Master volatility estimation with institutional-grade exponential weighting. Perfect for risk management, option pricing, and dynamic position sizing. The same methodology used by banks and hedge funds worldwide.

🏦 INSTITUTIONAL VOLATILITY MODELING MEETS cTRADER

Why Settle for Simple Moving Averages When You Can Have Exponential Intelligence?

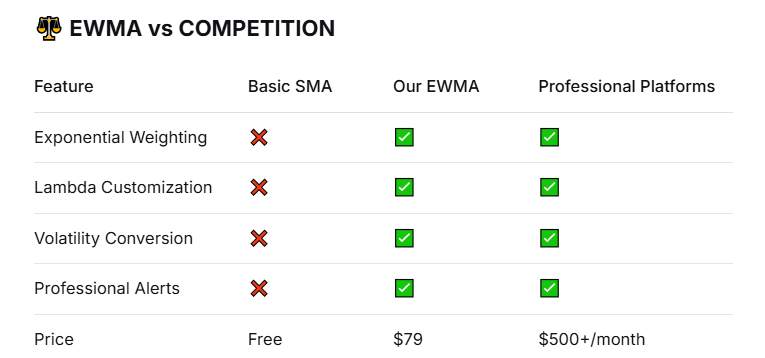

Most traders use outdated simple moving averages that treat all data equally. Professionals know the truth: recent market moves matter more. Our Professional EWMA Volatility Indicator brings the exact same exponential smoothing technology used by J.P. Morgan's RiskMetrics™ to your cTrader platform.

⚡ WHAT IS EWMA AND WHY IT MATTERS

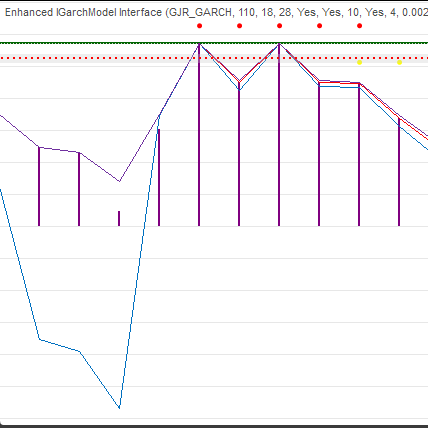

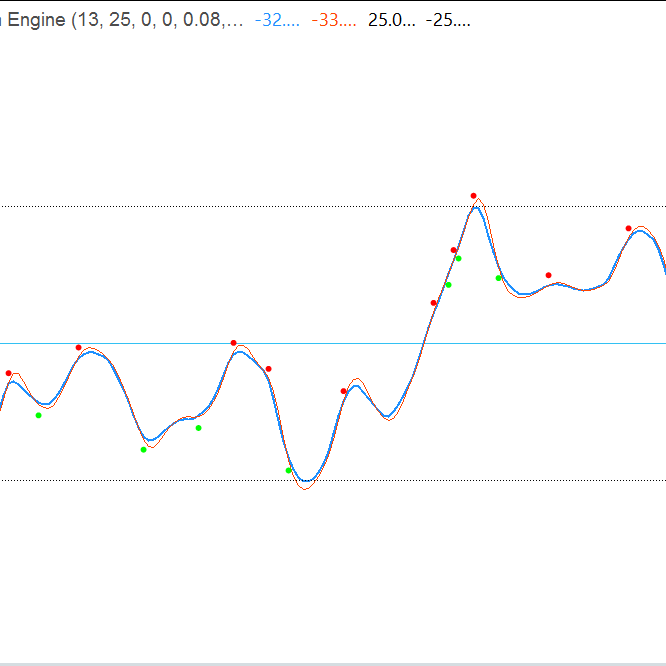

Exponentially Weighted Moving Average (EWMA) assigns higher weights to recent price data, making it dramatically more responsive to current market conditions while maintaining smoothness.

