🎯 MULTI-TIMEFRAME VOLATILITY INTELLIGENCE

Stop Missing Volatility Breakouts - See Every Timeframe Simultaneously

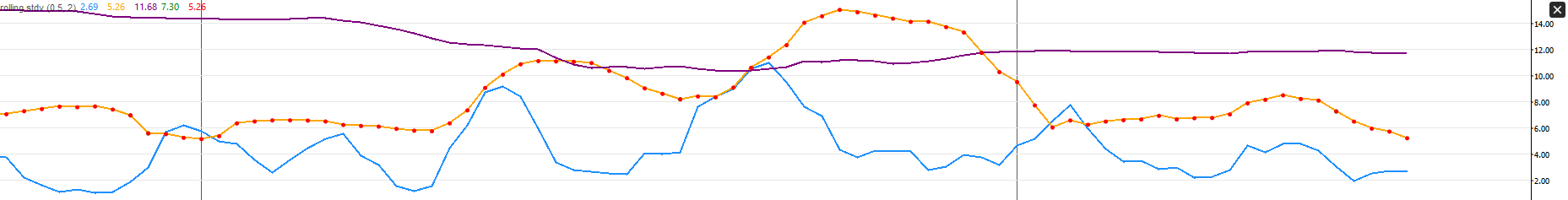

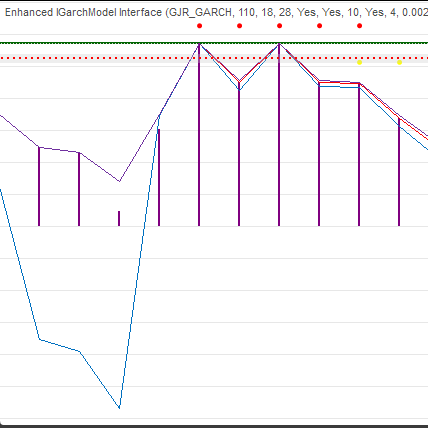

Most volatility indicators show you only one perspective. Our Multi-Timeframe Rolling Volatility Indicator gives you the complete picture across short-term (7), medium-term (21), and long-term (63) periods - with built-in trading signals that tell you exactly when to act.

⚡ WHY MULTI-TIMEFRAME VOLATILITY CHANGES EVERYTHING

Single Timeframe vs Our Multi-Timeframe Approach:

- ❌ Single Period: You see trees but miss the forest

- ✅ Three Periods: Complete volatility landscape with context

Real Trading Scenarios:

- Short-term spike while long-term calm → Temporary noise (ignore)

- All timeframes rising → Genuine regime change (act)

- Short-term calm amid long-term chaos → False calm (caution)

🎯 PROFESSIONAL FEATURES

✨ TRIPLE TIMEFRAME VISIBILITY

- StdDev 7: Catch immediate volatility shifts (intraday)

- StdDev 21: Medium-term volatility (swing trading)

- StdDev 63: Long-term volatility context (position trading)

