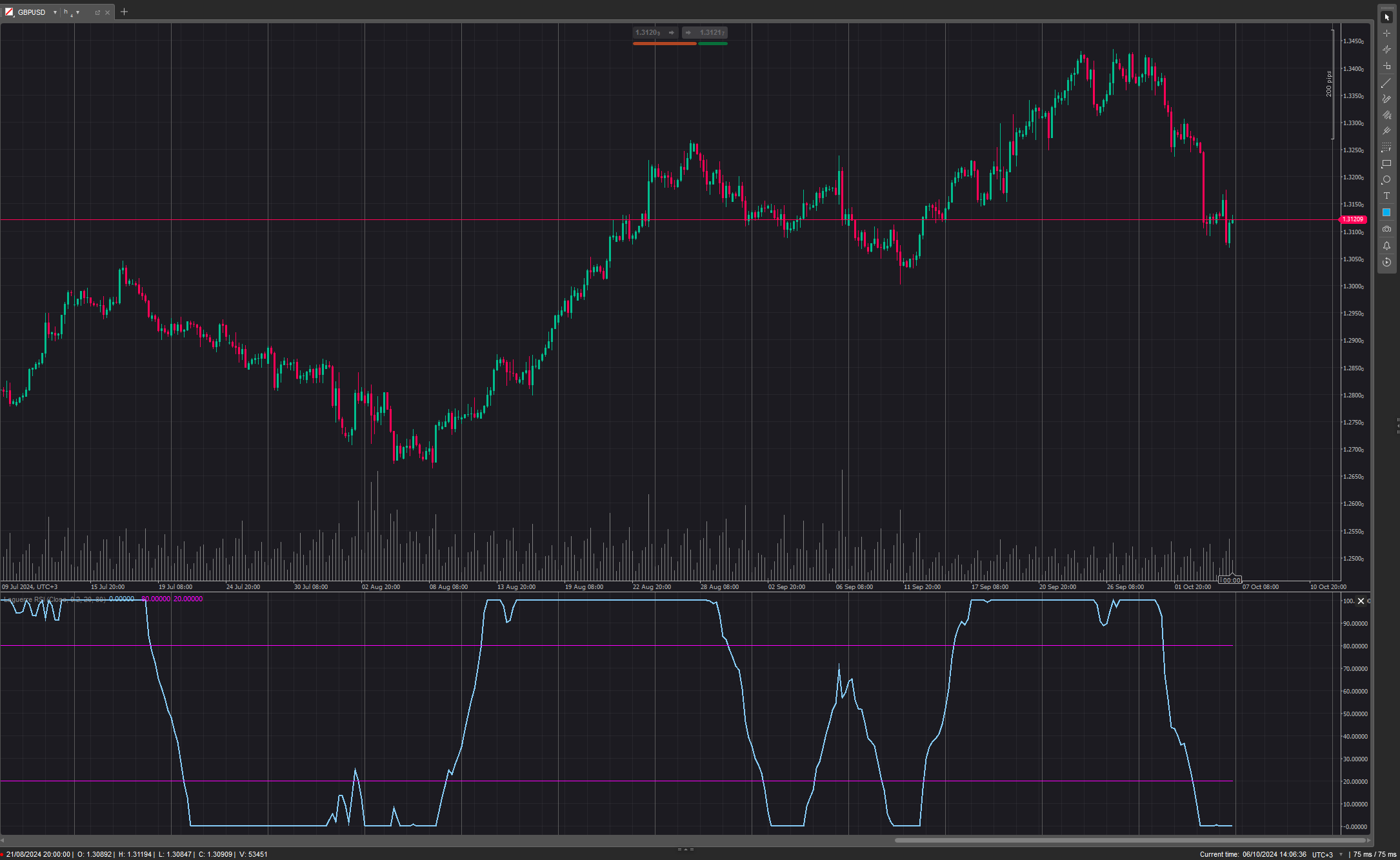

RSI

Laguerre RSI

Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.