Traditional SMA vs Our EWMA:

- ❌ SMA: All data points equal weight → Slow, lagging signals

- ✅ EWMA: Recent data = higher weight → Fast, accurate, professional-grade

🎯 KEY FEATURES THAT SEPARATE PROS FROM AMATEURS

✨ PRECISE EXPONENTIAL SMOOTHING

- Custom Lambda Parameter (0.01-0.99): Fine-tune decay rate for your trading style

- RiskMetrics™ Standard: Pre-set to λ=0.94 (industry standard for daily volatility)

- Multiple Timeframe Ready: Consistent performance across all chart timeframes

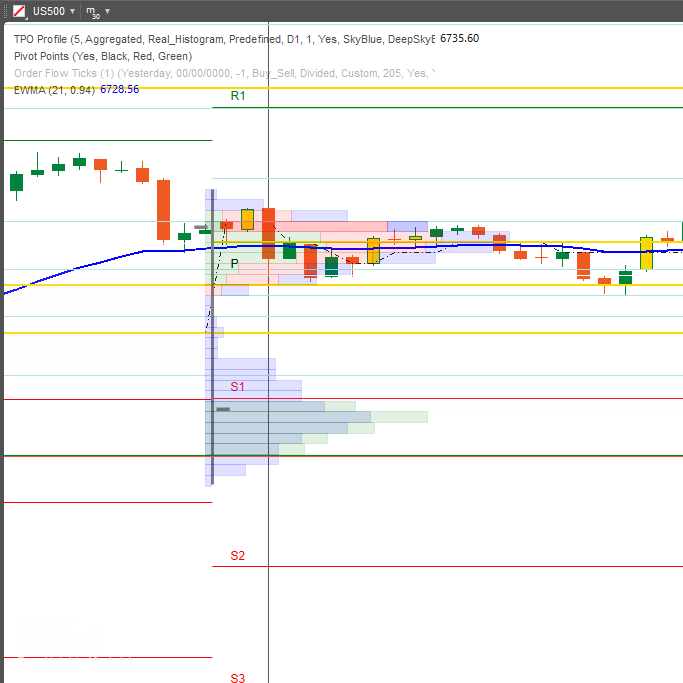

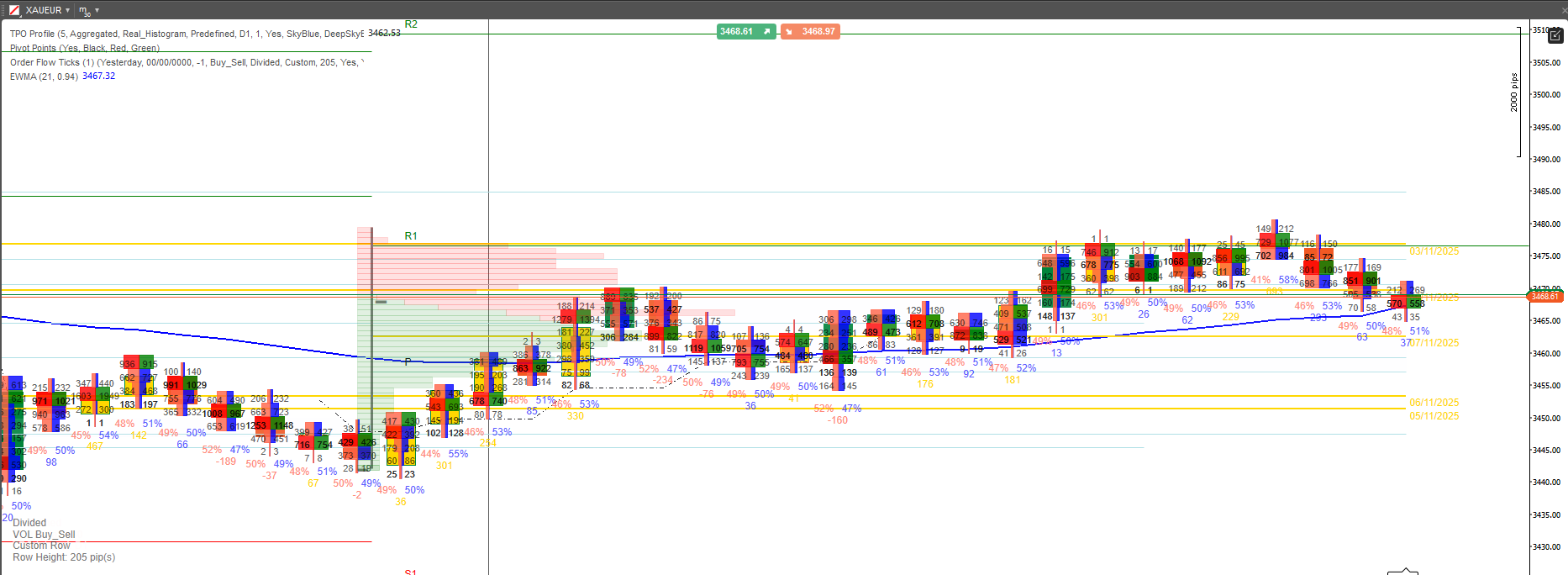

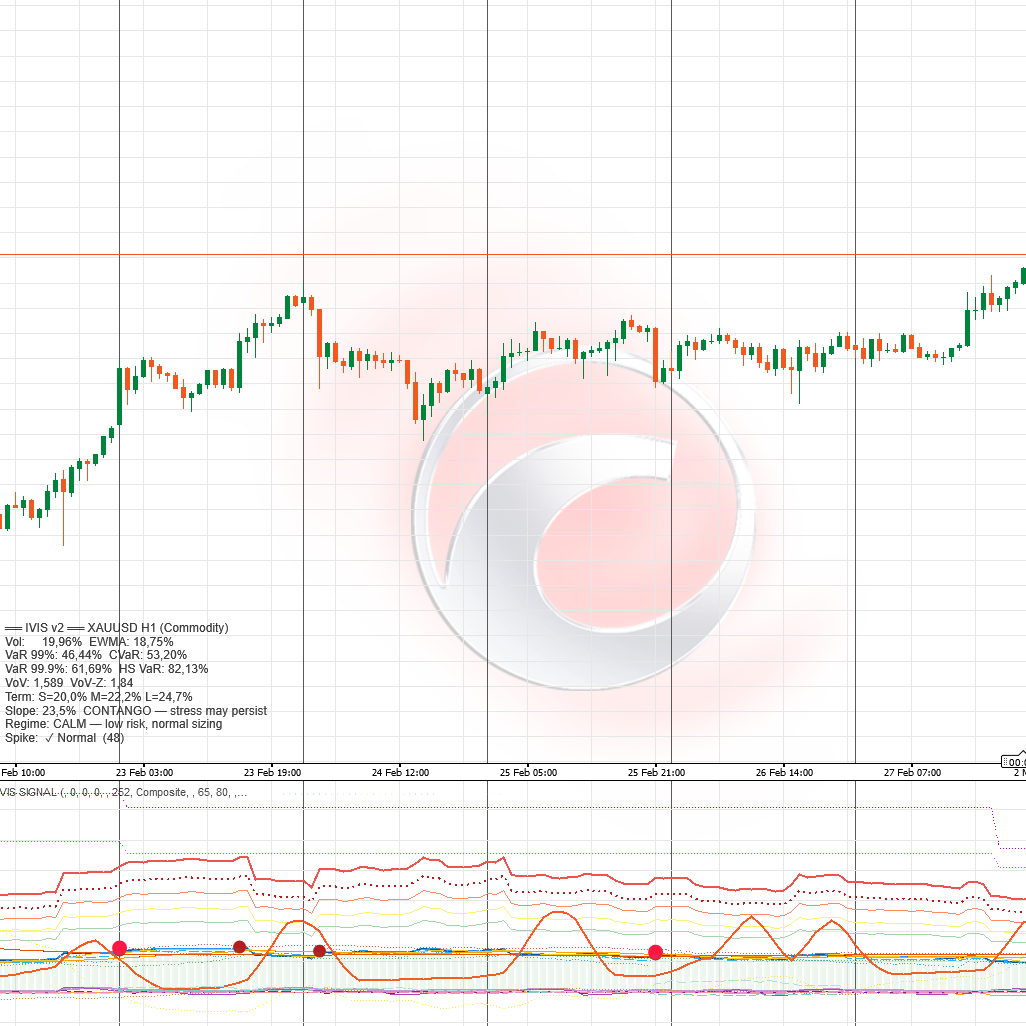

📊 VOLATILITY ESTIMATION MODE

- Annualized Volatility: Convert to percentage terms for option pricing

- Dynamic Bands: Create volatility-based support/resistance levels

- Regime Detection: Identify low/high volatility environments

🔔 PROFESSIONAL ALERT SYSTEM

- Volatility Breakout Alerts: When volatility exceeds threshold

- Trend Change Notifications: EWMA cross detection

- Customizable Conditions: Set your own trigger rules

💼 WHO NEEDS THIS INDICATOR?

🎯 Options & Derivatives Traders

- Accurate volatility estimation for pricing models

- IV vs HV comparisons for mispricing opportunities

- Dynamic delta hedging adjustments

📈 Risk Managers & Portfolio Managers