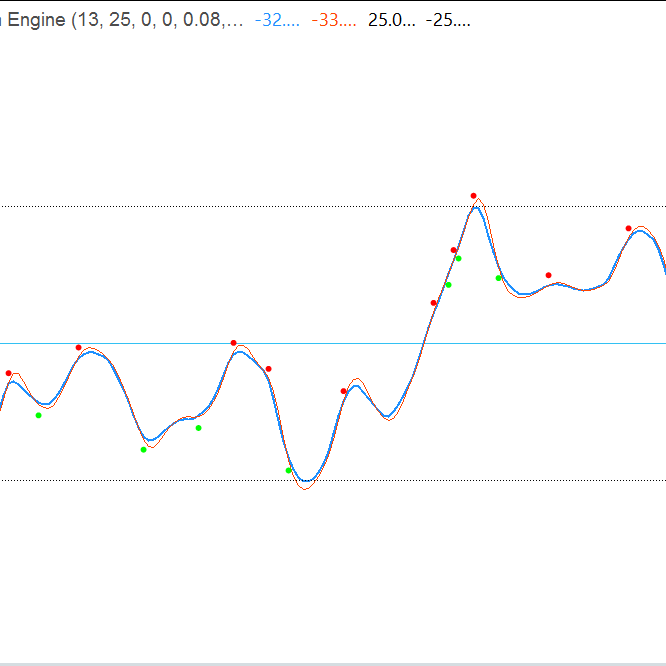

🚦 AUTOMATED TRADING SIGNALS

- Green Buy Arrows: Volatility compression opportunities

- Red Sell Arrows: Volatility expansion warnings

- Smart Thresholds: Configurable buy/sell levels

📊 ADVANCED VOLATILITY ANALYSIS

- Volatility Crossovers: StdDev lines crossing = regime changes

- Mean Reversion Signals: Volatility returning to average

- Spike Detection: Extreme volatility events

💡 PERFECT FOR THESE TRADING STYLES:

🎯 Volatility Breakout Traders

- Enter during low volatility before explosive moves

- Exit during high volatility before reversals

- Time entries with precision using triple confirmation

📈 Mean Reversion Traders

- Fade volatility extremes with confidence

- Identify overextended market conditions

- Use volatility as contrarian indicator

🛡 Risk-Averse Traders

- Avoid high volatility periods entirely

- Trade only during calm, predictable markets

- Use volatility as position sizing guide

📊 Options Traders

- Time premium selling during high volatility

- Buy options during volatility compression

- IV vs HV analysis for mispricing

Built-In Smart Signals:

- ✅ Buy when: Volatility drops below threshold OR crosses below moving average

- ✅ Sell when: Volatility spikes above threshold OR crosses above moving average

📈 WHAT YOU GET:

✅ Triple Timeframe Visibility - No more guessing volatility context

✅ Automated Buy/Sell Signals - Clear visual arrows at optimal points

✅ Volatility Regime Detection - Know when markets are calm or chaotic

✅ Customizable Thresholds - Adapt to any trading style or asset

✅ Professional Color Coding - Instant visual understanding

💰 SPECIAL LAUNCH PRICING: $50

(Regular price: $100)

Value Breakdown:

- StdDev 7 Indicator: $29 value

- StdDev 21 Indicator: $29 value

- StdDev 63 Indicator: $29 value

- Trading Signals: $49 value

- Total Value: $136

- Your Price: $50 (Save 35%)

Included: Full indicator + Lifetime updates + Priority support

30-Day Money Back Guarantee - If this doesn't improve your volatility timing, we'll refund every penny.

🎁 BONUS: Free Volatility Timing Guide

Purchase includes "Multi-Timeframe Volatility Mastery" - a $39 value FREE.

Includes:

- Volatility compression trading strategies

- Multi-timeframe confirmation techniques

- Risk management for volatile periods

- Real-world trade examples

🚀 READY TO MASTER VOLATILITY TIMING?

Click "Add to Cart" and transform how you see and trade market volatility.

"I've tried every volatility indicator out there. This triple timeframe approach with built-in signals is what I use daily in my prop firm trading."

- Sarah Rodriguez, Professional Swing Trader

PERFECT FOR THESE MARKETS:

📊 Stocks & ETFs

- SPY, QQQ volatility timing

- Sector rotation based on volatility

- Earnings volatility plays

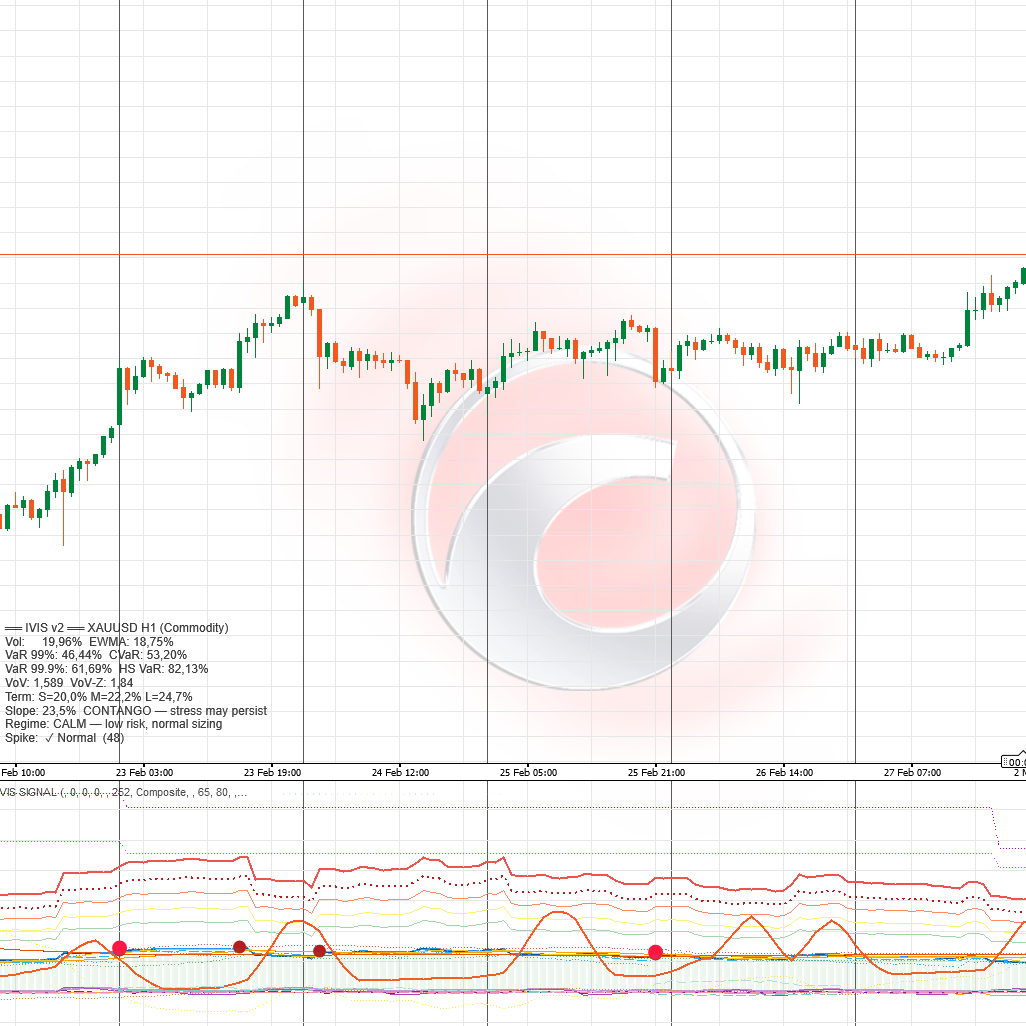

💹 Forex Pairs

- Major pairs volatility analysis

- Carry trade risk assessment

- Breakout confirmation

📈 Commodities

- Gold volatility cycles

- Oil volatility spikes

- Agricultural seasonal volatility

🔄 Cryptocurrencies

- BTC/ETH volatility regimes

- Altcoin volatility opportunities

- Risk management in crypto

Bottom Line: This isn't just another standard deviation indicator. It's a complete volatility timing system that shows you exactly when markets are about to move.

Limited Launch Offer: First 150 copies at $89 (save $30)

"The difference between amateur and professional trading often comes down to volatility timing. This indicator closes that gap."

Add to Cart Now → Start Trading Volatility Like a Pro

![Logo „Smart Money Concepts (SMC) [Iridio Capital]”](https://cdn.ctrader.com/image/png/7c1558de-fd25-4662-8a60-98c34626cee6_1360)

![Logo „Session Volume Profile (SVP) [Iridio Capital]”](https://cdn.ctrader.com/image/png/ea8d1285-8653-4881-adfb-89d8ce6c0347_1347)

![Logo „High-Low Divergence [Iridio Capital]”](https://cdn.ctrader.com/image/png/a38f34cc-a220-4da9-89ce-a85459d73aff_1321)