Indicateur

RSI

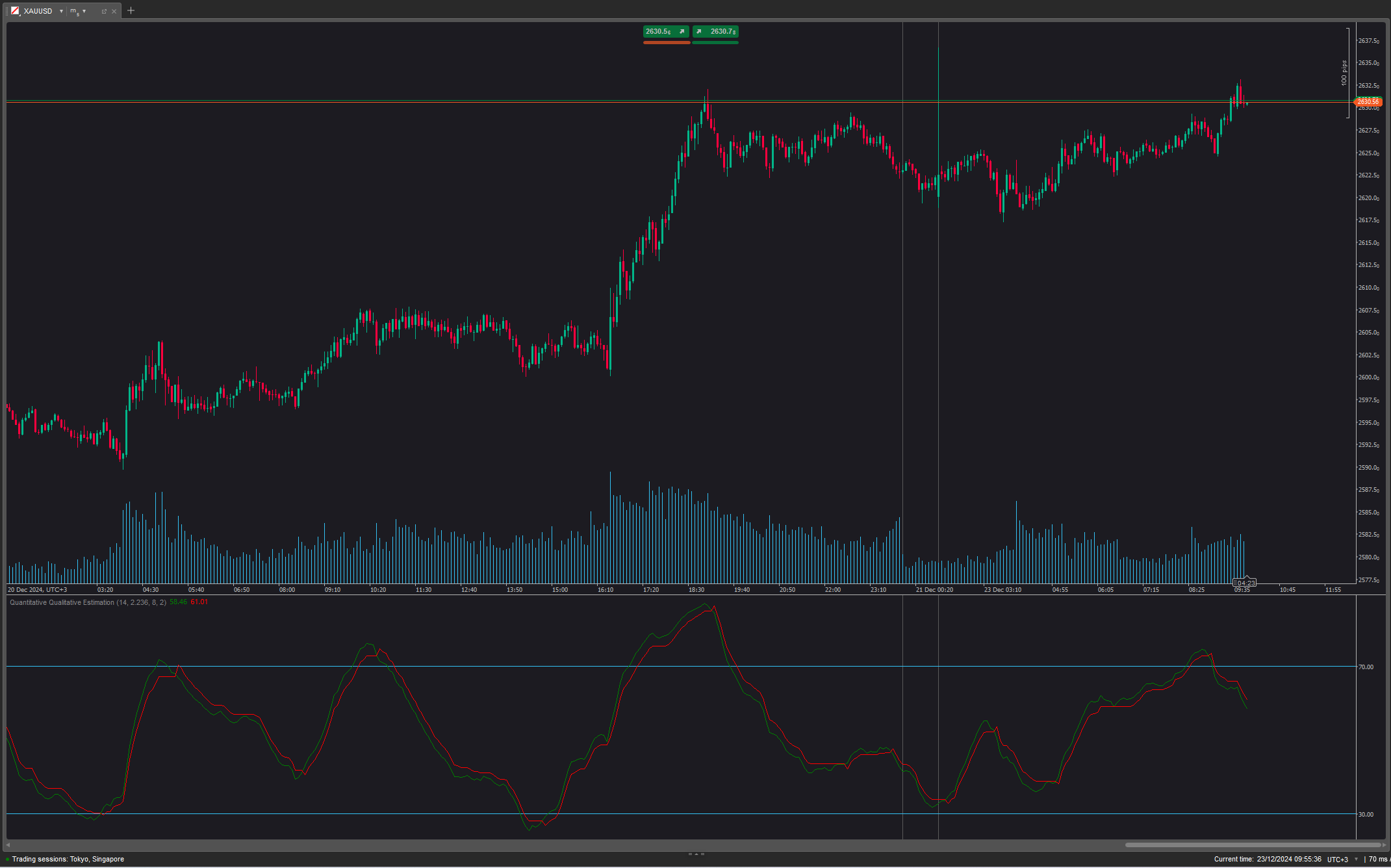

Quantitative Qualitative Estimation

The QQE (Quantitative Qualitative Estimation) Weighted Oscillator improves its original version by weighting the RSI.