- Real-time portfolio volatility monitoring

- VaR (Value at Risk) calculations

- Position sizing based on current market conditions

💹 Algorithmic Traders

- Volatility regime detection for strategy switching

- Dynamic parameter optimization

- Backtesting volatility-dependent systems

📊 Technical Analysts

- Cleaner trend identification than SMA

- Reduced lag for faster signals

- Professional-grade charting

No Complex Setup Required

- Load and immediately see professional volatility estimates

- Pre-optimized for major asset classes

- Intuitive visual outputs

📈 TRANSFORM YOUR ANALYSIS WITH:

✅ Faster Signals - React to market changes before SMA users

✅ Accurate Volatility - Professional-grade estimation for risk management

✅ Reduced Noise - Exponential smoothing eliminates false signals

✅ Dynamic Adaptation - Automatically weights recent data more heavily

✅ Institutional Methodology - Same models used by top financial firms

💰 SPECIAL LAUNCH PRICING: $79

(Regular price: $99)

Why It's Worth Every Penny:

- Free Alternatives? Yes, but they lack precision tuning, volatility conversion, and professional features

- Time Savings? Hours of manual calculations done automatically

- Performance Gain? Earlier signals = better entries & exits

Included: Full indicator + Lifetime updates + Priority support

30-Day Money Back Guarantee - If this doesn't become your go-to volatility tool, we'll refund 100%.

🎁 BONUS: Free Volatility Trading Guide

Purchase includes "EWMA Mastery: Professional Applications Guide" - a $29 value FREE.

Includes:

- Volatility-based position sizing formulas

- EWMA crossover strategies

- Risk management frameworks

- Real-world case studies

🚀 READY TO TRADE LIKE THE PROS?

Click "Add to Cart" and upgrade from amateur moving averages to professional exponential smoothing.

"I've used EWMA in my hedge fund for years. This cTrader implementation brings institutional tools to retail traders at an unbelievable price."

- Marcus Chen, Former Quantitative Analyst, Goldman Sachs

Bottom Line: This isn't just another moving average. It's a professional volatility estimation tool that belongs in every serious trader's arsenal.

Limited Launch Discount: First 100 copies at $79 (save $20)

![Logo „Smart Money Concepts (SMC) [Iridio Capital]”](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo „Session Volume Profile (SVP) [Iridio Capital]”](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![Logo „High-Low Divergence [Iridio Capital]”](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)