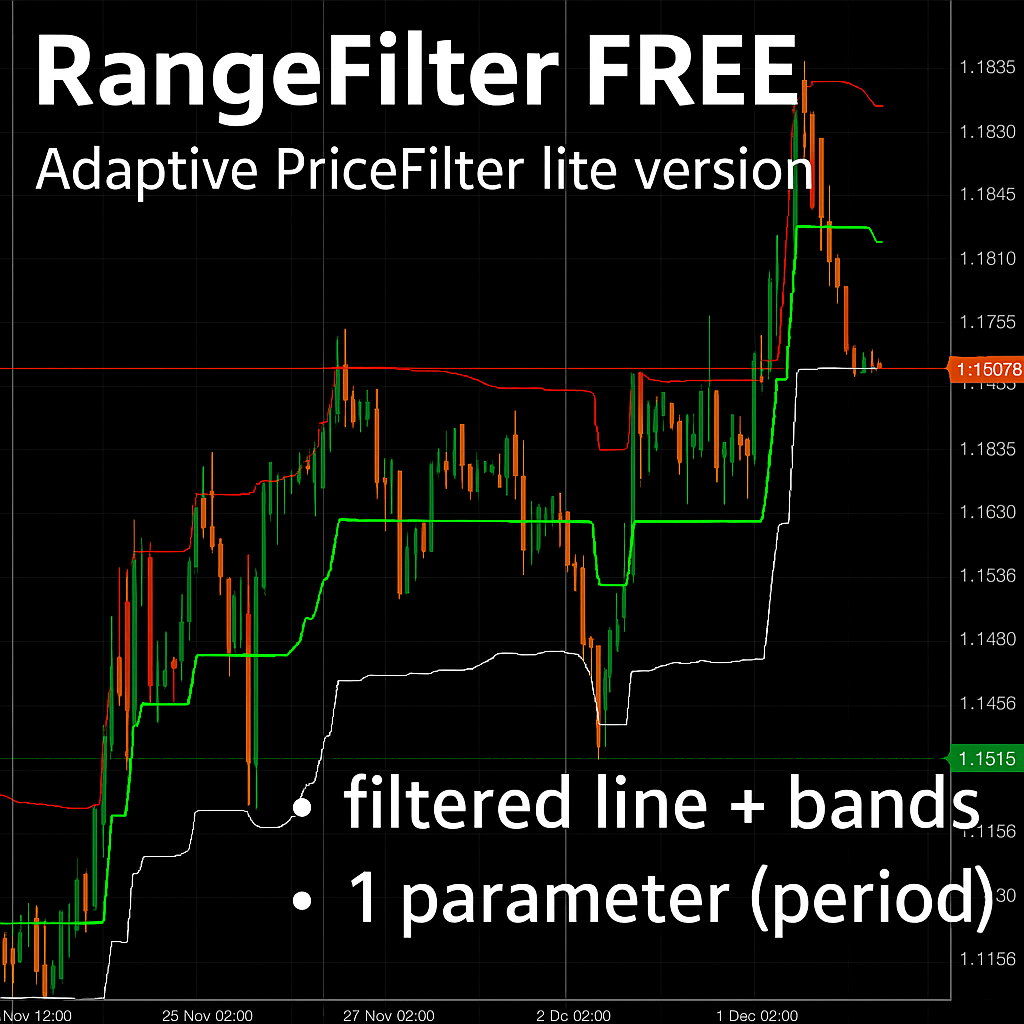

Vous pourriez aussi aimer

Indicateur

Forex

VegaXLR - Auto Support and Resistance

cTrader Auto Support & Resistance detects key levels with Fibonacci analysis and sends real-time trading alerts.

2

Ventes

6.19K

Installations gratuites